Blog about successful marketing strategies in russia

Global Trends Meet Russian Market: Exploring the Landscape of Future Marketing Innovations

DIGITAL MARKETING

Share this Post

Against the backdrop of dynamic change in 2022-2023, the Russian market has adapted to new formats and the demands of buyer audiences. In 2024, this metamorphosis will continue, combining the unique features of the region with global digital marketing trends.

Many of the trends of 2023 will transit seamlessly into 2024. Gamification and video content remain at the forefront of most digital strategies. At the same time, they evolve thanks to new technologies.

Simultaneously, AI tools are increasingly integrated into marketing and new human-centered approaches emerge as a result. The coming trends will focus heavily on user engagement and establishing deeper relationships with customers. Digital promotion will become more precise and attentive, matching consumer needs and preferences.

In this review, we will talk about the main trends of 2024 and how they will affect the future of the Russian market in the context of the new digital reality.

Humanity and Safety. Common marketing trends

As we enter 2024, we see the marketing landscape changing rapidly, with data security and customer trust becoming major trends. People's growing concern about the privacy of their data changes the way companies approach promotion in general. Consumers are increasingly cautious about giving out personal information, which emphasizes the importance of data security in marketing strategies.

At the forefront of this change is the idea of Zero Party Data. This is data that customers share with companies intentionally and directly. The technology empowers people's possibilities by giving them control over what information they share and how it is used. Meanwhile, companies also remain in an advantageous position. Brands that support transparency in data collection can significantly increase their audience loyalty, segment their audience, and identify patterns of buying behavior. In addition, Zero Party Data is invaluable for product development. They provide direct insights into customer preferences. This feedback is critical to developing new products or improving existing ones, ensuring that they meet or exceed customer expectations.

In addition, today's marketing landscape is often characterized by an excessive amount of information, leading to audience fatigue. The constant bombardment with offers and news can be exhausting for consumers. Recognizing this, brands are in growing need to shift their focus. The future of marketing lies in moving away from aggressive sales tactics and building trust through communication that evokes an emotional response and demonstrates core values. This approach is key to forming stronger and more meaningful connections with audiences.

The "Safe" trend goes to the ideas of personalization, marking another important trend - the "human" approach. The increasing use of automation in creating communication with audiences in any form, whether it's textual content or images, starts to show the downside. Users see the difference between being "robotic" and being "human." In the first case a person's interest towards the product drops.

Thus, the overall marketing direction of 2024 centers around the value of customer privacy, ethical use of data, and building genuine relationships with consumers. Brands that accept these changes and prioritize trusting relationships with their customers are likely to achieve greater success within the promotional framework.

Not just AI. A look from the technology side

There is no doubt that artificial intelligence and trends related to it will lead the way for years to come. But we need to look at the trends from a technology perspective a little more broadly.

In 2023, the transition to automation of contextual and targeted advertising processes in the Russian market stabilized. This is related to the leading promotion tools. For example, VK Holding completely switched to the new advertising platform VK Ads. By the way, even the format of the campaign is adjusted there to different sites independently. Yandex.Direct, the leader in contextual promotion, switched to automatic strategies depending on the goals of campaigns and launched a promotion in the popular messenger Telegram. The platform itself previously created its resource for targeted advertising, Telegram Ads, which began to be actively used by marketers in 2023.

What does all this tell us? Of course, about a more systematic, time-saving approach, regardless of the nature of the promotion. An image campaign or performance strategy is no longer a matter of more or less creative/time resources, but a goal that is initially driven from. In a good scenario of a process automation approach, there is a place for personalization for each customer.

It would not hurt to mention the e-commerce segment, since many marketplaces position themselves as an advertising platform equal to social networks and search engines, creating their retail media. Personalized product selections, banners on the main pages, special promotions - all this already works successfully as the consumer on such sites is already interested in shopping. In 2024, the trend will only develop and the mechanisms will be refined.

Clickable banner of Ozon marketplace with a transition to the review of goods with discounts.

Another trend in contextual advertising should be highlighted separately since in addition to the automation of processes, there is a new nuance here - the orientation of the campaign also on voice search. Of course, it appeared a long time ago, but by 2024 it has become one of the key features due to the active use of interactive speakers by the audience. According to M.Video and Eldorado (note - one of the leading chains of home appliance stores) "smart speaker" was bought twice as much in 2023 compared to 2022. Due to new voice-activated devices, people's interactions with search engines have changed. This needs to be considered as much as the other promotion criteria.

Continuing the "voice" theme, let's emphasize the trend of podcasts. Globally, the situation with podcasts is positive. For example, in the countries of the Pacific region, 70% of the podcast audience listens to them attentively. In addition, 71% take targeted actions after listening to an advertisement.

