Blog about successful marketing strategies in russia

Consumer Preferences for Beauty Market: Online Influence in Russia

DIGITAL MARKETING

Share this Post

The Internet has a big impact on how people buy cosmetics, especially facial care products. They actively look for information on the Internet, whether they're shopping online or in a store. One reason for this high percentage of internet usage is that there's a vast amount of information out there. You can find detailed product descriptions, price comparisons, and reviews from real users online. This helps consumers make an informed choice and avoid making the wrong purchase.

Earlier we examined some of the key trends in the beauty and personal care market, including some useful analytical insights. Now, let's turn the tables and examine what buyers are guided by.

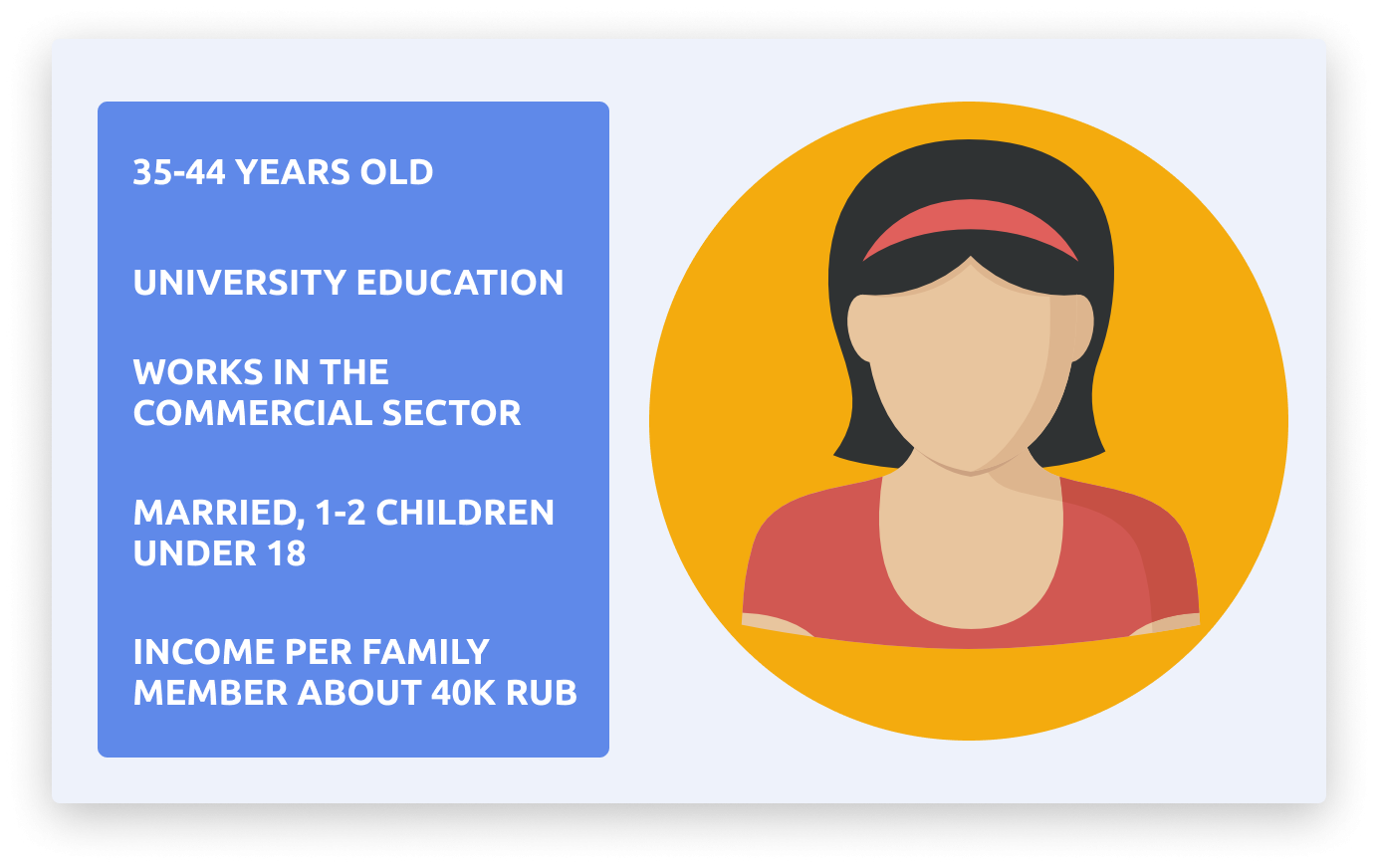

Russian consumer portrait

The majority of customers (57%) are women, with an average age of between 35 and 44, who purchase beauty products for themselves and their loved ones. Special attention is paid to the care of men, who rarely buy beauty products on their own.

It is noteworthy that almost one-quarter of men use products for facial skincare, with the luxury cosmetics segment representing almost half of this figure.

Consumers are becoming more and more conscious of their choice of products. They carefully compare products among themselves and switch between different stores repeatedly. The main goal is to find the optimal product at the most reasonable price.

