Blog about successful marketing strategies in russia

How Russian Travelers Choose, Book and Explore: Behavior Insights

DIGITAL MARKETING

Share this Post

Since 2022, the Russian tourism market has undergone a radical transformation: familiar booking channels have disappeared, and local players have taken their place. What does this mean for international brands working with the Russian audience? Below are the key behavioral shifts, relevant platforms, and tools that should be considered to stay visible to the Russian traveler in 2025.

How Russian tourists plan and book their trips in 2025

After the departure of Booking and Airbnb in 2022, the Russian tourism market underwent a transformation, and now this change has entered a stable phase. Active growth in direct bookings began the year before last, and last year, hotels received $4.55 billion through online sales — an increase of 8.8% compared to the previous year.

At the same time, there has been an increase in interest in package tours: in the past year, their online sales amounted to $4.76 billion (+9.4%). This is a sign that, despite external isolation, Russians continue to travel, increasingly choosing straightforward and quick solutions, either directly or through platforms.

In light of this, outbound tourism is also showing steady growth. Last year, Russians made about 29.2 million overseas trips — a 7.8% increase compared to the previous year. The most popular destination remains Turkey, with 6.3 million travelers, which is an 11.7% increase from the year before. There was also a significant rise in trips to the UAE: it became easier to obtain a visa, and the number of direct flights from Russian cities increased.

Russians are once again actively choosing China for their trips, mainly due to the simplified visa regime and the removal of COVID restrictions. The destination has regained interest due to its accessibility and the restoration of direct flights. Thailand continues to grow its tourist flow thanks to its special relationship with Russians. It has become one of the most sought-after destinations. From January to early March 2025, over 559,000 Russians traveled to Thailand — a 14% increase compared to last year. Vietnam is also seeing a rise in interest, particularly in the first months of 2025.

Egypt remains firmly among popular destinations, with its main advantages being visa-free entry and a year-round season. Last year, there were 5.9 million trips to Abkhazia. The growth was modest (+1.1%) but steady. European destinations are recovering slowly and with difficulty: only 1.4 million Russians visited Europe last year, almost ten times fewer than in 2019. Most travelers flew to Europe via third countries, primarily through Turkey.

|

Rank |

Country |

Trips (million) |

Change (%) |

|

1 |

Turkey |

6.27 |

+11.7% |

|

2 |

Abkhazia |

5.81 |

+1.1% |

|

3 |

Kazakhstan |

2.81 |

–4.4% |

|

4 |

UAE |

1.99 |

+15.6% |

|

5 |

China |

1.90 |

+96.5% |

|

6 |

Egypt |

1.48 |

+15.3% |

|

7 |

Georgia |

1.35 |

+21.5% |

|

8 |

Thailand |

1.32 |

+24.5% |

|

9 |

Armenia |

0.97 |

–12.5% |

|

10 |

Azerbaijan |

0.71 |

+26.8% |

Total number of outbound trips: 29.18 million

Annual growth: +7.8%

Tourist behavior continues to evolve: the habit of planning ahead is growing. Last year, the booking window at the early stages of sales reached 74–80 days. Now, as of the first quarter of 2025, the average booking window is 34 days, longer than in previous years when trips were booked two to three weeks in advance.

Russians want to lock in the price of their vacation in advance, have the option of partial payment, and reduce their dependence on fluctuations in the ruble exchange rate. Additionally, the number of bookings for accommodations has significantly increased compared to the same period last year. The demand for travel in summer 2025 has risen by 30%, with the first bookings already appearing in March of the previous year.

The international platforms that left were replaced by Russian services — Yandex.Travel, Ostrovok.ru, Aviasales. All of them offer not only bookings but also affiliate programs, special placements, and integrated ads, including for international brands working with the Russian audience.

What does this mean for brands? In 2025, Russian tourists value comfort, transparent conditions, and accessible information. They are accustomed to planning vacations online, in advance, relying on trusted local services. For international brands to successfully engage with this audience, it's crucial to be present on the platforms that Russians already know and trust.

Advertising formats within online booking services

In 2025, the entry point to the Russian travel audience is not Instagram or Booking. It's local platforms, through which the main flow of search and payment actions occurs: from trip planning to payment. And if a brand is not present there, it essentially doesn't exist for the user.

Let's take a look at the services where people are searching and booking today.

