Blog about successful marketing strategies in russia

Where Are We Going? Russian Tourism Market in 2022

DIGITAL MARKETING

Share this Post

The beginning of 2022 and the events that took place during this period of time significantly affected the Russian market as a whole. The tourism sector was no exception. Various nuances and challenges with visiting some countries, blocking the work of many foreign services in Russia, etc. - all these factors adversely affected the market. But also there were also advantages associated with the development of new tourist destinations.

Let's talk about it in more detail.

RMAA specialists, who constantly monitor the market situation, have found out what awaits the tourism industry in the current 2022 and what trends are most relevant for the industry.

Subscribe to our digest of the Russian travel market and get up-to-date business data.

The Beginning of 2021 VS the Beginning of 2022

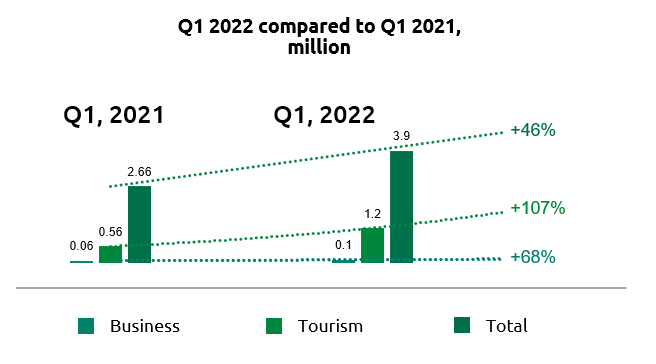

At the beginning of the year, the Border Service of the Federal Security Service of the Russian Federation released some numbers on traveling of Russians abroad in the period from January to March 2022. According to their calculations, at that time citizens of the Russian Federation made 3,880,679 trips abroad for various purposes. This figure is much higher than in the same period of 2021 (2,644,444 trips). However, the traveling flow is still much lower than the pre-pandemic indicators.

Source: Digest of the Russian travel market, Q1 2022

The obvious reason for such increase compared to the last year was the removal or mitigation of covid restrictions for tourists on entry. Thanks to this, new destinations have been opened for Russians (closed in 2021). First of all, the most popular of them were far abroad countries. The number of trips for this destination increased by 77.2% and reached 2,157,346 (there were 1,217,134 in 2021). Much lower increase was seen for trips to the countries of the “post-Soviet space”: +19.1% (1,447,118 trips) compared to the same period in 2021.

