Blog about successful marketing strategies in russia

Outdoor and Indoor Advertising in Kyrgyzstan: Formats, Costs, and Brand Placement Strategies

MEDIA BUYING

Share this Post

Outdoor advertising in Kyrgyzstan remains a reliable tool. Brands include it in their media plans when they need offline visibility, brand recognition, or a presence in specific locations—not just on the streets, but also inside commercial and public spaces.

This channel covers everything from billboards, display boards, city formats, and branded bus stops to digital screens, ads on public transport, and LED panels in malls, elevators, and airports. In Bishkek alone, there are about 700 advertising structures; nationwide, the figure exceeds 1 000. The classic 3 × 6-meter billboard is still the most common format, but interest is growing in overhead road banners, building-front ads, digital bus stops, and indoor displays in shopping areas.

By 2025, the outdoor-ad market is projected to reach $3.25 million, while total ad spend in the country will be roughly $61 million (Statista). Although outdoor doesn’t command the largest share of media budgets, it has posted annual growth of more than 20 % in recent years, driven by price increases and by brands weaving offline touchpoints into the customer journey—from the street to the elevator, from the highway to the retail corridor.

Outdoor (and indoor) formats excel when a brand is entering a new city, opening a location, launching a campaign, or simply wants to be seen—literally. They perform best in high-traffic areas where people walk by, drive past, or pause just long enough to notice. As such, they remain one of the most direct ways to stay visible.