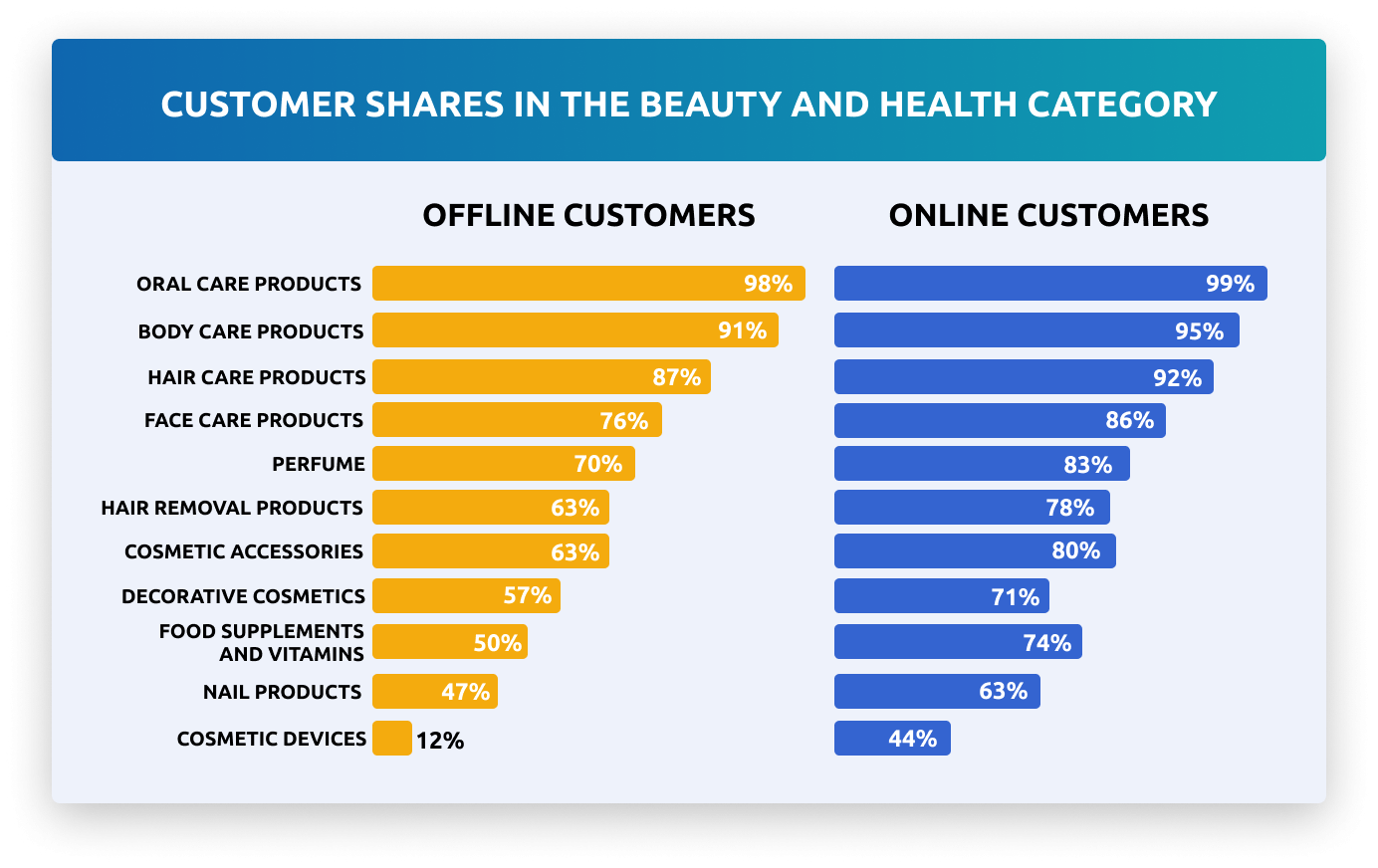

It is clear that neither men nor women will save on oral care products. However, it is possible for them to consider ways of saving money on cosmetic gadgets, accessories, and manicure/pedicure products. For women, facial and hair care products are of the utmost importance. It is interesting to note that in the ranking of products that women are least willing to save money on, vitamins and supplements are slightly in front of makeup and perfumes.

It is important to remember that even with the noticeable growth of Russian brands, the bygone giants of the cosmetics industry, such as L'Oréal or Estée Lauder, still have a significant impact on the market. This departure has had the greatest impact on the retailing network. Now large chains and small distributors are actively importing new brands from different regions such as Asia, Europe, and Arab countries. This has opened up an opportunity to enter the Russian market and fill the space left by the departing players. As a result, many new brands have emerged, but there is a lack of information about them.

Brand recognition is formed over time and depends on the effectiveness of marketing. Consumers are now forced to sort through all the new brands in search of replacements and alternatives to the departed brands. This is why new market players must adopt effective marketing strategies to gain traction.

Online purchases

Online platforms such as AliExpress, Golden Apple, Ozon, Wildberries, and others have become significant channels for product promotion. Quality advertising on these platforms can significantly increase brand visibility and conversion.

Statistics show that people on average buy cosmetics online a little less often than in offline stores. However, they spend 1.4 times more on a purchase than when ordering products online. Detailed analytics allows us to determine which products should be more intensively promoted in physical locations and which ones should be promoted through websites.

