Blog about successful marketing strategies in russia

Forecast for TV Commercial Market in Russia: Budgets, Strategies, and Key Players

MEDIA BUYING

Share this Post

The Russian TV advertising market continues to evolve while remaining attractive to major advertisers. Following sanctions and restrictions, the industry underwent a restructuring phase: as Western brands exited, significant advertising budgets were freed up, allowing Russian companies to strengthen their positions. By 2025, the market had fully adapted, budgets recovered, and TV advertising entered a new stage of development, focusing on local players and new audience engagement formats.

This article will be helpful for those who consider TV advertising as a primary promotional tool in Russia but do not know the main nuances, ratings, and figures. Let's dive into the main points.

Key Indicators of Russian TV Watching

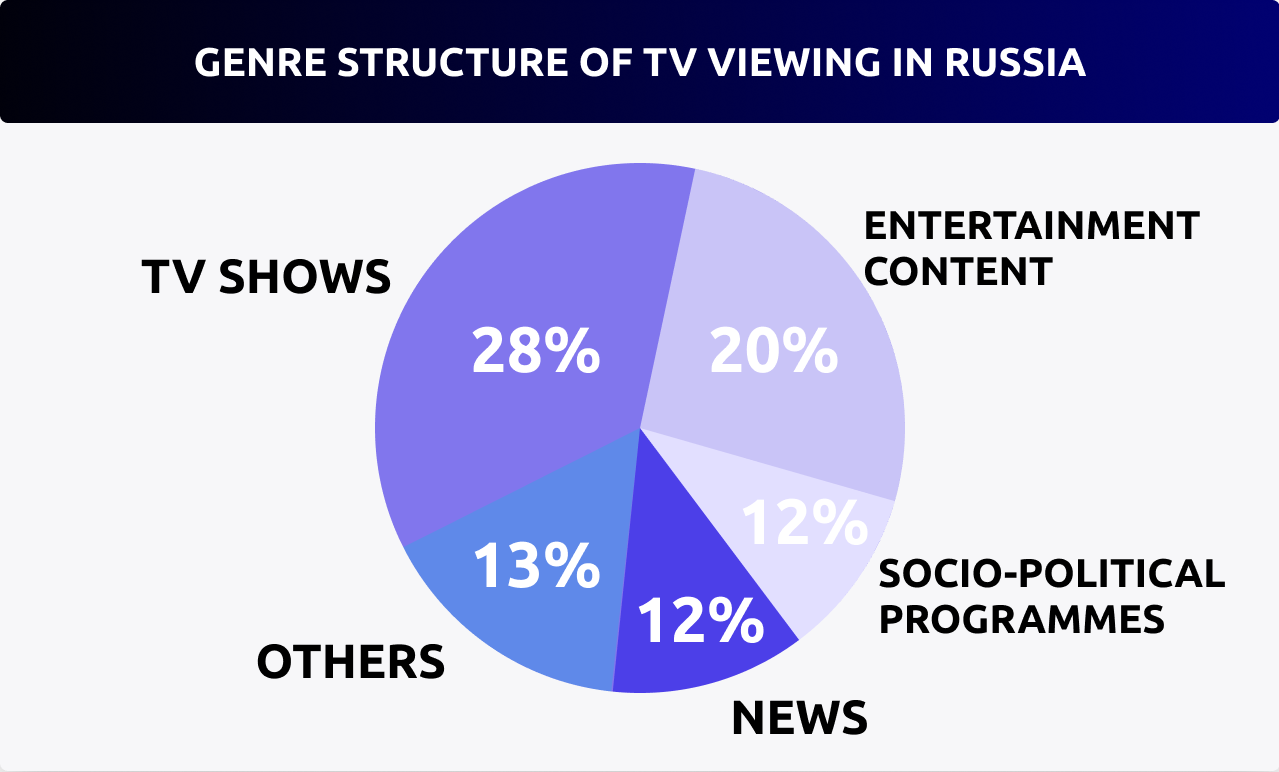

TV advertising has a wide reach. Approximately 97% of Russians watch TV at least once a month, while 63% tune in daily. The average viewing time remains high at around 3 hours and 24 minutes per day. TV series and entertainment programs continue to be the most popular content, accounting for 22% to 30% of airtime across all age groups.

Television continues to attract the older generation. In 2024, TV viewership remained stable, especially in the news and socio-political programming segment, which accounted for 29% of airtime. Of this, 13% was dedicated to news, and 16% to analytical programs.