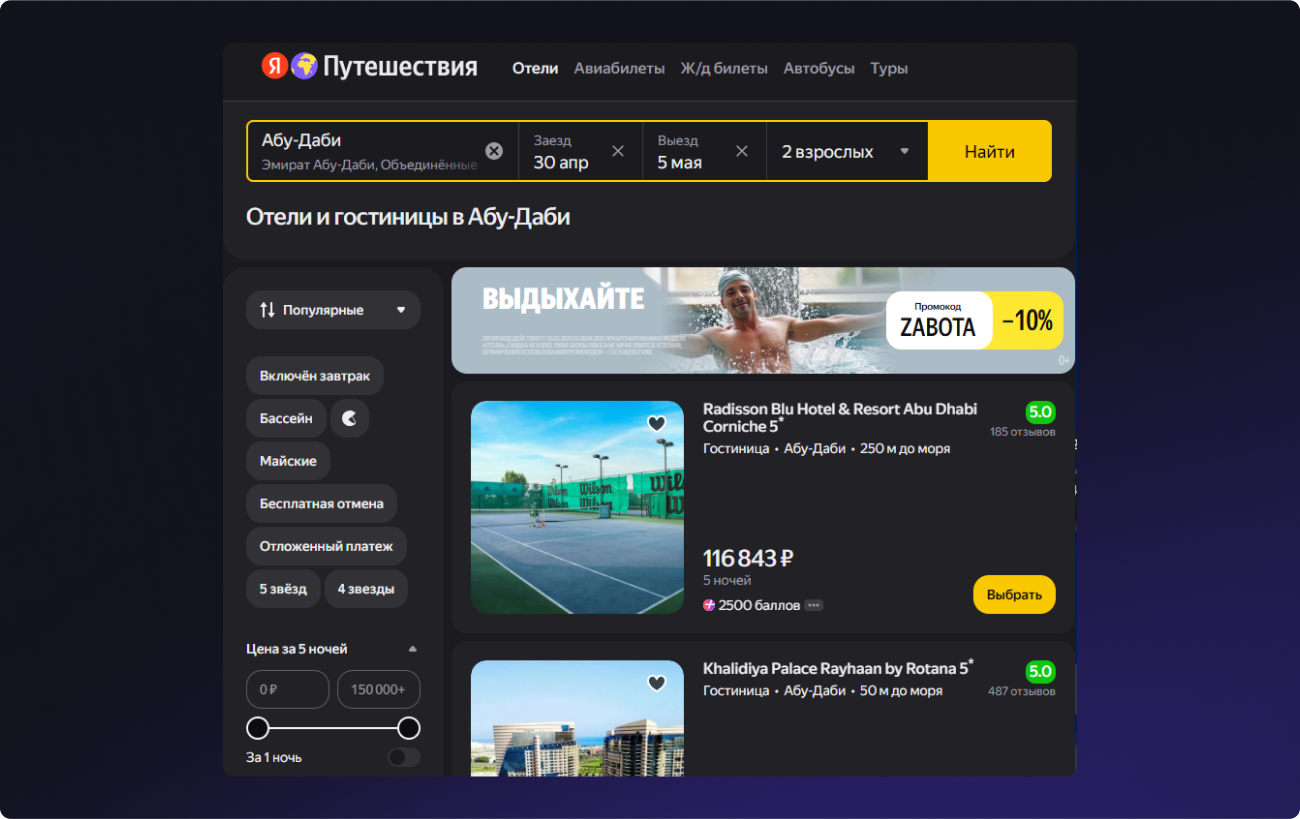

Yandex.Travel

The Yandex ecosystem is the main digital environment in Russia.

Advertising in Yandex.Travel is available through the Yandex.Direct paid ads platform, as it is part of the Yandex Advertising Network. The majority of these advertisements will be media banners located on the main screen of the service or under the hotel search box. It should be noted that in Yandex.Direct, it is not possible to specify exclusively Yandex.Travel as the main location of the creative. In other words, it is necessary to select the Yandex Advertising Network, after which the algorithms will automatically select the locations for advertising, taking into account the characteristics of the audience.

A strong impact can be achieved by combining search results with a banner on the homepage. There’s support for the Yandex Plus cashback program, built-in special placements, and the ability to integrate directly with the booking system via API.

This platform offers excellent reach, especially if the brand has a wide range of products or is running promotions. The format is ideal for those who are not afraid of competition in the auction and want to make a large-scale statement.

