Blog about successful marketing strategies in russia

Mastering How to Promote Mobile Games in Russia

DIGITAL MARKETING

Share this Post

Promoting games in the oversaturated Russian mobile gaming market can be a long and complicated process. Its niches are divided between large publishers offering more or less identical games. It is time to talk about it in detail, as new inputs are appearing in the game industry.

What figures and trends should we focus on in 2025?

Statistics of Mobile Games Audience in Russia

130.4 million internet connections were recorded in Russia in 2024. By January 2024, the share of mobile traffic in Russia and the CIS countries had increased to 42.30% from 31.7% in 2023. Currently, 95.1% of Russian users access the internet via their phones, with Android being the leading operating system chosen by 70.99% of Russians compared to 28.71% of Apple iOS users. The statistics show that people spend almost four hours a day on their mobile devices, with a significant 34.2% of the population choosing to spend this time gaming.

In the third quarter of 2024, Russian gamers spent 52.4 billion rubles on video games, slightly less than the second quarter's 54.5 billion rubles. In the first quarter of 2024, spending amounted to 49 billion rubles. Altogether, for the first three quarters of 2024, Russian gamers' expenditures on video games reached 155.9 billion rubles. While data for the fourth quarter is not yet available, based on previous trends, it is estimated that total annual spending will exceed 200 billion rubles. This is a significant increase compared to the previous year, where gamers spent approximately 161 billion rubles.

The volume of gamers' spending was calculated based on a survey of 1,000 Russian players. Currently, there are no alternative methods to accurately measure user expenditures, as Russian players often resort to various workarounds for making game purchases.

Google Play and AppStore initially blocked payments with Russian cards within their services due to the sanctions policy towards Russia after 2022. However, they have since allowed external payment methods for Russian citizens, such as payments from Russian cards via AppGallery (for Huawei smartphone owners), RuStore (for Android owners), NashStore (available for iPhone and Android), and others. Alternative payment systems, gift cards, VPN region change, foreign bank cards, and mobile phone account payments through service providers are all viable options for users. iOS and Android users can easily pay through their mobile phone accounts. Pay Easy! allows you to purchase products on AppStore and GooglePlay, as well as Adobe Photoshop, GPT, and other foreign products that do not accept Russian cards. Remember that you will have to pay a commission of 20% or more for this service.

Of course, the Russian mobile gaming market isn't the largest globally, but international publishers cannot ignore it. In the first half of 2024 alone, users in Russia downloaded 1.183 billion games, a notably high figure.

Top Mobile Games in Russia

In 2024, puzzle and role-playing games (RPG) remained popular. Puzzle downloads increased by 6.6%, reaching 255 million, while RPG downloads grew by 3% to 36.4 million.

The majority of installations were for strategy, match-three, and hyper-casual games. Simulators captured the interest of only one-fifth of users, while blockchain games saw minimal engagement due to the decline in cryptocurrency value in 2023. Card games also had limited appeal, but this is expected to change, with the segment projected to see steady growth in the next few years.

The rating of games by downloads from Russia for January 2025 was as follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The success of these games can be attributed to promotion quality. Otherwise, all the development work would have been in vain.

Sources of Russian Gamers' Traffic

In 2024, Russian gamers predominantly played video games on smartphones powered by Android. This trend is linked to the fact that Android users slightly outnumber iPhone users in Russia, accounting for 58–60% of the market compared to iPhone’s 40–42%. Additionally, the shift toward Android has been influenced by changes in the digital landscape due to sanctions and the resulting restrictions on certain platforms.

Yandex, Rutube, Vkontakte, and Telegram were added to the list of platforms used for game promotion, alongside the already established Google, Youtube, TikTok, and social networks by META*.

Until February 2022, there were only two key stores, AppStore and Google Play. Today, there are alternatives in the Russian market.

As we can see, there have been changes in the sources of traffic. What's changed in the advertising tools?

Effective Tools For Promoting Mobile Games in Russia in 2025

The promotion of mobile games differs significantly from that of console games. While successful news hooks are key to recognition for console games, optimisation is fundamental for mobile games. App Store Optimization (ASO), for example, plays a crucial role in determining a game's ranking within the market. The higher a game's position in the store, the greater the chances of it being found and installed. Note that other marketplaces have similar systems.

