Blog about successful marketing strategies in russia

Russian Beauty Trends and Cosmetics Market Overview

DIGITAL MARKETING

Share this Post

The Russian cosmetics market is rapidly changing. After the departure of Western brands, Korean and local manufacturers have filled the gap, with demand shifting towards eco-friendly formulas, marketplaces, and digital promotion. What lies ahead for the industry?

Which brands are winning in the new conditions? Let's explore in our article.

Cosmetics Market Overview in Russia

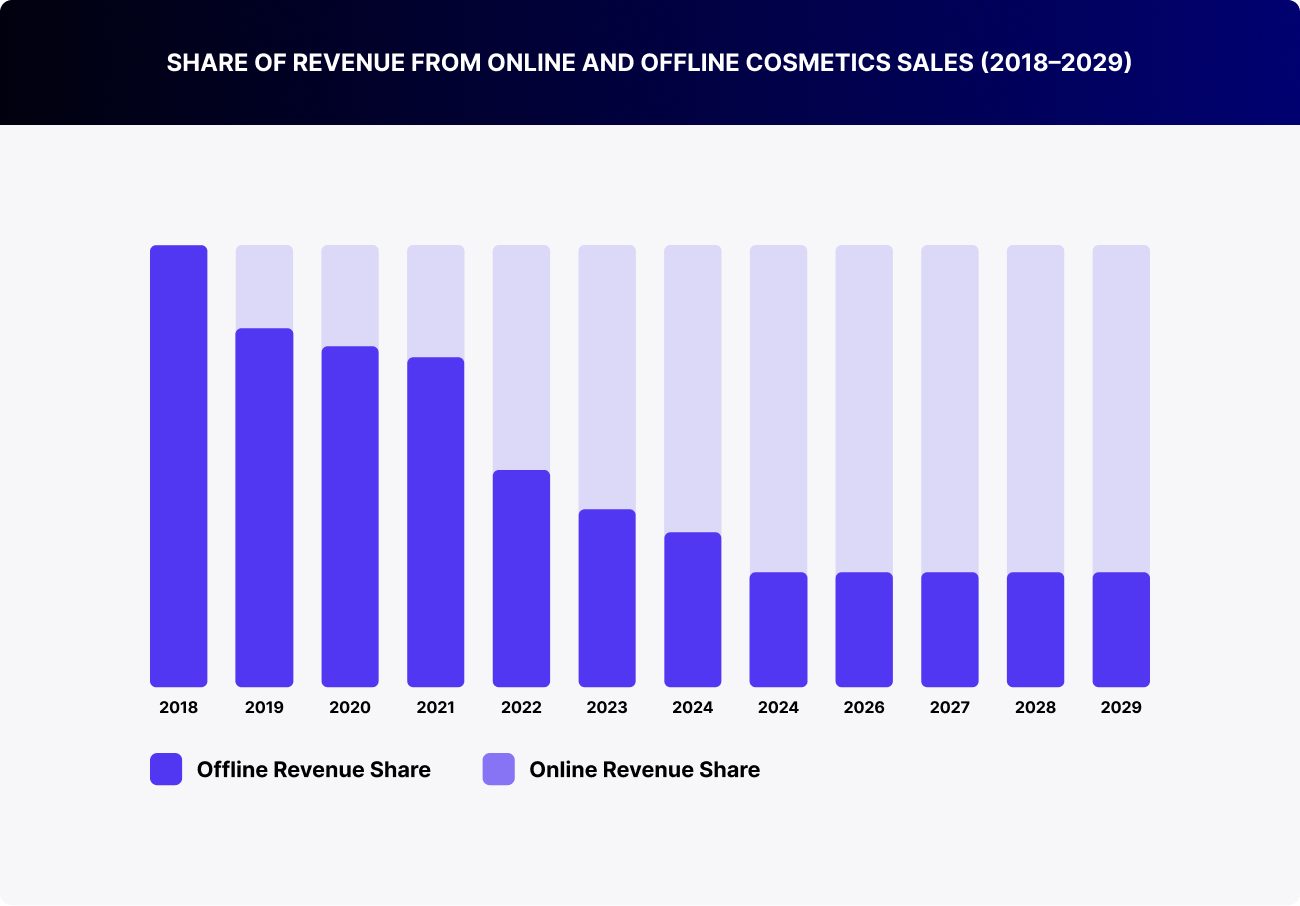

The Russian cosmetics market will reach $3.2 billion by 2025, with an annual growth rate of 2.69% (CAGR 2025-2028). After the departure of Western brands, the market adapted through the strengthening of local and Asian brands. The primary driver of sales growth is marketplaces, which accounted for 19.2% of all cosmetic purchases in 2024, marking a 3.3% increase compared to 2023. Overall, online sales continue to gain market share, while offline channels are gradually losing ground.

