Blog about successful marketing strategies in russia

Exploring the Power of Kazakhstan TV Market

MEDIA BUYING

Share this Post

Television remains one of the leading advertising channels in Kazakhstan, despite the rapid growth of digital media. In 2024, TV advertising accounted for 43% of the total media budget, with digital close behind at 39%, steadily moving toward parity.

The TV advertising market in Kazakhstan operates under strict regulations. Since 2016, advertising on foreign TV channels has been prohibited, and at least 50% of broadcast content must be in Kazakh. Prime time is limited to 12 minutes of ads per hour, and the total volume of advertising cannot exceed 20% of daily airtime. Moreover, by 2027, the share of programs in the state language is set to increase to 60% of all broadcasts.

Despite these restrictions, advertisers' interest in TV continues to grow. In 2024, investments in television advertising saw a 25% rise. Television actively integrates with digital formats, creating more comprehensive media mixes, while localized content strengthens engagement with the local audience.

Main Indicators of TV Viewing in Kazakhstan

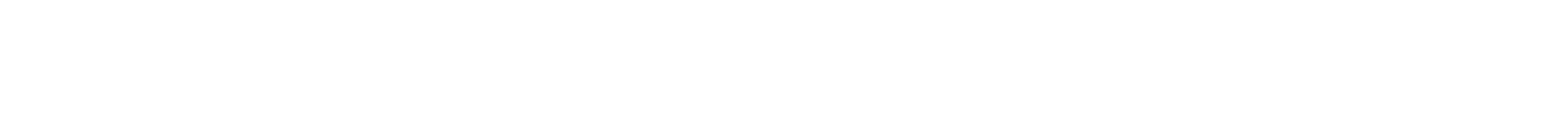

Television in Kazakhstan reaches both younger and older audiences, though significant shifts in its composition and behavior are evident.

Demographic profile of Kazakhstani viewers:

-

The average viewer age was 39 in 2023, up by 2 years from 37, indicating a "maturing" audience base.

-

Viewers under 34 make up 50%, with many younger people shifting to digital media.

-

The share of viewers aged 55+ has grown from 18% to 22%.

TV consumption:

-

65% of Kazakhstanis watch television daily, though this figure is gradually declining.

-

Home watching remains dominant—about 60% of all viewers prefer to watch TV at home.

-

70% of the audience spends 2 to 3.5 hours daily watching TV, reflecting stable content consumption.

-

The average daily viewing time per person is approximately 2 hours and 58 minutes.

Top TV Channels in Kazakhstan

The audience of Kazakhstani TV channels has distinct demographic characteristics: the majority of viewers are women aged 34–44. Over 90% of the audience is concentrated on the top seven TV channels and the top three TV networks.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TV Audience Leaders

First Eurasia Channel – A historical leader, capturing 23.6% of the audience. Known for programs like the morning show “Good Morning, Kazakhstan” and the hit romantic show “QosLike”, a standout in entertainment.

KTK – Commands 17.1% of the audience, particularly popular for projects like the talk show “Astarli Aqikat” and informational programs.

NTK – With 14.3%, excels in entertainment, notably with its project “Bir Bolaiyq” ranking highly.

31 Channel – At 14.1%, known for its popular TV shows and films.

Mir – 10.3%, caters to a Russian-speaking audience.

Astana – 8.0%, attracts viewers with entertainment content and modern TV series.

Channel Seven – 5.1%, a family-friendly educational and entertainment channel airing both Kazakh and international shows. In October 2024, it launched a project with Tengrinews.kz (one of the largest media outlets in the country) to cover the referendum on constructing a nuclear power plant in Kazakhstan.

RTV Network – 3.2%, offers news, entertainment, and educational programming.

Almaty TV – 1.1%, one of Kazakhstan’s longest-running channels, celebrated its 25th anniversary in 2024. Its content includes news, cultural programs, series, and films.

Balapan – 0.8%. It’s Kazakhstan’s first national children’s channel, which began broadcasting in 2010.

The majority of TV ad spending in Kazakhstan is concentrated on First Eurasia Channel, KTK, and 31 Channel, forming the core of the market due to their stable audiences and high viewer trust.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialized channels also draw significant attention. For instance, Balapan focused on children, leads among kids' channels while Qazsport is the top choice for sports programming as well as Qazaqstan, the national channel, which offers popular shows like “Aqparat” and the morning show “Tan Sholpan”.

