Digital Marketing Agency in Armenia

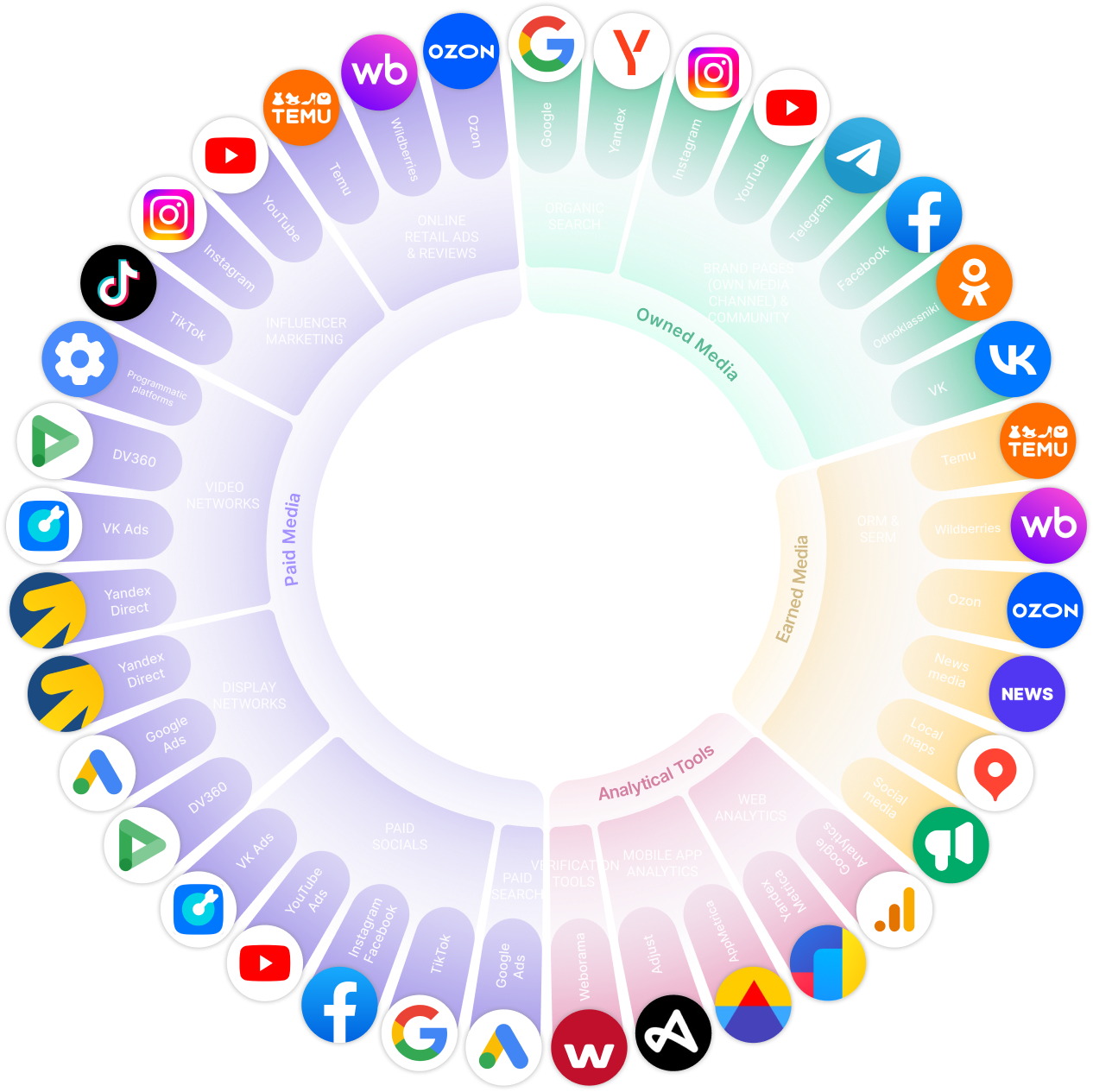

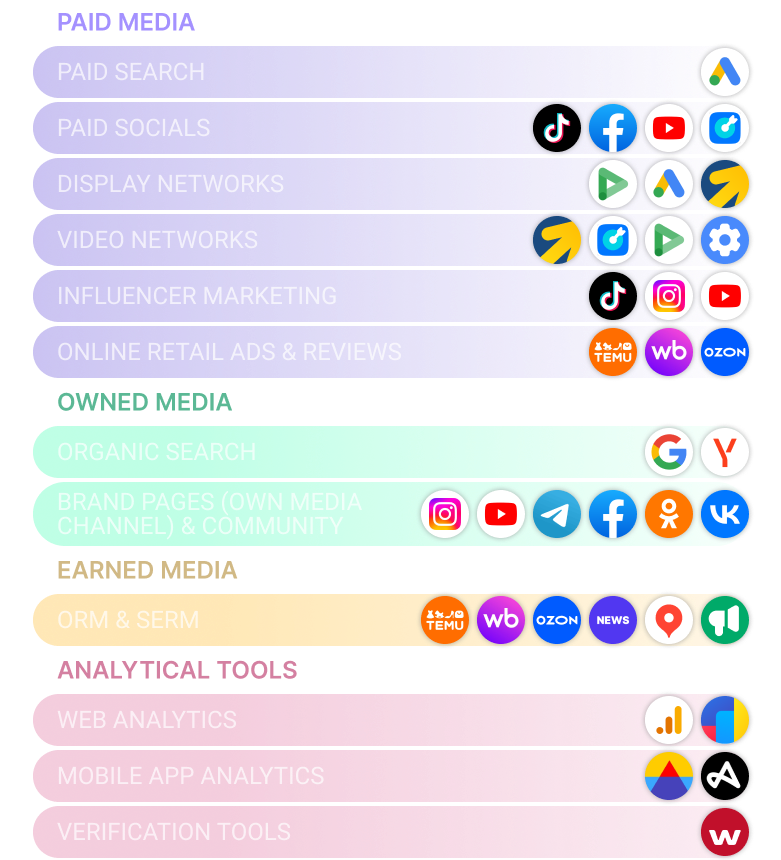

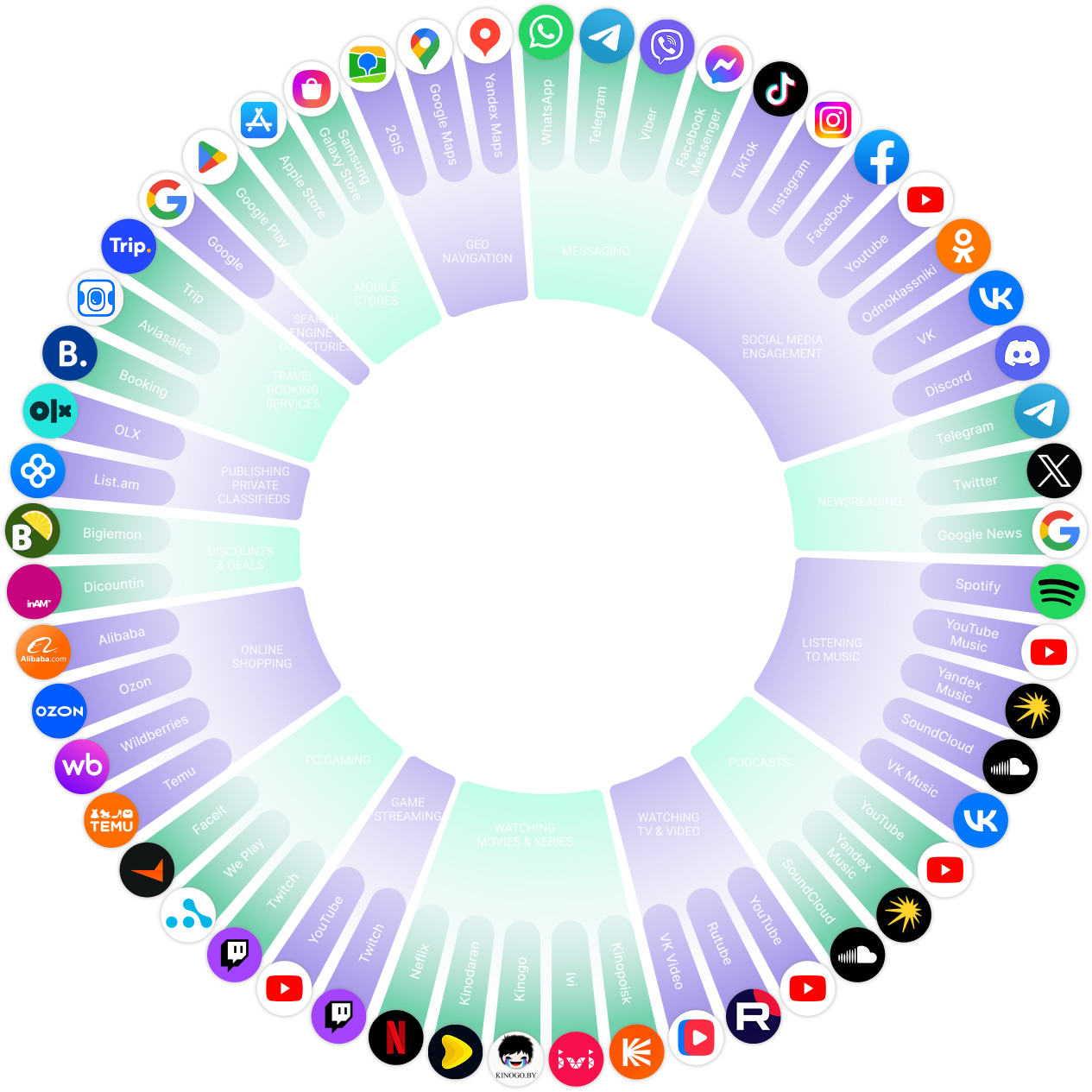

