Blog about successful marketing strategies in russia

Kazakhstan Advertising Market Overview. Key Trends and Insights

DIGITAL MARKETING

Share this Post

The advertising market in Kazakhstan is booming in 2024. It's not just growing—it's undergoing a major transformation driven by economic changes and new approaches to media consumption. A closer look reveals a steady recovery in budgets and significant growth in the digital segment, which shows that businesses are adapting to the demands of modern audiences.

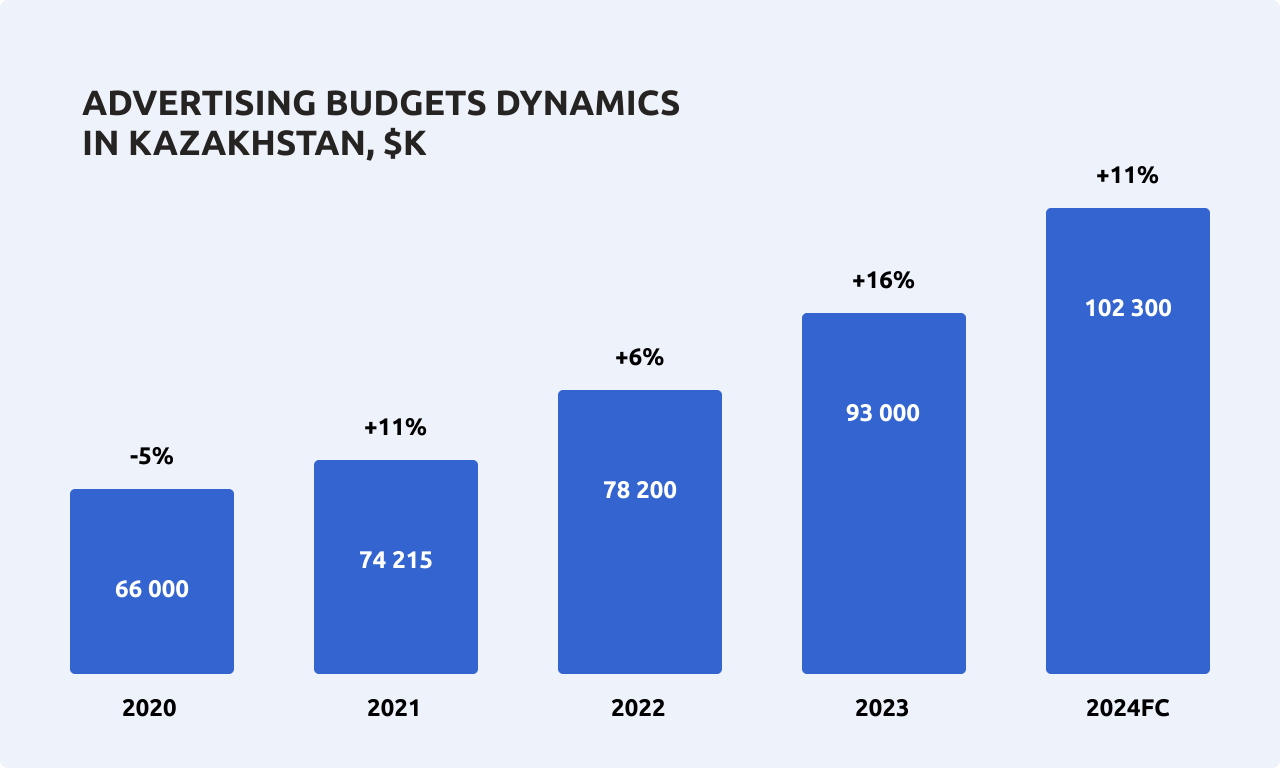

Overall Growth and Budget Forecasts

In the context of a generally stable economy, businesses are becoming more confident about their prospects, and it is reflected immediately in their advertising budgets. In the first quarter of 2024, the market reached 23.2 billion tenge (approx. $46.1 million), a 29% increase year-on-year. By the end of the year, it will exceed 1 trillion tenge (approx. $200 million). Companies are investing in customer attraction and position strengthening, considering advertising as a powerful tool to increase reach and improve reputation.