Kazakhstani channels are actively refreshing their offerings and expanding their programming grids. For instance, Balapan is launching new shows, while Qazaqstan continues to deliver diverse musical and educational programming.

What is happening to the Kazakh TV market now?

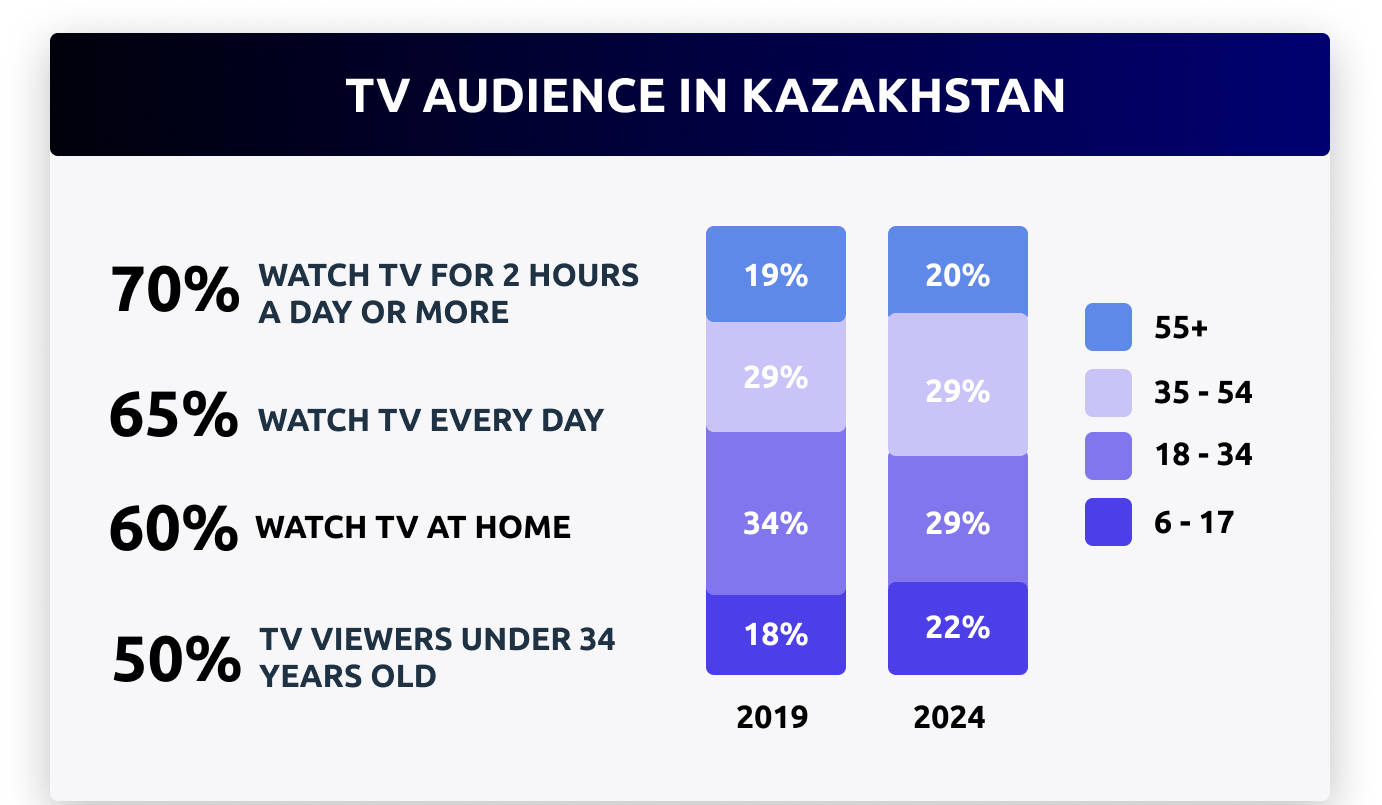

There is notable competition for airtime, especially during peak seasons at the beginning and end of the year, as advertising inventory is nearly maxed out: almost 100% of ad slots are already sold. Meanwhile, the emergence of a new sales house, Media Nova, and the transition of the ORT Eurasia channel to the IMS network has further solidified the positions of major players. With a 45% audience share, IMS has secured its leadership in the market.