Source: Digest of the Russian travel market, Q1 2022

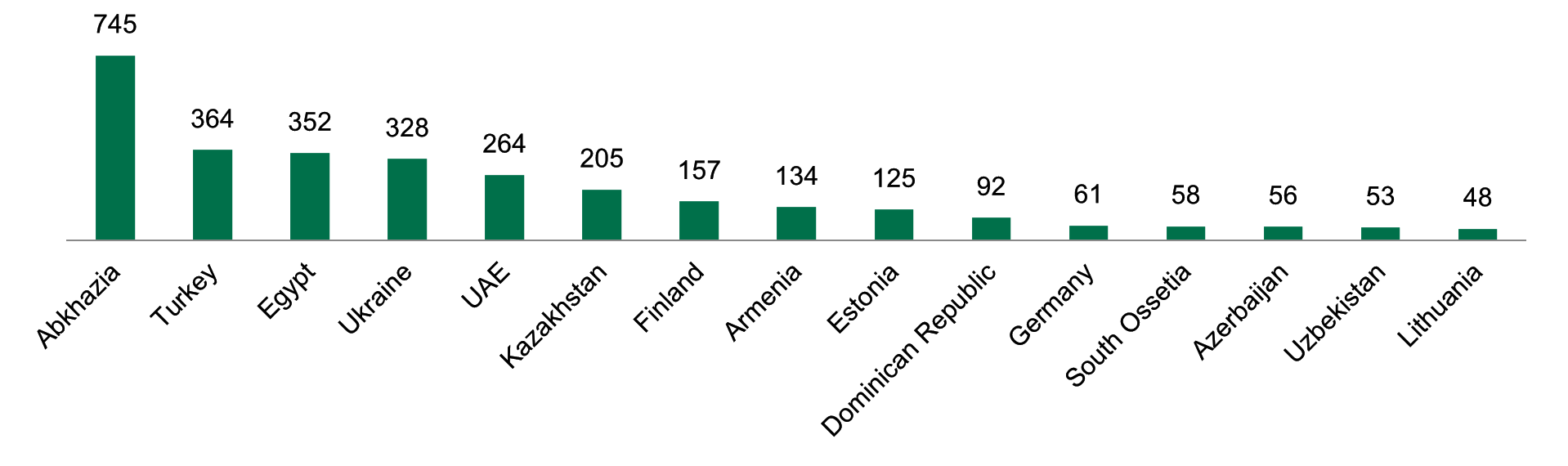

Delving into the statistics of the Border Service of the Federal Security Service of the Russian Federation, you can see that in 2022 the list of the most visited countries for Russians increased by several positions compared to 2021.

At the same time:

- Turkey and the UAE are still the leaders;

- Egypt, the Dominican Republic, Thailand, Hungary and Mexico have been added to the list of popular destinations;

- but Tanzania, which closed its borders at the beginning of 2022 due to an increase in the incidence of covid_19, turned out to be inaccessible for entry. However, now the government of the country is gradually beginning to ease restrictions on entry of Russian tourists. Perhaps, by the end of 2022, the number of tourists from Russia in this destination will increase again.

The reasons for such indicators can be explained by natural changes. Experts note high percentages of growth in a number of destinations, again, due to the opening of borders, as well as the launch of charter flights and an increase in regular air transportation. For example, in 2021, the Dominican Republic, Mexico, Hungary and Thailand were closed. During the same period, there were no direct flights to Egypt, charter flights to Cuba, and the cost of a flight to the UAE was much more expensive due to quotas. At the beginning of 2022, a number of countries managed to solve these problems, thanks to which the flow of incoming tourists increased again.

The only popular destination that lost a significant part of the tourist flow from Russia (-22.4%) was Turkey. Experts note that Russians started active travel season to this region from March for several years in a row. However, this year the influx of Russian tourists was reduced due to sanctions restrictions and rising prices for air transportation at that period of time.

A completely different situation exists with regard to the “post-Soviet” destination. As a rule, visits of Russians to these countries are non-tourist. For example, during the period from January to March 2022, the increase in the number of trips to Uzbekistan and Armenia amounted to 249% and 200% correspondingly. This is mainly due to the March jump in “debit-card tours”, the purpose of which is, rather, business and personal requests of citizens.

When it comes to the volume of business trips abroad in general, then at the beginning of 2022 they increased by 68% compared to the same period in 2021. In addition, the list of countries to be visited for such purposes has changed. For example, Turkey is found to be in second place in 2022, behind Estonia. Plus, Spain and Serbia appeared in the ranking, while Poland and Switzerland turned out to be unpopular destinations for business tours among Russians in 2022.

Find out more from the Digest of the Russian travel market, Q1 2022

Decline in Interest to European Destinations Among Russians

This conclusion was made by the European Travel Commission (ETC) based on the results of a study of the “Long-Haul Travel Barometer” (LHTB), which shows traveller sentiment for the summer period from May to June of the current year. Moreover, this expert examination is carried out every 4 months in six countries, which have the status of long-haul markets in relation to the EU (Brazil, Canada, USA, China and Russia).

According to an analysis from LHTB published in the second quarter of 2022, interest in trips to Europe, in general, remains weak for all of the above countries for a number of reasons. This can include worsening economic development, covid restrictions, geopolitical shocks and, as a result, high travel costs for European destination.

At the same time, ETC experts point out that in Brazil, Canada and the USA, all these factors have a limited impact on tourists. But in the case of China and Russia, everything is much more complicated. Because Russian and Chinese tourists are much more pessimistic about the prospects to travel to the European destination in the near future.

Moreover, the desire of Russians to go to Europe has reached the lowest level in the entire history of ETC observations (78 points). This indicator turned out to be significantly worse than the level recorded during imposition of the first covid restrictions in the period from May to August 2020.

Russians gave the following most relevant reasons not to travel:

- 24% of respondents do not want to travel anywhere outside Russia;

- 13% of respondents stated high travel cost to European destinations;

- 10% of respondents expressed concerns about anti-Russian sentiments of European citizens;

- 9% of respondents mentioned negative impact of the political situation as a whole;

- 4% of respondents would like to go to Europe, but the desired countries have been closed to them during the current period;

- 3% of respondents do not have the ability to bypass the current sanctioned financial restrictions (inability to use credit /debit cards, etc.);

- 2% of respondents mentioned lack of direct flights to the desired countries, as well as concerns about travelling due to covid_19.