At the same time, there is no doubt that media inflation is accelerating. Prices for advertising channels are rising due to several factors. Television and digital advertising are the main drivers of inflation. Television is facing inventory shrinkage, which means there is a limited amount of available advertising time on popular channels. Together with tax increases and the expansion of the DOOH (digital out-of-home) segment, this is pushing rates up noticeably, creating a shortage of advertising opportunities for businesses.

Outdoor advertising is also becoming more expensive due to rising taxes and the emergence of new, more innovative formats—such as LED screens and interactive surfaces. These formats require greater investment, but they are effective in capturing audience attention and increasing brand awareness.

The digital segment is also experiencing high inflation. The exchange rate affects the cost of advertising purchases and placement. The increasing number of advertisers and growing competition for audiences put additional pressure on prices, making digital an even more in-demand but also more costly channel.

Kazakhstan's Key Market Drivers

The advertising market in Kazakhstan is made up of several large segments, each of which is developing at its own pace.

Television Advertising

Television in Kazakhstan remains a highly sought-after advertising platform, despite the growing influence of digital channels. It currently accounts for 43% of the market. In the first quarter of 2024, spending on TV advertising reached 7.3 billion tenge, a remarkable 25% increase over the same period last year. This growth is due to the demand for TV as a mass-reach channel, especially for broad demographic groups. Brands know that TV is the best way to reach a wide audience, including older age groups who remain loyal to traditional media.

TV advertising remains relevant because viewers prefer more "serious" content than entertaining social media clips.

Kazakhstani companies use television for effective image and educational campaigns. They are designed to leave a lasting impact through multiple reminders, solidifying the brand image. Furthermore, television advertising is highly trusted, particularly among older audiences who view it as a reliable source of information. TV space is undoubtedly attractive for large companies and government projects that need to maintain a serious and reliable reputation.

Nevertheless, television is facing a number of changes that are pushing to adapt and optimize strategies. Among the main factors are the increasing tax burden and the reduction in available advertising inventory that began in 2019.

One innovation has been the phased integration of digital out-of-home (DOOH) technologies that allow for more precise targeting of advertising messages on screens in public spaces. This could potentially change the role of TV in the media mix, allowing traditional broadcasting to be combined with digital formats and thus retain a loyal audience, despite the rapidly growing popularity of online channels.

Kazakhstani advertisers are beginning to combine TV with digital to increase reach and improve ROI. With digital formats increasingly consuming advertising budgets, TV channels are forced to look for ways of compatibility and synergy with digital platforms, which promises new opportunities for media channel integration.