At the same time, video hosting platforms have gradually been losing popularity. Regular viewing of video platforms dropped from 80% in June to 70% in October 2024 among users who watched videos at least once a week. Television also experienced slight fluctuations: the daily audience decreased from 55% in June to 52% in September, but increased again by 2 percentage points in October.

Telecommunication groups continue to consolidate, offering clients comprehensive solutions by integrating marketing, PR, digital advertising, and analytics. This has led to a decline in the number of independent agencies, while simultaneously providing access to advanced technologies and consistently high-quality services.

Amidst market saturation, viewers are beginning to tire of monotonous content. Interest is gradually shifting toward more authentic and emotionally resonant projects created by enthusiasts. Audiences are becoming more discerning, choosing content that aligns with their personal values and interests.

TV Channel Ratings in Russia

Thematic TV has become increasingly popular among the Russian audience in recent years, as evidenced by the current period's coverage figures. Notably, channels such as Russia 1, Ren TV, TNT, Channel One, NTV, and others consistently rank in the top 10.

Тop-10 TV channels in Russia

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

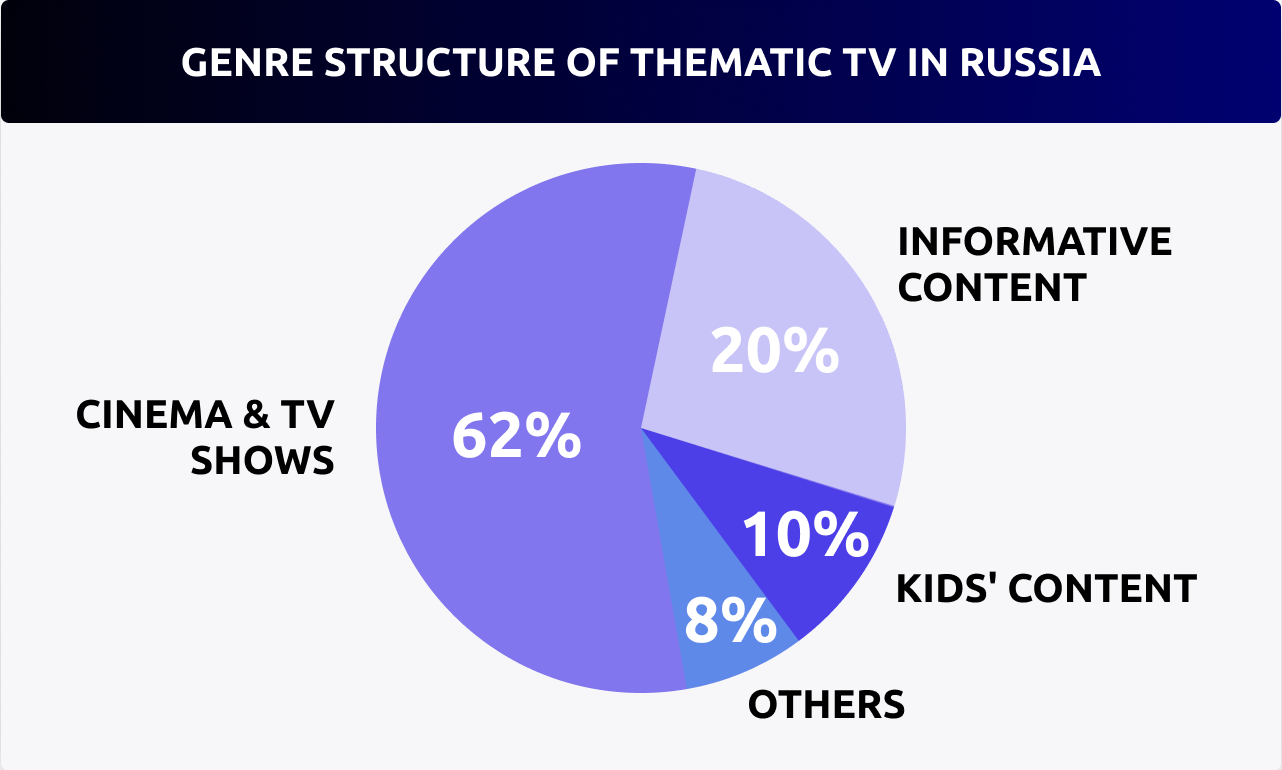

Over the past year, the share of thematic channels has increased by 6%, with movie, informative, children's, and entertainment channels being the most sought-after. Thematic channels hold great promise for advertising, despite the limited analysis of TV resources, as many companies are just beginning to develop in this niche (for example, MTS, VK, etc.). But it is already becoming clear that thematic channels are promising in terms of advertising.

