Blog about successful marketing strategies in russia

Where Russian Tourists Travel in 2025: Top Asian Destinations and Travel Trends

DIGITAL MARKETING

Share this Post

Since 2022, Asia has stopped feeling something rare or remote. It simply filled the gap left in vacation plans after Europe faded from the itinerary. By 2025, Thailand, Vietnam, China, Japan, and South Korea have become familiar travel destinations, much like Italy or Greece once were.

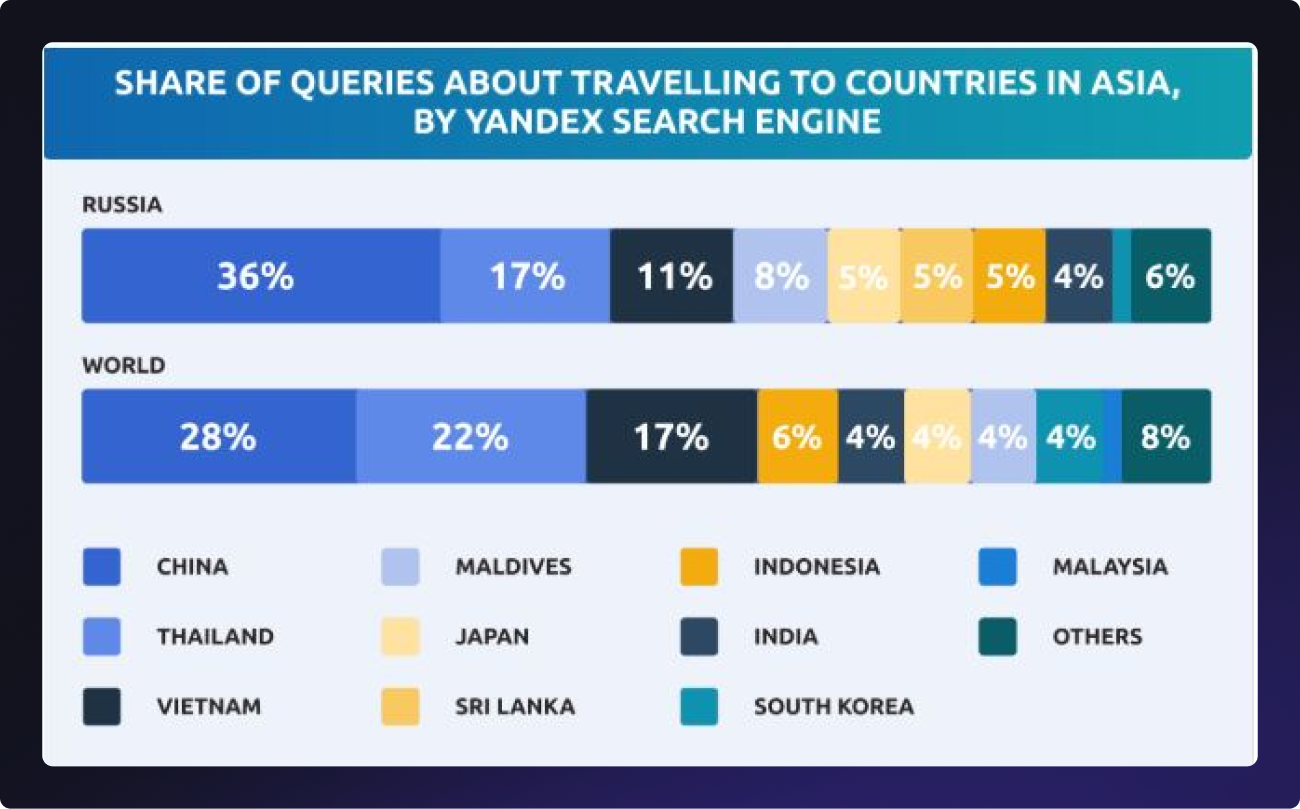

In 2024 alone, Yandex recorded 3.3 million search queries related to travel in Asia — a third more than the previous year. Most users were looking into China, Thailand, Vietnam, and Japan. This isn’t just casual curiosity anymore. It’s a decision-making phase: people are reading reviews, comparing prices, and digging into the details.