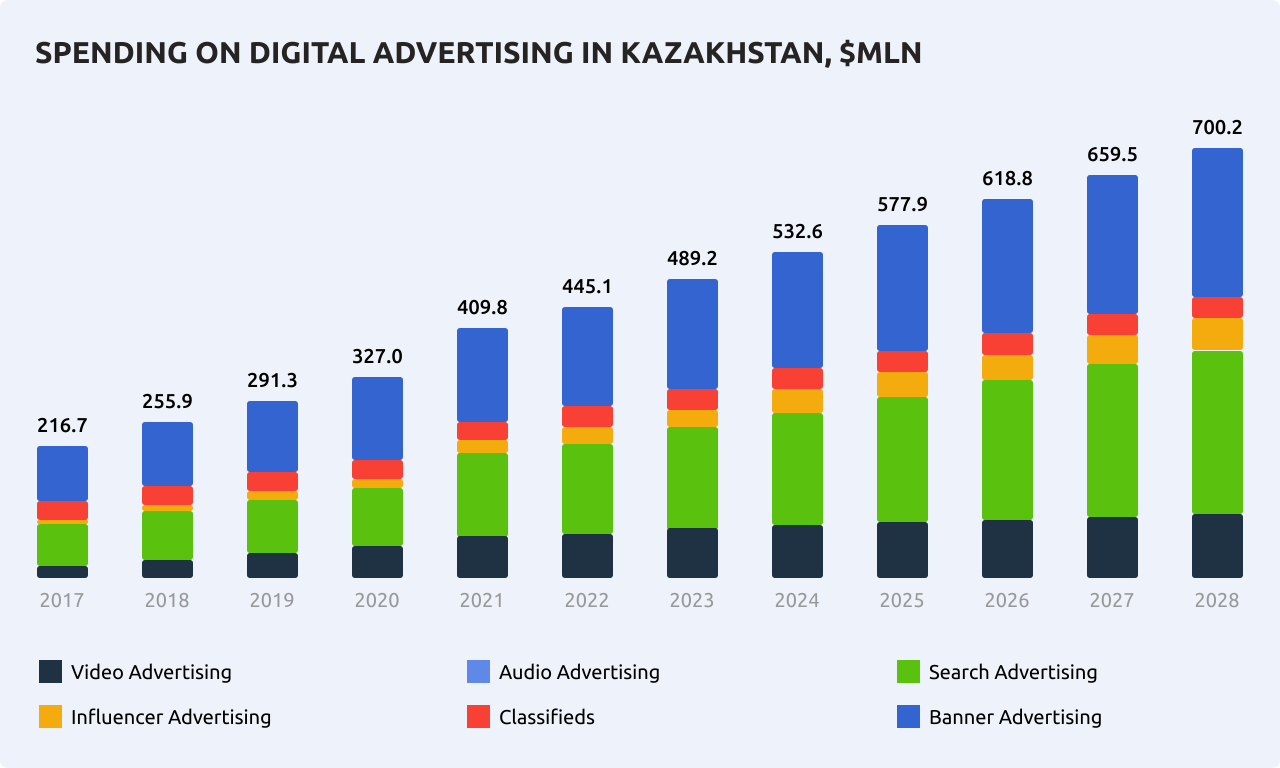

Digital Advertising

The digital segment is the leader in growth, with an impressive 29% increase in volume in the first quarter. Outdoor and online advertising also performed exceptionally well, with gains of 46% and 35%, respectively. Kazakhstani companies are embracing digital formats with full force. Trends show that by 2028, 77% of the advertising budget in this segment will be invested in programmatic advertising because automation and targeting offer incredible opportunities for growth.

The structure of digital sales is changing, and the largest players in the market are gaining ground. TVM Digital and VI Digital are the largest sales houses, through which the majority of advertising traffic passes, forming the main revenue streams from digital advertising. An interesting trend is that Meta now provides advertising tools directly, providing local companies with more accessible and understandable conditions for entering global platforms and attracting new audiences.

There has been a surge in activity in categories such as gaming and betting, as well as e-commerce. E-commerce is on the rise, and companies are waking up to the fact that an online presence is a must-have for sales. This is driving them to invest more heavily in advertising on digital platforms.