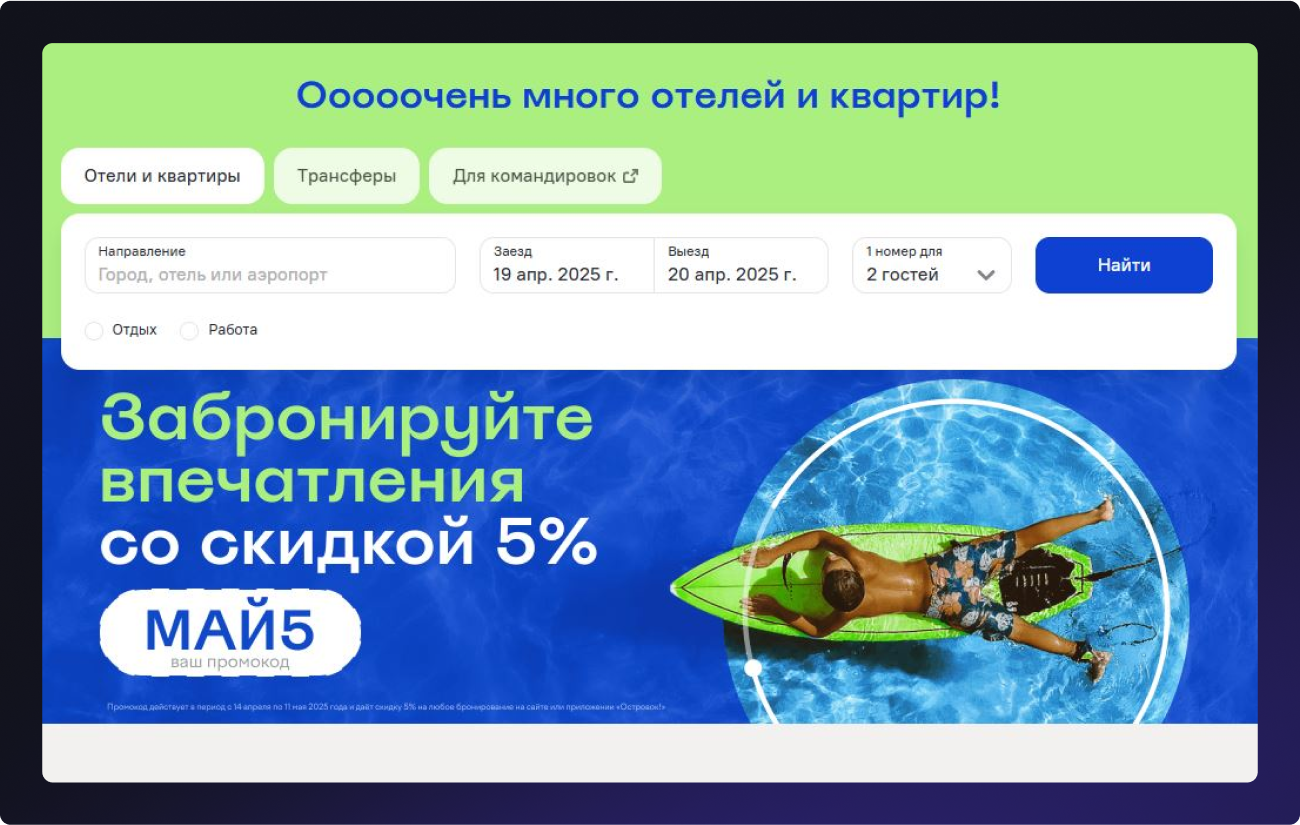

Ostrovok.ru

The platform is focused on hotels and apartments. The audience consists of those who are looking for accommodation rather than tours.

There are additional formats available on Ostrovok.ru. Media banners are also featured on the homepage and within the search engine. In addition, users have the option of creating an email newsletter based on the service, writing an article for a blog, or launching a special project with a promotional page.

A selection of Saudi Arabia hotels on the Ostrovok.ru promo page

It is suitable for those promoting hotels, tours with accommodation, or destinations that are still gaining traction. It can be used as an entry point for testing.

