Blog about successful marketing strategies in russia

Russian Marketing & Brand Strategy: Effective Localization Tactics

DIGITAL MARKETING

Share this Post

The year 2025 is not a time of rapid growth. It is the year of the funnel. Only brands that are ready for real adaptation will make it through.

In the first quarter of 2025, only 8 new brands entered the Russian market — half the number from the previous year. Among them are De’Longhi, Kennel & Schmenger, the Chinese furniture company Jinkailai, and the Kazakh fashion brand Gaissina. It’s a small number. And it’s not about a lack of interest, but about barriers.

There’s almost no vacant space in shopping centers. In Moscow, vacancy rates dropped to 6.8%, mostly consisting of small spots for food, fitness, or services, not flagship stores. At the same time, the cost of entry has risen: expensive loans, high rent prices, and logistics difficulties. Sanctions and reputational risks have not been canceled either.

For comparison: last year, the market welcomed 61 new brands, 28 of which were foreign. China led the way (25% of all new foreign brands), followed by Italy (14%), Germany, and Turkey (both 11%). Moscow remains the main entry point, accounting for 82% of new openings. The rest is a small fraction: 7% — St. Petersburg, 11% — the rest of Russia.

The categories remain unchanged: clothing, footwear, household appliances, home goods, and foodservice. These are basic needs that don’t require explanation. But the entry strategy does.

Simply opening a store is not enough today. Brands are forced to rethink their approach: testing marketplaces, entering through local partners, building e-commerce with local logistics, or launching a pop-up for 3 months. The market is tough. But it is still growing, especially in digital.

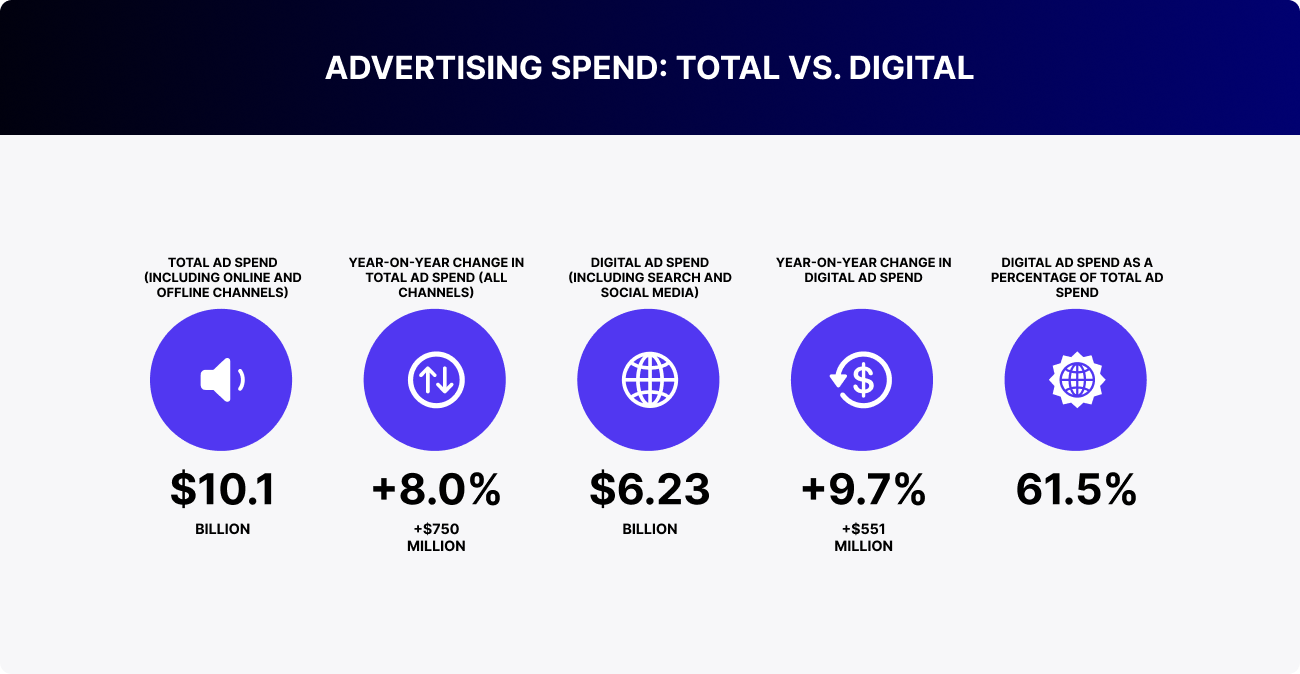

There are 133 million internet users in Russia. 106 million are active on social media. Telegram and VK are replacing Facebook and Instagram. YouTube remains available, albeit with restrictions and via VPN. But even in these conditions, digital advertising grew by 8% and reached $6.23 billion in 2024.