China and Thailand have both made it into the top ten most popular countries among Russian tourists. Within Asia-related search trends, China leads with 36% of queries, followed by Thailand (17%), Vietnam (11%), and Japan (5%).

According to tour operators, travel to Asian countries grew by 20–30% in the first months of 2025, and that’s not even counting the summer season, when demand typically peaks.

Russian travelers are opting for what’s easy: direct flights, visa-free entry, and clear pricing. They search for routes on Yandex, read posts on Telegram, and save trip ideas on VK. Booking happens online, and decisions are made quickly. Today’s travel path isn’t just about geography — it’s a mindset.

Let's dive a bit deeper into each of these destinations and see why they're so popular with Russian travelers.

China

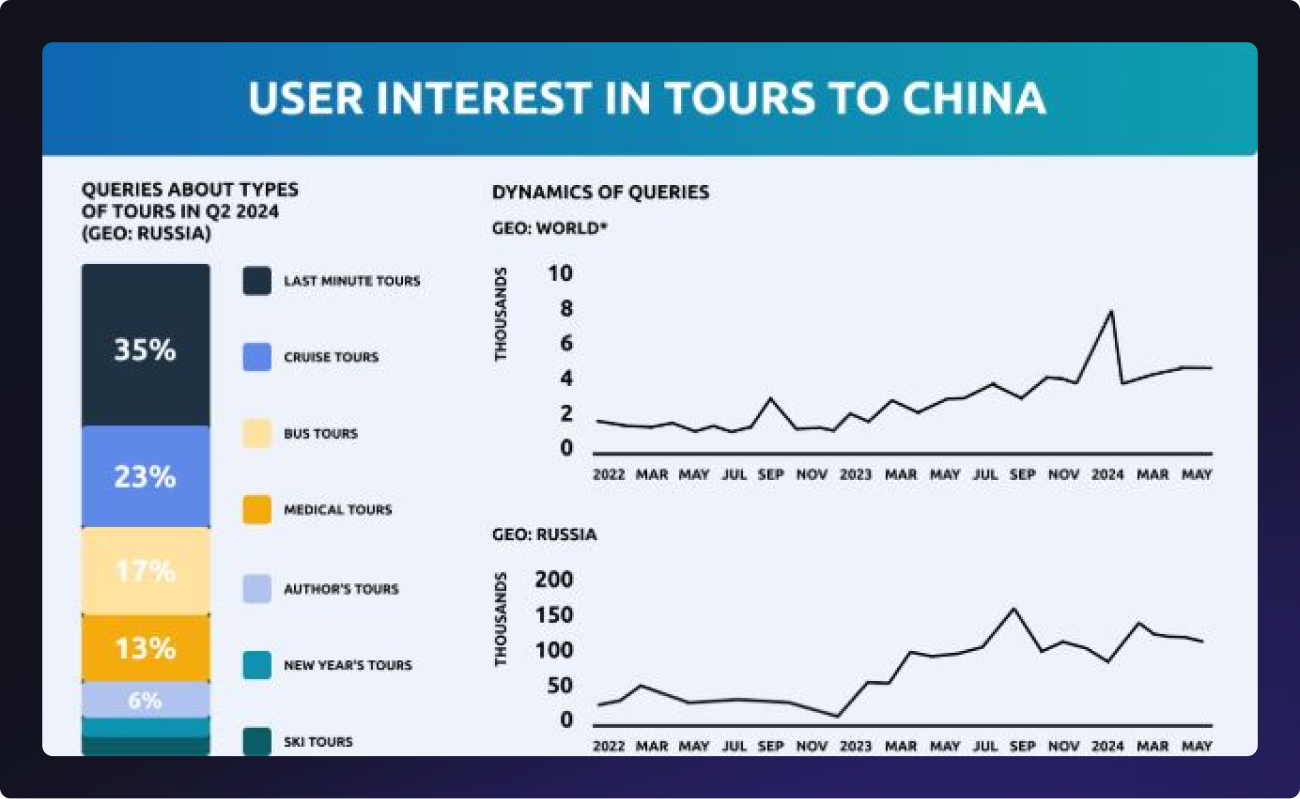

China is the most popular destination among Russian tourists, with 36% of requests.In 2024, a total of 1.897 million Russians visited this country, including transit passengers, twice as many as the year before last. The number of bookings also rose by 65%.

There's something for everyone in China, from the megacities like Beijing, Shanghai, and Hong Kong to the provinces on Hainan Island. In spring 2025, tour operators are reporting a noticeable increase in bookings, both for beach vacations in Hainan and for sightseeing tours across mainland China. With the expansion of direct flights and the simplification of group visa procedures for Hainan, the country is emerging as one of the most promising travel destinations.

Medical tourism is another draw for Russians, especially the international cluster "Lechen," which is located in the Chinese city of Boao on the same Hainan Island.

We've also seen a lot more interest in China's largest science, trade, and industry hub, Guangzhou. Tourists are drawn to the amusement parks, shopping, and the vast number of restaurants and cafés where they can experience Chinese cuisine.

For brands, this is a market where offering flexible experiences is key. Hainan may be the entry point, but it’s the variety that keeps the audience engaged. It’s not just about ‘sun-seeking vacations’ — it’s about seeing China as a multi-layered journey.

Thailand

Thailand is still a popular choice for Russian tourists and is one of the most in-demand destinations. It ranks second on the list of search queries, making up 17% of the total.