Placement and Formats: Bishkek, Osh, and the Logic Behind Media Presence

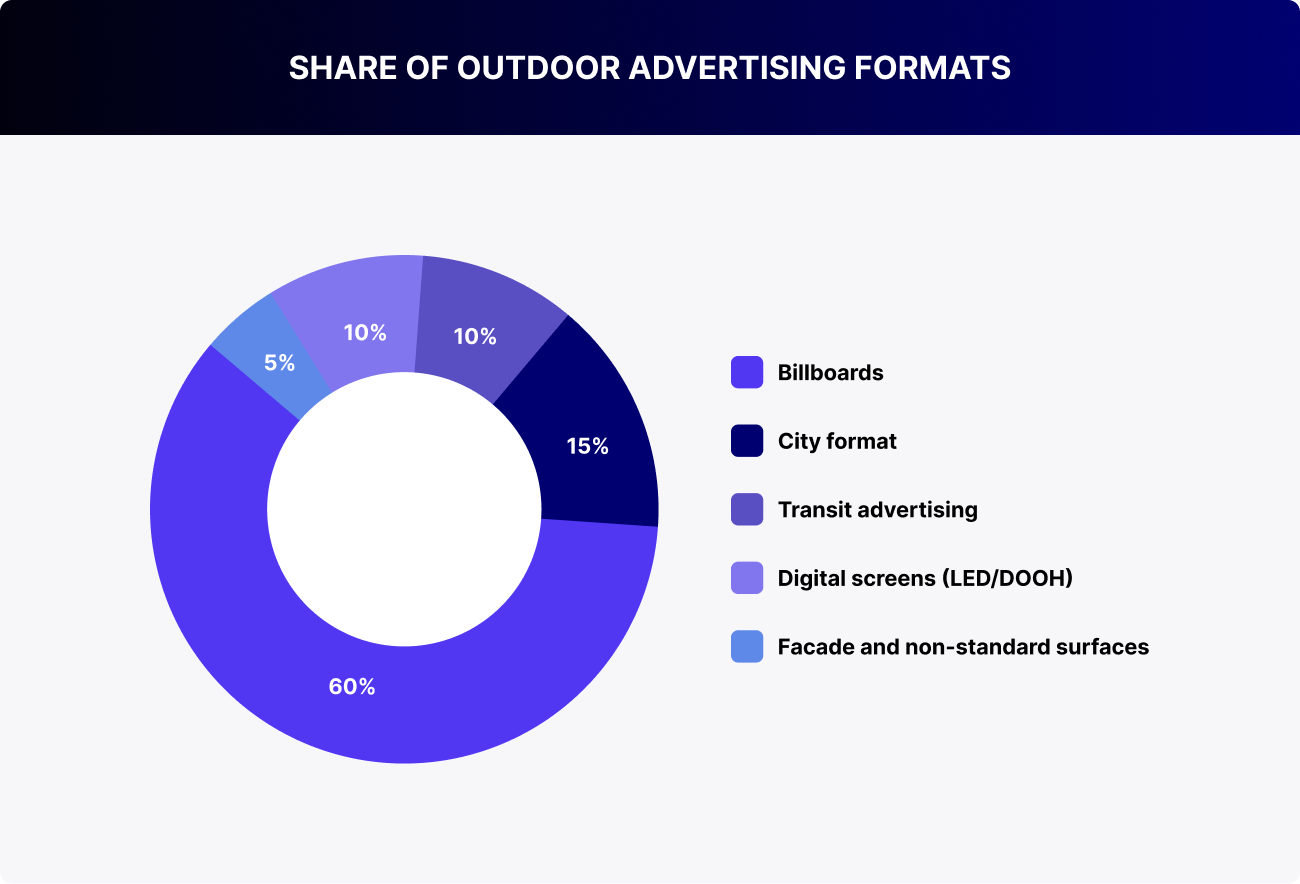

As of 2024, Kyrgyzstan hosts roughly 1 000 – 1 100 outdoor advertising structures, with about 700 located in Bishkek. The remaining inventory is split between Osh and other regions. Classic 3 × 6-meter billboards account for around 60 % of all placements, while the rest comprises city formats, overhead banners, transport ads, building façades, and digital panels.

Beyond outdoor surfaces, indoor advertising is also active in major cities—inside shopping malls, elevators, offices, and cinemas. While it’s difficult to measure exact volumes, indoor screens serve as a natural extension of audience interaction, especially in high-footfall areas.

The bulk of advertising activity is concentrated in Bishkek and Osh. These cities drive the pace of the entire market: key campaigns are launched here, new formats are tested, and the highest levels of audience engagement are recorded. That’s why we’ll focus on how outdoor and indoor advertising function specifically in these two urban centers.

Bishkek: Broad Reach with Targeted Reinforcement

The capital is the country’s primary media market. Outdoor advertising here follows traffic flow:

- Chuy Avenue is the main artery

- Kievskaya, Masalieva, and Yunusalieva are major transit routes

- Osh Bazaar, Dordoi Plaza, and Asia Mall are high-density audience zones

- Manas Airport and exit roads are key transit points

Billboards and city formats are the most frequently used, but digital formats are gaining ground rapidly. According to media operators, there are now over 100 LED screens in Bishkek, installed both on building façades and at bus stops.

At the same time, indoor advertising is present in the same zones. Asia Mall, Bishkek Park, and VEFA Center are equipped with video walls and LED screens that run 10-second promo loops. One example is a Flynas airline campaign in Bishkek Park: a vertical LED screen placed by the escalator captures attention with a travel offer precisely when people are in motion but not distracted.

This format is especially effective for travel and lifestyle brands that aim to do more than just showcase a product—they want to integrate into the customer’s path inside the mall.

Osh: Compact Yet Dense

Osh is the southern hub of the country. Here, outdoor advertising doesn’t complement digital; it often replaces it, especially for older and more offline-oriented audiences. Key high-traffic zones include:

- Masaliev Street

- Kurmanjan Datka Avenue

- Japalak

- Stations, markets, and major intersections

The formats in Osh are mostly traditional—classic billboards, overhead banners, and building façades. However, digital structures are beginning to appear. Confirmed examples include a circular LED totem at a central roundabout in the city and a façade-mounted LED screen on a historic building.

These types of structures perform well with heavy traffic, especially in the evenings, thanks to their brightness and motion. Indoor screens are also placed inside buildings, near markets and transport hubs, in a more targeted way, but always in areas with strong footfall.

How Placement Works

In Bishkek, the placement process is relatively straightforward. There’s an electronic application system in place with set deadlines and a clear approval workflow. The city administration typically reviews applications within three business days, and permits are issued for durations ranging from one month to one year. The process is well-established, especially for standard structures in pre-approved locations.

In Osh, things move more slowly. There’s no digital platform, some decisions are made manually, and many ad surfaces are managed by local contractors. Still, placements are doable, as long as you understand who to work with and how to navigate the system.