The majority of sales are attributed to skincare products, while decorative cosmetics are gradually regaining ground after the decline in previous years. Natural cosmetics remain the fastest-growing segment.

The sales distribution by segment is as follows:

| Category | Market share | Segment Features |

|---|---|---|

| Skincare products | 40% | Anti-aging creams, serums, cleansing |

| Makeup products | 25% | Eye makeup (12%), lip makeup (8%), face makeup (5%) |

| Nail care products | 10% | Nail polishes, cuticle care, nail strengthening |

| Natural cosmetics | 15% | Natural ingredients, biodegradable packaging |

| Other segments | 10% | Body care products, sunscreen, and therapeutic cosmetics |

In 2024, Asian brands, particularly from China and South Korea, actively expanded their presence in the Russian market. The export of South Korean cosmetics surpassed $10 billion, with Russia ranking sixth among importing countries at $406 million.

The popularity of South Korean cosmetics can be attributed to their diverse and interesting range of products, affordable prices, and regular updates to their lines. Brands offer products for all skin types, and their price-to-quality ratio makes them attractive to a broad audience. Over the past year, more than 30 new Asian cosmetic brands entered the Russian market, and in the facial care segment, Korean products accounted for more than 10% of total sales. Experts believe that South Korean cosmetics may eventually replace the luxury brands that have left the market, filling their niche.

