Blog about successful marketing strategies in russia

Mass Market Travel and Tourism: Russian Tour Operators and Travel Agencies

B2B MARKETING

Share this Post

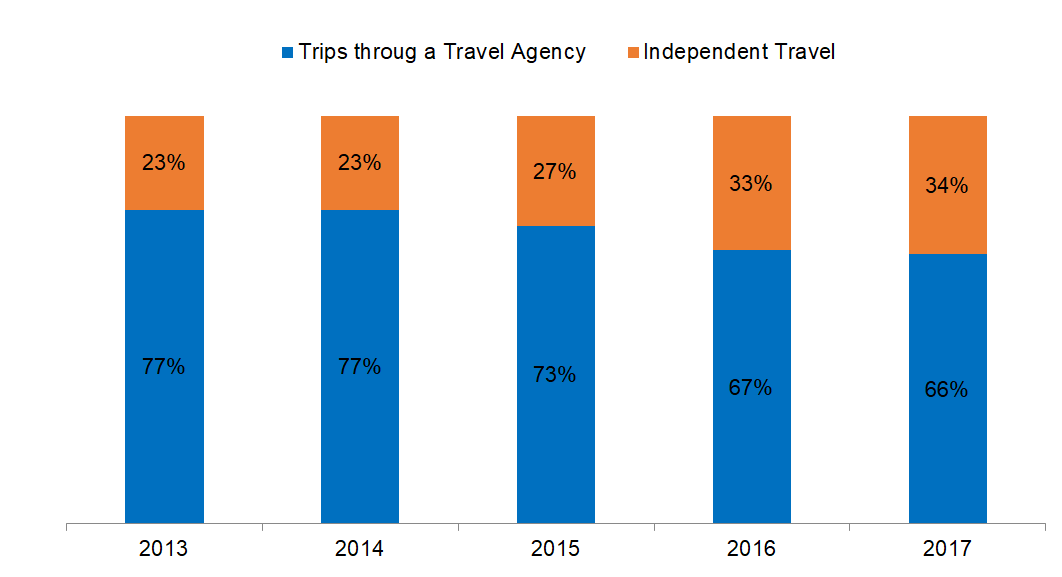

We have noted more than once that Russian tourists prefer organized tours. More than 60% Russians address to tour operators and agents for assistance in the choice and organization of their travel. Today we will look at the structure and trends of the Russian travel and tourism mass market.

Tour Operators and Travel Agencies Market Structure

Organized tourism in Russia is represented by tour operators and travel agencies. While the former actually elaborate tours and render travel services, the latter sell the tours created by the former and also provide information support. There are much more travel agencies in Russia rather than tour operators.

Having survived a fall in demand in 2014-2016, organized tours in Russia finally started growing. The number of tour packages to foreign countries that Russians bought rose from 1.625 thousand in 2016 to 2.605 thousand in 2017 as well.

Mass Market Travel and Tourism in 2018

Recent disturbances such as a fall in the ruble, restriction of trips to Egypt and Turkey, and bankruptcy of Transaero Airlines caused an inability of some tour operators to sustain competition and, as a result, they had to leave the market or terminate their activities. For instance, in 2018 it was the tour operator Natalie Tours that experienced problems, having failed to perform its obligations to nearly 8,000 people who bought tickets for the summer season. Before that, three other bog operators abandoned the market: Raduga Travel announced their cessation on business on June 10; Polar Tour, on June 15; and Martyoshka Tour, on June 22. All these things could provoke another credibility crisis in the market.

In 2017, Russians bought tour packages to other countries in the total amount of $3.8 billion.

