Blog about successful marketing strategies in russia

Russian Online Shopping: Key Trends and Consumer Behavior Insights

MEDIA BUYING

Share this Post

The Russian e-commerce market continues to grow in 2025, despite restrictions, the exit of brands, and economic turbulence.

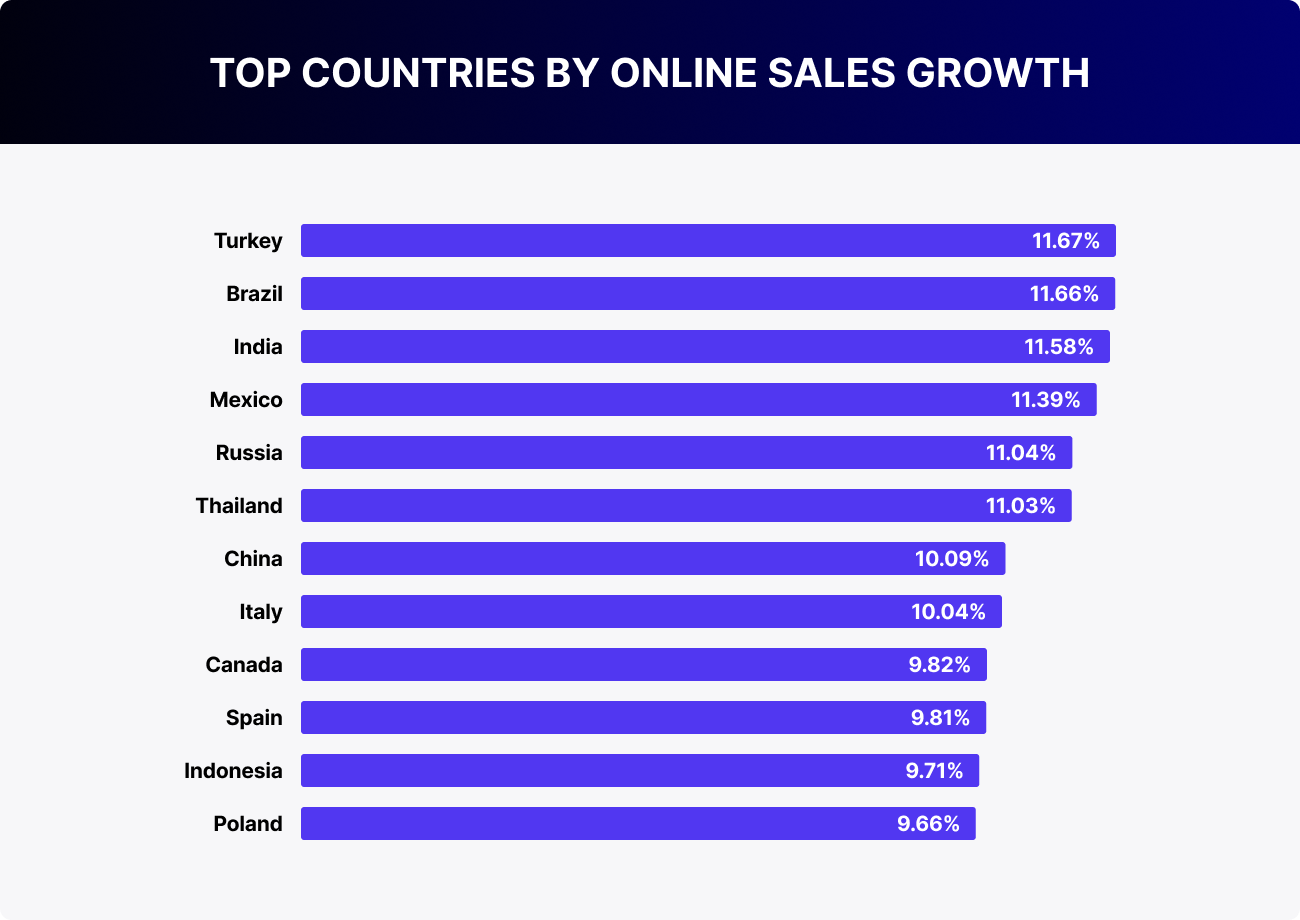

Last year, the volume of online sales in Russia reached 10.7 trillion rubles, a 36% increase compared to the previous year. According to forecasts, the compound annual growth rate (CAGR) for retail online commerce in Russia from 2024 to 2029 will be 11.04%. This places Russia alongside fast-growing markets like India (11.58%) and Mexico (11.39%).

At the same time, 97% of purchases are made on Russian platforms — Ozon, Wildberries, Yandex.Market. The share of cross-border purchases is only 3%.

For some foreign companies, this means one thing: the market is closed, but only formally. The Russian consumer hasn’t left; they’ve simply changed their purchasing routes. To sell here in 2025, it’s important not only to enter a marketplace but also to understand how Russians choose, compare, trust, and pay.

In this review, we will examine how consumer behavior is structured in Russia, which platforms perform the best, and what foreign brands should do to integrate into the current ecosystem.