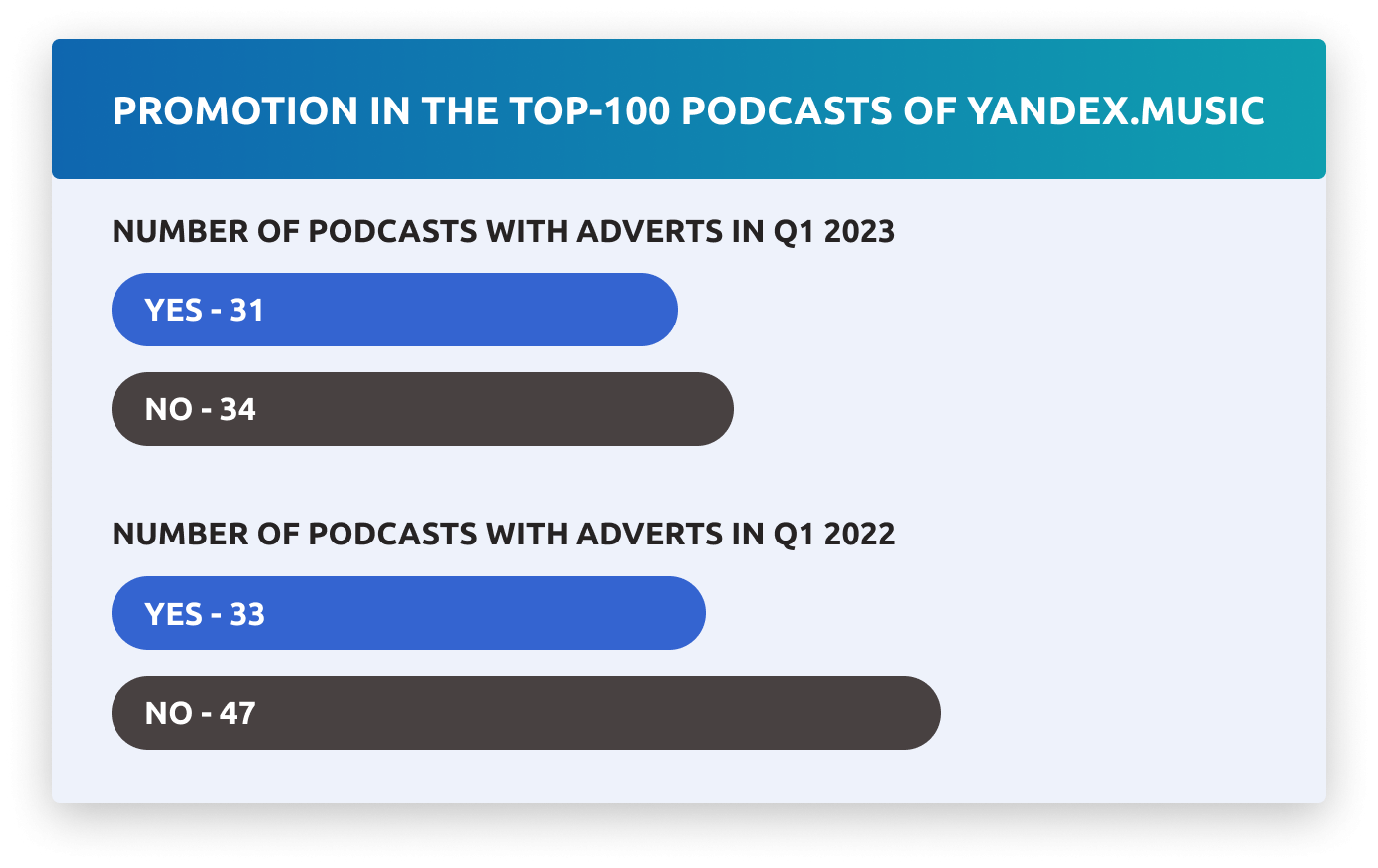

Yandex.Music is the leading platform for advertising podcasts on the Russian market due to restrictions on foreign services. According to the digital media Lifehacker, 31 of the platform's 65 podcasts contained at least one advertising integration (note - which is 7% more than in 2022). The most popular formats of integrations were rubric (40%) and promo block (38%). Partner editions (12%) and short mentions of the advertiser (10%) were much less common. 148 out of 176 episodes contained a reference to advertisers in the episode description. In percentage terms, this figure increased by 10 points compared to last year.

Source: Lifehacker

Despite limited resources, podcasts are and will continue to grow in popularity. It is no coincidence that they grow in number every year. Given that the Russian market has been able to adapt to the blocked YouTube in terms of direct advertising, podcasts may follow a similar trend of native format integration into the output.

Since we're talking about YouTube, let's move on to Influencer Marketing.