Wildberries is the leader among marketplaces, followed by Ozon, Yandex.Market, Aliexpress and MegaMarket. In addition, there are separate cosmetics marketplaces, such as L’Etoile and Golden Apple, which specialize in selling cosmetic products of various brands and offer a wide range of products for skincare, hair care, and makeup.

Marketplaces provide a variety of promotional opportunities.

Online shoppers are more active in purchasing beauty products on all available platforms, including offline stores. They make approximately 1-2 purchases in almost every category. This is compared to offline shoppers, who prefer to store exclusively offline. When looking at specific categories, the number of makeup purchases is almost the same, with a slight advantage for offline customers. The leaders are mascara, lipstick, foundation, various pencils, eyebrow products, and powder.

However, offline shoppers are still more accustomed to buying basic body and hair care products. These include liquid soap, shower gel, hand cream, deodorants, and shampoos. They account for almost twice as many purchases compared to online customers.

The same is true for the facial care category. Offline purchases are much more common, for example, anti-age cream is 55% vs. 39% online, and eye care products are 44% vs. 34%.

Lipstick remains the most popular product for all channels without exception, with AliExpress shoppers most likely to order it more than 3 times a year. It's also worth noting that cosmetic devices (29% vs. 12%), sports nutrition products (21% vs. 11%), and weight loss products (14% vs. 8%) are also more frequently purchased online.

When buying makeup products on different sites, consumer preferences differ a lot. People spend the most on powder and foundation cream, about 500 rubles on average, while lip pencils cost less than 200 rubles. In the “body care” category, the average purchase receipt is higher for AliExpress customers, especially anti-cellulite care, sunscreen, and foot and hand scrubs. However, offline shoppers have the lowest spending on products in this category.