Increase the number of online users

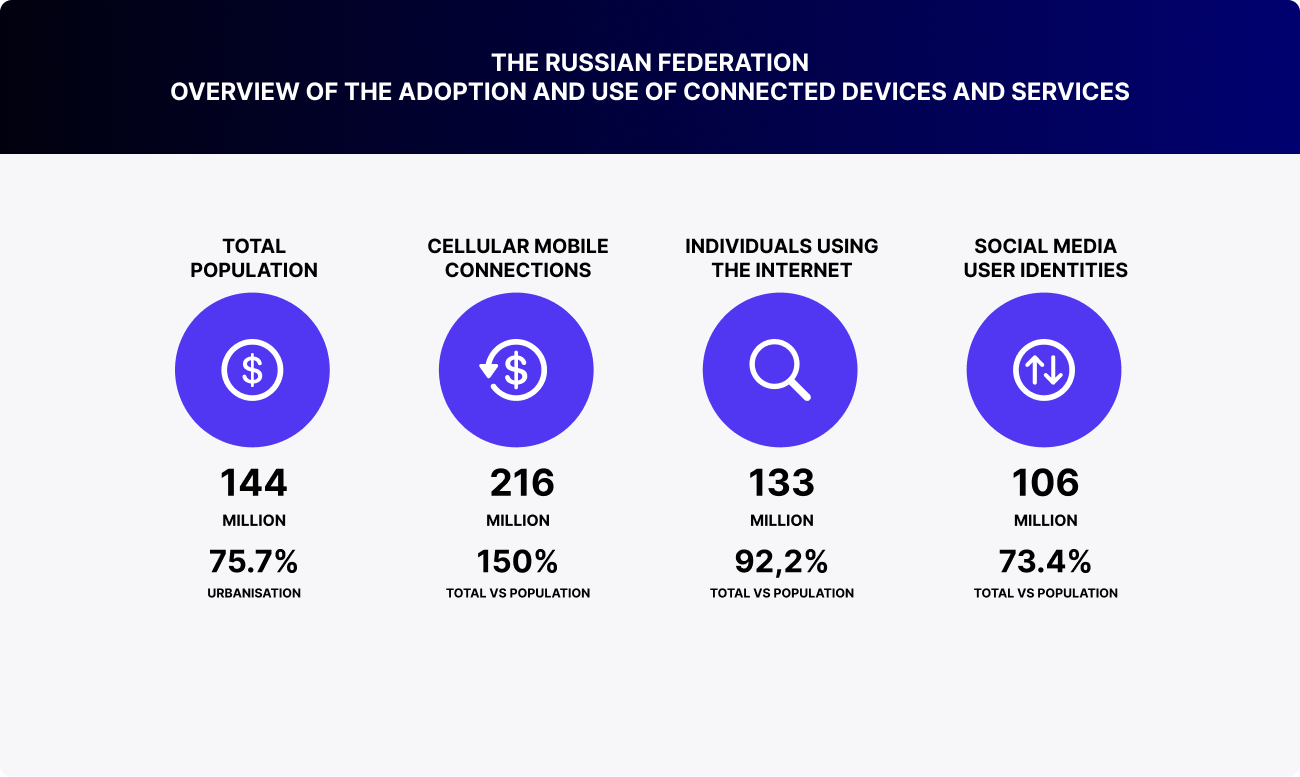

As of the beginning of 2025, the number of internet users in Russia stands at 133 million, more than 92% of the country’s total population.

Growth has slowed, but digitalization has almost reached its peak: the only groups remaining offline are the older generation and those in remote regions.

The most active and numerous group is users aged 25 to 34, making up over 11% of the total population. This is the key audience for e-commerce, and they are the ones driving trends in mobile shopping, marketplace selection, reviews, and advertising on Telegram.

If you plan to enter the Russian market, your consumer is already online. They are mobile, accustomed to fast delivery, and do not tolerate complicated purchasing scenarios. Your task is not only to appear online but also to integrate into their familiar digital journey.

Marketplaces in Russia — Not an option, but a standard

In 2025, marketplaces have firmly become the primary shopping channel, accounting for over 80% of all online orders.

By 2025, the Russian marketplace sector is nearly completely segmented:

- Wildberries confidently holds the lead, having almost half of all online sales (47%).

- Ozon follows with 34.4%, becoming the main competitor.

- Yandex Market is still lagging at 8.1%, but is growing.

- Megamarket and Sima-land occupy niche positions, with 6.9% and 1.8% respectively.

- The remaining 1.9% is held by smaller players

Let's take a closer look at the key players.

Wildberries — profit, expansion, and the new market landscape

While competitors are still catching up, Wildberries is already changing the rules of the game. In 2024, the company didn’t just grow, it reshaped the market to its advantage. Its turnover exceeded 4 trillion rubles, marking a 60% increase from the previous year. Revenue reached 657.5 billion rubles, and net profit hit 66.5 billion rubles, which is 3.5 times more than the year before. Two years ago, the marketplace was still operating at a loss, and now it is one of the few marketplaces in Russia that is seriously profitable.

And this is just the beginning. In 2025, the company plans to reach a turnover of 6–6.4 trillion rubles, increase revenue to 950 billion rubles, and earn up to 120 billion rubles in net profit. This growth is not accompanied by cuts, but instead by large-scale growth in infrastructure, logistics, and regional presence.

In 2024, Wildberries’ warehouse capacity was 1.5 million square meters. By the end of 2025, an additional 2.3 million square meters will be added — not only in Russia, but also in Kazakhstan and Uzbekistan. The network of pickup points is also expanding — there are already more than 50,000, with another 10,000 set to open in collaboration with Russian Post. A special focus is placed on small and medium-sized cities, where competition is lower, but logistics are more complex. Here, the marketplace aims to become the number one player.

Expansion beyond Russia continues. The company is already present in Armenia, Belarus, Kazakhstan, Uzbekistan, Georgia, and Kyrgyzstan. Last October, the first pickup points opened in Tbilisi in partnership with local players. This is not just expansion — it’s a transformation of the marketplace into a regional distribution channel. For brands, this means one thing: the audience is there, logistics are set up, and the market is functioning. And all this is not only in Russia but also beyond its borders, on understandable terms.

Product categories on Wildberries

Main product categories are Clothing and Footwear (leader), Home Goods, Electronics and Gadgets, Beauty and Health, Children’s Products, and Groceries.

Sales of Asian products continue to grow steadily: Korean cosmetics, Japanese gadgets, and unusual sweets are no longer bought out of curiosity but have become a regular part of life.

There is also high demand for basic wardrobe items: sweaters, pants, blazers — simple, high-quality pieces that are easy to mix and match. People are increasingly seeking to create comfort in their homes. Blankets, candles, wall hangings, and artificial plants are in high demand. Health and wellness are also trending — vitamins, dietary supplements, gluten-free products, and protein snacks have become everyday norms. Additionally, interest in hobby products has noticeably increased: board games, craft kits, and coloring books.