In these conditions, the ‘launch a website in Russian and wait for traffic’ strategy doesn’t work. Only deep adaptation works: to user behavior, to channels, to limitations. To integrate successfully, a brand will first need to change itself.

This article covers how exactly to do that. What to consider, where to go, and how not to get burned.

Localization: a strategy for russification

In order to achieve success in the Russian market, it is essential to adapt the product and marketing materials. Local businessmen have also taken this approach, purchasing shares in brands that were compelled to exit the market. As an illustration, Unilever has registered the brands "Дав" and Syoss, which is now called "Сьěсс". Coca-Cola HBC has renamed itself Multon Partners and launched "Добрый Cola". Additionally, Levi's was revived under the JNS brand with an updated positioning strategy. The Starbucks brand was rebranded as Stars Coffee.

Localization is the process of adapting a product to align with specific requirements and preferences. In order to successfully enter the Russian market, brands must ensure that their products reflect the preferences and expectations of Russian consumers. For instance, modifications may be required in regard to packaging and product naming. Furthermore, marketing materials must be adapted and russified, as we did for Blackview.

We employed a DOOH (Digital Out-of-Home) strategy to conduct a campaign to localize and promote the Blackview brand in the Russian market. Before product launch, we tailored Blackview's promotional materials for Russia. This involved translation and cultural adaptation slogans and visuals.

English client version. Blackview Tab 16. It's 11-inch Tablet, and 11-inch PC. Bigger than Bigger.

Russian language adaptation. The 11-inch screen is even bigger than you'd expect. Tablet and PC in one device.

English client version. Blackview BV 9300. One-Of-A-Kind Precise Measurement/Superbright Rugged Lifestyle. Charge for 3 Hours, Last for 76 Days.

Russian language adaptation. Blackview BV 9300. Unique precision rangefinder and shockproof housing. For vivid experiences and harsh conditions. Charges in 3 hours - lasts for 76 days.

What else needs to be done to enter the Russian market?

Entering strategies for the Russian market

It is essential to perform a thorough analysis of the market and competitive landscape before embarking on the localization process. Do comprehensive market research to gain insight into customer needs. Furthermore, it is essential to:

-

Сonduct local branding in a way that resonates with Russian audiences.

-

Adapt digital marketing strategies to include Russian social networks (VKontakte, Odnoklassniki), search engines (Yandex), and other digital platforms.

-

Interact with local influencers in order to increase brand awareness and consumer trust.

And, of course, it is essential to consider economic conditions and purchasing power when determining product and service pricing, as well as the most effective distribution channels, including online ones.

For instance, we developed a website and connected social media for Ascensia Diabetes Care, a global company focused on improving the health and lives of people with diabetes. We tailored the content to the Russian audience, including adapting texts and product descriptions.

VK post about using the Contour Diabetes mobile app on Contur's official VK community | Simply About Diabetes| Ascensia Diabetes Care

Russia's digital ecosystem: focus on what?

The digital ecosystem in Russia differs slightly from that of other countries. Therefore, it is essential to consider these nuances before developing a strategy.