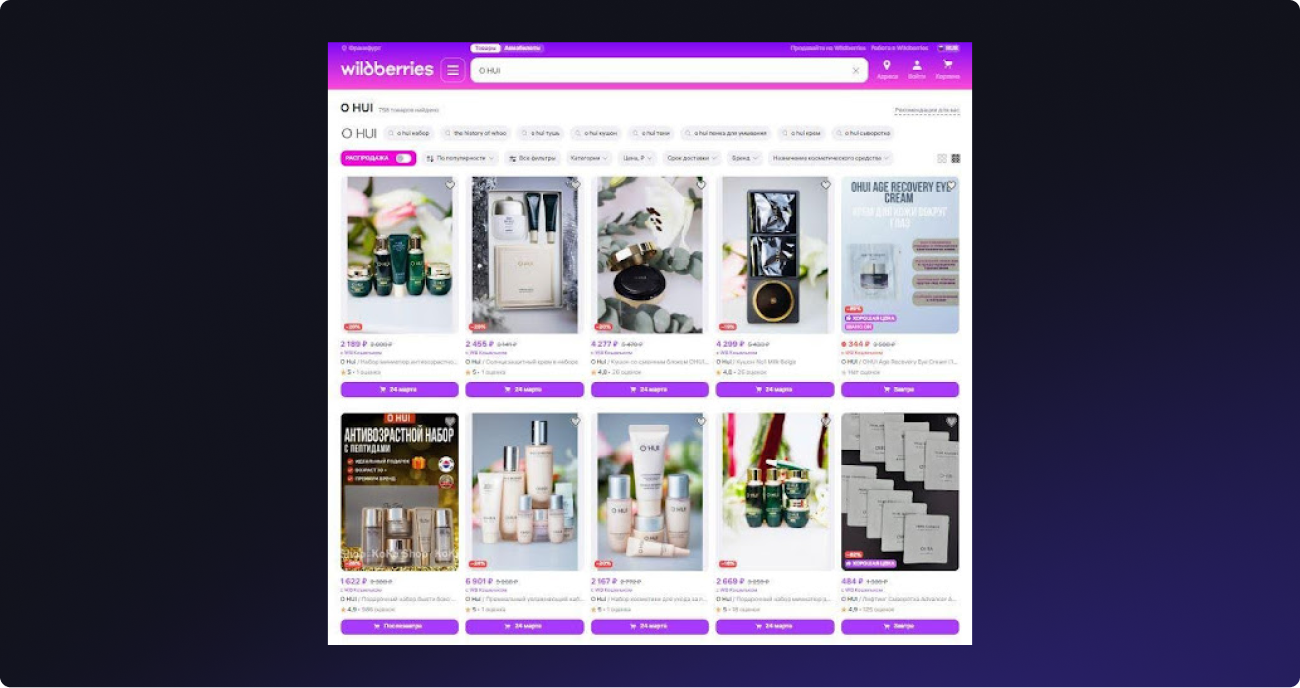

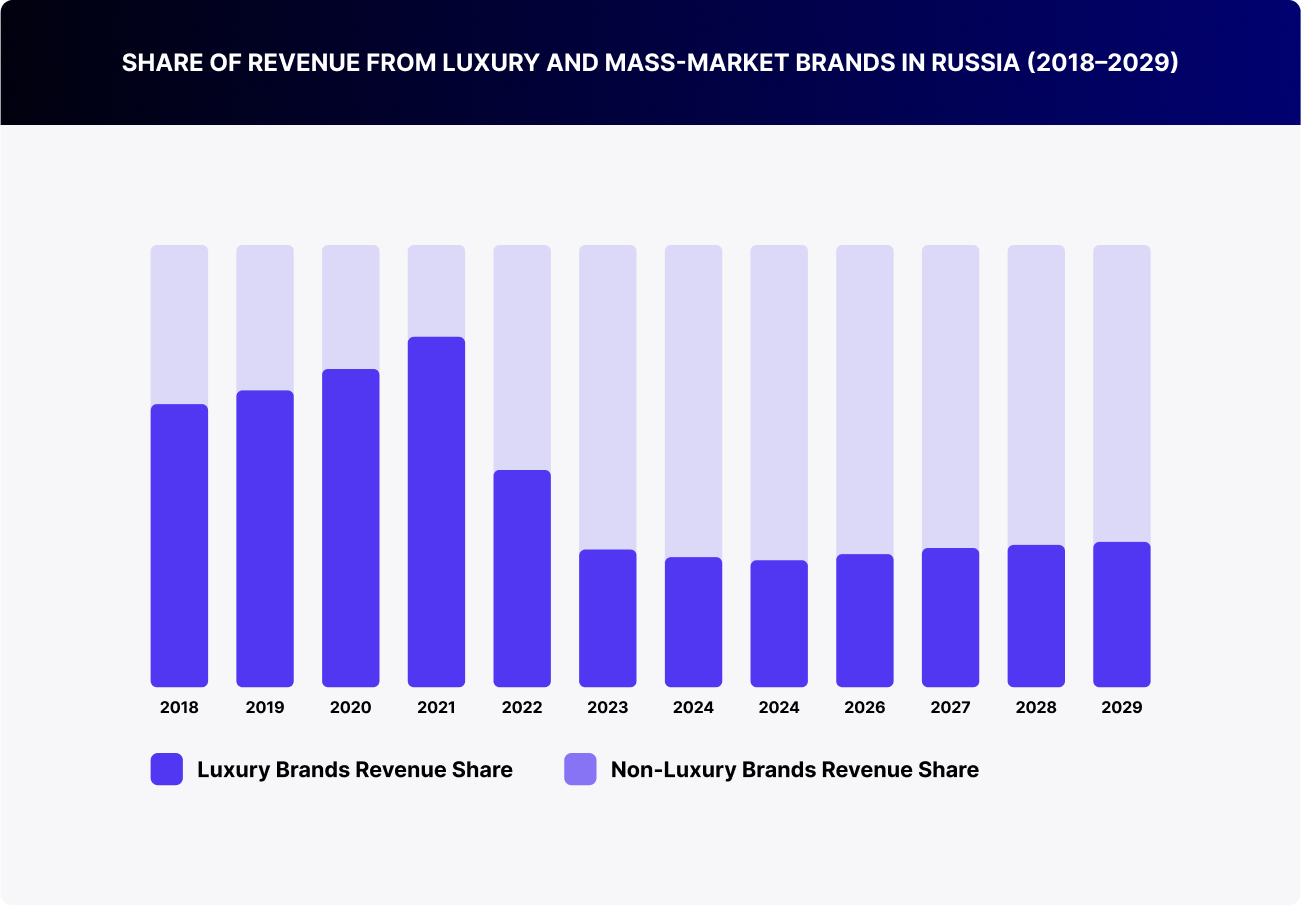

It's also worth noting the luxury cosmetics market in Russia, which has undergone significant changes. After the departure of several Western premium brands, a vacuum was created, which began to be filled by Asian and local producers. Among the most prominent in the luxury segment are South Korean brands Sulwhasoo, O HUI, The History of Whoo, and Chinese brands like Florasis and Herborist. These brands offered products with innovative formulas and natural ingredients, which helped them gain the trust of Russian consumers.

O HUI brand on Wildberries marketplace

However, despite the active development of Asian brands, the demand for luxury cosmetics remains relatively low, concentrating mainly in large cities like Moscow and St. Petersburg.

At the same time, Russian manufacturers are attempting to occupy the niches vacated by the departure of cosmetic brands, including in the luxury segment and among products with active ingredients. Over the past three years, the number of domestic cosmetic brands has doubled, reaching 3,000 companies. However, they face some challenges.

Firstly, Russia has a poorly developed cosmetic raw materials base , which forces manufacturers to import most of the components. This increases production costs and reduces the competitiveness of domestic brands. Secondly, Russian brands are not always able to offer the same range and level of innovation as Asian brands, which reduces their attractiveness to consumers. And thirdly, producing luxury cosmetics requires a high level of professionalism and an understanding of the specifics of elite clientele. Russian cosmetics companies still lack sufficient experience in this segment.

While Asian brands continue to strengthen their positions, Russian companies are developing but need to overcome the technological gap and create products that can compete with Asian and Western counterparts. The winners in this market are those who invest in innovations, take consumer demands into account, and actively use digital channels for promotion.