In July 2024, new legislative restrictions on advertising for betting companies were introduced. These changes could shift budgets within the industry and open new opportunities for other advertiser categories.

Another key trend is the integration of advertising tools. To expand reach, advertisers are increasingly combining TV with digital formats like DOOH and social media to counter seasonal slumps and enhance campaign efficiency.

It’s worth noting that the annual “traditional” decline in TV audiences in Kazakhstan occurs during the summer. This significantly impacts ad budget distribution: while the third quarter sees reduced advertising activity, the second quarter accounts for up to 53.9% of total budgets.

Key TV Advertisers in Kazakhstan

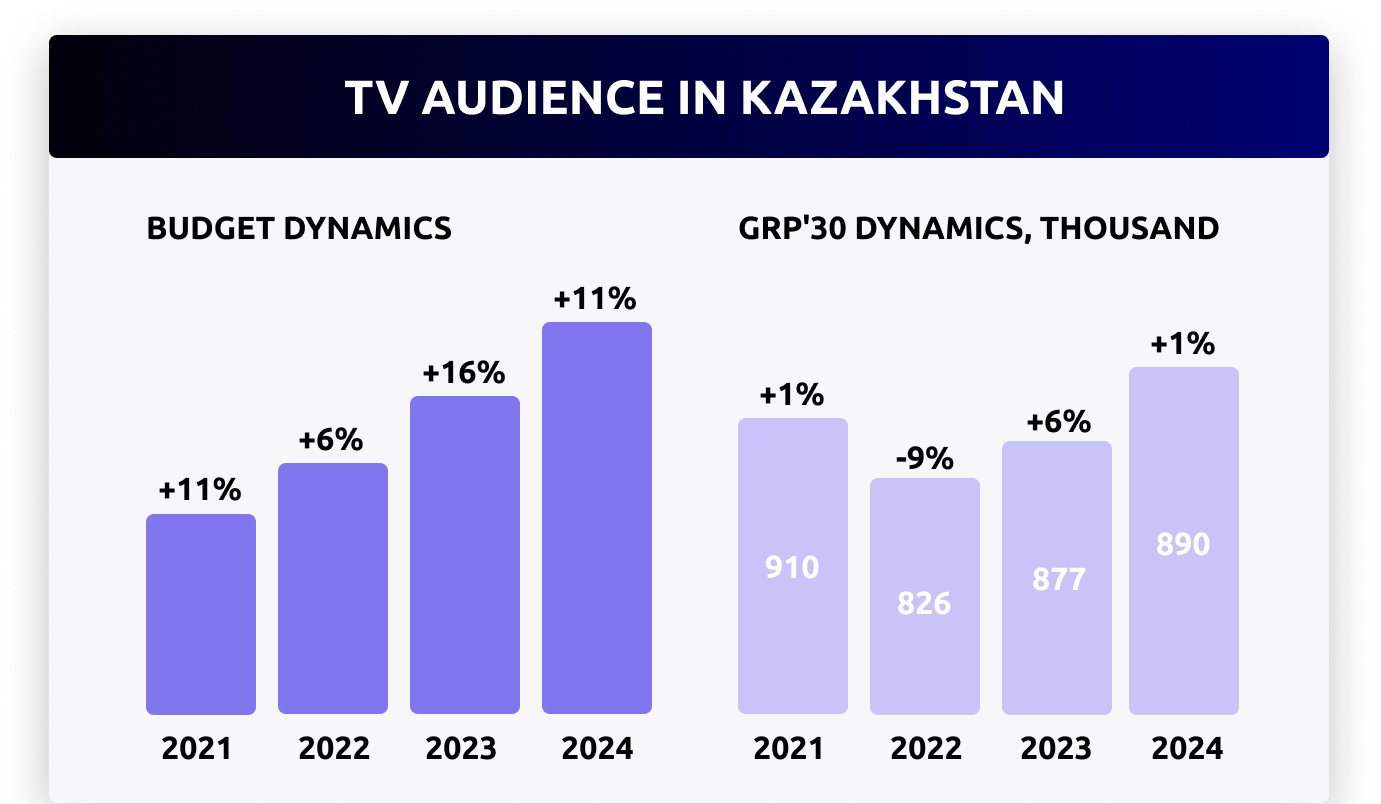

The TV advertising market in Kazakhstan remains stable in terms of sold ratings (GRPs) despite rising costs. In 2024, advertising budgets grew by 11%, below the average TV inflation rate of 20%.