| Platform | 2024 (million users) | Current Restrictions |

|---|---|---|

| Search Engines | ||

| Yandex | 100.2 | no restrictions |

| 99.66 | ad placement is not allowed | |

| Social Media | ||

| VK | 90.1 | no restrictions |

| Telegram | 85.3 | no restrictions |

| Dzen | 80.3 | no restrictions |

| OK (Odnoklassniki) | 50.9 | no restrictions |

| Video Content Platforms | ||

| YouTube | 96.1 | ad placement is not allowed |

| Tik-Tok | 58.59 | no restrictions |

| Twitch | 36 | no restrictions |

| 25.1 | blocked, available via VPN, ad placement is not allowed | |

Search engines

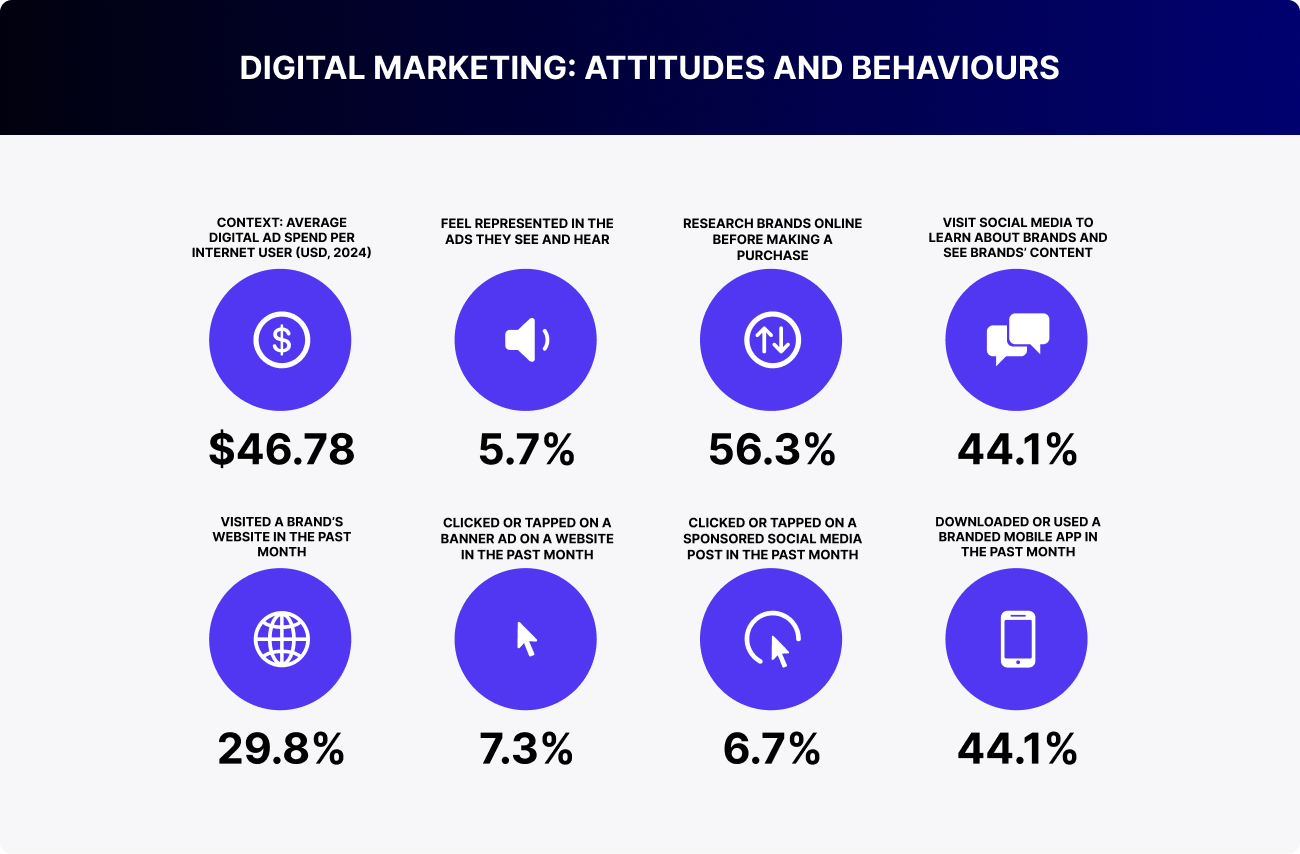