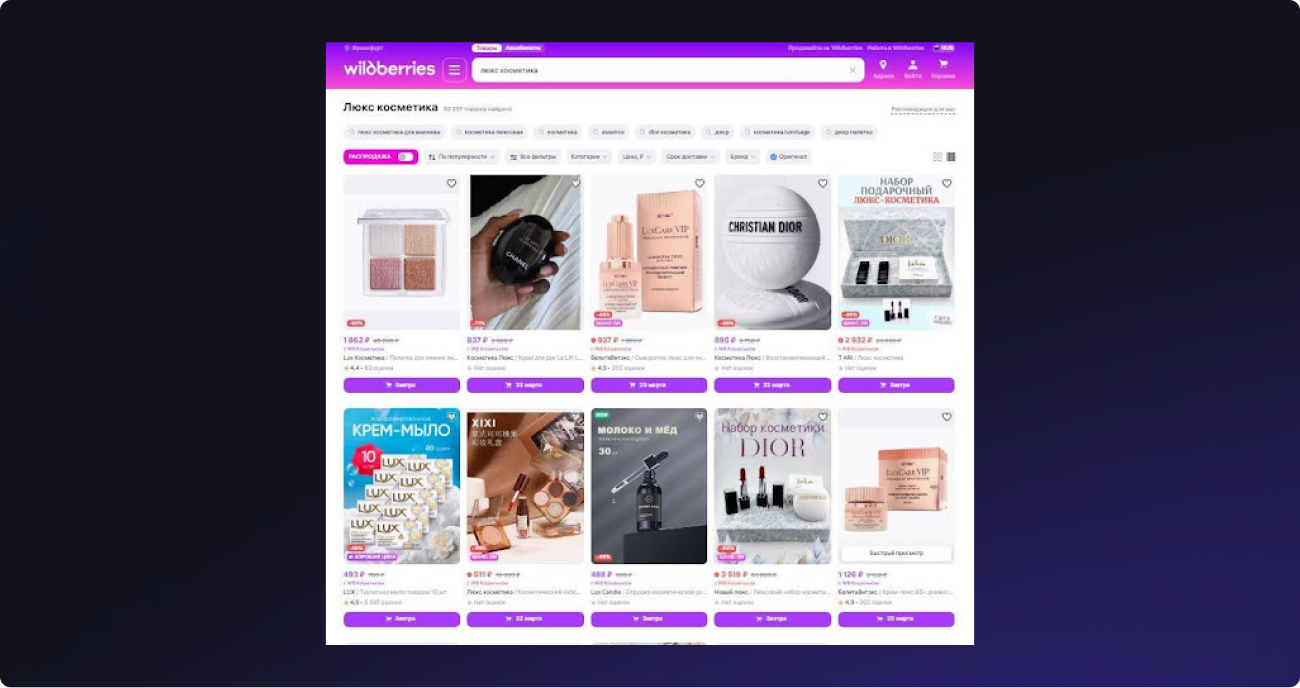

It is also important to note that despite the departure of Western cosmetic brands from Russia, their products are still available on the market, but no longer through official channels. Today, brands like Christian Dior, Chanel, and L'Oreal are sold exclusively through marketplaces or large retail networks via parallel imports. As a result, their prices have increased by more than 40%, which has led a significant portion of the audience to pay attention to brands with lower prices.

Luxury cosmetics of Western brands on the Russian marketplace Wildberries

However, this segment remains unstable. The share of counterfeit products in perfumes and cosmetics on marketplaces has reached 20%, which undermines consumer trust in such goods. Russian buyers are looking for quality alternatives to familiar brands, and cosmetics from affordable brands have already become the primary choice for many of them.

Korean Cosmetics vs. Russian Brands: What Do Consumers Prefer?

Russian consumers are increasingly paying attention to the ingredients of cosmetics and quality. Last year, 22% of consumers stated that they were dissatisfied with the existing assortment of perfumes and cosmetics, while 37% were doubtful about its quality. Against this backdrop, the demand for natural formulas is growing: 75% are willing to pay more for ‘green’ cosmetics.

At the same time, price remains an important factor in decision-making. Around 60% of Russians prefer cosmetics in the price range of 500–2000 rubles, where accessibility and quality are well-balanced.

One of the main beneficiaries of these changes has been Korean brands. Their products offer effective formulas at affordable prices, making them attractive to Russian consumers. Today, 32% of women in Russia use Asian cosmetics, with 90% of them preferring Korean brands. In Moscow, the demand for these products is especially high: in January 2024, traffic to Korean online stores increased by 28%, particularly in the Moscow region.

With the growing share of the population aged 55 and older (30% of Russians), interest in products containing retinol, peptides, and hyaluronic acid is increasing. Asian brands are ready to offer and are offering a wide range of anti-aging products that meet these demands.

When choosing cosmetics, skincare products, and perfumes, Russian consumers increasingly prefer online platforms. They appreciate convenient delivery, a wide selection, and the ability to compare prices, making marketplaces the primary sales channel.