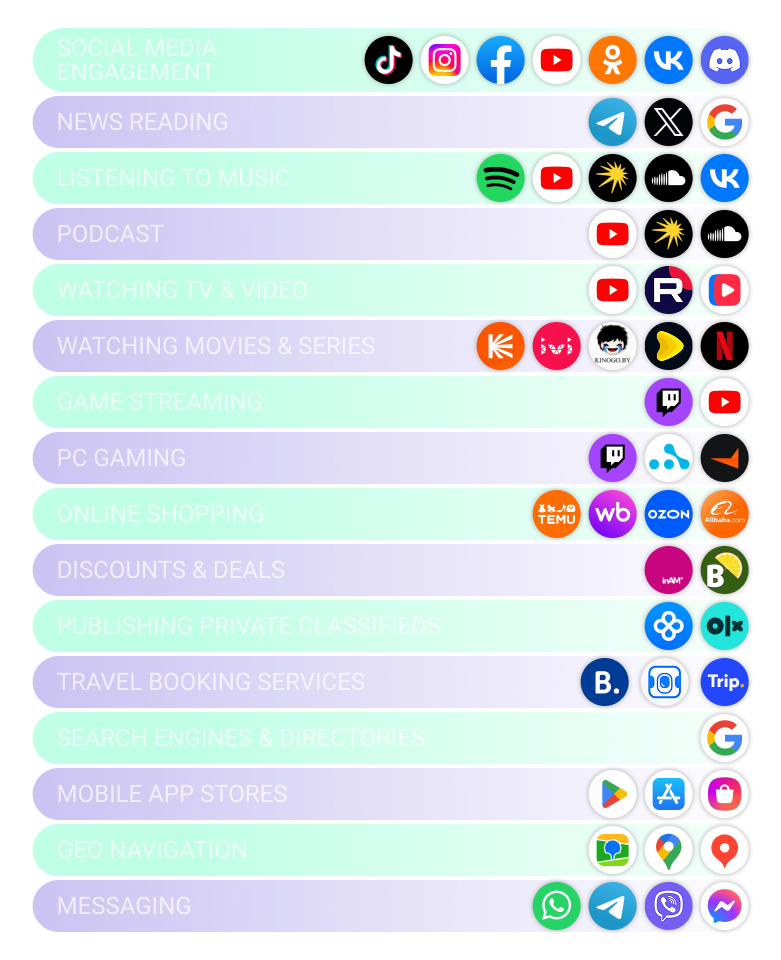

RMAA delivers full-scale digital marketing services in Armenia, combining data-driven strategies with deep local expertise. From paid digital media to influencer collaborations, we enable brands to effectively reach their target audiences in Yerevan, Gyumri, Vanadzor, and other major cities