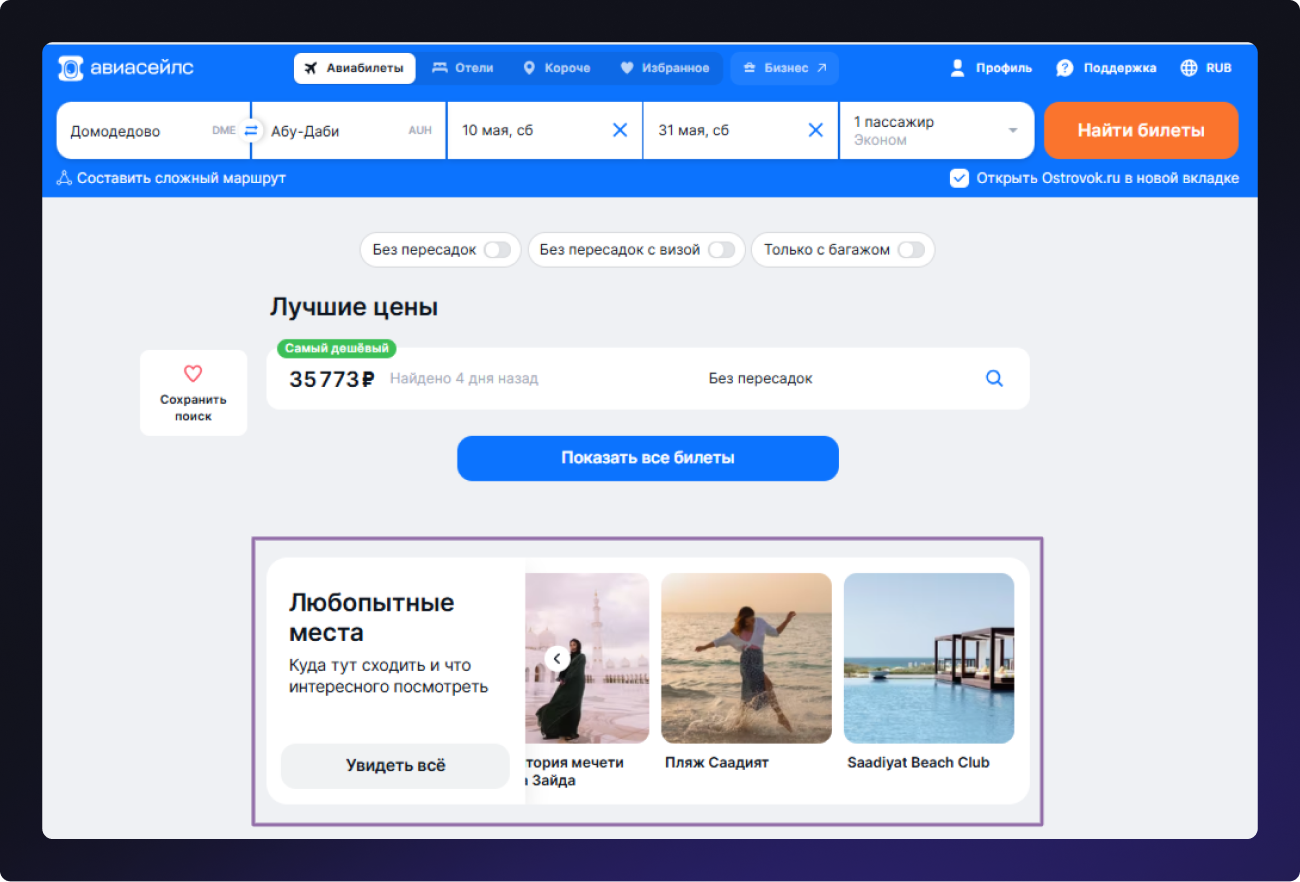

Aviasales

Aviasales is the largest travel metasearch engine in Russia. Every month, 18 million people visit the platform to conduct over 150 million flight searches. This is where people start their journey: choosing destinations, looking for tickets, and considering their options. For brands, this is a rare moment: the audience's attention is focused, decisions haven't been made yet — it's the perfect time to make an impression.

The audience here is accustomed to planning trips independently and comparing prices.

Among the advertising tools available are banners, native integrations, email newsletters, as well as non-standard formats and special projects. The platform also has a Telegram channel and a VK group where brands can create native posts, selections, or special projects.