In 2024, ASO underwent changes thanks to artificial intelligence. Publishers were no longer restricted to text and visual optimization, as voice search optimization (VSO) was added. By 2025, VSO had become a necessity to reach the target audience and boost organic traffic.

In-app Advertising in 2025

The mobile game market is highly competitive, with many games sharing similar features and target audiences. By promoting a game within other apps, publishers can differentiate their title from the saturated genre niches in mobile games, resulting in a more diverse user demographic. This strategy enables targeting of a specific audience, particularly those who are already engaged with similar content.

In 2024, publishers increasingly relied on in-game advertising: early in the year, there were 7% more ad impressions per user, and advertisers spent 10% more on in-app promotions. As a result, revenue grew, particularly for casual games, which are traditionally promoted through in-app ads.

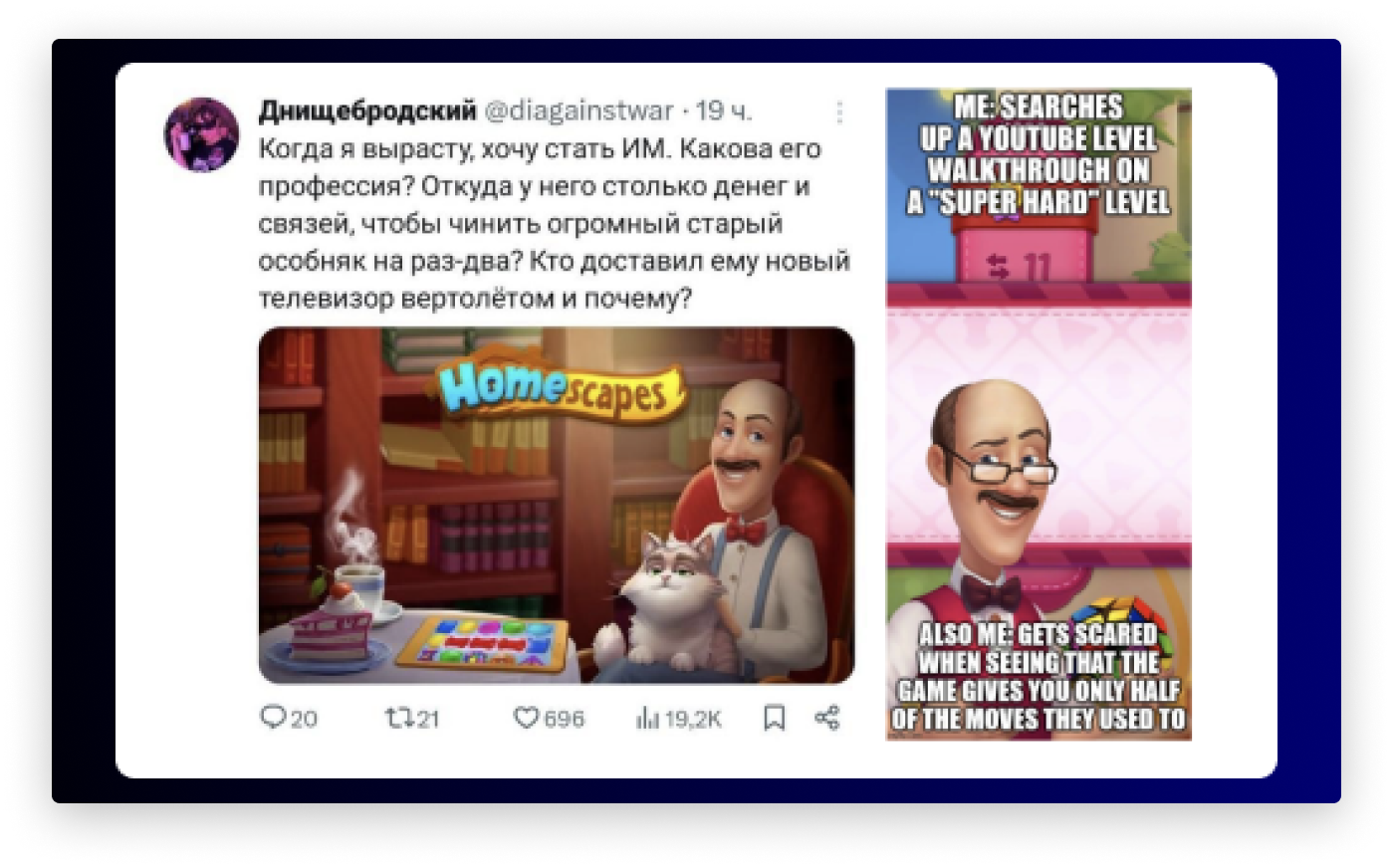

Gambling Ambassadors

It is difficult to use the images of ambassadors in mobile games, but game characters can serve as effective ones, as demonstrated by the success of the butler character in Gardenscapes. The game featuring the quirky butler about whom Zemfira, a popular Russian performer (recognized as a foreign agent on the territory of the Russian Federation) wrote a song, ranked fourth among female players in 2023 and the character became a popular meme subject that same year.

Streamers and Bloggers

Independent influencers always yield better results as they make the advert more active and appealing to users. In the mobile gaming industry, bloggers and streamers are considered opinion leaders.

Youtube bloggers played a significant role in promoting the game Genshin Impact by creatively sharing their playthrough experience with their audience. They showcased their gameplay in unique ways, such as playing in a Chernobyl dugout or voicing cartoon characters. Genshin Impact has consistently maintained a top position in Russia for several years, thanks in part to RMAA's skilled attraction of influencers.

Genshin Impact collaboration with YouTube channel Vlad Reznov by RMAA

Due to streamers, the Russian-speaking audience has warmly embraced the mobile version of the Call of Duty shooter. The international championship #CODMCHAMPS23 played a significant role in bringing together renowned players to compete for in-game awards. This event was narrated live and proved to be a great success. As a result, it is no surprise that Call of Duty Mobile ranked fifth in 2023 among 16 to 25-year-olds.

Game Events

The most effective promotional events for the mobile games segment are external cyber sports championships. These events receive extensive media coverage and attract the attention of even those who have never downloaded games from the stores.