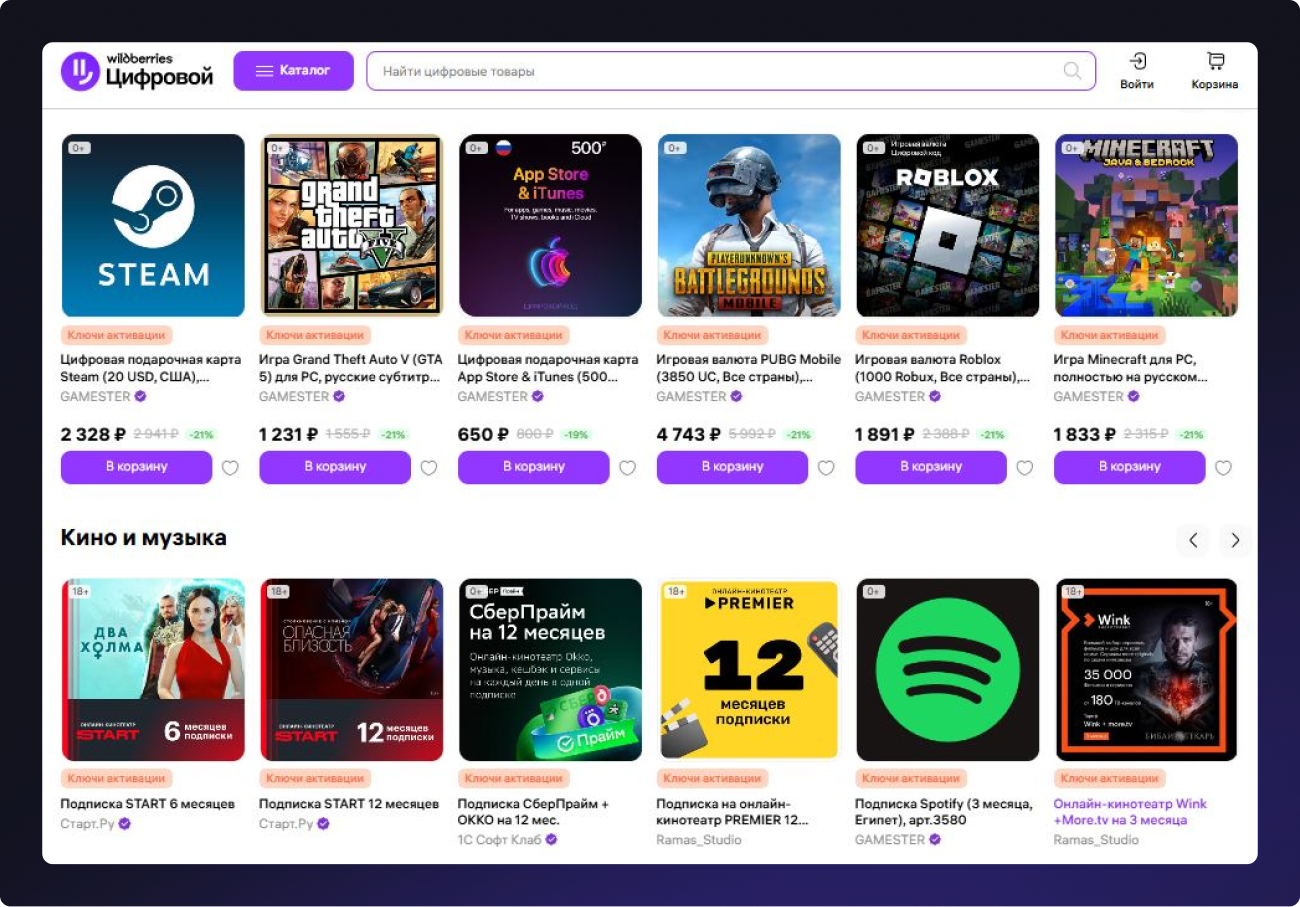

What about games and digital products?

Wildberries is one of the few platforms in Russia where digital products, including game keys and content, are officially sold.

In the section Wildberries Digital, PC games from Steam, Epic Games, Rockstar, and others are available for purchase, as well as keys for Xbox and Nintendo, and there is also an option to top up eShop or gaming accounts.

Ozon - growth on losses and ecosystem building

Ozon's marketplace is also experiencing exponential growth.

Judging by the results of the past year and plans for 2025, the company is focusing not just on sales but on complete dominance in digital retail.

The marketplace's turnover grew by 64%, reaching 2.875 trillion rubles. A total of 1.47 billion orders were processed, and the number of active buyers surpassed 56.5 million people. Nearly every second adult Russian makes online purchases on this marketplace.

And all of this is happening despite the company still operating in the red: the net deficit for the past year amounted to 59.4 billion rubles. However, this no longer seems like a failure, but a part of a long-term strategy. Ozon continues to scale up with the goal of making profits tomorrow. And the signs of this ‘tomorrow’ are already visible.

EBITDA increased sixfold — from 6.3 to 40.1 billion rubles, and in 2025, the company plans to reach 90 billion. This is now a story about growth at any cost.

Behind this growth are not only goods. Fintech is one of the main drivers: wallets, loans, installment plans. In 2024, revenue from this segment tripled, reaching 93.3 billion rubles. And in 2025, the company plans to increase it by another 70%.

The advertising business is also growing rapidly. More and more sellers are purchasing promotions on the platform, and Ozon is becoming a true media environment with precise targeting and rich analytics.

Logistics is another strong point. Warehouse space increased to 3.5 million square meters, and the number of pickup points exceeded 60,000. Of these, 25,000 are located in small towns. This is not a coincidence but a strategy: while competitors focus on megacities, Ozon is conquering regions where loyalty is higher and the selection is smaller.

Ozon product categories

The fastest-growing category is clothing. Last year, its turnover on the platform increased by 86%. People are actively searching for replacements for the brands that left, and they are finding them on this marketplace, where it's convenient, fast, and familiar.

For fashion brands, this is a clear signal: if you’re not on Ozon, you’re not being chosen.

The main product categories on Ozon are: Clothing and Footwear, Home and Kitchen Goods, Electronics and Home Appliances, Groceries and FMCG, and Children’s Products.

Yandex.Market - investments, growth, and struggle for market share

Against the backdrop of Ozon's aggressive scaling and Wildberries' financial leap, Yandex Market has chosen a different strategy: active investments, expanding its assortment, and acquiring logistics solutions. Yes, it’s still in the red, but with a clear goal to secure a stable niche in the growing market.

Last year, the GMV of Yandex Market increased by 64%, reaching 503.4 billion rubles. Revenue amounted to 322.3 billion (+45%), but the company's e-commerce segment is still in the negative: the loss was 63 billion rubles. This is not a miscalculation, but a planned investment in future market share.

Yandex.Market is expanding not only in terms of revenue. By the end of 2024, the assortment reached 80 million products, and the number of active sellers exceeded 90,000. This is already more than Ozon had at the beginning of the year before last. For brands, this means the opportunity to launch their own store before the competition becomes overwhelming.

In spring 2025, Yandex acquired the logistics company Boxberry. This gave it a network of pickup points, warehouses, and control over the last mile of delivery. Now Yandex.Market has a chance to approach Wildberries' infrastructure level, and for brands, this means more flexibility, speed, and fewer barriers when expanding into regional markets.

The forecast for 2025 is a minimum of +30% in revenue and the launch of new technologies: AI in recommendations and logistics, expanded personalization, and growth in regional coverage. Yandex may not have the same order volume as the top two market leaders, but it has its own weapon: a technological platform, powerful algorithms, and resources for the long haul.

For brands, this is an opportunity to enter the platform before it becomes overheated. Product listings with good content rise in search without additional investments. The platform focuses on quality, not just price, and this is its key differentiator.