Social Media and Influencers: Connect Directly with Audiences

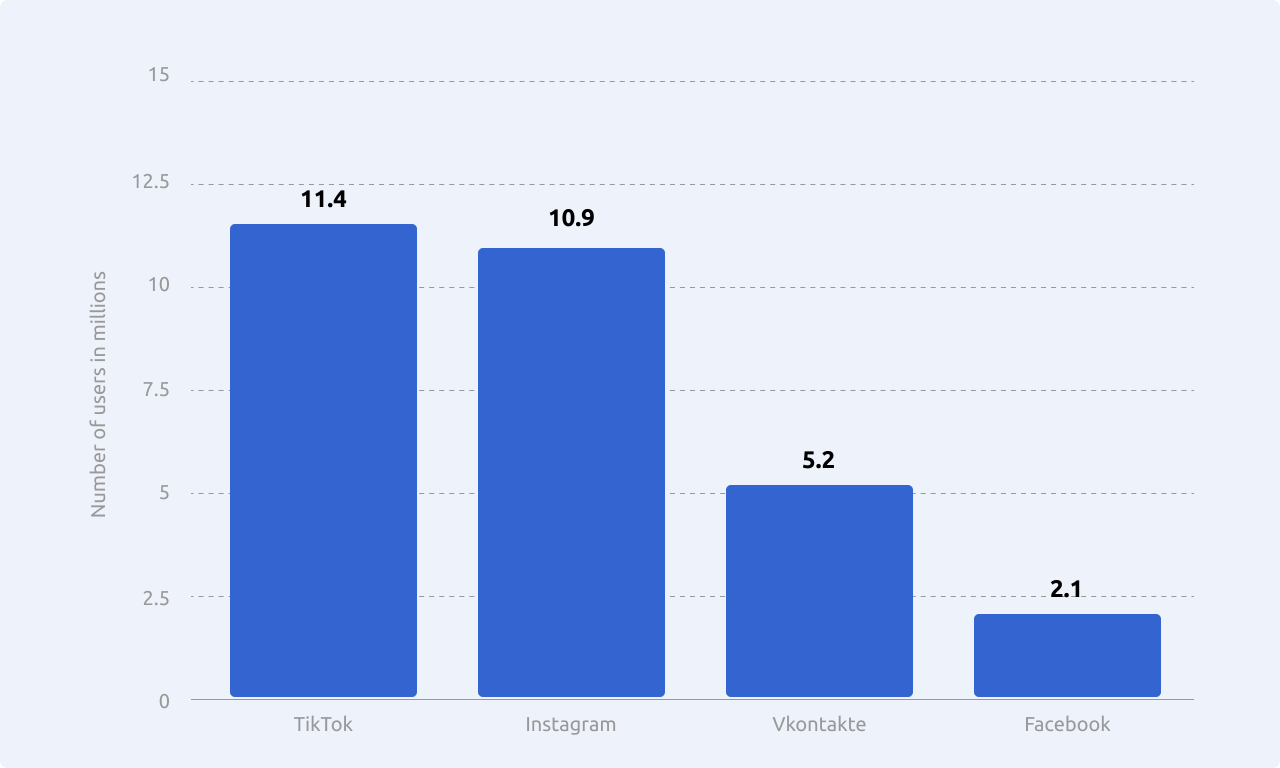

Social networks are the most affordable media in Kazakhstan. TikTok and Instagram are the most popular platforms, offering brands a direct opportunity to interact with their audience.

TikTok is the most important platform for advertising aimed at both young and more mature audiences in Kazakhstan, with 14.1 million users. Creative and entertaining advertising formats are the most effective here. The potential reach of TikTok ads in Kazakhstan increased by 3.7 million (+35.4%) between early 2023 and early 2024.

