Blog about successful marketing strategies in russia

Exploring of Radio Advertising Market in Russia: Industry Insights

MEDIA BUYING

Share this Post

The radio advertising market in Russia grew by 31% in 2024 compared to the same period the year before last. By the end of the first two quarters, its volume reached 11–11.2 billion rubles (approximately $128 million). Among the most prominent advertisers were Sber, Chery Automobile, FSK, Alfa-Bank, and the Central Bank of Russia. The volume of online radio listening increased by 15%, which also influenced advertising budgets allocated to this segment.

What is the secret behind the growing popularity of radio advertising? Let's talk about it in detail.

Transformation and Growth of Radio Advertising in Russia

The radio market remains attractive to advertisers due to its large and rapid reach, as well as relatively low production costs for advertising. In 2024, demand for radio ads continued to grow, leading to an increase in placement costs: prices on federal and Moscow stations rose by an average of 10–15%, and in some cases, up to 20%. The growing interest in radio advertising is explained both by the low base effect and the increasing competition for airtime.

In 2022, amid shifts in the socio-political landscape, major Western advertisers withdrew from the Russian market, causing a decline. However, the industry quickly adapted: by 2023, new companies had taken the place of departed brands. In the automotive segment, where foreign advertisers had traditionally dominated, especially in the passenger car category, Chinese manufacturers became more active. By the summer of 2023, Autostat reported the entry of 20 new Chinese brands with 46 car models, which quickly filled radio advertising slots alongside Russian companies.

This trend intensified in 2024: Chinese automakers continued expanding their presence in Russia, becoming the leading radio advertisers, accounting for 20% of total ad placements.