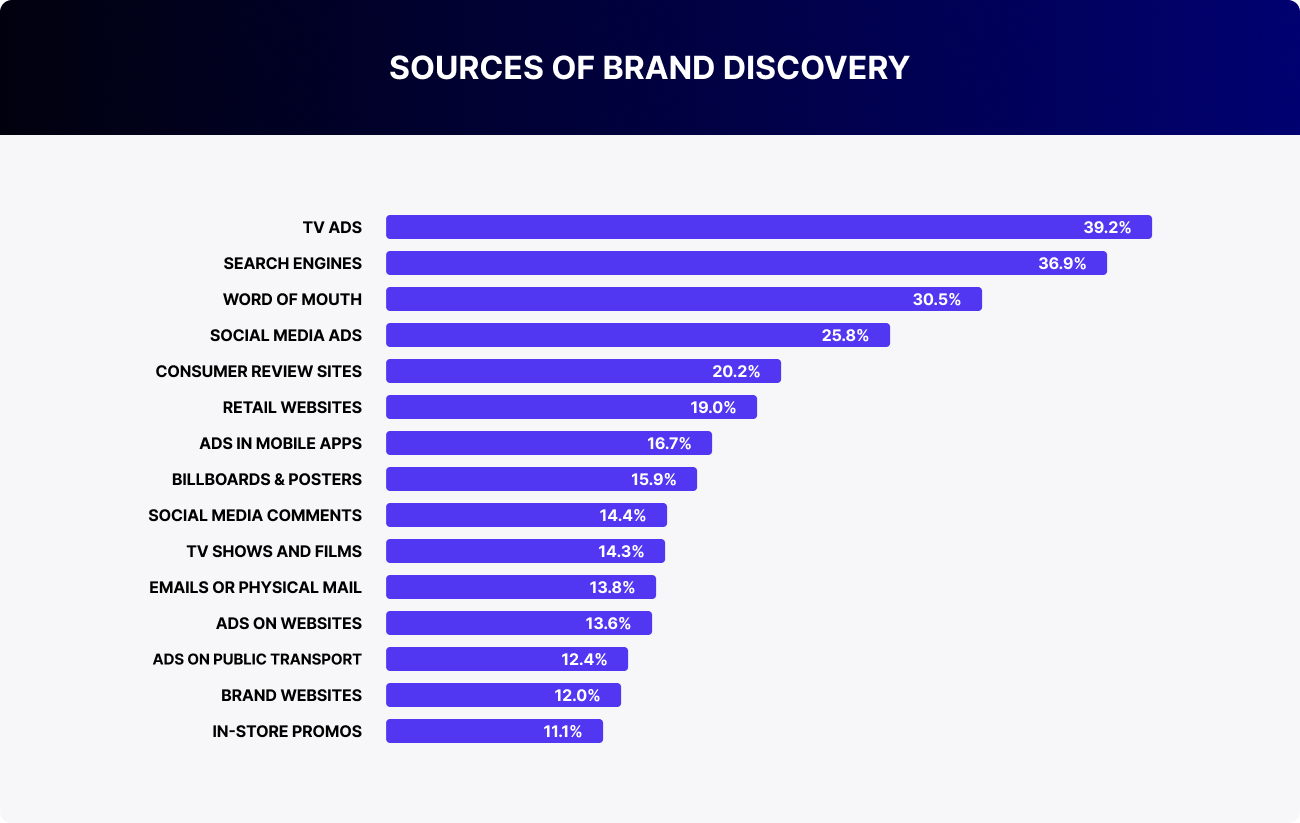

Search engines remain a key channel for consumer behavior in Russia. According to Datareportal, 56.3% of users over the age of 16 use search to explore brands and products before making a purchase. This is also confirmed by GWI data: search engines rank second (36.9%) among all sources for discovering brands, right after television (39.2%).

Even with the spread of ad blockers (5.7%), users continue to actively interact with brands through search. The blockers don't interfere because the interaction happens through SEO and native answers, not direct banner ads.