Product categories on Yandex Market

Yandex.Market leads with children's products — a stable and active segment. Following that are clothing and footwear, which are especially popular during seasonal sales. FMCG remains one of the most frequent purchases, as part of everyday demand. Users are also keen on home goods, from kitchenware to cleaning products. Electronics and home appliances round out the top five, but they contribute the highest average check.

Top categories: Children’s Products (leader), Clothing and Footwear, FMCG Products, Home and Household Goods, Electronics and Home Appliances.

Marketplaces comparison: 2024-2025

| Metric | Wildberries | Ozon | Yandex Market |

|---|---|---|---|

| GMV | $43.0 billion | $30.9 billion | $5.4 billion |

| Revenue | $7.1 billion | $6.6 billion | $3.5 billion |

| Pickup Points | 50,000+ | 60,000+ | via Boxberry network |

| Active Sellers | 371,000 | 600,000 | 97,300 |

| Product Assortment | 500+ million | 370+ million | 80 million |

| Key 2025 Investments | Warehouses in Russia & CIS | Fintech, advertising, regions | Logistics, AI, Boxberry |

Why are marketplaces displacing direct sales

In general, there is a trend of buyers leaving direct sales channels for marketplaces. The reason is more attractive prices, installments, and convenient logistics. The buyer is sure that he will receive the order, and if something is wrong, he can make a return. The buyer knows that he will find exactly what he needs and knows in advance the terms of delivery. The reason for the wide selection of products on marketplaces is the sellers — they are the ones driving market growth, rather than the platforms themselves.

Fast delivery has also become a key factor. Last year, consumers were already willing to pay a little more if the product arrived not in 5 days, but the next day. In 2025, this model has solidified, and competition has shifted from ‘what we sell’ to ‘how quickly we deliver’.

As a result, if you're selling on a marketplace, you're no longer competing with other brands, but with other sellers. The competition is not at the level of "brand recognition," but at the level of: delivery tomorrow, higher ratings, lower prices. Success is determined by reviews, product listings, and search cover images. Everything else is already at the bottom of the page.

How foreign brands that left still sell in Russia

Despite sanctions and official exits, products from foreign brands continue to be sold in Russia, and marketplaces and parallel import services play a key role in this.

How does it work? A customer finds a brand's product on Ozon or Wildberries. The product is not supplied by the brand itself, but by a local reseller, legally independent, but well-versed in logistics. The reseller purchases the goods through an intermediary (usually from Turkey, China, or the UAE), delivers them to Russia, and lists them on the marketplace.

The marketplace does not ask for the brand's permission. It checks the documents of the seller. Everything else is within the law.

For example, MAC, Estée Lauder, Dior, and Clinique are all available for sale on marketplaces, even though they officially left the market.

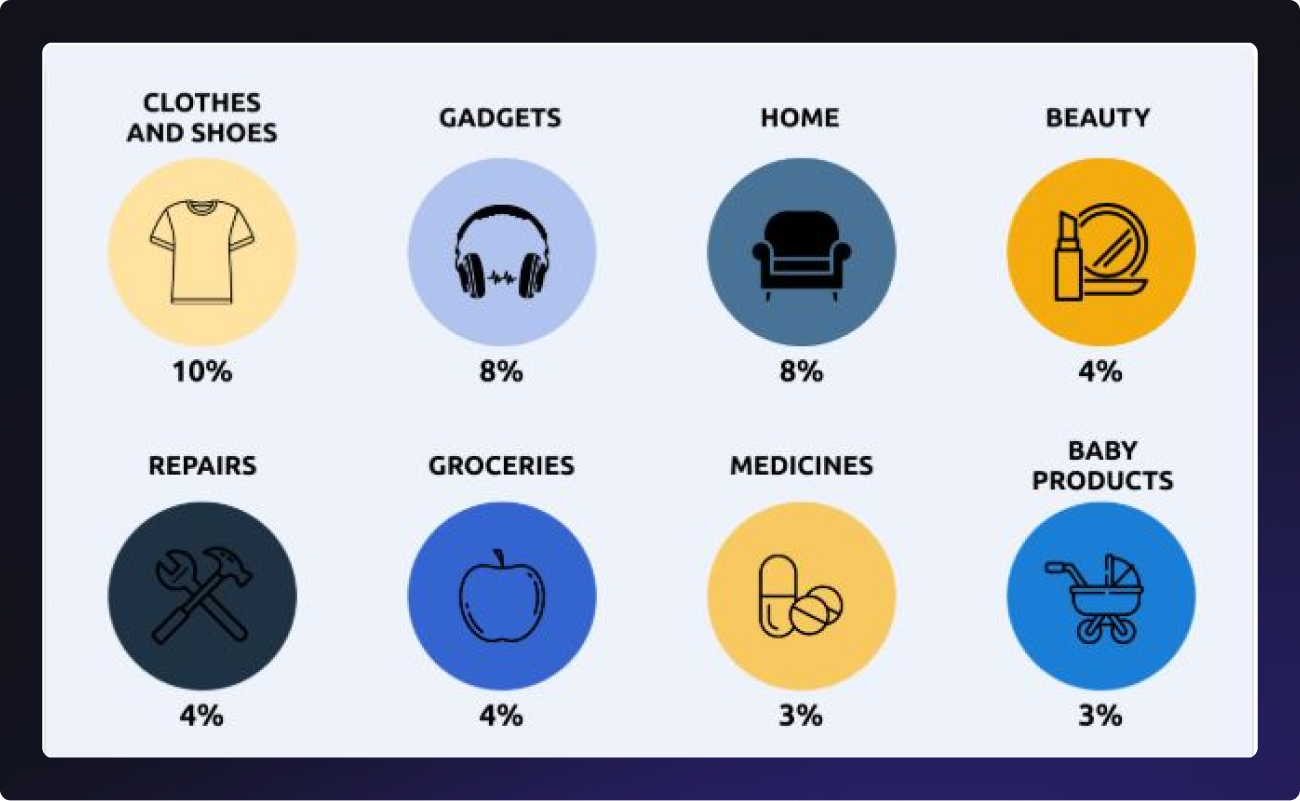

Top online purchases by Russians

In 2025, clothing and footwear, electronics, home goods, cosmetics, and groceries remain the most in-demand product categories online.

What’s the key feature? The buyer is not loyal to the brand — they are loyal to the result. If they are looking for ‘waterproof mascara with volume effect’ or a ‘robot vacuum cleaner under 15,000 rubles’, they don’t search by brand — they search by need. Less frequently bought online are alcohol, flowers, and large household appliances. These categories remain either for gifting or require an in-person evaluation.