Viewers are increasingly choosing content that combines entertainment and value. In the age groups 25–54 and 22–55, there is a growing interest in educational programs that can be discussed with others.

In response to this demand, TV channels are launching projects with educational elements. For example, the show Kupі-prodаy on NTV provides viewers with practical tips on financial management.

In addition, shows with a positive tone and a happy ending are gaining popularity. Projects with emotional appeal elicit a strong response from the audience. Among these shows are reality series about family life on a farm and programs about building countryside homes with celebrities.

Announcement of the ‘Ideal Repair’ show on Channel One

TV channels are also adopting modern technologies, such as Motion Capture and Face Tracking, to create original content. This is especially noticeable in projects where digital graphics are combined with live footage, such as in the Avatar Show on NTV, where these technologies helped the second season achieve an 18.6% share.

Collaboration between TV channels and online cinemas has become a common practice. Many projects initially created for digital platforms later air on television, increasing their audience reach. This also expands marketing opportunities and allows for the unification of viewers with different preferences.

The TV series ‘Sklifosovsky’ popular on Russia 1 channel is simultaneously streamed on the "Smotrim" platform

It is clear that today's TV viewers are increasingly active and diverse consumers of television content. They willingly use digital platforms, such as Video on Demand, to watch their favorite programs and movies at their convenience. This trend has a significant impact on TV channel ratings and creates new opportunities for advertisers.

What is Happening to the TV Advertising Market in Russia Now?

In recent years, the TV advertising market has continued to show consistent growth despite the development of Internet services and other digital media platforms. In terms of the percentage of advertising purchases, the TV segment leads with 35.5% of advertising budgets.

By 2024, TV advertising budgets increased by 28% compared to the previous year, reaching 255 billion rubles. Driven by the growing demand for advertising from industries such as FMCG, automotive, and telecom. In addition, base rates for TV advertising increased by an average of 40% compared to the previous year. This is due to the high demand for advertising slots and the limited availability of inventory.

The TV rating, based on advertisers' budgets, has also changed, with Russian companies now leading the way. Major brands such as SBER, Yandex, INTERNET SOLUTIONS (Ozon), Tinkoff, MTS and VTB continue to heavily invest in TV advertising. Compared to last year, ALFA-BANK and Vkusno — i Tochka entered the top 10 for the first time, as they were not present in the leaders' list last year. Meanwhile, VK and Tander (Magnit) dropped out of the ranking, falling to 14th and 13th positions. In addition, most companies increased their advertising budgets, indicating a rise in advertising investments among the largest market players.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As for foreign brands purchasing advertising on Russian television, a new trend emerged in 2024, which continues into 2025. Now, commercial ads are broadcast in the format of store/marketplace advertisement featuring the brand's product. For example, Honor smartphones appear in an Eldorado store commercial, and Korean beauty brands feature in Ozon marketplace ads. This strategy works to the benefit of both: the marketplace/store enhances its image by offering foreign products, while the brand demonstrates its easy availability in Russia.

Types of TV Advertising Purchases in Russia

When it comes to TV ads, the most effective format depends on the advertising campaign and budget.

Direct purchase advertising blocks from TV channels allow advertisers to select the precise time and channel for their ads, which is particularly important for reaching the target audience.

Programmatic automated platforms can also be used to great effect. The development of technology has led to the rise in popularity of them among advertisers. These platforms strengthen campaign targeting and automate the process of buying advertising slots on TV, reducing time and resource costs. However, programmatic TV services are significantly fewer than digital advertising. It is advisable to scrutinize this method or entrust it to professionals.

Buying TV advertising through an agency is the most effective and simple way of promotion, especially for foreign brands in Russia. This is the case when a team with deep expertise takes all responsibility and provides the client with favorable conditions for TV placement.

RMAA with its wealth of experience is ready to help brands develop an effective strategy in a short period of time. TV advertising is often included in a large-scale campaign along with digital tools. When a brand requires only TV advertising for promotion, we calculate the risks and effectiveness to achieve optimal results.

If you would like to discuss your project, please fill out the application form below to contact your RMAA manager.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"A media buyer's quick guide for effective work in Russia"

for FREE!

How does the Media Buying Market in Russia Work?

Navigating the Media Buying System in Russia

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Expert in Media Buying. Julia specializes in optimizing and executing strategic media placements across Russia & the CIS region.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "A media buyer's quick guide for effective work in Russia?" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it