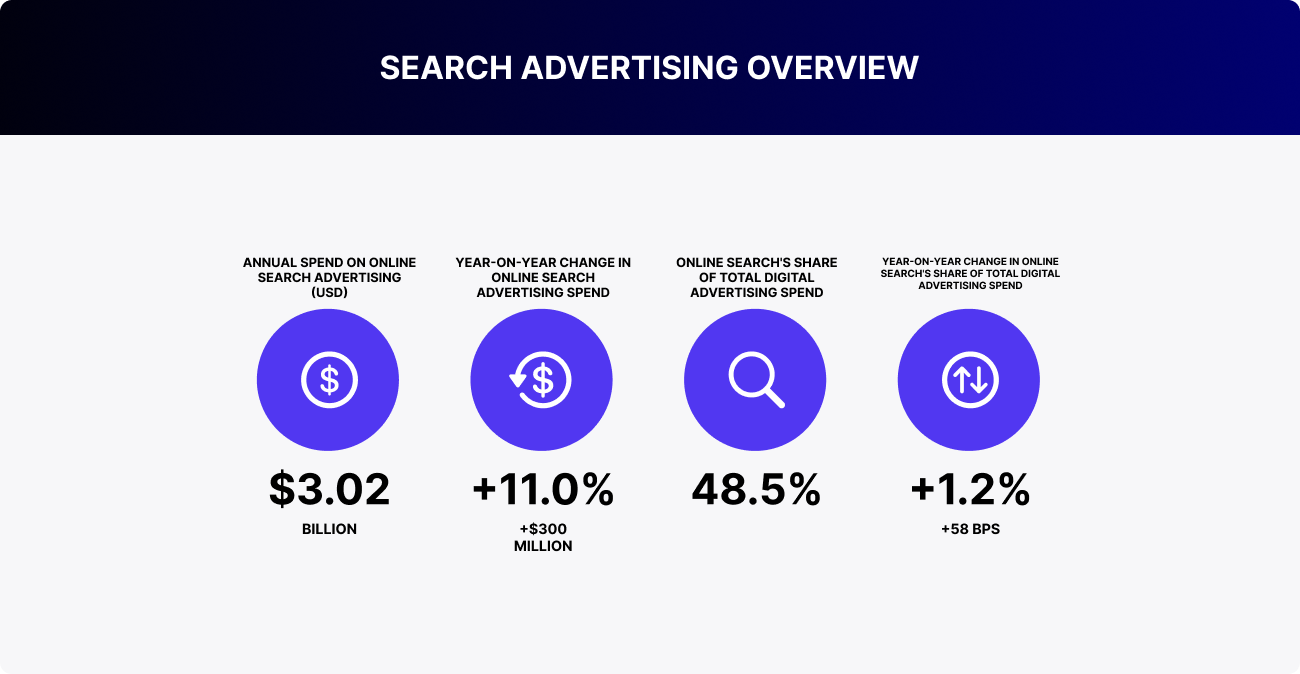

In light of this, the search advertising market is growing. Last year, it accounted for 48.5% of the entire digital market and reached $3.02 billion, growing by 11% compared to the year before last.

Search activity is expanding rapidly across all demographic groups, with notable growth among young and older populations. The most significant one is evident in settlements with a population of less than 100,000.

The e-commerce market remains highly competitive, with a relatively small share of unique users on the largest marketplaces. The product categories demonstrating the most significant growth are those related to clothing, footwear, home and garden, DIY, food, and household chemicals.

| Marketplace | Number of Requests | Request Rate, % | Coverage (ths people) | Coverage Rate, % |

|---|---|---|---|---|

| Wildberries | 1 321 108 465 | +49% | 52 670 | +31% |

| OZON | 1 007 493 297 | +46% | 49 678 | +29% |

| Yandex.Market | 174 589 798 | +53% | 16 842 | +11% |

| AliExpress | 41 028 340 | −73% | 4 800 | −67% |

| MegaMarket | 31 567 668 | +29% | 2 792 | −4% |

In Russia, the most popular search engines are Yandex and Google. To ensure effective promotion, it is essential to consider the algorithms and specificities of each system, as well as the distinctive features of the global system in Russia. Therefore, although Google has officially ceased operations in Russia, there is a way to circumvent the restrictions and advertise in the Russian Federation and beyond. This can be accomplished by establishing a confirmed foreign account. However, there is one aspect that requires further consideration. Advertising will be shown only to users with a connected VPN. One significant drawback is that, when evaluating the efficacy of campaigns, it will not be possible to ascertain the precise number of Russian users. All users will be attributed to the country with which they are connected, for example, France or Germany.

Consequently, for official search promotions, we are left with one search engine, it's Yandex. Alternatively, we can work on an effective SEO site in Google, as 31.93% of Russian users still use this system as of July 2024.

With regard to Yandex, it represents the largest digital ecosystem in Russia, offering a number of possibilities beyond paid ads. The ecosystem presents a range of compelling avenues for promotion and brand awareness.