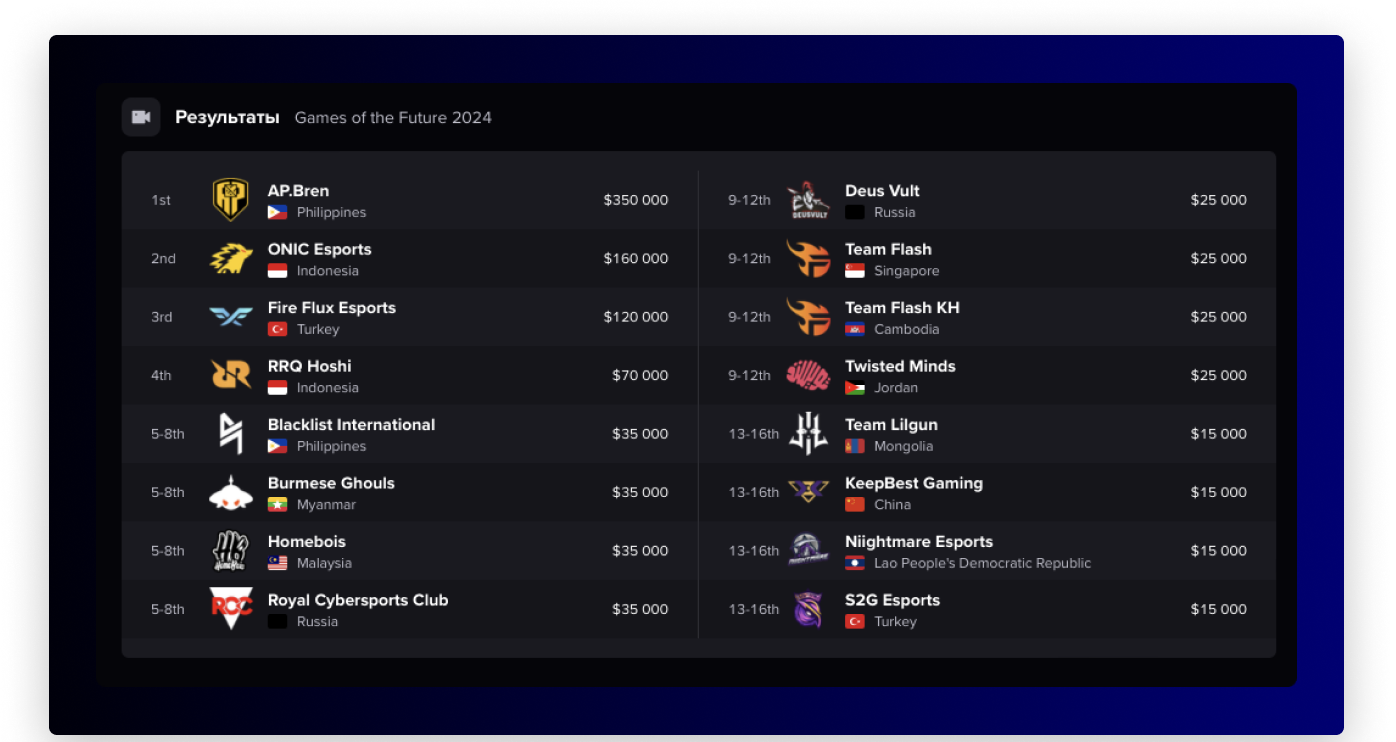

The IESF World Championship, for example, has successfully introduced many gamers to popular titles such as PUBG Mobile and Mobile Legends: Bang Bang. The last one hosted a separate event in Kazan at the Games of the Future (note - a multi-sport eSports tournament in Russia), with a prize pool exceeding that of the World Championship.

Results of the Mobile Legends: Bang Bang tournament, Games of the Future, Russia, 2024

Collaborations

We have already written about the collaboration of console game developers with gaming and non-gaming brands. In the context of mobile games the situation will be identical. Collaborations are highly sought after to share costs and promote brands.

It is common for mobile games to feature well-known products from other genres. Russian gamers had the opportunity to play games based on the anime 'Tokyo Gul' and 'Word of the Patsan: War of the Districts' in 2023 and 2024, respectively. The game 'Word of the Patsan' gained popularity due to the interest in the “gop culture” of the 90s, sparked by the TV series of the same name. Moreover, a new mobile game set in the Walking Deads universe will be released this year, promising an engaging storyline in the match-three genre.

Word of the Patsan: War of the Districts’ mobile game on RuStore

In early 2024, MLBB collaborated with 'Attack of the Titans' with original replicas of anime characters, skins, and equipment such as the 'rittai kido sochi'. Additionally, Fortnite partnered with Disney to merge the world of Fortnite with the universe of famous cartoon characters.