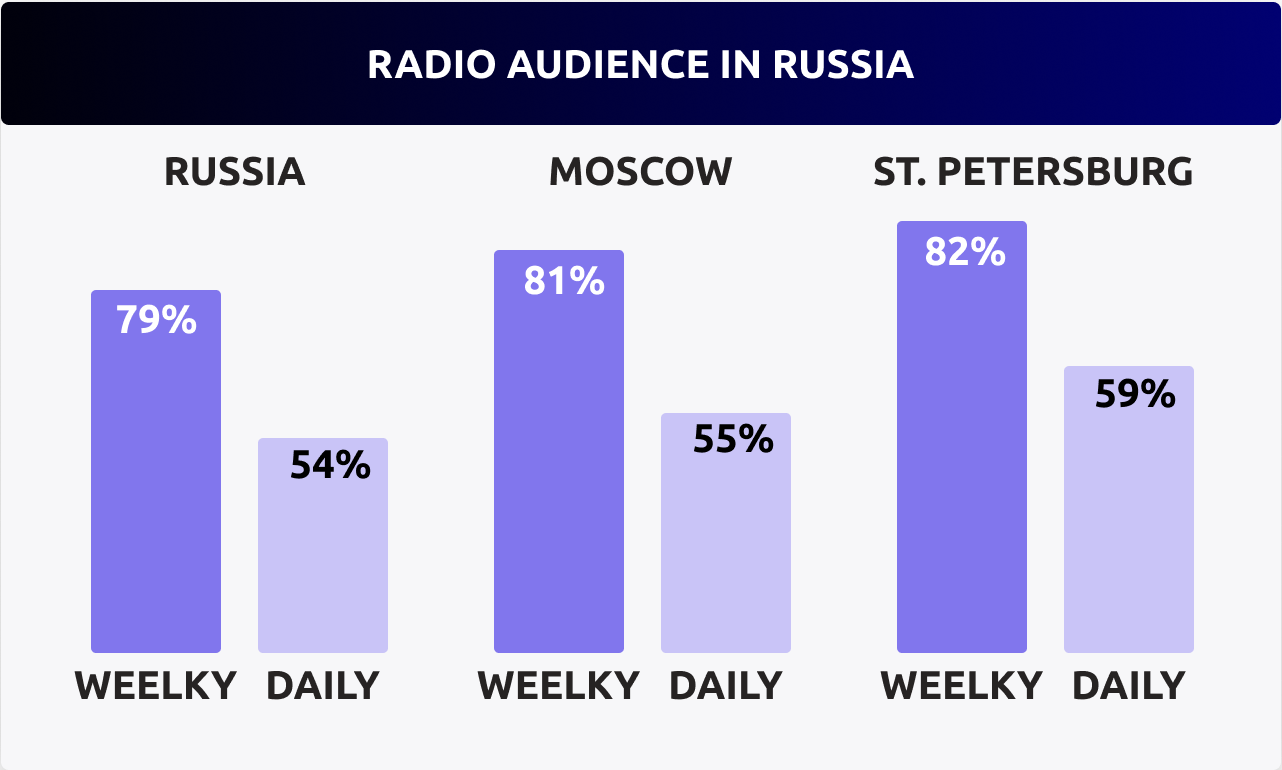

Top 10 Russian Radio Stations

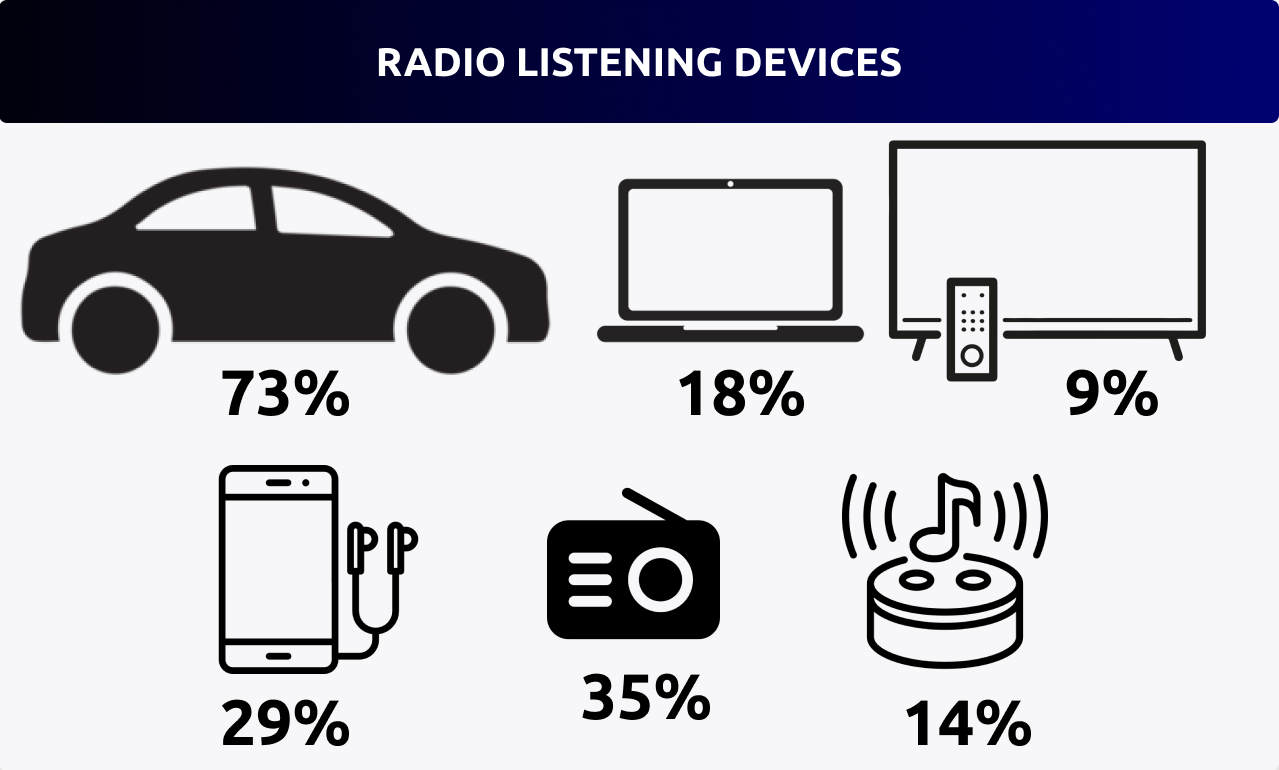

Every month, radio reaches 85% of the country’s population. Meanwhile, in 2024, the daily audience of the ten largest radio stations declined to 32.6 million listeners, down from 34 million the previous year. Despite this slight decrease, radio remains one of the most effective channels for reaching car owners, who represent a financially capable audience. In major cities like Moscow and St. Petersburg, a significant portion of the adult population listens to the radio daily while driving, making this format particularly appealing to automakers, financial companies, and FMCG brands. In regional areas, where internet penetration is lower, radio retains its importance, remaining one of the key mass communication tools.