International companies continue to dominate, accounting for 88% of total GRP shares among the top 50 advertisers. However, local brands are gradually increasing their presence, though they face high entry costs. The leading product categories in TV advertising include food products, healthcare, and non-alcoholic beverages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The number of active advertisers increased from 251 to 253 companies in 2024.

Key shifts among major players:

-

Coca-Cola Almaty Bottlers claimed the top spot among advertisers for the first time, bolstered by active campaigns.

-

Procter & Gamble, the leader in previous years, moved to second place.

-

PepsiCo/WBL retained third place but demonstrated 17% growth compared to the previous year.

The local brand Kaspi Bank climbed from 12th to 5th position, showcasing rapid growth in advertising activity.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The 11% growth in TV advertising budgets in 2024 lags behind the 20% inflation rate in the TV ad market. This may be attributed to local companies becoming more active in the market despite high entry barriers. Additionally, the adoption of new advertising strategies, including digitalization and audience behavior data utilization, is influencing market dynamics.

Types of TV Ads Purchases and Trends in Kazakhstan

Kazakhstan’s TV advertising market predominantly operates on an auction-based system, although direct deals with sales houses also play a significant role. However, for “newcomers” without a proven reputation as reliable buyers, securing favorable deals through direct negotiations can be challenging. In such cases, working with intermediary agencies that frequently collaborate with media holdings can provide a solution.

Additionally, regarding the types of TV ad purchases in Kazakhstan, there are several noteworthy points that highlight the market’s development:

-

Classic GRP purchasing, which remains the market’s mainstay, focuses on buying Gross Rating Points (GRPs). Advertisers purchase a fixed volume of audience points to reach their target audience. This approach is popular due to its transparency and predictability.

-

Programmatic TV is a growing trend in Kazakhstan, with implementation actively tested since 2018. Programmatic advertising allows TV campaigns to be placed using automated systems and audience data. For example, the MAKSAT system, developed by Publicis Groupe Kazakhstan, has successfully completed testing. Its advantage lies in helping to optimize ad budgets and increase audience reach without additional costs.

-

Due to the shortage of ad inventory, competition for prime-time slots is increasing. This drives advertisers to explore new formats and platforms, including local and niche TV channels.

-

In Kazakhstan, advertisements must be presented in both Kazakh and Russian, which increases the complexity and cost of ad campaigns. This also influences channel and airtime selection.

The market continues to transform under the influence of global trends and local specificities. Notably, programmatic advertising (Programmatic TV) is being actively introduced, offering an automated and more precise approach to ad placements.

Brands are using DSP (Demand-Side Platforms) to configure campaigns targeting specific demographic groups with audience data. The advantage of programmatic is that it allows both large brands and local companies with limited budgets to enter the TV advertising market by lowering entry barriers.

Addressable TV is also widely used, replacing standard ad blocks with personalized ads targeted at specific devices through an internet connection. This format is perfect for fine-tuning content and increasing ROI by attracting relevant audiences. Additionally, it helps optimize inventory usage and avoid shortages, which remain a critical issue in Kazakhstan’s TV market.

Traditional linear ad purchases remain a stable tool, particularly for major players who value broad reach and audience predictability. However, the merging of digital technologies with traditional TV opens new opportunities for a more flexible approach to campaign planning, making the market more appealing to advertisers at all levels.

Let's summarize

Despite the overall decline in TV viewing time, advertisers continue to invest in television due to its broad reach and high level of audience trust. This balance of stability and innovation allows the TV advertising market to remain one of the most effective channels for brand promotion in Kazakhstan.

RMAA has extensive experience in the TV markets of Russia and the CIS, so we are always ready to assist brands in developing an effective strategy. We often encounter cases where TV advertising is part of a large-scale campaign alongside digital tools. Alternatively, some brands may require TV advertising as the sole channel for promotion. In either scenario, we calculate risks and efficiency to achieve optimal results.

Contact an RMAA manager by filling out the contact form so we can start working on your project as soon as possible.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"A media buyer's quick guide for effective work in Russia"

for FREE!

How does the Media Buying Market in Russia Work?

Navigating the Media Buying System in Russia

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Resident Author at RMAA Blog. Polina shares insights and expertise on the latest trends in the Russian-speaking marketing landscape.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "A media buyer's quick guide for effective work in Russia?" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it