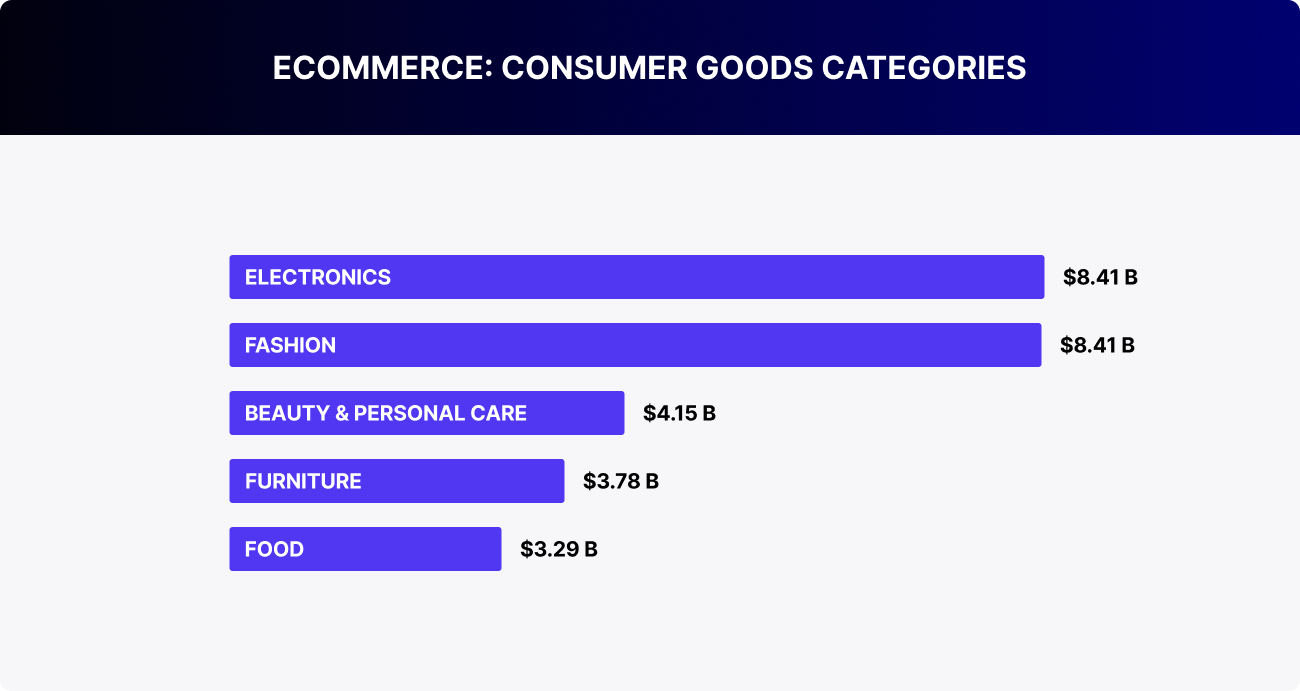

In 2024, Russians spent $4.15 billion on cosmetics online, and this figure will continue to grow. Online shopping is becoming a familiar choice for consumers, and brands are actively adapting their sales strategies to this trend.

Moreover, the choice of cosmetics among Russian women is largely influenced by the opinions of other buyers — 54% of consumers make purchasing decisions after reviewing feedback.