One such example is Yandex Dzen. This is a platform for publishing articles and news. Additionally, native advertising and articles can be leveraged to promote content and attract audiences. Another option is the Yandex platform. The Advertising Network provides the opportunity of placing advertising banners and videos on partner sites. Additionally, Yandex offers two streaming services, Yandex.Music and Yandex.Video, which provide platforms for promoting audio and video content. Another valuable resource is Yandex's own movie theater, Kinopoisk, which offers the option of integrating commercials. Furthermore, in July of this year, Yandex released updates. As an illustration, it is now feasible to conduct a promotional campaign on Yandex Maps.

T-Bank advertising in Yandex Maps

Social media

In 2025, social media remains an integral part of daily life for most Russians: 106 million people use them, which is 73.4% of the population. Women are more active than men: 54.8% vs. 45.2%. On average, people spend 2 hours and 23 minutes per day on social media — almost like watching a full TV series.

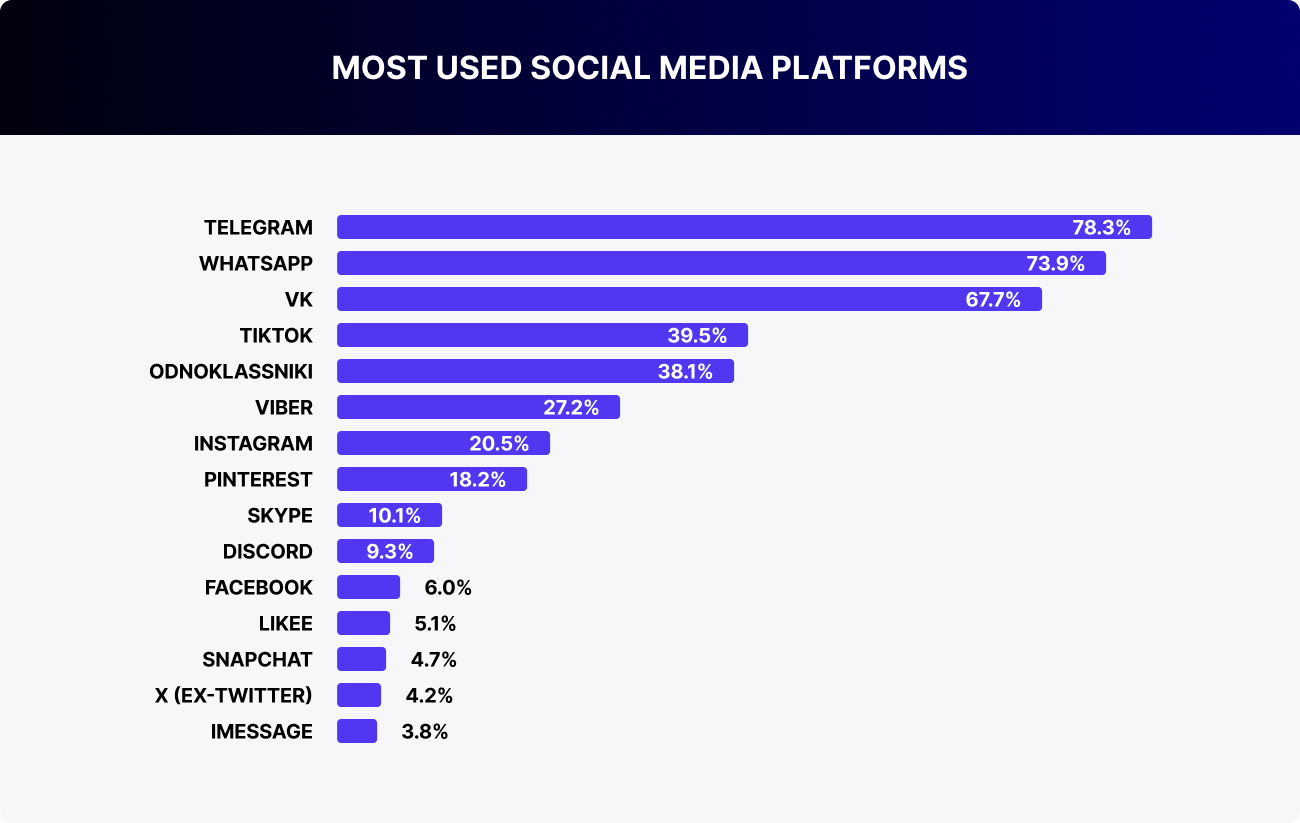

The most effective platforms are Telegram (78.3%), WhatsApp (73.9%), and VK (67.7%). TikTok still holds 39.5%, while Instagram, despite the ban, continues to function through VPNs, with its audience remaining at 20.5%.