If your product falls into the ‘mass functional demand’ category, you are already in the game. However, you need to adapt to search behavior by choosing the right keywords, writing concise descriptions, obtaining reviews with photos, and showcasing real-life use cases. This is particularly important in beauty, tech, and household categories.

If you are in the ‘premium selection’ niche (e.g., premium electronics or perfumes), you’ll need to rebuild trust through local visuals, video content, and tests.

At the same time, people are making more purchases, but spending less on each one. In the wake of the pandemic and the imposition of sanctions, consumers have become more rational in their spending and have been saving money where possible.

For foreign brands, this means entering either through ‘small formats’ — mini-products, testers, sets — or offering installment plans. We’ll discuss this further next.

Payment and goods delivery

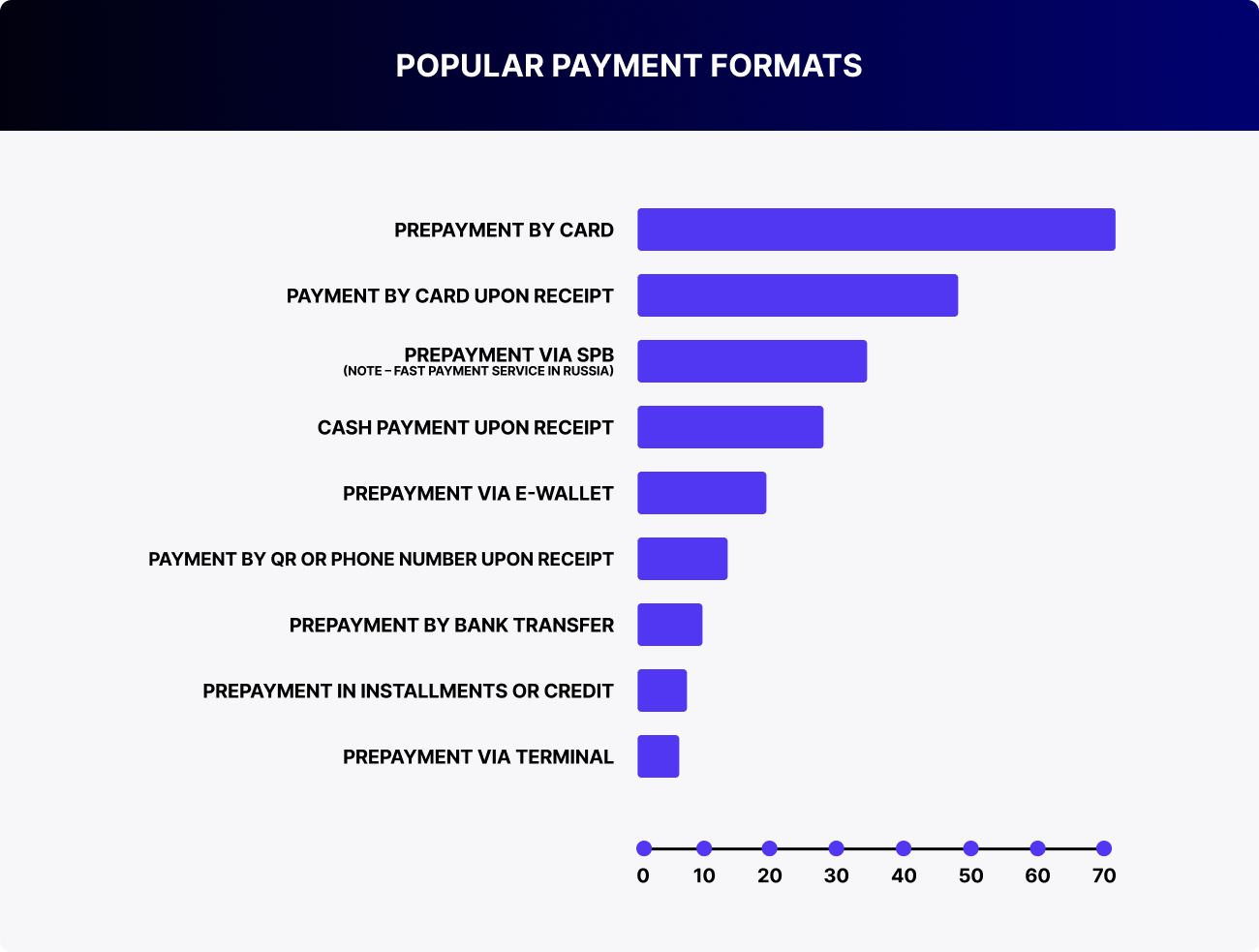

The most popular payment methods in Russia are bank card and payment on receipt. A survey conducted by Yandex Market revealed that approximately 70% of buyers have made at least one annual bank card purchase. This payment format is the most prevalent.

Just over 40% of customers opted to pay by card upon receipt.