That said, 2024 brought significant changes for everyone in the market. The revised Law of the Kyrgyz Republic “On Advertising” , new regulations from the Bishkek City Council, and amendments to the Code of Offenses introduced several key updates:

- Language requirements: All ad copy must be in both Kyrgyz and Russian, with correct spelling and grammar.

- Placement restrictions: Advertising is now prohibited on monuments, religious sites, natural landmarks, educational institutions, fences, bus stops, and light poles.

- Penalties: Violations carry fines ranging from 1 000 to 5 000 KGS, depending on the context.

We work under an agency model. That means only vetted structures with valid permits are included in media plans. Through partnership agreements with local operators, we know in advance which surfaces are available, which are already reserved, and which should be avoided due to risks such as approval issues or limited visibility.

Seasonal Cycle of Outdoor Advertising: What Gets Booked and When

The outdoor advertising market in Kyrgyzstan follows its own seasonal rhythm—one that doesn’t always align with the calendar but shows consistent patterns year after year.

Spring marks the exit from winter’s quiet. By April and May, the market enters an active phase: new campaigns launch, and less-typical advertisers come into play—from concert promotions to educational services. In April 2024, a noticeable spike was seen across several categories, according to pilot data from METER monitoring.

This is also when indoor advertising begins to pick up, especially in malls and cinemas, where foot traffic increases thanks to warmer weather and public events.

Summer is peak season. In June, July, and August, billboards are filled with ads for beverages, telecom services, car-care products, travel, and summer sales. Short-term retail campaigns, seasonal offers, and local festivals become more prominent.

Inside shopping centers, there’s a surge in demand for LED screens and window banners. Brands use this time to catch shoppers in a vacation mindset, taking advantage of the traffic between browsing and buying.

Autumn brings steady activity. From September through October, major campaigns from banks, developers, and service providers continue. This is also when planning for New-Year campaigns begins, both outdoors and indoors: video loops are scheduled for indoor screens, digital bus stops are reserved, and media façades near shopping areas are locked in.

December delivers a short but powerful burst. FMCG, retail, and financial services all ramp up, particularly anything tied to gifting, holiday promos, or loans. Malls become full-fledged media spaces: LED-screen ads, branded storefronts, and placements near food courts and entry points are in high demand. Ads in elevators and reception areas help reinforce brand contact with urban audiences, especially in office buildings and residential complexes.

January slows down. Most campaigns wrap up by New Year’s, and new budgets are only starting to move. But by February, both outdoor and indoor advertising come back to life as brands reassert their presence early in the year—not just on roads and intersections, but also at store entrances or near elevators in residential buildings.

As of early 2025, the outlook is positive: despite economic uncertainty, brands are not cutting offline budgets. In fact, they’re increasing visibility to counteract digital oversaturation.

Top Advertisers in Kyrgyzstan’s Outdoor Market

Within the structure of media investment, outdoor advertising ranks third, behind television and digital. TV continues to hold the largest share of budgets (around 70 %), followed by online campaigns and then street formats. Despite this, outdoor advertising remains a consistent part of the media mix for most major brands. It delivers reach—particularly in urban areas—and acts as a reinforcement layer for TV or digital, strengthening brand recognition.

This includes indoor placements as well—in malls, office buildings, elevators, and airports. Together, they form an offline touchpoint that works in tandem with online efforts.

Traditionally, telecom operators have been the most active advertisers in this segment. But in recent years, commercial banks have joined them, steadily increasing their outdoor presence. FMCG brands (food and beverages), car dealerships, motor-oil manufacturers, pharmaceutical companies, and private clinics have also been highly visible players in the space.

Top Advertisers by Number of Placements

One of the key metrics in outdoor advertising is the number of ad surfaces occupied. It reflects how widely a brand is represented in the field—how many billboards, digital screens, stands, and banners are involved in a campaign.