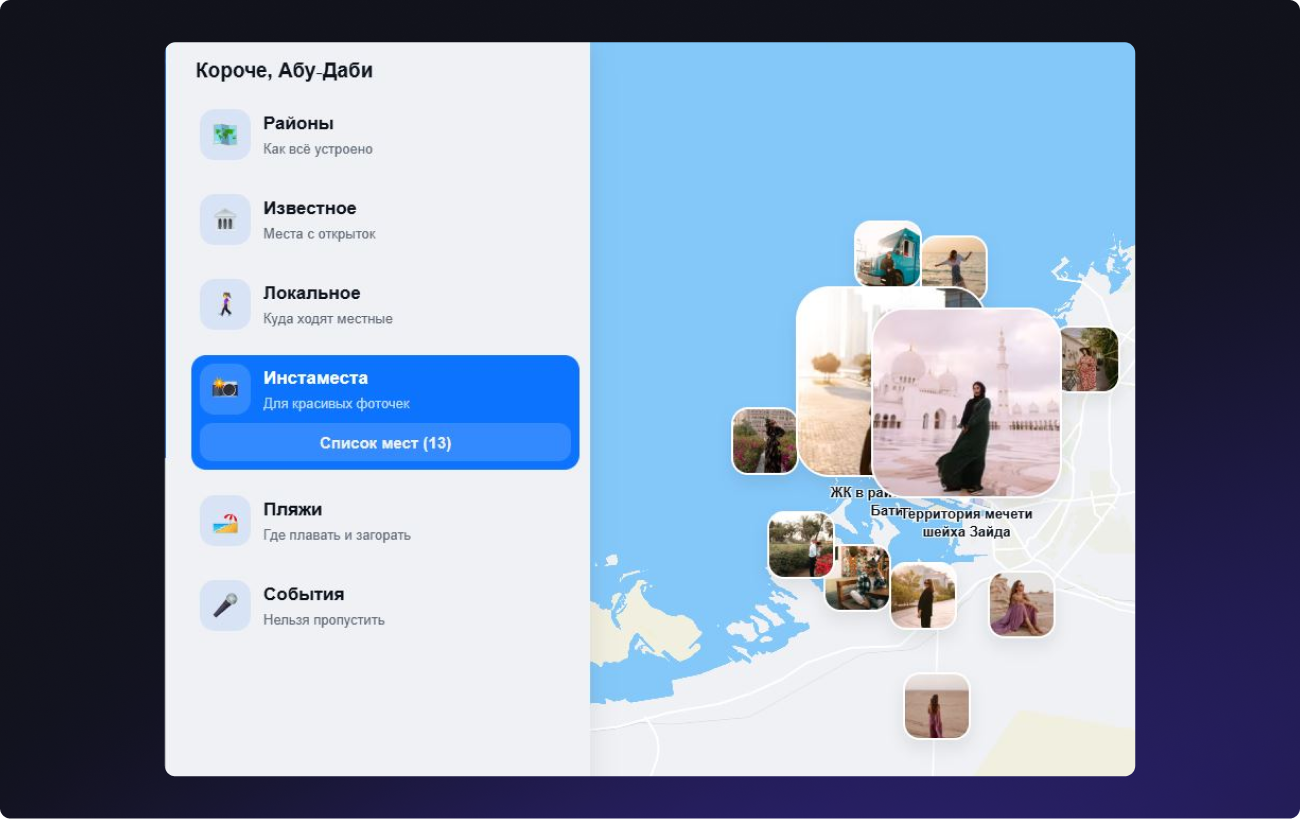

Aviasales offers a wide range of native formats, including curated selections, branded routes, special content blocks, and integrations on search results pages. These are ideal for those who want to integrate into the decision-making process rather than just ‘show up’. One particularly interesting format is ‘Koroche’.

"Koroche" (‘In short’) is Aviasales' proprietary deep native integration format. The brand is embedded directly into the user's journey. It’s not a banner or a separate article: the brand becomes part of the product.

For example, in the Abu Dhabi travel guide, the brand might appear on a map next to landmarks, restaurants, and other points of interest. In a selection, there’s a hotel, service, or product with a visual emphasis and a natural description embedded into the route.

The entire selection from this section also appears right under the ticket search bar, exactly when the user is planning their trip. This creates a subtle but precise brand presence and boosts conversion.

Such an integration works on brand recognition, strengthens trust, and drives action.

For brands, the Aviasales platform offers the opportunity to integrate into recommendation content, where the audience is already in the trip-planning mode.