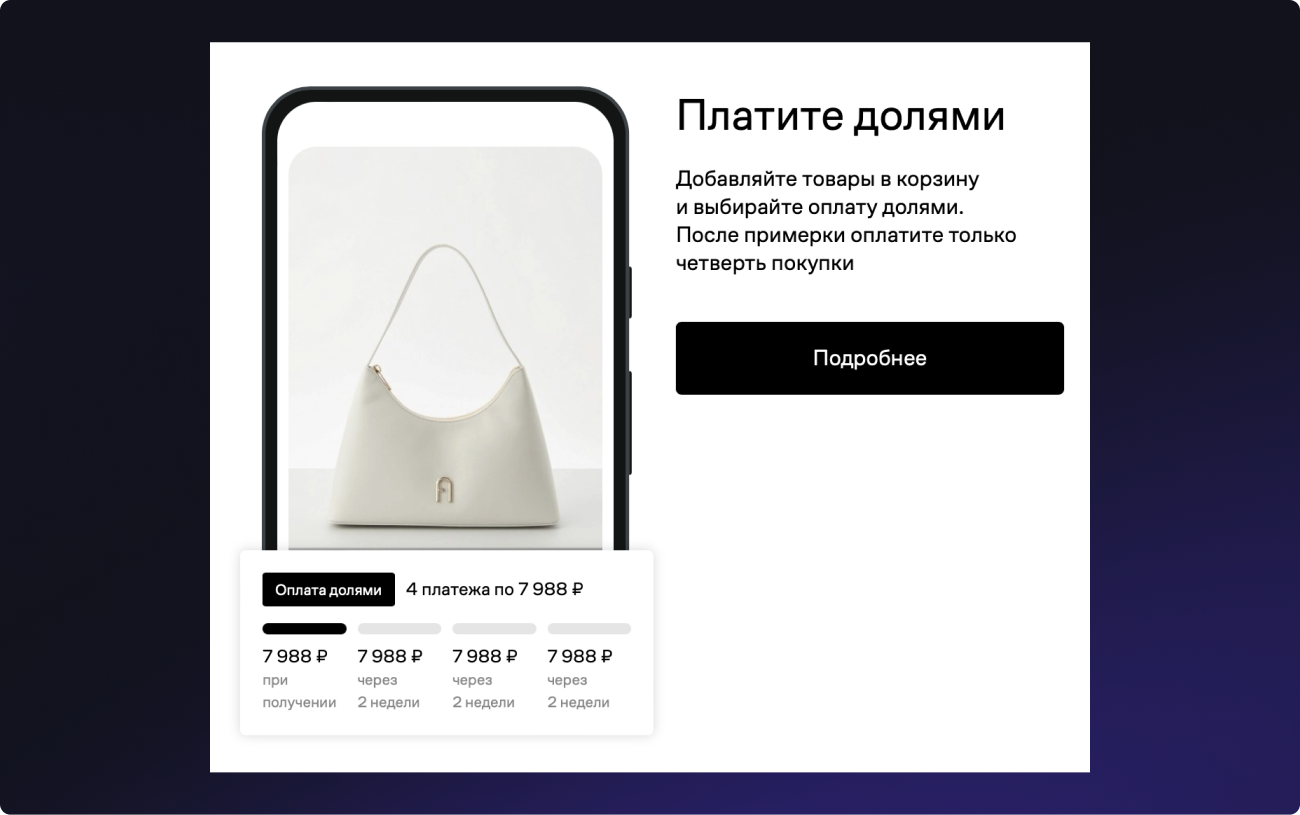

At the same time, the ‘buy now – pay later’ (BNPL) model through services like Dolyami continues to gain momentum. This is especially important for categories like clothing, electronics, and cosmetics, as the user pays 25% upfront, with the rest due later, without interest.

The payment for the product is divided into 4 equal parts. So, the customer only needs to pay 25% of the product price initially, and then another 25% every two weeks, and so on. Essentially, this is an installment plan, as no additional interest is charged for using the service. This can be used for purchases up to 30,000 rubles. It collaborates with both online and offline stores selling cosmetics, clothing and footwear, home goods, and children's products.

This lowers the barrier to purchase, especially in an environment of inflation and subdued consumption.

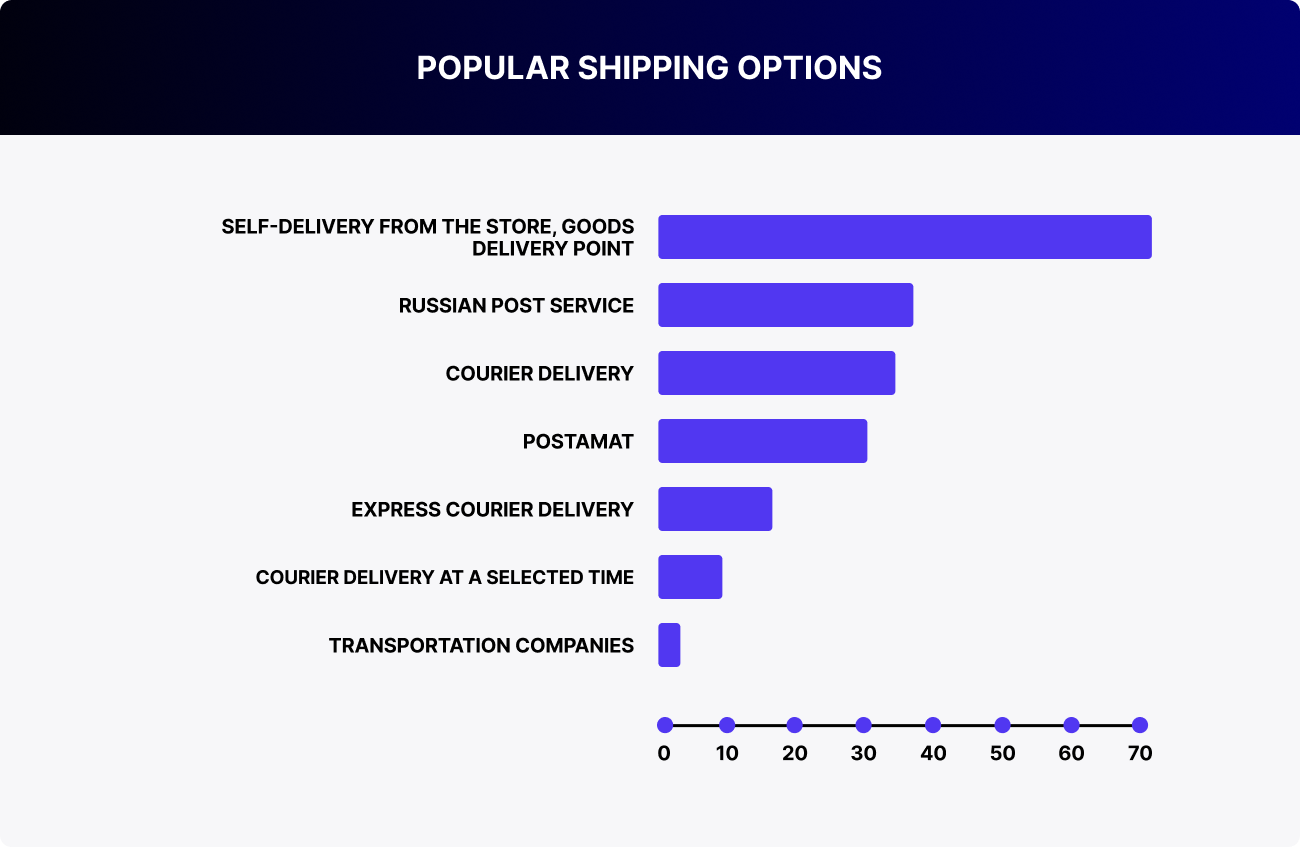

The most prevalent method of delivery is self-collection from a store or designated delivery point. This method was utilized by nearly 80% of buyers at least once a year. The next most popular methods of receiving goods are delivery by Russian Post (35%) and via courier (30%). If a brand sells through marketplaces, it should take into account that self- pickup is normal in Russia.

.It is important to choose fulfillment platforms that are connected to the logistics of marketplaces (e.g., Ozon Logistics, WB Partner).

The closer the product is to the customer, the higher the chance of choosing it.