When it comes to facial care products, consumers are willing to spend the most on anti-age creams—up to 895 rubles when buying online, which is twice as much as the average cost of an offline purchase. Russians also spend more online than offline on oral, hair, and nail care products. However, spending on cosmetic devices and perfumes is higher offline than online. The biggest spend is on epilators, which cost up to 8,000 rubles offline versus 1,880 rubles online. Massagers, irrigators, and devices for diversifying intimate life are also at the top in terms of offline costs.

Factors in selecting cosmetic products when shopping

When it comes to choosing beauty products, customers are guided by several factors, let's take a look at them:

Social Media Recommendations

Approximately 71% of consumers decide to buy a product based on reviews posted on social media. Opinions from other users are more important for online purchases than offline purchases - 36% vs. 17%. Companies are actively using this tool by creating pages for their brands, publishing promotional posts, and running contests among subscribers.

A good example is a blogger who publishes a review of a cosmetic product, talking about his/her experience using it and showing the results before and after application. Subscribers actively comment on the post, share their opinions, and recommend it to their friends.

Review of cosmetics from Wildberries on Marina Suya YouTube channel

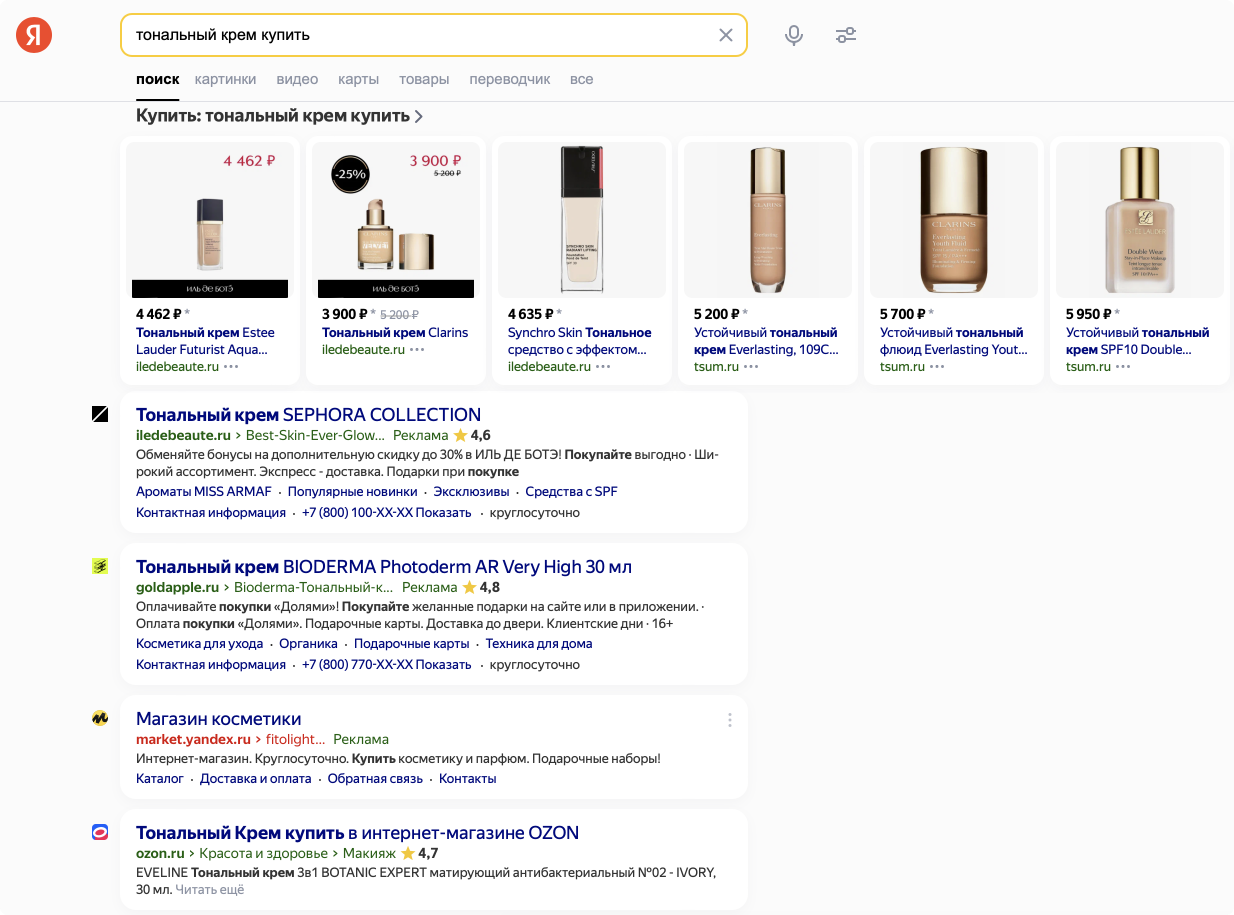

Search networks (organic website results and paid ads)

They are essential for influencing the buying decision process.

Search engines provide users with real-time information about various cosmetic products, prices, reviews, and ratings. This helps customers quickly find relevant information and compare offers from different sellers.

Paid ads are also an effective tool for attracting the attention of potential customers to certain products or services. Based on their search queries and interests, users are shown ads with the highest likelihood of buying.

Yandex search result for “foundation buy”

Yandex is the leading search engine in Russia. It has a monthly user reach of 99.78 million people, which is about 63% of Russian Internet users. In fact, Yandex search is 10% more popular than it was five years ago. It also ranks fourth in the world's most popular search engines.

Yandex employs a wide range of promotion strategies, including a multitude of paid ad campaigns. For more details, see our previous article on the subject.