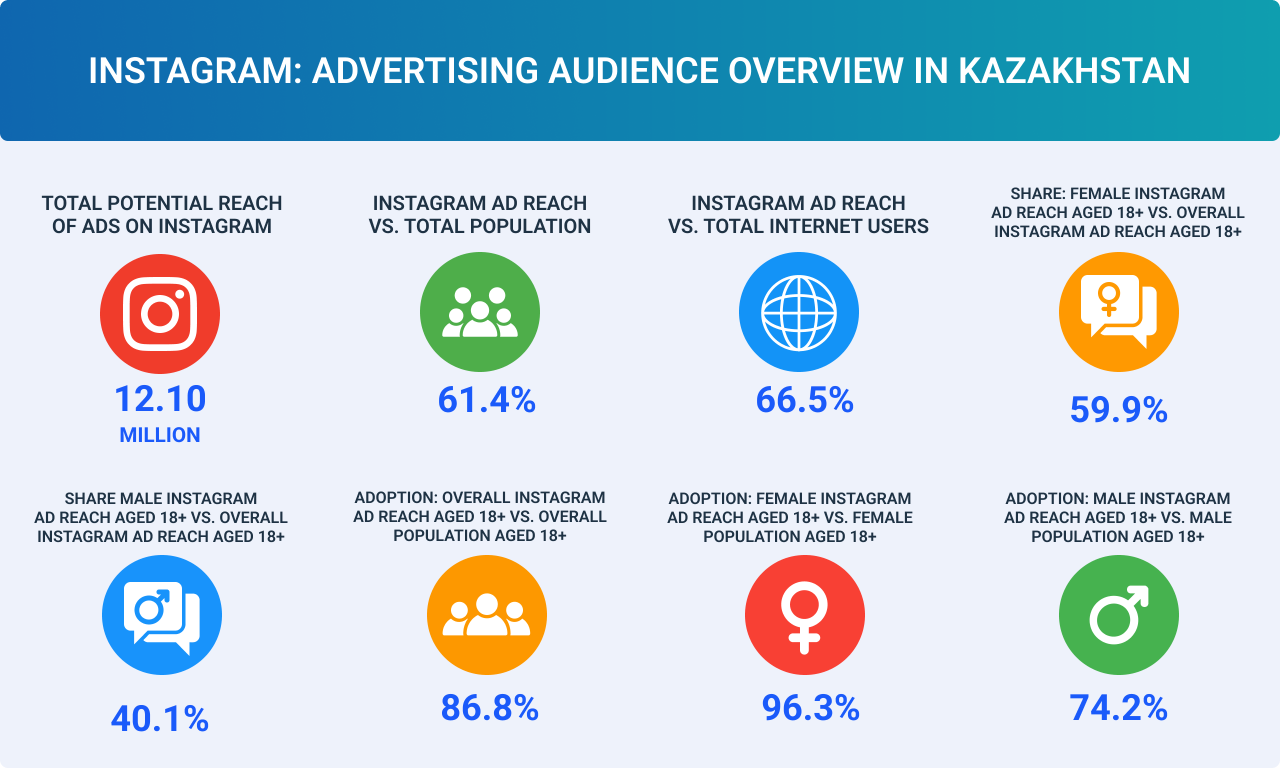

Instagram is also seeing a surge in advertising budgets, thanks to its visually oriented formats. For example, the potential reach of ads in Kazakhstan increased by 1.7 million (+15.8%) between January 2023 and January 2024. The latest figures show an increase in the advertising audience, with 250 thousand new people (+2.1%) engaging with ads from October 2023 to January 2024.

Platforms allow brands to reach their target audience and create interaction, fueling interest through polls, slide options, and instant reactions. In Kazakhstan, social media is used to build long-term brand loyalty and to prompt instant audience response.

Interactive formats such as stories and short videos are the future. They are especially popular with younger audiences. Companies are developing creative content that makes an impact and using analytics to optimize campaigns. Kazakhstanis are highly represented on social networks and actively engage with brands, making digital the dominant field for advertising.

Radio and Media Press

Radio and print media in Kazakhstan faced significant challenges in 2024. Radio advertising budgets have fallen markedly, by as much as 32% year-on-year. This is due to many advertisers, especially in sectors such as betting companies and banking services, shifting their focus to more flexible and digital promotion channels. The decline in interest in radio highlights the gradual reallocation of budgets in favor of digital formats, which offer accurate metrics and targeting capabilities.

Print media are also feeling the pressure. Audiences are moving to more immediate and accessible sources of information, which undeniably reduces the demand for traditional print advertising. However, magazines and specialized publications remain in demand among highly specialized audiences and premium brands seeking an accentuated quality image. Overall, traditional media are undergoing a transformation, forced to adapt to digital formats to retain their audience.

Telegram channel of the Tengrinews.kz, the largest news media in Kazakhstan

Digitalization of Outdoor Advertising

Outdoor advertising in Kazakhstan is undergoing remarkable changes due to digitalization. This market grew by 46% in 2024, despite being the most expensive media in terms of cost per 1,000 contacts. The active use of digital formats (DOOH - Digital Out-of-Home) will drive this growth.

Classic advertising structures are being replaced by dynamic LED screens in large cities such as Almaty and Astana. Advertisers can convey more flexible and rich visual messages that change depending on the time of day or even weather conditions.

At the intersection of Al-Farabi and Nazarbayev avenues in Almaty, the largest LED screen in Kazakhstan has appeared. It is a new flagship advertising object, covering an area of about 700 square meters. The screen blends seamlessly into the building's design, commanding attention from a distance.

Massive LED screen at the Al-Farabi-Nazarbayev intersection

Furthermore, in 2023, Kazakhstan introduced new DOOH technologies that have taken outdoor advertising to the next level through targeting and integration with digital platforms. For example, FocusON targets drivers based on parameters such as car brand and gender. QuickClick links media board display with Instagram ads. SuperFly targets via Wi-Fi to devices within a radius. MagicMupi responds to road conditions.

Media Usage in Kazakhstan

In 2024, the interests of Kazakhstan's audience in the Internet and digital channels change rapidly. Approximately 90% of the population (18.19 million people) is already online, making the Internet an indispensable tool for brands seeking to reach virtually every citizen.