Factors influencing consumer choice

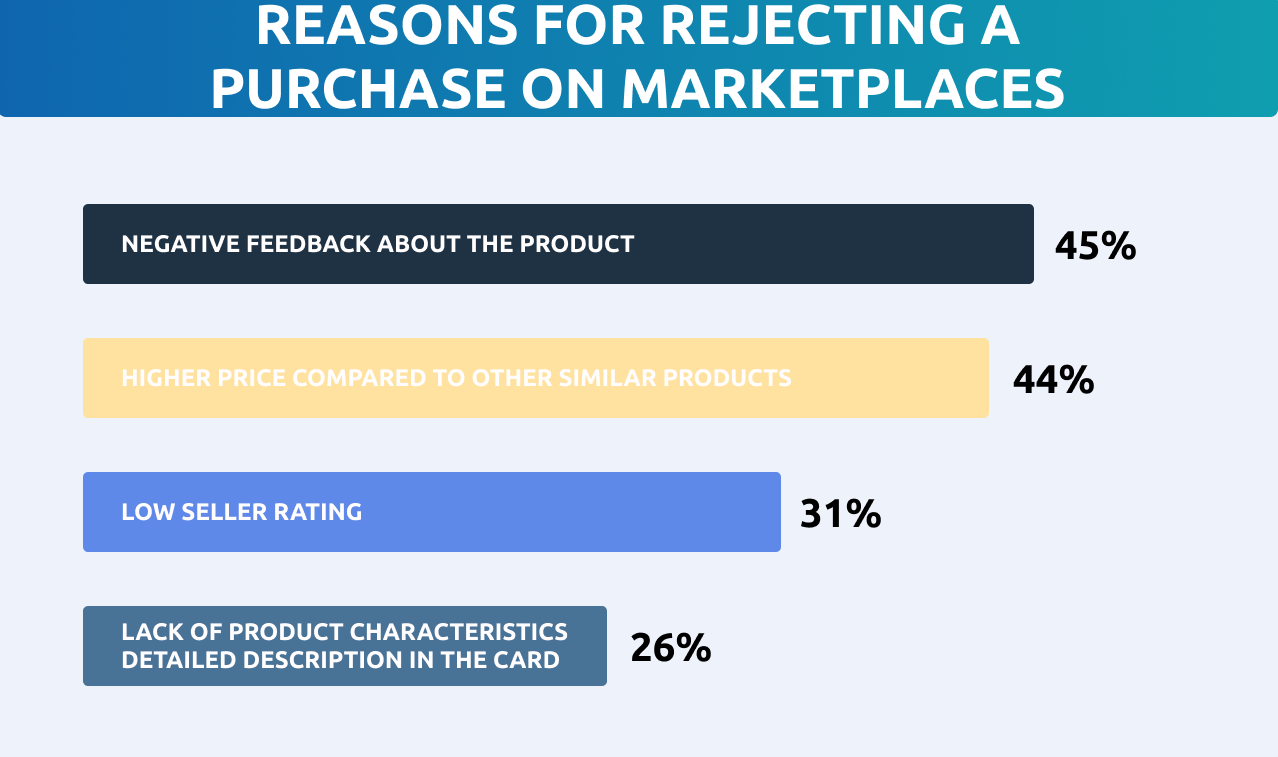

The primary factors that influence consumer decisions regarding goods and services remain price, reviews, and the convenience of delivery. For instance, Ozon employs reviews as a sales-boosting strategy. Marketplace statistics indicate that goods with 10 reviews are ordered 30-40% more often, and those with 100 reviews, are twice as often. Orders increase threefold when there are more than 1,000 reviews.

Customer reviews

The results of surveys indicate that 45% of buyers are influenced by negative reviews when making purchasing decisions, leading them to choose a different product instead. Furthermore, 44% of consumers are influenced by price differences. Thirty-one percent of buyers will not place an order with a seller who has received a low rating. Additionally, 26% of respondents indicated that a comprehensive product description on the product card is a key factor in their purchasing decision.

With regard to reviews, it is important to consider the impact of social networks. Approximately 45% of Russians make purchasing decisions based on reviews on social networks. To promote their products, companies create brand pages, publish promotional posts, and hold contests for subscribers. Direct recommendations and reposts in local communities often generate more traffic than paid ads.

Video content via bloggers

All contemporary promotional channels are now utilizing video content as a means of attracting customers. In order to achieve these goals, it is important to engage with well-known bloggers. They publish reviews and unboxings of products, providing insight into their experience of using them. Subscribers give feedback on these videos, sharing their impressions and recommending the product to others. In 2025, video content from influencers is the main source of trust in e-commerce. People don’t read press releases. They watch: how it looks, who has already tried it, and what’s wrong with it. For this purpose, brands are engaging famous influencers.

Influencer marketing is particularly effective in categories like cosmetics and perfumes, electronics and accessories, children’s products, clothing, and footwear.

Why does this work in Russia? First, the market is flooded with similar products. Second, people don’t trust brands, but they trust ‘their own kind’. Third, video content can be ‘felt with the eyes’, which is more powerful than a written description.

If you want to use influencers effectively in Russia, start with simple, honest reviews from those who are trusted locally.

How does this work in practice? A single review from a YouTube opinion leader in the ‘electronics’ category can bring in more orders than all of the paid ads combined. Especially if the video is posted in a Telegram channel and generates discussion in the comments.

One example is the review of AirPods by the content creator Wylsacom. This isn’t an advertisement, but a straightforward analysis: which models to choose in 2025 — from regular AirPods to Pro and Max versions. He gets to the point talking about sound, comfort, noise cancellation, comparing them with each other, and showing where it makes sense to pay extra and where it doesn’t. Such videos build trust because they answer real questions, not repeat advertising clichés.

For a brand looking to enter the Russian market without risks, influencer marketing is the best way to gain trust. There’s no need to spend on a glossy commercial when five authentic, realistic videos from microbloggers on Telegram, YouTube, and VK will be much more effective.

This is especially important given the limited media presence and general distrust of advertising. Today, brands need a ‘human voice’ — one that’s relatable, understandable, and unpretentious. This is especially true for TikTok and Telegram, where a younger audience under 35 is concentrated. We've written more about the impact of influencers on purchasing decisions here. We also covered the specifics of SMM for brands in a separate article.

The top channels in 2025 are YouTube, Telegram, VK, and Instagram via VPN. TikTok is weaker but still engages an audience of 18- to 24-year-olds.