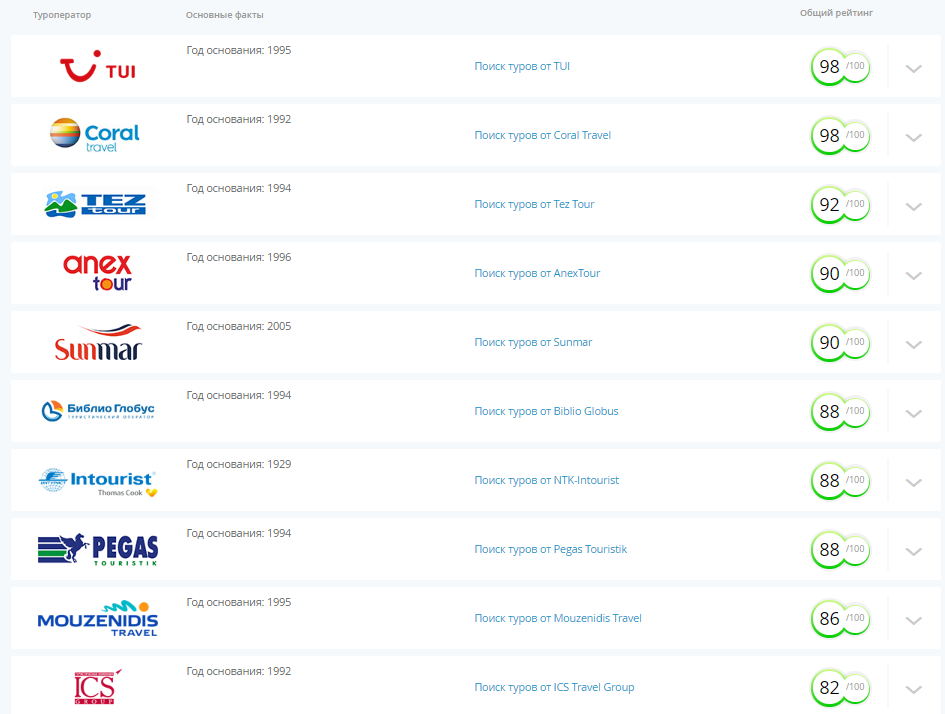

Rating of Tour Operators according to Travaleta.Ru 2018-2019

Travelata.ru, an online tour hypermarket, prepared the credit rating of tour operators based on of 10 key criteria that influence a tour operator’s credibility and position in the travel market.

The purpose of this rating is to make the assessment of tour operators transparent and focused on open data, having no intentions to foresee certain companies going bankrupt. The rating can be of use for all travelers who would like to look at the work of major tour operators on the basis of their data.

According to the counting system, 100 points are the maximum possible rating that a tour operator can get as a total sum of all criteria. 24 largest tour operators were included into the rating, evaluated by these 10 key criteria that describe a tour operator in terms of its credibility.

Compared to the rating of last year, in March 2019 tour operator Biblio Globus improved its position (+2 points). Other operators saved their places in Top 10.

In our study, we devoted one whole chapter to the analysis of the Russian travel mass market. To learn the statistics deeper, download Russian Tourism Market Report: Trends, Analysis & Statistics.

Russian Travel and Tourism Mass Market Trends in 2019

As of December 2018, the Unified Federal Register of Tour Operators contains 4,377 companies, with more than 530 of them dealing with outbound tourism. Due to reduction of the effective demand, which will obviously continue in 2019, too, the market will see further concentration expressed in natural exit of actors who do not have sufficient reserves in the face of ‘hard times’ or planning failures.

In the opinion of experts from the Association of Tour Operators of Russia, the most vulnerable companies are small and medium-sized ones working on mass travel destinations (Turkey, Tunisia, Greece, UAE, Thailand etc.). At the same time, the role of big players in the tour operator market will grow, facilitated by diversity of their business, a wide product portfolio, technological solutions, and possession of their own financial reserves.

In 2019, the digitalization trend in the travel business will start taking its shape. So, a more and more important role in stability of tour operators will be played by technological solutions. The most advanced ones include real-time dynamic packaging systems, new booking services for B2B, as well as online services for direct sales of tour packages and separate services to tourists, including an opportunity to design a tour on one’s own.

Tour operator business will start going beyond its classic format (formation of tour packages) and mastering new fields, for which modern digital tools will also be required such as own hotel management systems, host company operation automation means, decisions based on big data on pricing management and demand forecasting etc.

Mergers and acquisitions among tour operators will speed up. With a conservative estimate, the reduction in the number of legal entities working in the travel sphere will be at least 20%. In the vast majority of cases, these processes will be invisible for consumers as the main reason of ongoing processes is a severe intensification of competition and, consequently, a further consolidation of businesses. At the same time, the market will not see any signs of the systemic crisis in organized travel in 2019.

RMAA Travel offers a range of various services for networking and organization of work with travel operators and agencies in the Russian market. We organize breakfast meetings, presentations, press tours, and we can plan and implement other marketing and PR measures that will let you contact the biggest representatives of the Russian travel mass market.

Travel Research

The Russian Tourism Market Report: Trends, Analysis & Statistics | 2019. How to impress Russian tourists and attract them to your country

Ready to partner with the specialists in Russian travel marketing and advertising?

About the Author

Head of Digital, editor-in-chief of the RMAA Agency Blog

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "How to sell to Russian large companies?" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it