Blog about successful marketing strategies in russia

Market Overview of Uzbekistan’s Advertising Industry

DIGITAL MARKETING

Share this Post

The advertising market in Uzbekistan is actively growing, driven by the development of digital technologies, the emergence of new communication channels, and increasing economic activity. Of course, there are challenges, but the prospects look highly optimistic: the economy is becoming more diverse, foreign investors are showing interest, and the media landscape continues to evolve.

Uzbekistan’s Population Dynamics and Its Impact on Advertising

Uzbekistan is a country with a young population: the average age is 28, and the total population has exceeded 37 million people. Every fourth resident is a child under the age of 10, making family audiences a priority for advertisers.

From an ethnic perspective, Uzbeks make up 83% of the population. The state language is Uzbek. Traditional family values and Sunni Islam significantly shape the cultural background and approach to advertising. Approximately 52% of the population lives in rural areas, requiring advertisers to combine digital and traditional communication channels.

Economic Indicators in Uzbekistan

Uzbekistan's economy is steadily growing: between 2018 and 2023, GDP increased from $62 billion to $97 billion. This economic surge is largely attributed to the growth of foreign direct investment, which accounts for up to 20% of the overall economy.

The average income of Uzbek residents is approximately $450 per month, although a significant portion of the economy remains informal. The primary expenses for Uzbeks are housing, education, and healthcare, driving demand for advertising in these sectors.

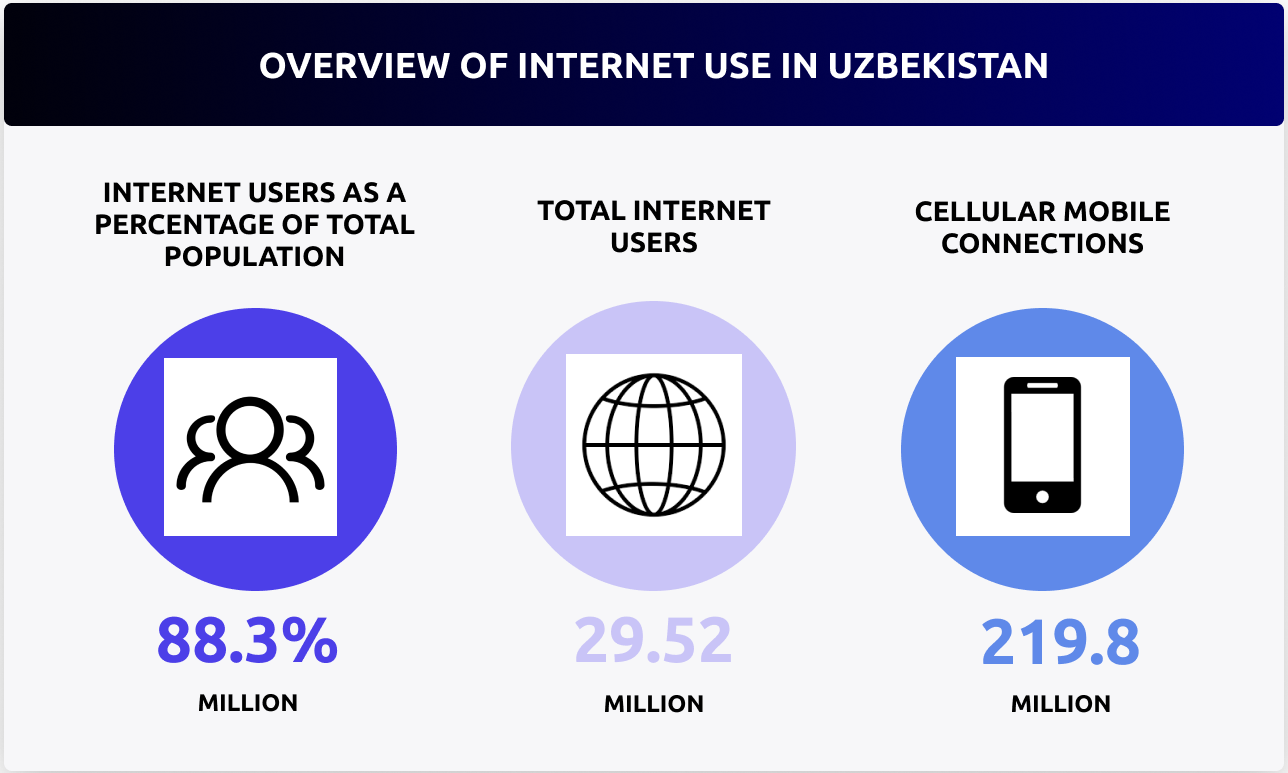

Internet Use and Digitalisation in Uzbekistan

As of early 2024, 83.3% of Uzbekistan's population (29.52 million people) had Internet access. The rapid penetration of the Internet has spurred the growth of digital marketing. The average internet speed has increased to 24.7 Mbps, enabling the use of video formats and complex advertising creatives.