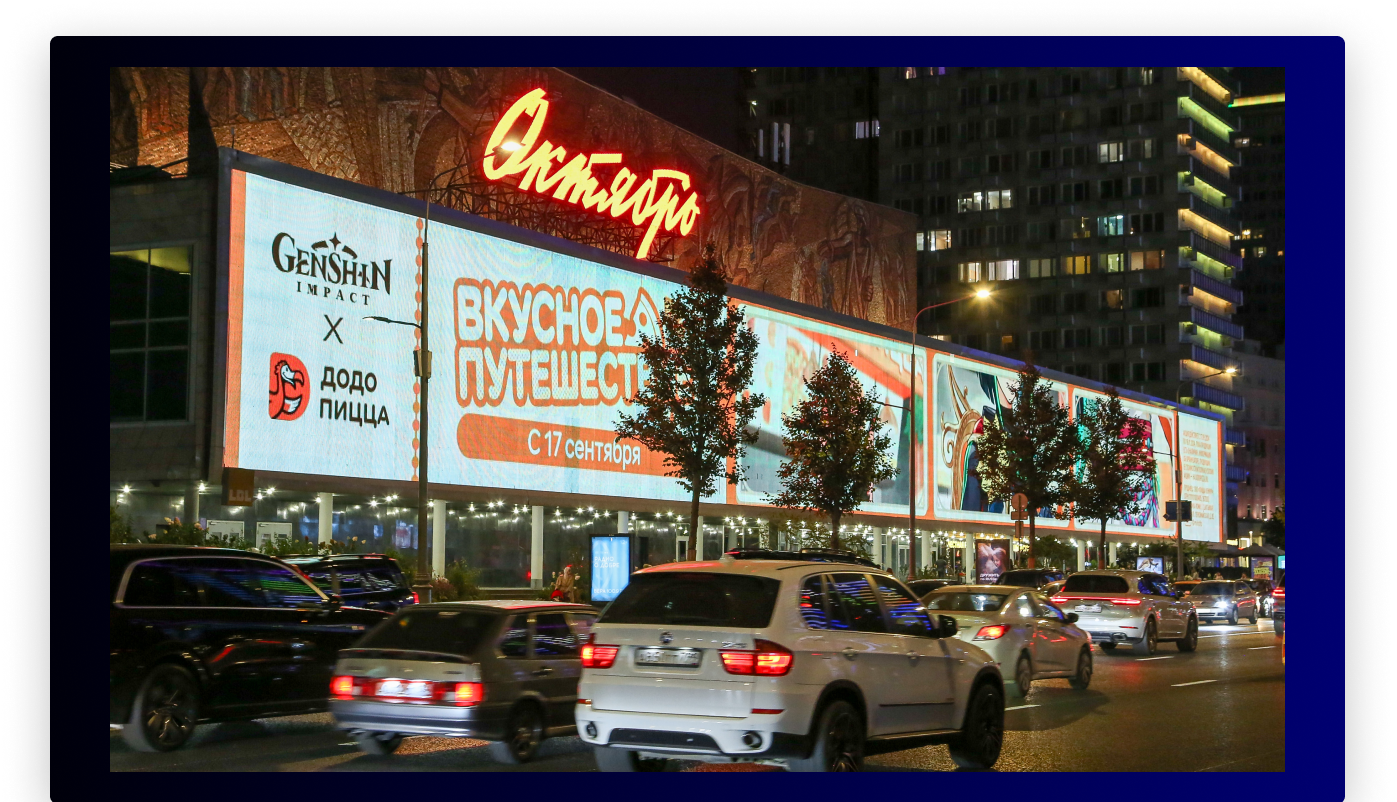

Another high-profile collaboration took place in Russia in September 2024: a joint promotion between Genshin Impact and Dodo Pizza. RMAA was partially involved in this project, highlighting the event through outdoor advertising in Moscow. As part of the brand's anniversary celebration, themed events dedicated to Genshin Impact were held at Dodo Pizza locations across Russia. Dodo Pizza introduced a special gaming menu called “Tasty Journey,” offering customers gifts such as keychains, toys, and promo codes for digital goods from Genshin Impact with their purchases. The campaign ran from September 17 to November 18, 2024, and was a massive success among the Russian audience. Fans of Genshin Impact purchased a quarter of the themed items in the campaign’s first week.

DOOH Campaign for a Genshin Impact Collaboration with Dodo Pizza, by RMAA 2024

It is important to note that collaborations between brands outside of the entertainment industry and mobile games are rare and do not generate much hype. However, it is common for gaming brands to partner with clothing brands. Gucci, Louis Vuitton, and Balenciaga collaborated with Roblox, League of Legends, and Fortnite respectively, creating virtual collections of equipment for the games' most popular characters. Although these collaborations were highly anticipated, they did not result in any significant improvements.

Localization Features

Adapting the game to each region while considering their cultural traditions and mentality will undoubtedly gain the loyalty of local gamers. Neglecting these factors, on the other hand, risks leaving them bewildered. In Fishing Clash, a fishing simulator developed by Polish creators, carp is often featured as a symbol of Christmas during New Year events. This association may not be immediately understood by players from other countries.

To effectively promote it, you must consider the specific mentality. Understanding marketing and speaking the same language with the users is crucial. This will prevent issues like the publicly available Polish version of Fishing Clash.

RMAA acts as a promotion expert between developers and the Russian audience. Our extensive experience in promoting mobile, console, and cross-platform games allows us to identify trends and develop highly effective strategies based on them. We are proud of our numerous successful cases. Furthermore, we have created a comprehensive Guide to Video Game Promotion in the Russian Market, which is available for free.

Stay up-to-date with the latest news on digital marketing in Russia and the CIS by subscribing to our blog. RMAA publishes fresh insights every week to help you gain a better understanding of the market.

*The organization is recognized as an extremist and banned in Russia.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Russian Digital Market Overview

Strategic Insights into Russian Digital Marketing Landscape

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Digital Strategist. Head of one of the project groups at RMAA. Maria started her journey in digital marketing in 2009.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it