The top 10 radio stations offer a diverse range of topics, including music, news, entertainment, and sports. The country’s oldest radio station, Mayak, also made it into the top ten. It is owned by VGTRK (All-Russia State Television and Radio Broadcasting Company), which manages Russia’s major state media outlets, including the TV channels Russia 1, Russia 24, Russia K, as well as the radio stations Vesti FM and Auto Radio.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The list also includes radio stations owned by the Gazprom-Media holding, such as Dorozhnoye Radio, Russkoe Radio, Retro FM, and Humor FM.

The structure of radio advertising sales is dominated by these media holdings. Radio stations often find it more convenient to have one holding own multiple popular stations and use a single airtime sales service, rather than selling advertising independently. As a result, an exclusive seller typically works for one or more holdings.

Radio advertising in Russia can be ordered in two variants: advertising for a specific selected region or nationwide advertising. All-Russian radio advertising is sold on a GRP basis, while regional radio advertising is sold per minute (except for large cities).

To learn more about the specifics of media buying in the Russian market, including radio, please, download our White Paper “How does Media-Buying in Russia Work?".

Leading Advertising Categories on Russian Radio

In 2024, the key industries actively using radio advertising included automotive, finance, digital services, healthcare, real estate, and retail, which together accounted for over 80% of ad spending. The automotive industry regained its top position in advertising volume after being surpassed by pharmaceuticals and finance in 2022–2023.

Previously, automakers led the ranking of advertising categories in 2021, with their share reaching 18%. In 2024, the leading advertisers in the sector were Chinese automotive brands, including Chery Automobile Co. (Chery, Exeed, Omoda, Jaecoo) and Haval (Haval, Tank, Wey).

Ranking of the Largest Radio Advertisers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trends in Radio Advertising in 2024:

-

Market Leaders – The largest advertisers remain banks (Sber, VTB, Alfa-Bank, Tinkoff) and automakers (Chery, Haval).

-

Growth of Chinese Carmakers – Chinese car manufacturers have taken a significant share of radio airtime following the withdrawal of Western brands.

-

Financial Sector – Banks continue to invest in radio advertising to reach a mass audience and promote new financial products.

-

Government Advertising – State projects and the Central Bank actively use radio to inform the public.

-

Digital Services – Companies like Avito and Yandex leverage radio to attract offline audiences.

Radio Advertising Formats

Radio advertising formats are divided into direct, sponsored, and integrated advertising.

Direct advertising can be of any genre and distributed in advertising blocks. It is important to note that, according to the law 'On Advertising', the volume of it cannot exceed 20% of the daily airtime. Direct radio advertising has two genres: advertisements and commercials.

An advertorial is an audio track that uses a voice to pronounce the text. The announcer talks about a product, service, or event.

Commercials are categorized into three types: informational, game, and musical. Informational ones deliver the message through a speaker accompanied by sounds, while game commercials involve scripted conversations between characters. Musical commercials feature music with complex special effects and accompanying text.

Commercials typically do not include contact details or additional information, unlike adverts. This format aims to draw attention to the product or create a positive brand image.

Sponsored advertising costs include the creation of a radio program or airtime, for which the advertiser receives a share. The advertiser's name is mentioned along with a brief description at the beginning or end of the broadcast. This type of advertising is advantageous as it guarantees that the message will be heard by viewers. It is important to note that listeners are unlikely to switch to another station during an advertising block.

Integrated advertising is a powerful tool that can be used on radio stations or in conversational programs. By featuring comments from an expert on the topic or an interview with the advertiser, this type of advertising can effectively promote a brand or business.

Main Benefits of Radio Promotion

The benefits of audio advertising are indeed significant. The affordable placement and high contact frequency make radio advertising more cost-effective compared to TV and digital advertising, especially for limited marketing budgets. Campaigns can be launched within just a few days, whereas TV or digital segments require significantly longer preparation times. The flexibility of the format allows advertisers to quickly respond to market changes and adapt messaging to current business needs promptly.

Launching a new radio advertising campaign takes only a few days, or even just a few hours for a small commercial. The cost of creating and promoting a radio commercial depends on its duration, frequency, and airtime.