Telegram and VK have taken the lead as the primary channels for promotion, due to the shift in traffic from Western services and bans. They have become the main entry points for brands that need quick audience responses and the ability to engage in dialogue without filters and restrictions.

Users are increasingly encountering brands on social media. Nearly 26% discover new products through ads in their feed. Another 20% rely on others' reviews — most often, these are posts by influencers, comments under videos, and recommendations in Telegram channels. These formats are particularly effective in the areas of fashion, cosmetics, technology, and food, where visual appeal and trust play a major role.

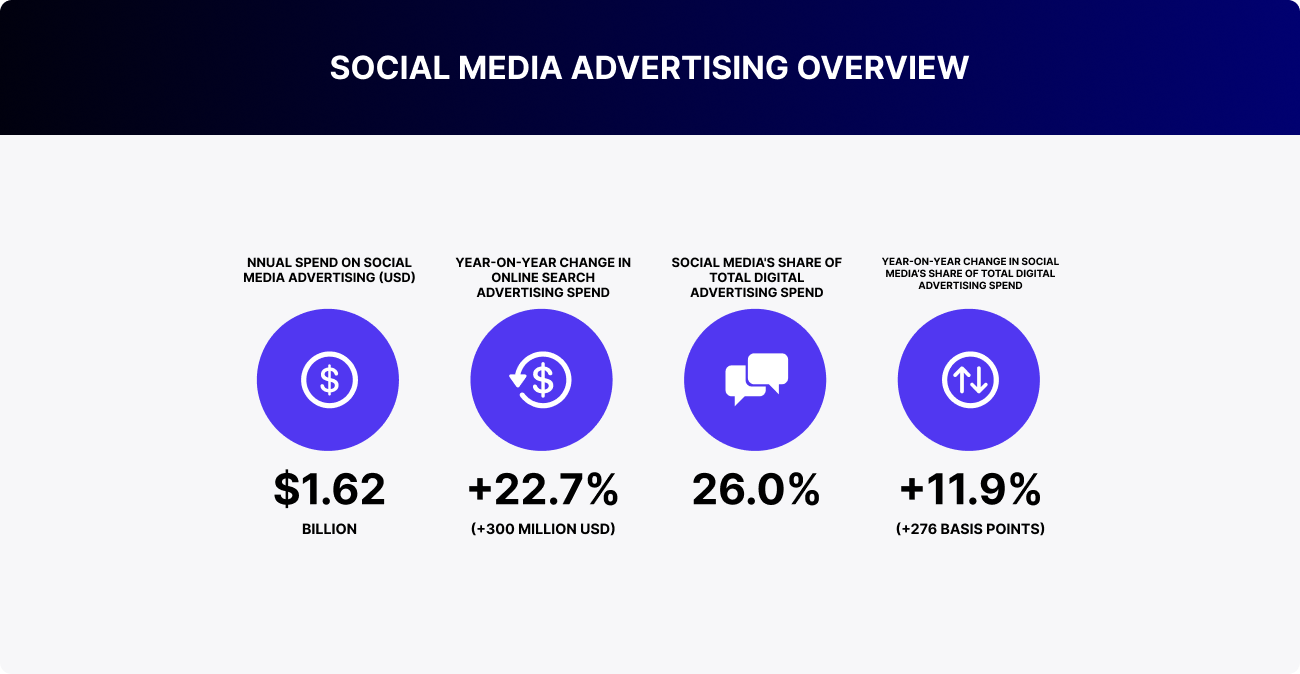

Advertising budgets are following the same trend. In 2024, $1.62 billion was spent on social media ads in Russia — a 22.7% increase compared to the previous year. Social media now accounts for 26% of the total digital market. Influencers are also in the game: $190 million was allocated to them, and this segment continues to grow. The focus has shifted towards micro-influencers — they have closer contact with their followers, less superficial gloss, and more trust.

A large portion of digital placements is now taken over by programmatic advertising. Social media platforms are included in automated purchases, and programmatic ads in Russia already account for 84.8% of all digital spending.

Content is also evolving, but the main focus remains on video. People watch reviews, challenges, tutorials, and short videos on Reels, Shorts, and TikTok — anything that grabs attention quickly and is easily shared. There is growing interest in user-generated content — authentic, native, and unphotoshopped. These formats work especially well in collaborations with influencers, where it feels more like personal advice rather than an ad.