Last year, interest in Thailand among Russian travelers grew significantly. A total of 1.745 million Russians visited the country, placing Russia in the top five source markets for Thai tourism. During the 2024/2025 winter season alone, Thailand welcomed 726,018 Russian tourists. That’s a 16.5% increase over the previous year. The peak month was January, with 255,920 visits.

Thailand no longer needs to be explained — it simply needs to be reminded. A 60-day visa-free stay, direct flights, reliable service, and year-round warm weather make it feel like a second Turkey for Russians, but with massages, tropical fruits, and a laid-back atmosphere.

For brands, this is clear, actionable demand. The traveler already knows where they want to go. They’re not looking for inspiration, they’re looking for a solution. The most effective campaigns focus on simple, ready-to-book experiences: Phuket, Pattaya, Samui, family hotels with breakfast, or combo packages like ‘Bangkok + beach’. Thailand should be presented as a dependable, stress-free getaway — no visas, no surprises, no extra costs.

Vietnam

Vietnam, which accounts for 11% of requests, is the third most popular destination for Russian tourists.

In 2024, Vietnam welcomed 232,300 Russian tourists. That’s a 2.8x increase compared to the year before. In the first half of 2025, the number of trips from Russia grew by 107% year-over-year, making it the fastest-growing international destination for Russian travelers.

Why are more Russians choosing Vietnam? The answer is clear. During winter and spring, the south of the country offers dry season conditions — warm sea and stable weather. Resorts like Nha Trang, Phu Quoc, and nearby coastal areas provide beach vacations without typhoons or oppressive humidity — a rare find in Southeast Asia.

When it comes to cost, Vietnam feels closer to Turkey than to Thailand for Russian tourists. Visa-free entry and direct flights eliminate the last barriers. For many, it’s becoming a full-fledged alternative to Thailand — fresh, affordable, and without the sense of déjà vu that comes from visiting the same place too many times.

People are also interested in the country because of its cultural heritage and natural beauty spots, like Halong Bay and Phong Nha-Kebang Caves in Quang Binh. Vietnamese cuisine, which is known for its fresh ingredients and unique flavors, also attracts tourists from Russia. There are plenty of other reasons why Vietnam has remained a popular destination for many years, especially Nha Trang with its white-sand beaches.