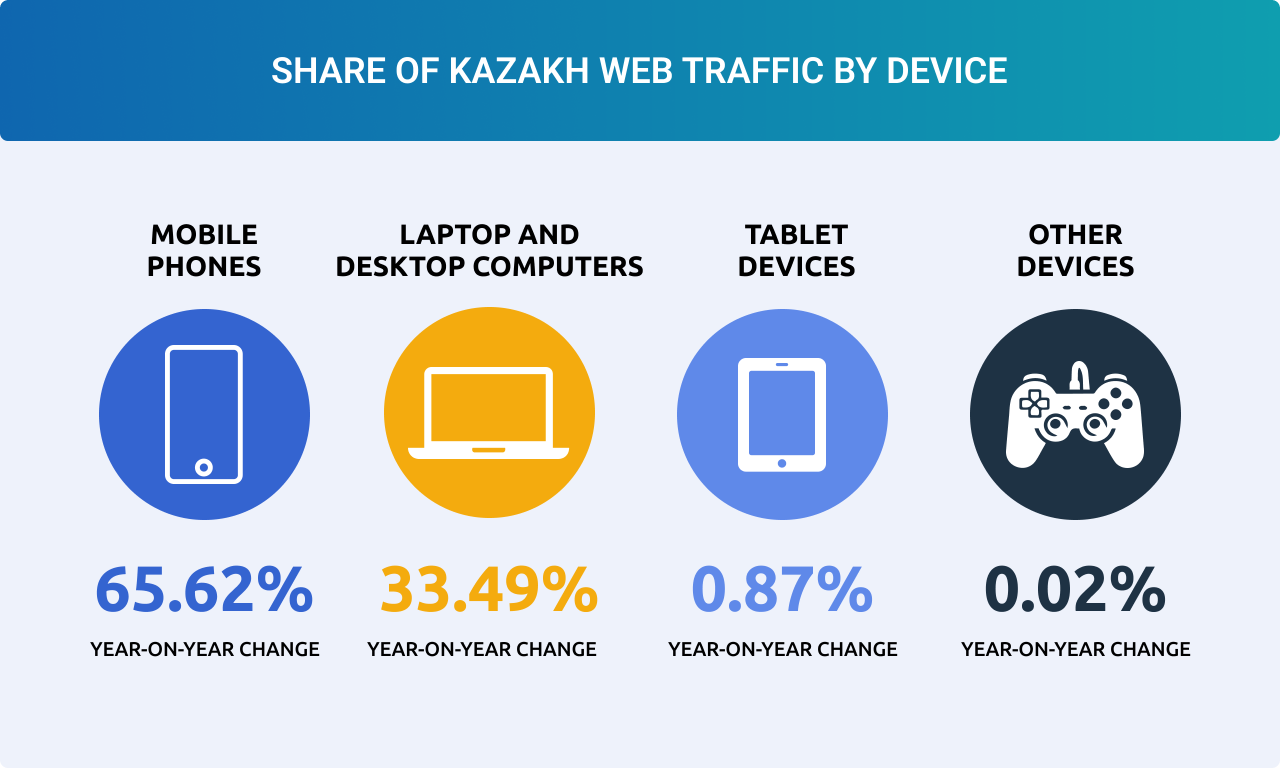

The average Kazakhstani spends around 3 hours online every day, creating an excellent environment for advertising integrations. Furthermore, around 65.6% of users access the Internet from mobile devices, making smartphone adaptation a priority for campaigns.

Local audiences actively engage with video content and also respond positively to interactive formats, from augmented reality to gamification. Brands can seize this opportunity to get more attention for their products. However, TV remains the market leader, favored by older audiences.

Let's Summarize

The Kazakhstan advertising market is on the rise. The Internet has reached almost all Kazakhstanis, who access the World Wide Web from mobile devices. Digital advertising is the priority tool, and social networks are the ideal place for audience engagement. Television and outdoor advertising remain crucial, and brands are adapting their messages in Kazakh and taking local peculiarities into account.

In other words, choosing Kazakhstan as the main or additional region for brand promotion means using different "variations" of advertising tools and strategies. At the same time, there is a vast potential audience.

What does this mean for you? To enter the Kazakhstan market, you must be flexible in your choice of advertising tools and have an accurate understanding of local peculiarities. Partnering with professionals who understand the region's specifics—that's the key to successful brand promotion. RMAA provides unparalleled advertising services throughout the CIS, including Kazakhstan. We are ready to help you develop and implement effective strategies for your business. Contact our manager directly by filling out the application form in the contacts.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

How does the Media Buying Market in Russia Work?

Navigating the Media Buying System in Russia

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Resident Author at RMAA Blog. Polina shares insights and expertise on the latest trends in the Russian-speaking marketing landscape.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it