Moreover, Aviasales works in tandem with the Ostrovok.ru platform within the same ecosystem, meaning the user’s journey can be supported from the very start to the booking stage. When they search for tickets, they see the brand. If they look for a hotel, they encounter the familiar offer again. All of this happens within a single environment, without unnecessary steps or switches. For brands, this increases engagement, ensures precise targeting at the decision-making moment, and boosts conversion.

Almost all platforms today offer partnership formats: native advertising, custom landing pages, and flexible payment models (CPC or CPA). Additionally, seasonal promotions are launched to stimulate demand. For example, Ostrovok promotes bookings through promo codes directly in the search interface.

This is important to keep in mind: the user might start their search on a search engine, but the purchase decision is often made within the ecosystem, especially if they are logged in, accumulating points, or receiving cashback. Therefore, the brand should not just be ‘somewhere nearby’ but embedded into the very logic of the platform.

Most platforms are open to collaboration, either directly or through local partners. This is not a closed system. The key is to communicate with the audience in their language and be where they are actually booking.

How to advertise a travel brand in Russia in 2025

Russian users still start their trip planning with a search. However, the purchase decision is made within ecosystems — travel services, aggregators, social networks, and messengers. In 2025, the task for a brand is not just to appear in search results but to accompany the user through all the key stages.

What works at the start:

- Search engines — the main channel for brand discovery (36.9%).

- Advertising on Yandex.Direct — through CPC model, via the Yandex Advertising Network (YAN). But it’s important to note: you can’t just select Yandex.Travel as placement is based on behavioral characteristics of the audience.

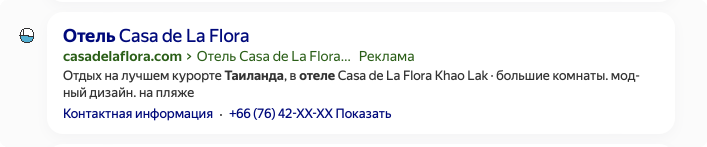

- Paid ads on Yandex work well for tours, hotels, and flights, especially with a geo-focus and special offers (e.g., ‘Visa-free Thailand in May — starting from 90,000 rubles’).

According to Yandex itself (note: RMAA is a Yandex certified partner), interest among Russians in Asian destinations increased by 45% in the first half of last year. The top destinations were China, Thailand, Sri Lanka, and Vietnam.