-

a lot (267!) of thermal springs;

-

plenty of hotels to choose from;

-

affordable prices, direct flights;

-

no visa required for up to 45 days.

Yandex search data shows that Russian travelers are interested in staying in aparthotels and spa hotels during their vacations. When they're traveling on their own, they're looking for places to stay, like apartments, rooms in recreation centers, and of course, villas.

Brands need to take a more proactive approach here. Vietnam still needs to be explained. Why is Nha Trang a better choice in summer? What makes Phu Quoc worth visiting? Why isn’t it just “for backpackers”? The answers to these questions form the foundation of effective communication, especially if you're targeting the premium or family segments.

Maldives

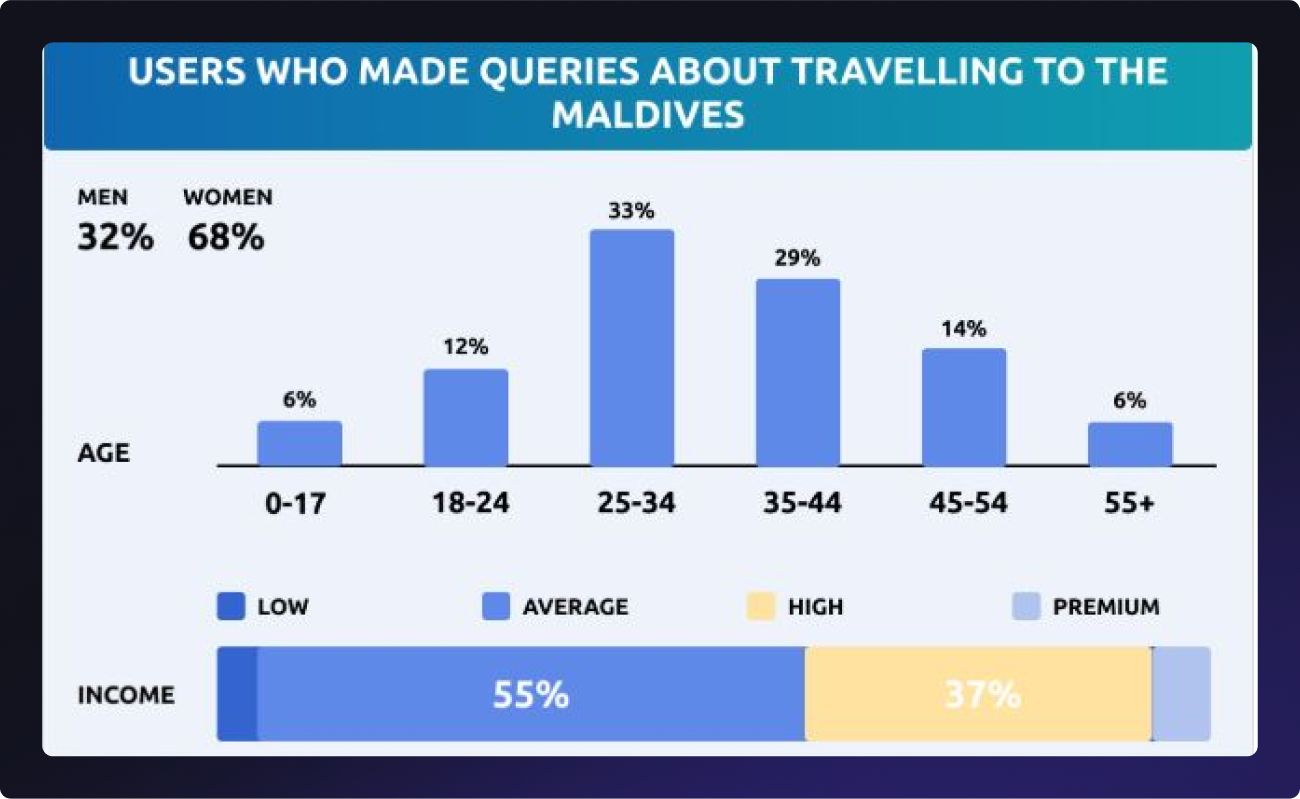

The Maldives are in fourth place with 8% of requests. In 2024, 225,000 Russians traveled to the Maldives — a 7.7% increase from the previous year and slightly above the record set in 2021. The peak month for travel was October, but January, February, March, the summer months, and the entire second half of autumn also saw strong numbers. May was the quietest period.

In Q1 2025 alone, the Maldives welcomed over 63,000 Russian tourists. Russia remains in the top two source markets, second only to China.

It’s worth noting that official figures likely underestimate the actual volume, as they only account for direct flights. Nearly half of Russian tourists fly to the Maldives via stopovers, most commonly through the UAE.