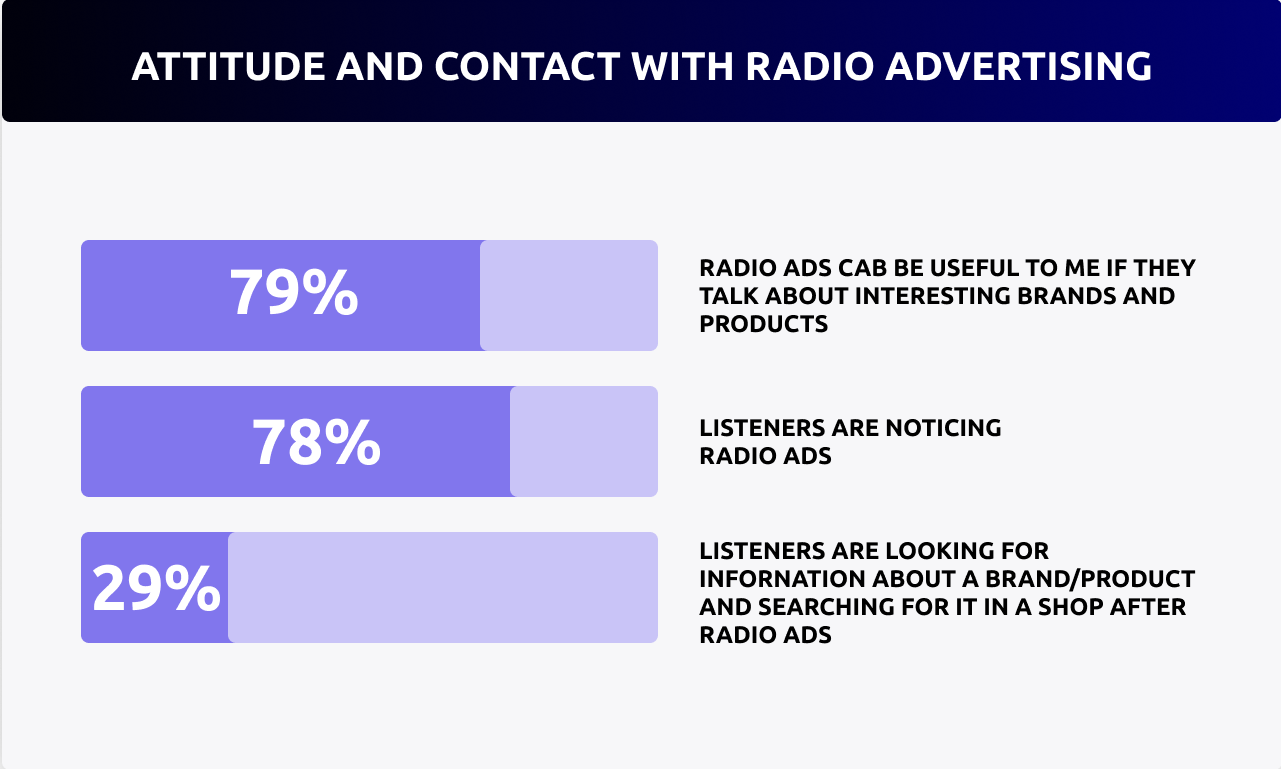

But what an effective result can be! Radio advertising is a highly effective way to promote a product or service, with a potential audience of 78% of listeners noticing adverts. In fact, approximately 29% of listeners make quick purchasing decisions after hearing a creative advertisement. Only 10% of all radio listeners have a negative attitude toward advertising, indicating a high level of acceptance of promotional messages among the audience.

Despite changing market conditions, radio advertising in Russia has demonstrated impressive resilience. Radio remains a powerful marketing tool, despite predictions of declining interest in traditional media. The innovation and digitalization of the radio space have opened up new opportunities for creative, integrated advertising campaigns.

As the Russian market adapts to new economic and political realities, radio advertising is poised to play a significant role in the growth of the advertising business. Advertisers can rely on radio to reach their target audiences, especially in segments where direct communication with the consumer is crucial. This trend is already evident with Chinese automotive brands, which became the leading buyers of radio advertising in 2024.

RMAA is ready to offer comprehensive radio advertising placement services in Russia and the CIS countries. Our team has the necessary expertise and resources to create and execute successful advertising campaigns that will take your brand to new heights. Contact our manager by completing the application form below to discuss your project and receive a tailored proposal.

Don't forget to subscribe to our blog to stay up-to-date with the latest trends in the digital marketing industry. We regularly publish fresh information and practical advice based on our in-depth understanding of the advertising industry.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"A media buyer's quick guide for effective work in Russia"

for FREE!

How does the Media Buying Market in Russia Work?

Navigating the Media Buying System in Russia

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Expert in Media Buying. Julia specializes in optimizing and executing strategic media placements across Russia & the CIS region.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "A media buyer's quick guide for effective work in Russia?" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it