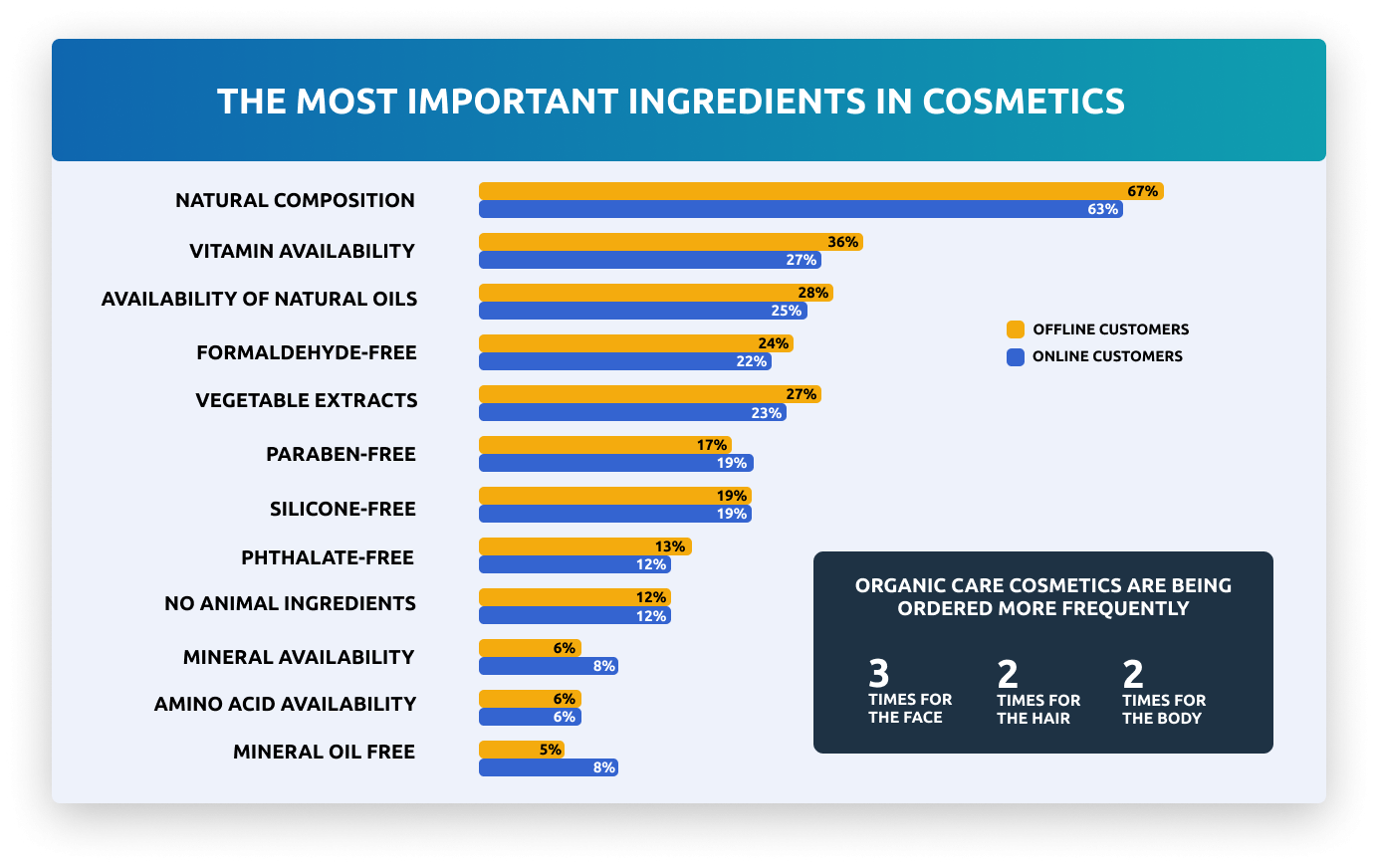

Emphasizing product composition in content

Product composition is a major factor influencing purchase decisions, both online and offline. Research shows that 60% and 53% of consumers, respectively, consider product composition when making a purchase.

The demand for natural products is growing in various fields, including the cosmetics industry. Brands that use natural ingredients grow faster than those that focus on synthetic substances. It is crucial to not only create natural products but also to actively communicate about them. Statements about the safety of the composition will undoubtedly increase sales.

Products with a natural composition are the most trusted. Over 60% of women are ready to buy natural cosmetics, even without any prior experience with the brand. We must also consider the environmental impact of packaging, as 21% of buyers prioritize this.

This is why the demand for Korean cosmetics is increasing in Russia because they align with consumers’ desires and are made with natural ingredients.

Price comparison in different stores

Users are always on the lookout for the best deals, so promotions and discounts from beauty bloggers are a great way to get their attention. 57% of shoppers compare prices from different stores.

For instance, if a popular beauty blogger recommends a product and announces a promotion for it at a certain store, it can be a great reason to buy.

For instance, VK blogger Yana Rudova offers comprehensive reviews of cosmetics from various brands, showcasing makeup for various occasions. She also provides invaluable insights on skincare and haircare. While her posts occasionally delve into personal topics, her primary focus is on in-depth reviews of beauty products.

User-generated content

User-generated content is photos, reviews, comments, and videos created by consumers themselves. Studies show that UGC inspires more trust in potential buyers than traditional advertising.

Valmont cosmetics review on Instagram* by microblogger Alexandra | Bayer | PERSONAL SHOPPER

82% of buyers trust specifically UGC videos on social media, i.e. testimonials that were filmed not for sale, because in them, the buyer can relate to the author and their story. To make a selling UGC in the beauty industry, you must focus on the non-obvious benefits of beauty products, the before/after effect, use the creator's face in the shot, and emphasize charisma.

This clearly demonstrates the importance of engaging with cosmetics customers through online channels. If you want to present your cosmetic product on the Russian market, trust RMAA specialists. We will conduct market research on your segment, make a strategy for effective entry into the Russian market, and implement it using the most effective promotion channels to attract the attention of Russian consumers.

Do you want to receive the most up-to-date information about marketing, its tools, and current analytics by industry? Subscribe to our blog by filling out the application form below.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Russian-Speaking Influencer Marketing Overview

Further insights and trends in the Influencer Industry within Russia and the CIS

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

A content lead. Natalia runs marketing projects promotion with different digital tools in the Russian-speaking market.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!