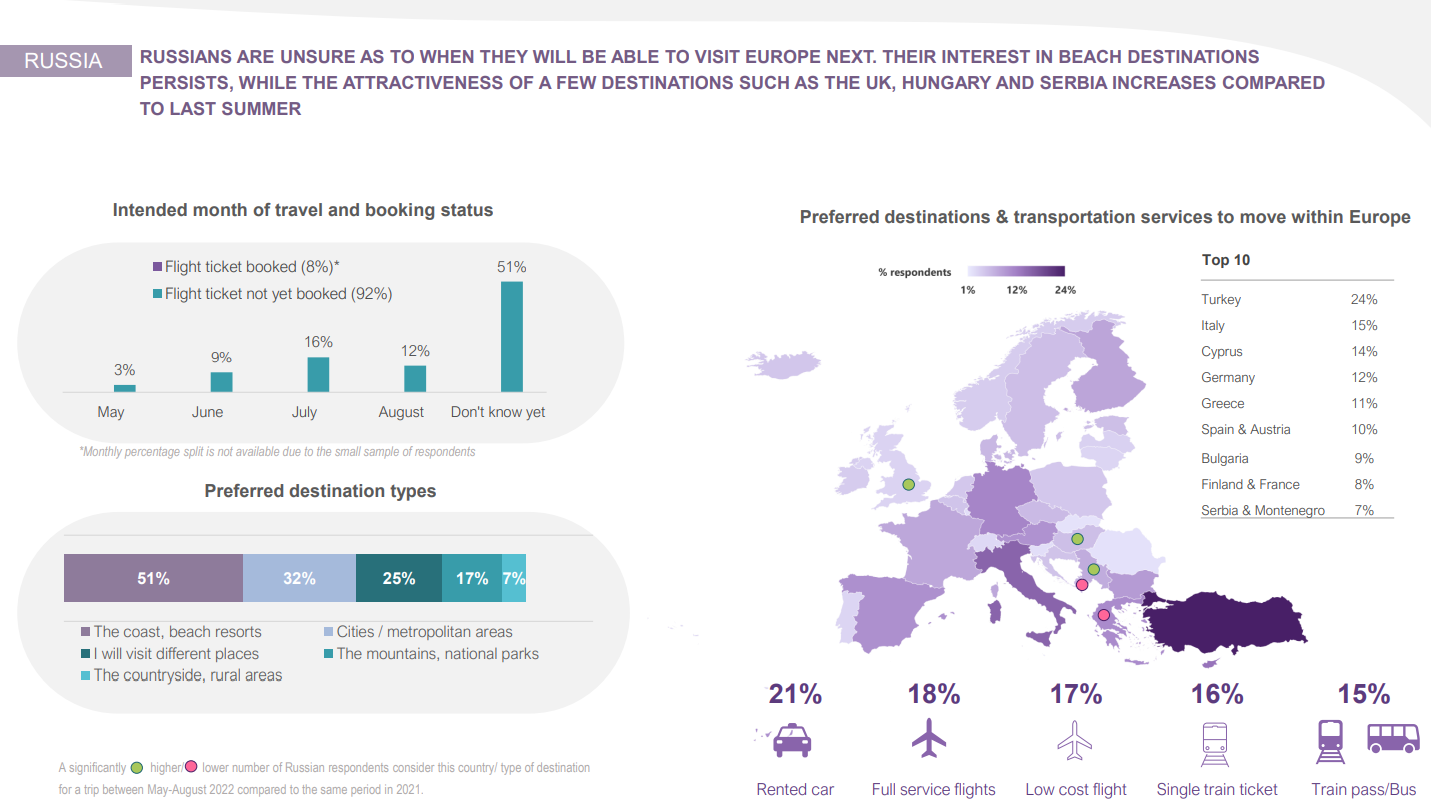

However, 20% of the examined Russians reported that they would be able to consider a European destination for leisure this summer. A year ago, there were 39% of such citizens. Also, 7% of Russian respondents are ready to visit European countries, but not in the current period. Respondents named beach holidays (51%), visits to various cities (32%), national parks and mountains (17%), rural areas (7%) as one of the main reasons for traveling to Europe. It should be noted that while making this research, ETC experts included Turkey in the list of European countries, which has been a priority destination for Russians for several years. Most likely, the LHTB indicators for Russian sentiment would be even smaller without it.