This destination is a big draw for Russians thanks to its one-of-a-kind scenery, pristine white beaches, and the sparkling blue waters of the Indian Ocean. The Maldives has long been a symbol of luxury vacations and romantic travel, as well as a place where you can have a beautiful wedding.

Most users are interested in last-minute tours (92%), and cruises (5%), and only 3% of requests are for author tours. When they're traveling independently, they're looking for guest houses, recreation centers, and villas. Tourists are also interested in family and spa hotels.

The visa-free regime for Russians is also valid for up to 90 days. But you'll need to fill out a health declaration before flying to the Maldives and before departure from the islands.

Some people think that only wealthy Russians go to the Maldives, but that's not true. As a general rule, Russian tourists who are interested in traveling to the Maldives tend to have an average (52%) or high (37%) income.

Japan

Japan makes up 5% of the top five countries in terms of tourist requests. In the first three months of 2025, 29,400 Russians visited Japanю That’s nearly twice as many as during the same period the previous year. In March alone, 18,800 Russian tourists arrived, marking a 77% increase compared to March 2024.

Even though there aren't any direct flights between Russia and Japan, Russians are still interested in this country. What's behind this?

First of all, it's easy to get a tourist visa. It can be done in 4-7 days in Moscow or St. Petersburg; no extra documents are needed.