Paid advertising in Russia: from search to CTV

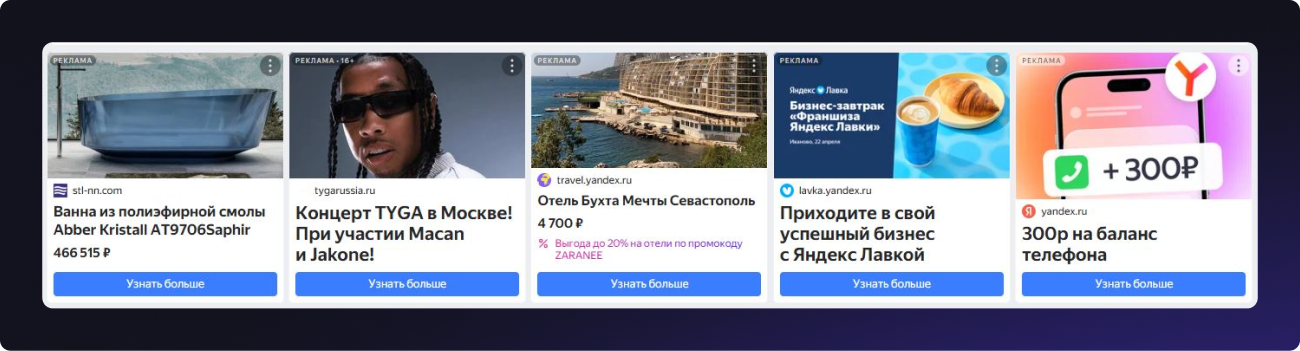

In 2025, paid advertising remains the most predictable channel for attracting an audience that is already ‘on the starting line’ — searching, comparing, and choosing. The main player is Yandex.Direct. It’s not just search results, but also display banners, ads in Telegram channels (through Yandex’s ad network), and product cards from marketplaces shown in native blocks.

What does this offer the brand?

- You can capture users right at the moment of choice.

- You can segment by interests, geography, and platforms (even showing ads on Yandex.Weather, news, and Dzen).

- You can scale quickly, without needing to build recognition from scratch.

If a brand doesn’t have a ready local name, paid advertising is a way to ‘enter the user’s logic’.

He searches — you appear. He compares — you’re right there. This is advertising that doesn’t interrupt, but guides.

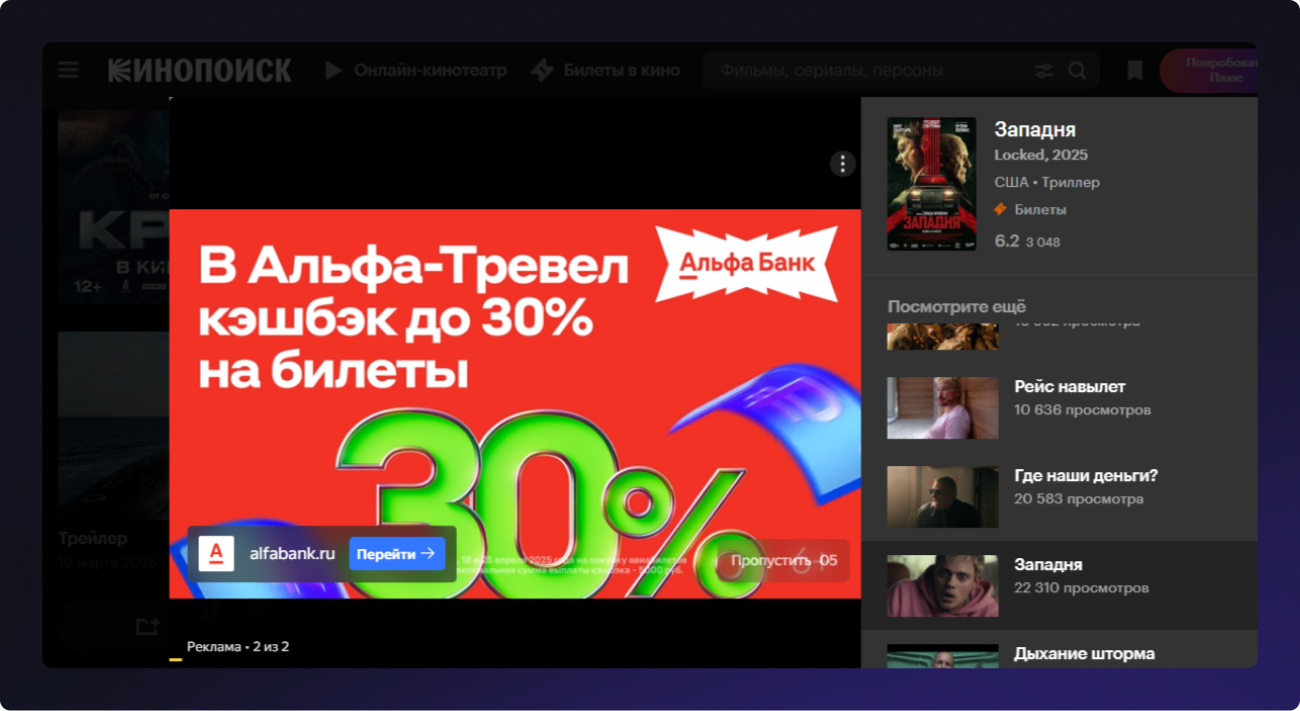

Connected TV and Online Cinemas (CTV) is a growing channel for premium advertising. It offers formats with targeting options by age, device, and content type. It’s suitable for brands that want to ‘make a smooth entry’ without participating on federal TV.

It is especially effective in segments like automotive, FMCG, cosmetics, real estate, electronics, and banking services.

If you're interested in how advertising works on Connected TV, we discussed it here. And we covered the specifics of online cinemas in a separate piece, which you can find here.

Fast insights

In 2025, the behavior of Russian users has fully shifted towards mobile internet and digital consumption of ‘here and now’. People discover brands through search, social networks, and influencer videos, compare reviews, and shop from their phones, often without visiting websites at all. This changes both media channels and the approaches to promotion, as it's not about reach, but about hitting the right moment. The main challenge for brands is not scale, but relevance. And relevance is achieved only through personalization.

At RMAA, we help international companies adapt to the realities of the Russian and CIS markets. If you're looking for a partner with analytics, experience, and a clear strategy, let’s talk. Our contact information is here.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"A media buyer's quick guide for effective work in Russia"

for FREE!

How does the Media Buying Market in Russia Work?

Navigating the Media Buying System in Russia

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Digital Strategist. Head of one of the project groups at RMAA. Maria started her journey in digital marketing in 2009.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "A media buyer's quick guide for effective work in Russia?" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it