The primary audience is youth. Most users engage in social media, watch movies and series, read news, and use educational platforms.

Media Market Trends in Uzbekistan

In 2024, the technology sector also experienced growth. For instance, the prominence of mobile banking and e-commerce platforms increased by 56%. The e-commerce market is valued at $311 million, accounting for 2% of total retail trade. The market is projected to grow sixfold by 2027. Leading platforms in 2024 included Uzum, Alif, Humans, and TutMarket.

Mobile operators are evolving into super-apps. Beeline and Mobiuz are further developing payment systems and streaming platforms.

The primary advertising channels in Uzbekistan are television, digital media, and outdoor advertising. Television remains the top channel, reaching 97% of the population. Digital channels are gaining traction thanks to 30 million Internet users. Outdoor advertising is also transforming, with increased investments in LED screens and DOOH formats.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV Advertising in Uzbekistan

Television remains the leading advertising channel in Uzbekistan, reaching 97% of the population. The most popular content among viewers includes movies and TV series (52%), music channels (44%), and sports broadcasts (43%).

In the past year, adjustments to TV advertising audience parameters have improved campaign efficiency. Advertisers now target the 18–54 age group, shifting from the previous 6–54 demographic, resulting in better RTG. Additionally, an auction-based system for ad placement has been introduced, increasing the cost per rating point by 20%. However, the system’s operation remains somewhat inconsistent.

The largest TV advertisers are international brands like Pepsi, Coca-Cola, and Nestle, alongside prominent local players such as Uzum. While the auction system has made advertising more expensive, it has also enhanced effectiveness by delivering better returns.

Top 10 TV Advertisers in Uzbekistan by wGRP*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* wGRP (Weighted Gross Rating Points) measures the effectiveness of advertising for a targeted audience, considering its relevance.

Digital Advertising in Uzbekistan

In Uzbekistan, 87% of the young population actively uses the Internet.

Online activity distribution among users:

-

47% read news;

-

40% spend time on social media;

-

39% watch movies and series;

-

32% explore financial services;

-

11% shop online.