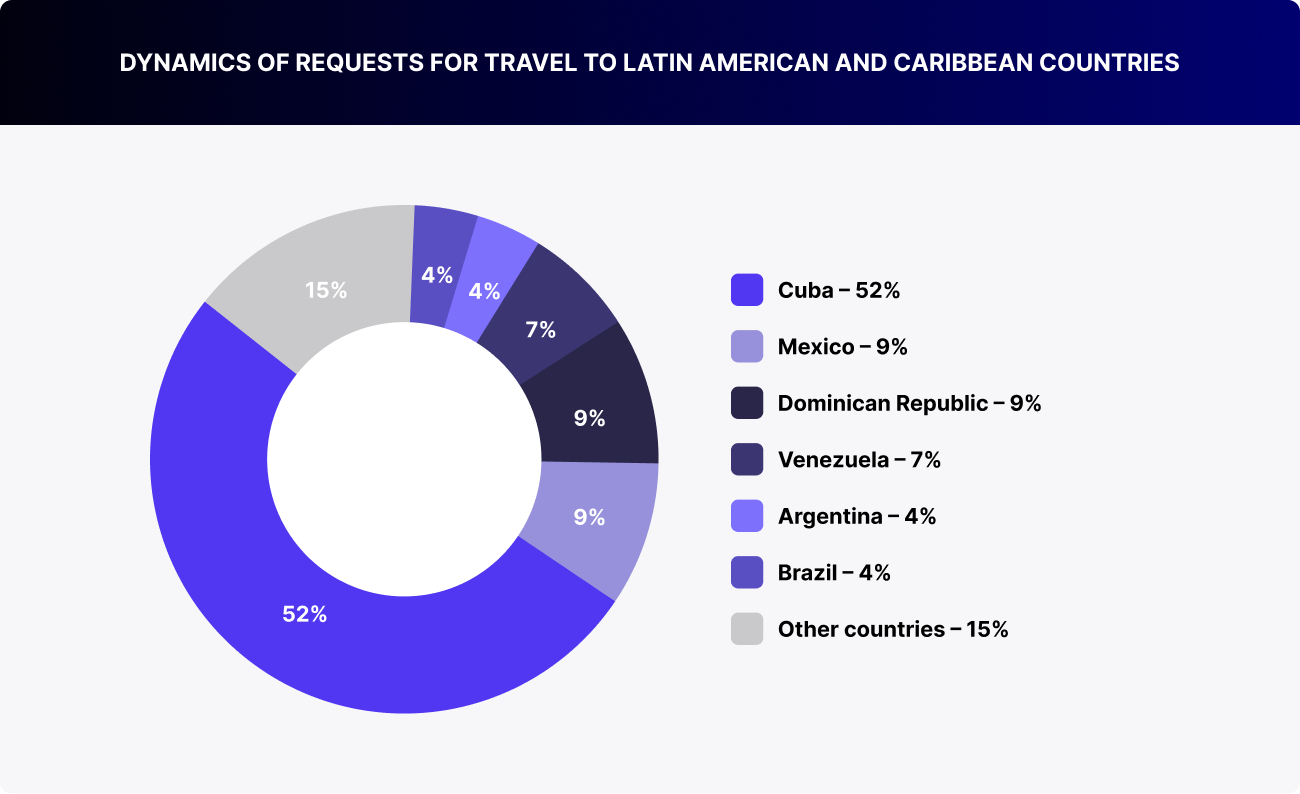

Also, there is still interest in traveling to Latin America and the Caribbean, where the number of searches for these destinations increased by 2%. The key countries here are Cuba (+60% growth in Yandex Russian language search results), Mexico, and the Dominican Republic.