Source: ETC, Long-haul travel barometer 2/2022

Other countries that Russian travellers would like to visit in Europe turned out to be Italy (15%), Cyprus (14%), Germany (12%), Greece (11%), Spain and Austria (10%), Bulgaria (9%), Finland and France (8%), and also Serbia and Montenegro (7%), which appeared for the first time in this study.

To sum up the LHTB findings analysis, it should be mentioned that 3% of respondents from Russia are ready to completely exclude the European region from their tourist route. In this connection, a logical question arises - what destinations have become preferred for Russians in the second quarter of 2022?

Summer Routes of Russian Tourists in 2022

The ATOR Analytical Service, based on the sales statistics of Russian tour operators for three summer months of 2022, distinguished the leading directions of the tourism market. Turkey and domestic tourism have become obvious favorites (which is a stable trend for the Russian market). However, there are other interesting facts in the report that are worth paying attention to.

The main one of them can be considered a decline in the package tour market in Russia by 20% compared to the summer of 2021. This includes both European destinations and domestic tourism. In general, the main reason for this trend is the low availability of direct air transportation. In other words, Russians prefer more accessible destinations for travel.

With reference to this conclusion, such regions turned out to be:

Turkey, ranking first in the sales structure of most Russian tour operators. Moreover, the main share of summer bookings (about 90%) falls on the resorts of Antalya (Alanya, Belek, Kemer, Side). Analysts note that the average price of a sold tour to Turkey ranges from 160 - 210 thousand rubles, and the average duration of rest is 7-12 nights.

Abkhazia is also one of the leaders in tour sales for most operators. In addition, the growth of booking of Abkhazian resorts in 2022 is steadily growing compared to the same period in 2021. The average price of tours (preferably without a flight) is about 50 - 60 thousand rubles per week.

UAE - sales growth for this destination is mainly due to the closing a large number of foreign destinations. According to ATOR, tours to the UAE turned out to be the most sold by Space Travel, Russian Express, and also entered the TOP 5 by ANEX Tour and PAC Group. The average price for 7 nights in the Emirates is about 160 - 230 thousand rubles. Plus, Russians prefer comfort-enhancing leisure for this destination.

Egypt - as in the case with the AOE, they choose it due to restrictions on many European destinations. By the summer of 2022, Goa charter flights to the region from Russia were opened by three tour operators at once (Biblio-Globus, Fun-Sun, TEZ Tour), which provided a large influx of Russians. The average price of one-week tour to Egypt is estimated at about 150 thousand rubles.

Maldives - tour packages to this region are in great demand among operators that are not able to provide charter flights to Egypt. Plus, the Maldives attracts Russians in the summer of 2022 with the presence of premium holidays, discounts and the appearance of a direct flight from the Aeroflot Russian Airlines .

The following destinations also entered the TOP popular tourist regions for Russians in the summer of 2022 (mainly due to the appearance of charter flights): Thailand, Sri Lanka (there is direct transportation), Seychelles, some European countries (Italy, France,Georgia, Croatia and Hungary) and exotic regions opened after covid restrictions (Malaysia, Nepal, Indonesia, Singapore and South Korea).

All this tells us that when choosing a summer vacation, Russians prefer regions according to two main criteria. The first of them is accessibility and availability of a convenient route, and the second is increased comfort conditions. Besides, market experts mentioned other important trends concerning search queries and the use of tourist resources.