Telegram is leading the way in this regard: brands use it not only for reach but also for sales. Limited collections are launched here, promotions are posted, and direct communication is built, without algorithms that hinder reaching the customer. This turns Telegram into not just a messenger but a standalone showcase that operates 24/7.

It is also crucial to tailor the content to the Russian audience and consider cultural nuances when promoting foreign brands on social media. For comparison purposes, we will examine the social media presence of the global company Ascensia Diabetes Care. In Russia, we have created a group for promotion on the popular Russian social network Vkontakte, an Instagram* account in Russian, and a Telegram one for this company. They have a presence on the international market via Facebook, Twitter, YouTube, and Instagram*. To understand how each of them works with content adaptation, let's compare their Instagram accounts.

The Russian account's content is primarily focused on promotions, special offers, and diet cooking, reflecting the fact that a significant proportion of Russian households prefer to cook at home, in contrast to the US market. In VKontakte, we implemented a similar approach. For instance, in response to the post inquiring about the most frequently prepared dish, the group's audience demonstrated heightened engagement.

The English-language account focuses on recreation, eco-business principles, and the prevention of diabetes in pregnancy. In short, the content caters to the interests of foreign audiences. It should be noted that these topics are not particularly relevant to the Russian-speaking audience.

Influencers and celebrities

Collaborating with Russian influencers and celebrities can be an effective strategy for enhancing brand awareness. Starting September 1, 2025, advertising by influencers on Instagram (including Stories, Reels) will be officially banned in Russia. This decision applies to both direct integrations and hidden ads without labeling. Formally, this means that even with access through a VPN, using Instagram as a platform for promotion has become legally risky.

What remains in use:

- Telegram — a key channel with high engagement. There is no external moderation, the format is flexible, and integrations are perceived as content

- VK — the main platform for visual promotion and video formats. Suitable for collaborations, live broadcasts, and giveaways.

- TikTok — despite a decrease in reach, it remains a working channel for challenges, reactions, and UGC.

- YouTube — a reliable platform for deep content, expert reviews, and launches.

- Odnoklassniki — strengthening its position in the 35+ segment, especially in regions.

Who to choose: influencers or celebrities?

Betting on well-known personalities no longer guarantees reach. Niche influencers, local opinion leaders, and experts with an engaged audience are now the key players. Brands focused on results are turning to Telegram and VK, where reach is combined with trust.

Further details on the most suitable candidates and the process of identifying the optimal opinion leader in Russia can be found in this article.

Legal regulation

In 2022, significant amendments were made to the law of 13.06.2006 No. 38-FZ on Internet advertising. All online ads must now be labeled and information about them must be transferred to the Unified Registry of Internet Advertising (ERIR) via an Advertising Data Operator (ADO). This applies to all parties involved in the advertising process in Russia, including advertisers, agencies, platforms, and bloggers.

A unique identifier, or token, must now be included in all advertisements to show who ordered the advertisement and who placed it. The token must be provided as a clickable link or incorporated into the text of the advertisement. Exceptions are made for social ads and ads that have been duplicated from other media, such as television or radio. All data pertaining to advertising publications is stored in the ERIR and is accessible to supervisory authorities.

The labeling of online advertising can present a significant challenge for the promotion of many brands, particularly foreign brands, in Russia. You can entrust all of these challenges to the experts at RMAA. Also, we have prepared a dedicated article on the labeling of digital advertising in Russia.

Key insights

Russia remains one of the most unconventional and simultaneously promising markets. The ‘copy-paste’ strategy doesn’t work here. The winners are those who integrate into the mentality, into the platforms, into the behavior patterns. And if a brand knows how to speak the language of the Russian audience, it earns their trust.

RMAA works with brands that are based abroad but want to reach the Russian audience effectively. No budget waste, no illusions, no compromises on quality.

If you need a partner who understands how the market works, we are here to help. The contact form is below.

*Meta's activities are banned on the territory of the Russian Federation.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Russian Digital Market Overview

Strategic Insights into Russian Digital Marketing Landscape

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Resident Author at RMAA Blog. Polina shares insights and expertise on the latest trends in the Russian-speaking marketing landscape.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it