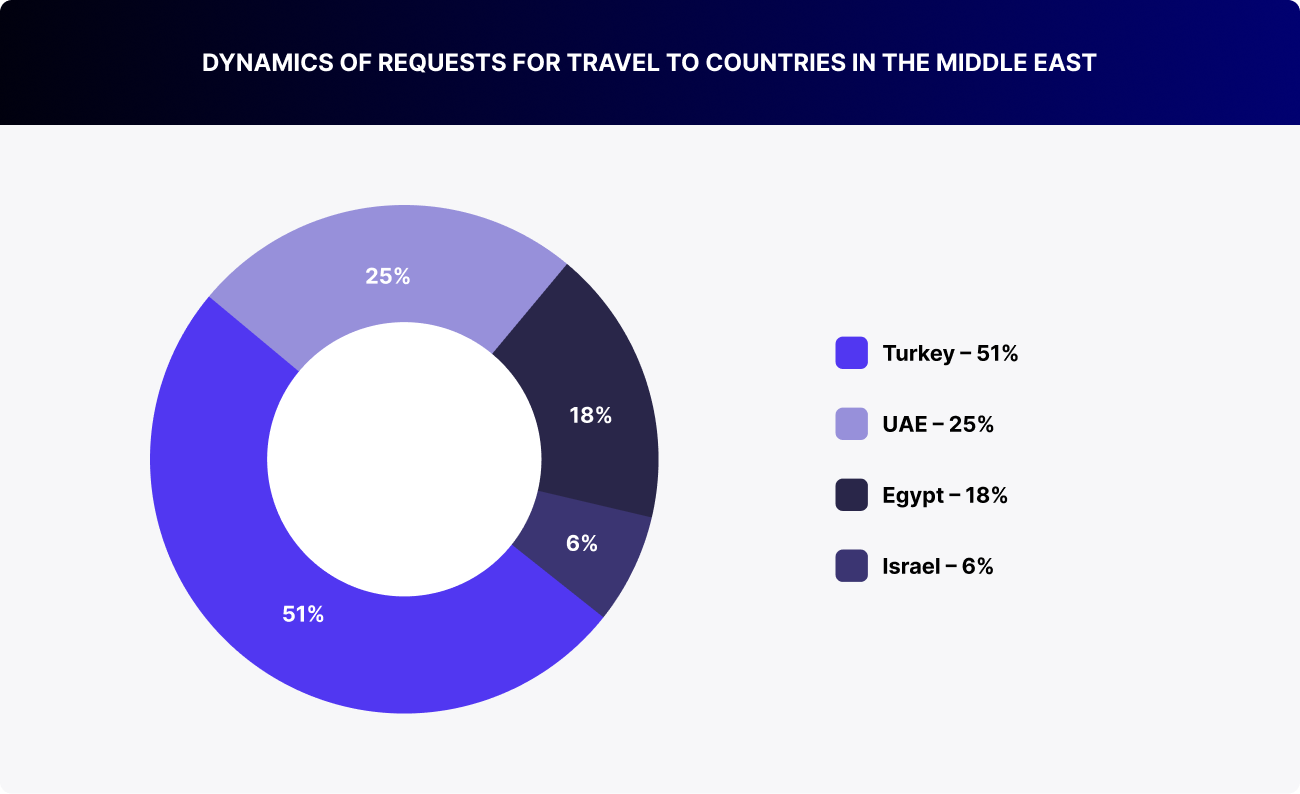

Another 10% increase in requests is for destinations that Russians have a strong affinity for - Turkey, the United Arab Emirates, and Egypt. Saudi Arabia was also included in this group, with an increase of 11% in queries.

What does this indicate about the current state of the market? Given that Russians are known to book travel services directly, they are likely to search for them on a search engine. The search results are influenced by the content of the website. Another possibility is that the user discovers a hotel on a travel service and then searches for the hotel's website through the search engine.

Where else do Russians discover any brand in 2025? First, it’s social media advertising as a brand discovery channel for 25.8% of users. Second, reviews and personal experiences — 20.2% rely on others’ impressions. Third, word-of-mouth — 30.5% hear about offers from friends and acquaintances.

This means that influencers, expert reviews, and native integrations are still effective, especially when they lead to a dedicated landing page where bookings can be made immediately.

Maximum reach can be achieved when a brand is present across travel ecosystems like Yandex, Aviasales, and Ostrovok. Sponsored placements and co-branded showcases on these platforms work particularly well — they catch the user's eye right away. Additional exposure comes from curated Telegram channels with an engaged audience, such as 'Voyage with Taste' — these kinds of integrations resonate with people who are already planning a trip.

The impact is even stronger when UTM tags are in place and there's a well-structured funnel with clear analytics. The results become even more tangible when combined with retargeting, for instance, via Yandex or Telegram Ads. And the finishing touch is a Russian-language landing page with transparent pricing and a clear user journey. The easier the path, the higher the conversion rate.

Let’s walk through a simple example. A user searches for 'Vietnam tours in spring' on Yandex, sees a banner from a travel service in the ad network, clicks through to a promo page, then reads a tour review in Telegram, and finally returns to book via a partner page on Ostrovok. This isn’t a linear funnel, but it’s a series of touchpoints. And every step needs to be covered.

So, what’s the takeaway? It’s not about a single channel, but the combination: search, travel platforms, social media, and reviews. The goal isn’t just to 'get noticed' — it’s to become part of the decision-making logic. And to do it through platforms Russians already use: Yandex, Aviasales, Ostrovok, and Telegram.

Let’s sum it up: what travel brands need to keep in mind in 2025

The Russian travel market hasn’t shrunk, it’s just transformed. People are still traveling, searching, and booking. But now, it’s not through Booking.com. They turn to Yandex.Travel and Ostrovok instead. They no longer look for inspiration on Instagram, but in Telegram channels. Instead of relying on a single service, they compare options across platforms like Aviasales.

Habits have shifted, but the audience remains the same — active, travel-focused, and willing to spend. And if a brand isn’t part of this new everyday behavior, it simply falls off the radar.

What matters today is not being everywhere, but being exactly where the decision-making begins. Yandex, Aviasales, Telegram, and travel platforms with direct traffic — these are no longer 'nice to have', they’re the baseline.

But showing up isn’t enough. In 2025, success comes to those who speak the customer’s language: early, clearly, and with transparent pricing logic. It’s not about selling a banner — it’s about selling clarity.

The RMAA team works with brands expanding in Russia using local platforms, digital channels, and the travel ecosystem. We help launch test campaigns, localize the product, and build a sales pipeline that actually delivers.

If you want to understand how local platforms and paid social work together in practice, we can walk you through it.

Drop us a request, and let’s talk about where to start.

You can also subscribe to our blog. We share case studies, insights, and solutions tailored to global travel brands navigating today’s landscape.

Russian Tourism Market Report: Trends, Analysis & Statistics 2022

Learn how to impress Russian tourists and attract them to your country

Ready to partner with the specialists in Russian travel marketing and advertising?

About the Author

A content lead. Natalia runs marketing projects promotion with different digital tools in the Russian-speaking market.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it