Advertising in the Travel Industry: Services and New Approaches

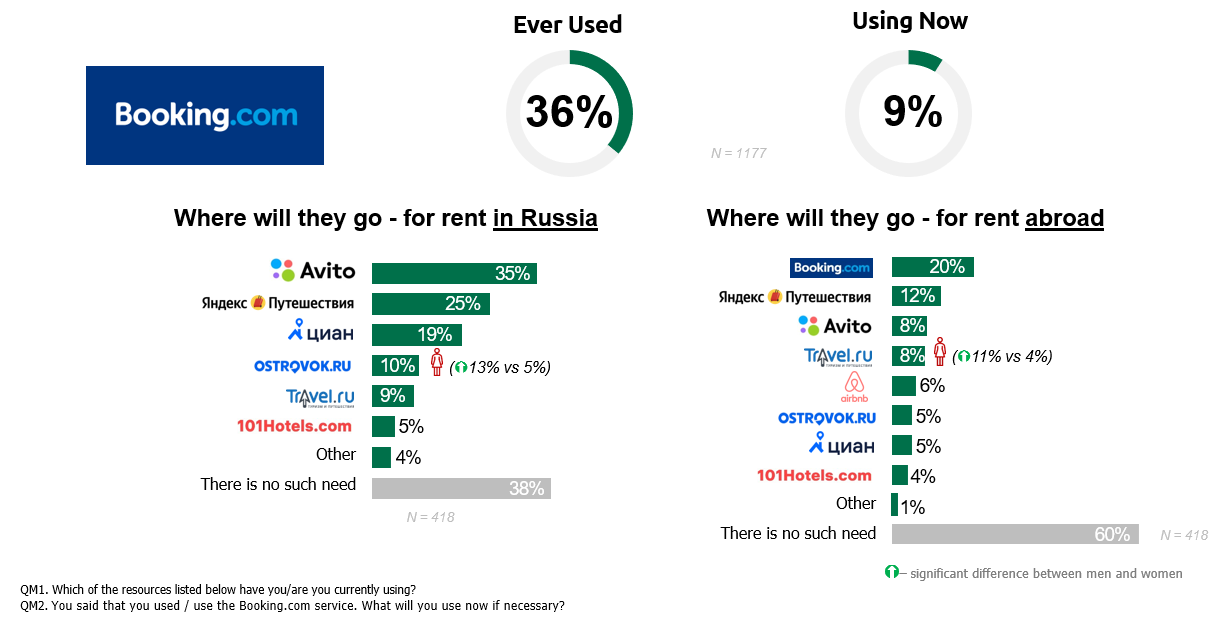

In the period from February 24 to March 24, 2022, Online Market Intelligence (OMi) published a report on changes in the media consumption of Russians resulting from the blocking of many foreign services. Including - tourist one. One of these was the platform Booking.com . It should be noted that Russians used these services both for Russian tours and for foreign ones.

Source: Online Market Intelligence (OMi), wave 1

According to the research findings, the number of Booking.com users decreased by 27% during the month and it was only 9% of the total number of the interviewed respondents by the end of March. At the same time, most Russians have started using “domestic” travel platforms (Yandex Travel, Avito, Travel.ru etc.). It goes without saying that the “cancellation” of the Booking.com service affected the entire hotel booking system.

Valentin Miklyaev, CEO of Bnovo (Russian company developing IT solutions for hotel booking), in an interview with Novy Prospekt shared the following conclusions: “75% of the small hotel room capacity in Russia have used only Booking or Airbnb so far. That is, a huge number of accommodation facilities did not have other channels of booking and lived with this stream for many years. Of course, when these channels were closed, the hotels were confused, and literally in one day we received an annual volume of requests from them. Everyone is trying to find alternatives.”

In addition to the rejection of foreign tourist systems, the trend in favor of “domestic” resources can be traced when choosing information projects about tourism. The TOP 10 in Russia includes Russian services-travel guides, platforms and magazines for independent travelers.

Despite the decline in sales on the package tours market, requests for this product in Russia have been increased. According to Yandex Wordstat analytics, Russians have entered a querry "buy a tour” by 66% more frequently than in 2021.

Read more in our digest.

Main Conclusions

The tourism market in Russia (both foreign and domestic) remains a promising niche. Because Russians are still interested in travelling abroad, premium tours to various destinations and new leisure formats. In 2022, the European region lost its leading position (except Turkey). While due to the removal of restrictions and appearance of direct or charter flights, Russians became interested in traveling on new routes.

The channels of communication with customers within the segment have also changed. If earlier Russians used foreign services to book hotels and buy tickets, now most of the audience has replaced them with domestic resources.

Consequently, promotion in the tourism sector requires from advertisers to use new tools and approaches, taking into account all of the above factors. Entrust this task to RMAA experts who always follow the latest market trends. And they know how to attract customers from Russia who prefer comfortable leisure abroad.

About the Author

A content lead. Natalia runs marketing projects promotion with different digital tools in the Russian-speaking market.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!