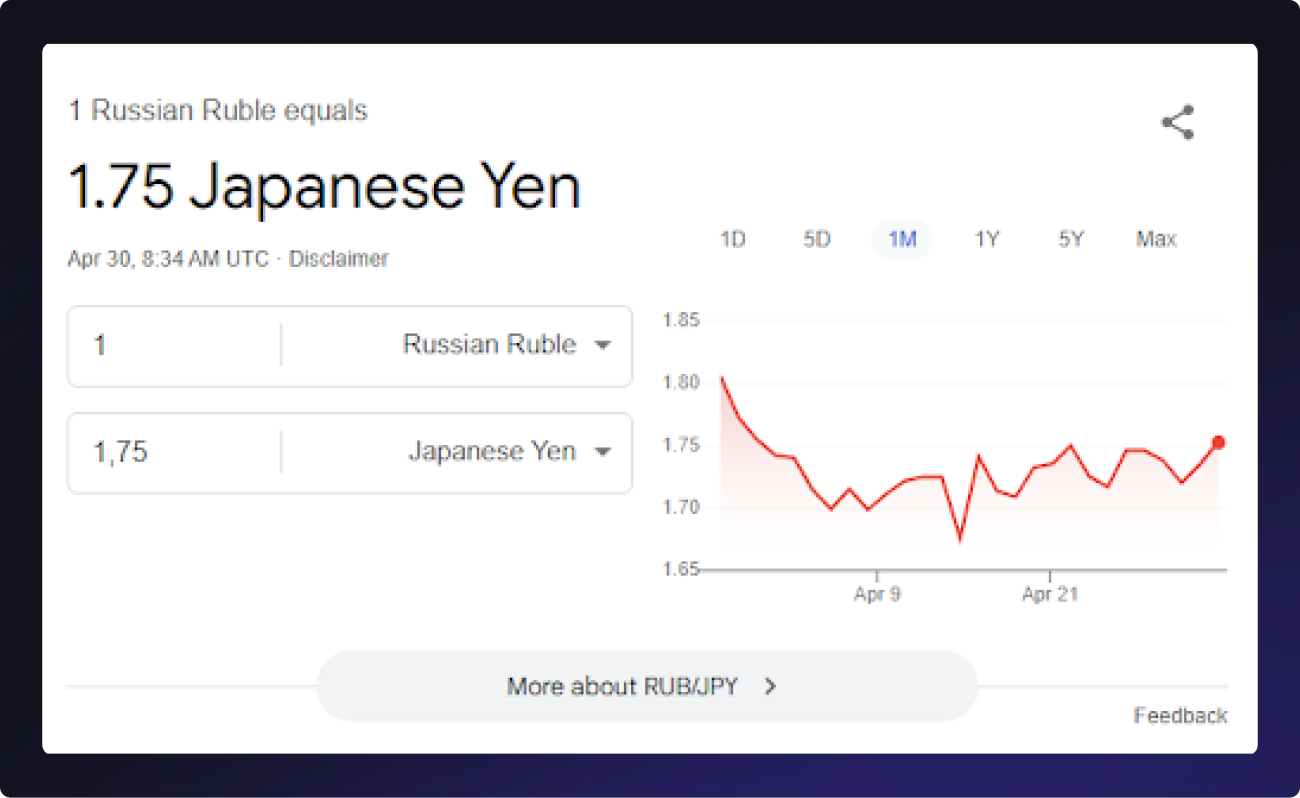

Another reason is the cost of living in Japan. As it stands, one Russian ruble is worth 1.75 Japanese yen. This means that Russians have great conditions for shopping, visiting entertainment centers, and booking rooms in high-end hotels.

Fueling interest in Asia through influencer marketing

Influencers are a true driving force behind travel interest. They spark desire and help people make the decision to go. Through Telegram, VK, YouTube, and other social platforms, Russians discover new destinations — reading personal stories, watching honest reviews, and saving useful recommendations. This is especially evident when it comes to Asia, where it’s not just about what to see, but who’s telling the story, because a trusted voice often carries more weight than any travel guide.

In 2025, social media has become the primary channel for travel promotion. Here’s how it plays out across different platforms.

Telegram

Telegram is the undisputed leader in reach across Russia in 2025. More than 78% of users open Messenger daily. This platform allows for highly targeted messaging. Official ads (Telegram Ads) offer segmentation by interest, location, and user behavior.

What makes Telegram stand out is its high engagement. Travel digests, personal recommendations, and native influencer ads perform better here than standard banners. It's where people search for trip ideas, real reviews, and route tips. Public channels and blogs now function like mini media outlets, where audiences follow not just friends, but trusted experts.

For example, the channel Po Zemle Budzhetno (46.5K subscribers) gets tens of thousands of views on posts about routes in Thailand, South Korea, and Mongolia.

Another example is Pognali! by Stas Natanzon (114K subscribers), which shares personal stories from trips to Japan, Laos, and Indonesia, including cultural insights, food guides, and tips for independent travelers. These formats generate more engagement than traditional ads: followers save posts, share links, and click through to booking sites.

Instagram*

Instagram is still used by Russian content creators as a platform for visual storytelling, especially in the travel segment. It’s where you’ll find short clips and Reels from trips across Asia — Japan, Thailand, India, Sri Lanka, and Vietnam.

However, due to the platform being blocked in Russia and new legal restrictions (as of September 1, 2025, influencer advertising is banned), Instagram can no longer serve as a core marketing channel. Most users access it via VPN, and brands have lost access to official ad tools and reliable analytics.