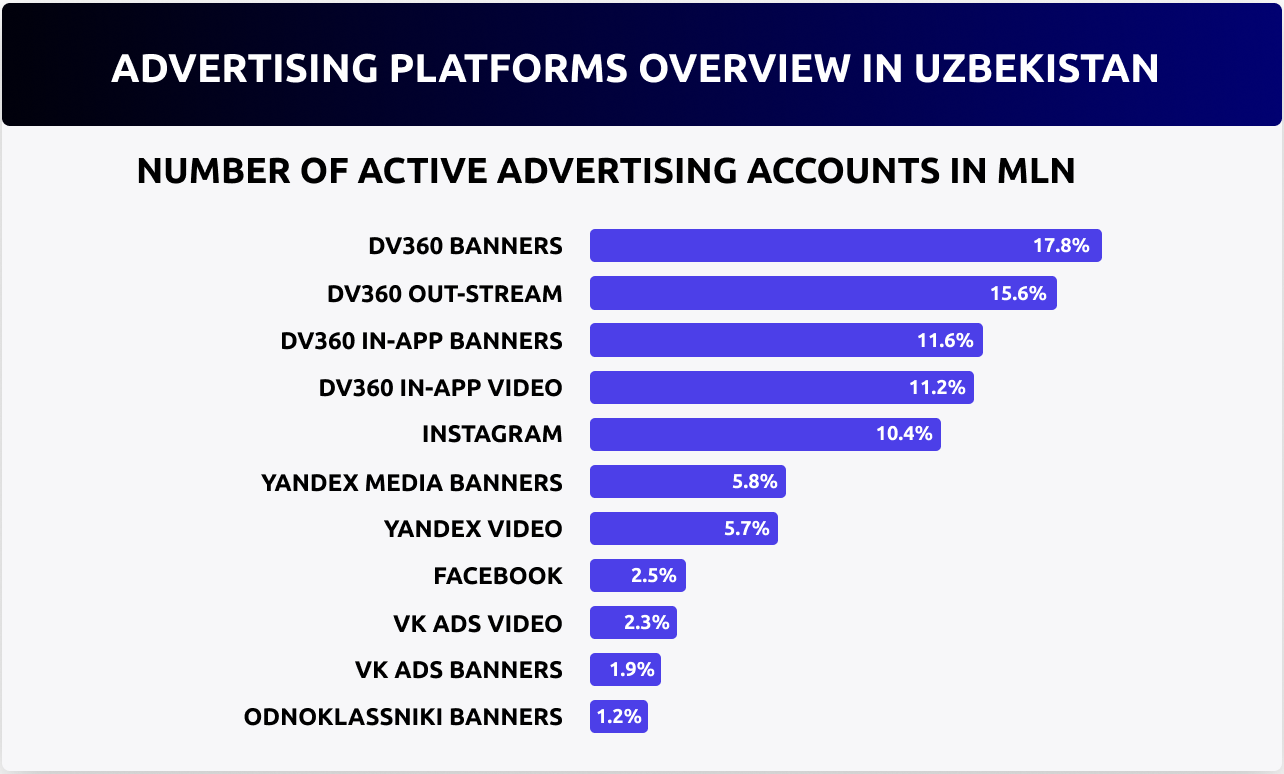

Digital advertising is on the rise. 80% of advertising budgets are allocated to targeted ads through Google Ads, DV360, and PC Yandex, while local resources such as Telegram channels and news websites account for the remaining 20%.

Tools available for advertisers:

-

Contextual networks: Google Ads, DV360, Yandex.

-

Social media and programmatic platforms: Instagram, Facebook, Eskimi, and Native Network.

-

Local formats: banner ads, Telegram channels, PR articles, and collaborations with bloggers.

Using these tools, advertisers can target audiences based on keywords, age, gender, and location. Common formats include banners, video ads, native integrations, and posts, allowing brands to effectively reach their desired audience.

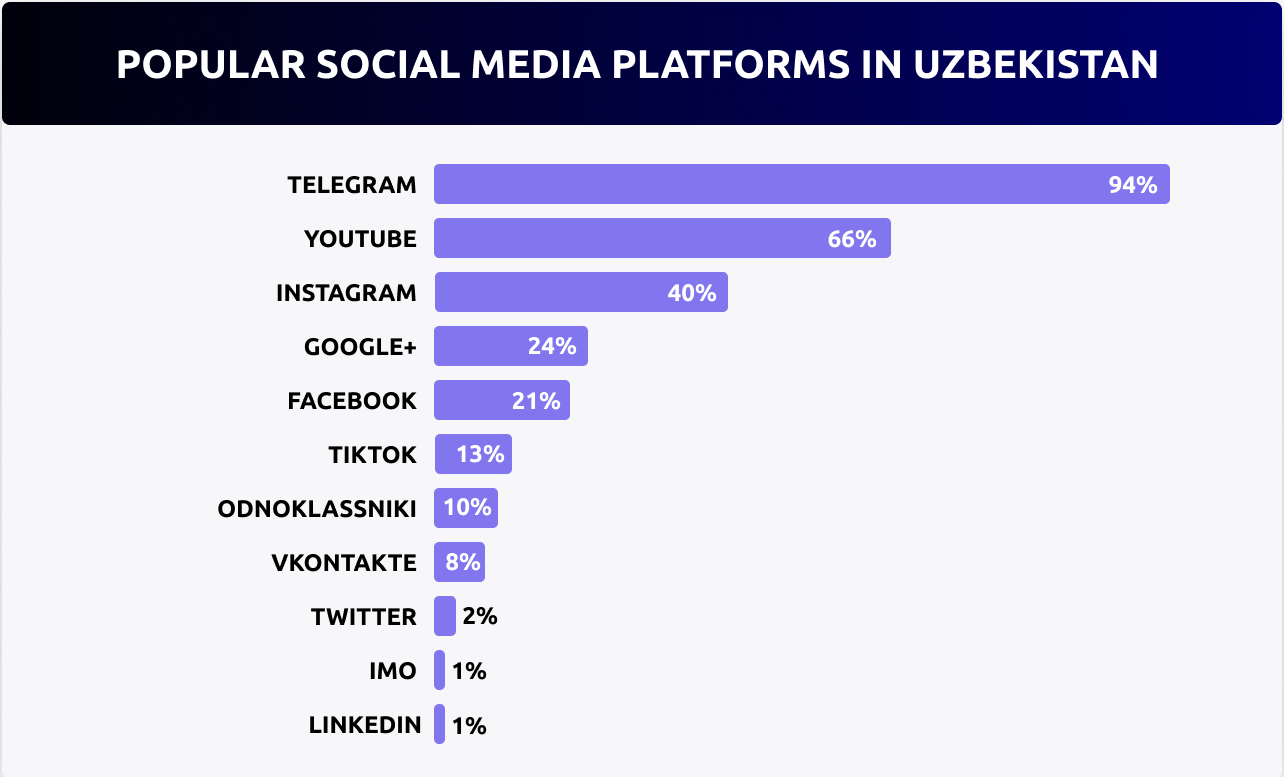

Social Media and Uzbek Bloggers

Influencer marketing in Uzbekistan is gradually developing, with a growing number of bloggers producing high-quality content. While simple video posts were sufficient for audiences in the past, today, both followers and advertisers demand higher standards, including professional filming and well-thought-out scripts. There is also a notable increase in bloggers creating content in Uzbek, strengthening the local focus of advertising and attracting brands targeting the domestic market.