This kind of ranking has its nuances. Some advertisers appear across dozens or even hundreds of placements by leveraging smaller formats or more budget-friendly options. That’s why it’s important to look beyond visibility on main streets and consider the overall density of presence across the city.

| Rank | Advertiser | Estimated Number of Advertising Surfaces |

Comments |

|---|---|---|---|

| 1 | NUR Telecom (“O!”) | ~200+ surfaces (nationwide) | Extensive banner network across all regions; branded boards and dealer signs. |

| 2 | Sky Mobile (“Beeline”) | ~200 surfaces | Large-scale campaigns in cities; ads for tariffs and services on billboards and bus stops. |

| 3 | “Alfa Telecom” (“MegaCom”) | ~150–180 surfaces | Maintains a significant presence, though volumes have declined since peak levels. |

| 4 | Coca-Cola | ~150 surfaces (seasonally up to 200+) | Maximum reach during summer promotions and holidays (billboards, city formats). |

| 5 | Yandex Go | ~100+ (including branded vehicles) | Promotional stickers, branded cars, and digital screens promoting services. |

The most noticeable brands on Kyrgyzstan’s streets are those that know how to scale. Mobile operators like O!, Beeline, and MegaCom not only have extensive branch networks but also a wide infrastructure of owned or leased ad inventory. Their banners appear in all major cities and most regional centers. Every new campaign—whether it’s a fresh plan or service—rolls out with dozens of placements across the country.

Outdoor media is often supplemented by in-office screens, branded storefronts, indoor panels, and lightboxes at retail locations.

Major FMCG brands such as Coca-Cola are also highly active in this channel. While their campaigns are often seasonal, during peak periods like summer or December they can occupy several hundred ad surfaces. Their media mix includes billboards and bus-stop ads, but also digital screens in malls, POS placements, and entrances to shopping zones.

In recent years, new players have entered the outdoor scene. A standout example is Yandex Go, which takes an unconventional approach: branding taxi vehicles (stickers, roof lights) and running ads on digital street screens. This makes the brand visible on the move, at practically every intersection. Beyond the street, the company also places ads in elevators, retail spaces, and on digital displays, keeping the brand present at every step of the user’s daily route—from the road to the doorstep.

Other digital services, from delivery apps to e-commerce platforms, are increasingly adopting this model as well.

A unique feature of the Kyrgyz market is the strong presence of posters and event-related ads. Before concerts, festivals, or premieres, the streets fill with promotional banners and themed displays. These cultural campaigns often surge in volume and frequently rank among the top in terms of number of placements.

It’s important to note that high street visibility doesn’t always come from major formats or traditional reach. Some brands focus on compact, high-volume placements—dozens of small banners, stickers, or city formats. Others go the opposite route, opting for one or two standout installations in prime locations, relying on bold scale or creative design to grab attention.

Leading the charts by number of placements are brands with broad networks, wide product offerings, and a strong emphasis on offline presence: telecom providers, FMCG companies, transport platforms, and digital services. These are the players shaping Kyrgyzstan’s visual street landscape, from the capital to the regions.

Summary

Outdoor advertising in Kyrgyzstan remains a stable and straightforward channel. It provides reach, builds brand recognition, and maintains audience contact in spaces where digital ads can sometimes get lost. This is especially effective along urban routes, entry roads, near retail zones, and in other familiar high-traffic locations.

Indoor advertising complements this—in malls, offices, elevators, and cinemas. Together, they create a continuous visual presence: from the street to the storefront.

The choice of format and location depends on your objectives. Classic billboards are ideal for reach; facade-mounted boards and bus stops work for localized contact; transport formats follow the movement of your audience. Seasonality, competition for attention, and channel mix (TV, social media, offline activations) all play a role in maximising impact.

If you’re entering the Kyrgyz market or planning a campaign in Bishkek, Osh, or beyond, outdoor advertising can serve as a reliable foundation. We build effective media plans based on availability, legal regulations, and local nuances.

RMAA works with both outdoor and indoor advertising in Kyrgyzstan, with clarity and precision. We understand the market, how it operates, and—crucially—how to choose not just any placements, but the ones that perform.

Need placement? Submit a request. We’ll find the right locations, timing, and format to fit your goals.

Want to stay updated on the CIS media market? Subscribe to our blog. We share only verified insights: data, trends, real-world cases, and actionable strategies.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"A media buyer's quick guide for effective work in Russia"

for FREE!

How does the Media Buying Market in Russia Work?

Navigating the Media Buying System in Russia

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Digital Strategist. Head of one of the project groups at RMAA. Maria started her journey in digital marketing in 2009.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "A media buyer's quick guide for effective work in Russia?" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it