Bloggers or not bloggers. Diverse approaches in influencer marketing

The marketing landscape continues to change, but Influencer marketing is always at the forefront in terms of promotion. What can be said about trends?

The diversity trend continues to gain momentum, recognizing people of different genders, ages, ethnicities, and health conditions without discrimination. This shift is becoming more and more evident in brand content: from the traditional focus on models with "perfect" figures, and image changes to portraits of ordinary people from real life. This approach is particularly relevant for female audiences, who have long been subject to beauty standards. By accepting diversity, brands broaden their audience reach and resonate with a wider range of consumers.

Advertising campaign of Russian brand Econika FW 23/24.

Globally, the Influencer Marketing market has shown a significant rise and reached $21.1 billion in 2023 (note - in 2022 it was $16.4 billion). In Russia, experts anticipate an active growth of at least 150-200% in the segment.

For several years now, one of the key trends has been the focus on micro-influencers. Although they have a smaller audience, these people stand out for their high level of engagement. The appeal of microbloggers lies in their ability to create content that feels more authentic and easily digestible.

Premiata brand promotional post with micro blogger Alena Savko.

Another trend that emerges from here is the short format. Influencer advertising is becoming more and more native, seamlessly integrated into the content. The fast pace of consumption has led to the popularity of short video formats, ideal for viewing on mobile devices. Major social networks are supporting this trend by creating dedicated feeds for vertical videos, such as YouTube Shorts, VK Clips (note - which we've written about before), Instagram* Reels, Yappy, and Dzen. Even Telegram has introduced stories, and it further reinforced the role of short videos in marketing.

Revyline brand advertisement in VK Clips by popular Russian singer Klava Koka. The same content is duplicated in YouTube Shorts.

Overall, influencer marketing in 2024 is characterized by a strong commitment to diversity, effective use of micro and macro influencers, and a growing reliance on short-form video content. These trends emphasize the industry's shift to more inclusive and engaging marketing strategies.

A few words about creative concepts

As we dive into the digital marketing of 2024, creative concepts closely associated with Generation Z and artificial intelligence technologies take center stage.

This generation is defined by its digital nature, emphasis on technology and a strong inclination towards the freedom of self-expression. Unlike previous generations, Zoomers are less fixated on traditional milestones such as building a career or starting a family. Their core values are about experiencing life to the fullest, achieving personal goals, and maintaining health and wellness. For marketers looking to appeal to this age demographic, understanding and targeting Zoomers is important given their high purchasing power. About 64% of the Z audience report being constantly online, more tethered to smartphones than physical wallets, often lacking cash. This trend calls for a mobile-centric approach to content creation. Having at least a mobile version of a website is no longer just an additional task, but a major one.

Social media for Generation Z goes beyond just communicating; it's a market heavily influenced by blogger recommendations, with 55% of Zoomers considering them decisive in their purchasing decisions. This generation's concerns about social and economic issues surpass those of their predecessors.

In this context, joy, softness, and playfulness become powerful tools in confronting a chaotic world. The overwhelming success of the Barbie movie in 2023 as a symbol of candy pink positivity emphasizes this trend. Fashion, too, takes a more surreal approach. For Generation Z, self-care, especially skincare, has become a form of quiet rebellion in an era full of anxiety. This is leading to a market where humor is considered as a therapy.

VK Clip of Don't Touch My Skin brand, dedicated to the sale on Ozon marketplace. The main element of the content is the meme "Surprise, Surprise", taken from the British TV show of the same name from the 90s.

Forms of content that were once considered superficial again become tools for social change. Generation Z, raised on peace-building and co-creation, carries these skills into adulthood, expecting enhanced autonomy and empowerment.

3D visual concept for the facade of the new Poison Drop shop in Moscow.

The better AI gets, the more questions arise about the role of technology in expanding our humanity - from empowering us to bridging the digital-physical gap through touch, tactile sensations, and gestures. The future of business is in understanding the role of human touch, both literally and figuratively.

In 2024, business success will require sustainable models, strong customer relationships, imagination, and optimism. The ability to foresee a better future and innovate is key, even in a world that often seems unstable and unsettling.

In conclusion, we'd like to say that in an ever-changing digital marketing landscape, understanding and adapting to these trends is crucial for being successful. From the issue of data security and the dynamic world of bloggers to the creative innovations driven by Generation Z along with AI. One thing is certain: the marketing world in 2024 will be vibrant and full of opportunity.

Subscribe to our blog to keep your finger on the pulse of the latest developments in digital marketing.

*Meta Platforms Inc. project, the activities of which are prohibited in Russia.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Russian Digital Market Overview

Strategic Insights into Russian Digital Marketing Landscape

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

A content lead. Natalia runs marketing projects promotion with different digital tools in the Russian-speaking market.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it