Telegram remains the leading platform for both users and bloggers, offering easy communication. The niche for personal blogs on Telegram is still relatively untapped. With over 123,000 channels geotagged to Uzbekistan, the most popular ones fall into the "news and media" category.

YouTube is gaining traction due to improved Internet connectivity and the demand for content in Uzbek, particularly for educational, entertainment, and cultural materials. Instagram, TikTok, and Russian platforms like VKontakte and Odnoklassniki also enjoy significant popularity.

Million jamoasi - Alfons kuyovlar YouTube channel

Uzbek bloggers currently lack a distinct legal status but must adhere to general legislative norms, including the Law on Mass Media. They are allowed to engage in advertising activities, sign contracts with clients, and are required to pay taxes.

Despite positive changes, the blogging sphere in Uzbekistan faces challenges. For instance, there is a lack of clear legal regulations, particularly regarding contractual relationships. Also, many niches, such as high-quality blogs about science, technology, and beauty, remain underserved.

Radio Advertising in Uzbekistan

In 2024, radio remains a popular media channel in Uzbekistan. In Tashkent and the Tashkent region, 72.2% of the population listen to the radio at least once a month, while 63% tune in at least once a week.

The majority of the audience consists of individuals with middle and upper-middle incomes, who predominantly listen to the radio in cars. 40% of listeners prefer car radios, and 89% of all radio listening occurs outside the home.

The average daily listening time is approximately 3 hours and 13 minutes, comparable to levels in countries such as Slovakia and Italy. In 2023, Uzbek radio recorded 110 advertisers and 148 brands, with Roodell and Davrbank leading in the number of advertising integrations.

Outdoor Advertising in Uzbekistan

In 2023, the annual turnover of outdoor advertising in Uzbekistan reached $20.99 million, with approximately 80% of investments concentrated in the country’s capital, Tashkent. By 2024, investments in outdoor advertising began to grow more actively. The share of expenditures on LED screens rose to 60% of the total outdoor advertising budget, an increase of 14% compared to the previous year. This growth can be attributed to the ongoing digitalization of the sector and advertisers' preference for more dynamic and engaging formats.

Currently, outdoor advertising in Uzbekistan is primarily concentrated in the country’s three leading cities: Tashkent, Samarkand, and Bukhara.

Visit SaudiDOOH campaign in Tashkent, by RMAA, 2024

In the capital of the country, backlights and billboards are widely used along roads and on building facades, as well as wallscapes mounted on blank walls. Additionally, rooftop structures and installations at public transportation passenger drop-off points are common.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At the Tashkent Advertising Festival (TAF!24) in 2023–2024, several successful outdoor advertising projects were recognized. Among them was the brand Datum Parfume, which won gold in the "Outdoor Advertising 2024" category, as well as the local mobile operator Ucell, awarded in 2023 for effective ad placement at the "Amirsoy Resort" mountain resort complex.

Despite its active development, this market faces certain challenges, including the absence of a unified seller, high production costs, and long lead times for launching ad campaigns. Nevertheless, ongoing digitalization and the introduction of 3D screens and advertising on transport offer exciting opportunities for advertisers and contribute to the sector's continued growth.

Let's summarize

The advertising market in Uzbekistan continues to grow, driven by economic reforms, digitalization, and increasing interest in media activities. Television and digital remain dominant while emerging trends such as e-commerce and the digitalization of outdoor advertising create promising opportunities for further growth. Despite existing risks, the country's advertising industry demonstrates significant potential.

In other words, Uzbekistan, whether as a primary or supplementary region for brand promotion, offers diverse options for advertising tools and strategies. Should you prioritize traditional channels or capitalize on current digital trends? Clearly, entering the Uzbek market requires flexibility. Partnering with experts who understand the region's specifics will ensure quick and successful brand promotion.

RMAA offers advertising services across the CIS, including Uzbekistan. We can assist in designing and implementing effective strategies for your business. For prompt assistance, please complete the contact form.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

How does the Media Buying Market in Russia Work?

Navigating the Media Buying System in Russia

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Resident Author at RMAA Blog. Polina shares insights and expertise on the latest trends in the Russian-speaking marketing landscape.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it