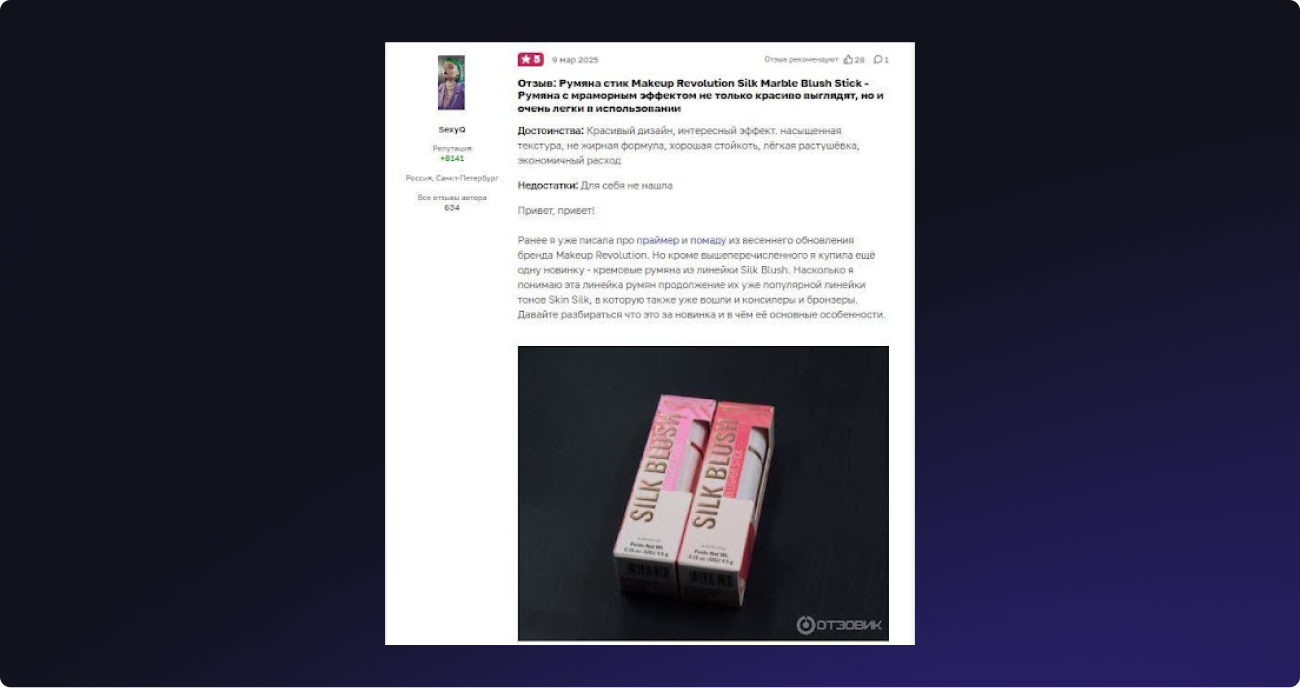

Before adding a product to their cart, female shoppers check ratings and comments on platforms like Wildberries, Ozon, and Yandex Market. Many also refer to specialized review sites such as IRecommend and Otzovik.

Review of Makeup Revolution blush on the Ozovik

Social media platforms are particularly popular, with users actively sharing their experiences with cosmetics. For example, on YouTube, you can find unboxing videos, long-wear tests, and reviews from influencers.

Cosmetic reviews from marketplaces are especially popular, where influencers check the authenticity of products, show textures, and share their first impressions. These formats help shoppers see the product in real-life use and make a final decision about the purchase.

MIXIT brand cosmetics review by popular beauty influencer Yana Piletskaya

A Key Trend in the Beauty Market in Russia

Over the past three years, there has been a consistent trend towards ‘eco-friendly’ cosmetics (which helps explain the popularity of Korean brands). In 2024, demand for natural products grew by 47%, and in the segments of hair, facial, and body care, sales increased by 2–4 times.

Experts expect that the share of certified organic and eco-friendly cosmetics may double in the next three years. Many brands have already started focusing on natural ingredients and eco-friendly packaging.

By aligning with important market trends, such as the demand for environmental conservation and sustainability, these brands gain additional intangible value and a competitive advantage over their rivals.

The demand for products with recyclable packaging and cosmetics that are not tested on animals is driving the growth of eco-focused product development. Customers are increasingly scrutinizing the composition of cosmetics and showing a preference for those with organic components. This trend towards natural ingredients is evident both in the digital space (63%) and in traditional retail (67%).

Consumers are increasingly choosing brands that not only produce eco-friendly cosmetics but also openly communicate their approach: using recyclable packaging, avoiding harsh ingredients, and supporting sustainable production. For those who want to maintain audience interest, it is important not only to offer natural formulations but also to demonstrate that there is a genuine commitment to quality and the environment behind it.

The WHAMISA brand talks about its concept on its Instagram account

How can this be achieved? Promoting eco-friendly cosmetics is effectively done through influencers, KOLs and celebrities who build trust with their audience. Instead of direct advertising, they show how the product fits into their lifestyle: testing it, talking about the ingredients, and sharing personal experiences. This approach works better than standard advertising campaigns because consumers are more likely to trust the opinions of those they consider experts or simply trust.

A post about men's eco-cosmetics brand Ecolatier on a macroinfluencer's account

RMAA demonstrates this in practice. Our agency's systematic approach to selecting and collaborating with beauty bloggers on YouTube resulted in high demand for Celimax brand products, particularly the Celimax Noni care products line. The effectiveness of the campaign resulted in the ‘sold out’ of the product in the popular beauty market Golden Apple. We successfully collaborated with six popular YouTube channels, showcasing our expertise in influencer marketing. The integrations blended seamlessly with the bloggers' content, capturing audience attention and increasing interest in Celimax products.

Promotion through influencers is just one of the tools that help build trust with the audience and boost sales. RMAA has extensive expertise in promoting beauty brands in Russia and the CIS. Depending on the task, we select the right strategy: it can include not only YouTube integrations but also effective SMM, targeted advertising, or launching collaborations. There are many options depending on budgets and goals. At the moment, the Russian market remains highly promising for cosmetic companies, and such an opportunity should not be missed.

Have any questions? To start working with RMAA, please fill out the contact form.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Russian Digital Market Overview

Strategic Insights into Russian Digital Marketing Landscape

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

A content lead. Natalia runs marketing projects promotion with different digital tools in the Russian-speaking market.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it