At this point, Instagram should be treated as an additional showcase channel for image-based reach, not for performance-driven campaigns or direct sales.

Until September 1, 2025, brands can still collaborate with influencers. After that date, even native ads may lead to serious legal and reputational risks.

Irina is a travel content creator with an engaged audience. Alongside Instagram, she actively develops her presence on VK and Telegram. Starting in September 2025, collaborations with influencers like her can continue, but only on legally permitted platforms, such as Telegram and VK. Instagram, meanwhile, will remain a visual showcase only, where brands can no longer be mentioned. Only organic content without links, brand names, or calls to action will be allowed.

YouTube

YouTube remains one of the key video platforms in Russia, despite ongoing technical restrictions. After access began slowing in August 2024, the audience declined significantly. By February 2025, the average daily user base had dropped nearly in half, from 52 to 29 million, and the monthly average fell by 14 million.

Still, video blogs remain a powerful format for promoting destinations in Asia. Long-form travel narratives, route reviews, and ‘travel-and-show’ formats continue to resonate. For brands, this is a chance to integrate into extended, visually rich content that audiences watch with trust.

VKontakte

VK is one of the main digital platforms for travel content promotion in Russia. In 2025, the platform continues to grow steadily, with over 93.8 million users. Its core audience is aged 25–44, a demographic that shows strong interest in travel across Asia.

VK remains a convenient ecosystem for working with travel content. It brings together video, posts, curated guides, and influencer collaborations. For example, Ksenia Prokhorova (70.6 K followers) released a series of videos about her trip to Sri Lanka, focusing on national parks, urban areas, and routes for independent travelers.

An added advantage of VK is its precise ad-targeting capabilities — by region, travel interests, and user interactions with past travel-related content.

The platform has long outgrown its status as a backup option. Today, it offers reach, engagement, and advanced tools for fine-tuned campaign management — everything a brand needs for confident and effective promotion.

Outdoor advertising is another way to tell Russians about Asia

Out-of-home advertising helps quickly reach the right audience, especially in high-attention areas. Locations like Sheremetyevo and Pulkovo airports, central streets, and media façades serve as entry points into the travel experience even before departure.

A strong example is the Wonderful Indonesia campaign during the World Cup. We launched it across Moscow, St. Petersburg, Nizhny Novgorod, Rostov, and Samara. Indonesia stood out and stayed in people’s minds.

This kind of advertising in Russia requires thoughtful adaptation. It’s essential to consider the local visual context and the exact point of audience contact. RMAA works with travel brands worldwide and understands how to launch a DOOH campaign tailored to the Russian market, from selecting the right locations to delivering ready-to-run visuals.

DOOH delivers results when used strategically — in places where the audience is already primed to engage with the message: airports, transit hubs, and high-traffic tourist zones.

Key Ideas

Asian countries have become a familiar part of vacation plans for Russians. In winter, they fly to Thailand; in spring, to Japan. People are choosing travel that’s simple and predictable: beaches, food, city walks. The key factors are visa-free entry, direct flights, and reasonable pricing. If one of those elements is missing, travelers lean toward destinations where everything is already arranged — convenient flights, ready-made tours, and clear itineraries.

This isn’t chaos — it’s demand, and it can be captured.

RMAA helps brands connect with this audience through influencers, Telegram, VK, digital campaigns, DOOH, and even TV if it fits the goal. We don’t offer one-size-fits-all solutions. We tailor each strategy to the market, season, and budget.

Looking to reach Russian travelers?

Fill out the form below. Let’s talk about how to do it quickly, precisely, and effectively.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Travel Research

The Russian Tourism Market Report: Trends, Analysis & Statistics | 2019. How to impress Russian tourists and attract them to your country

Ready to partner with the specialists in Russian travel marketing and advertising?

About the Author

Digital Strategist. Head of one of the project groups at RMAA. Maria started her journey in digital marketing in 2009.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it