Blog about successful marketing strategies in russia

Gaming Industry in Russia 2022. Market Review and Possible Prospects for Development

DIGITAL MARKETING

Share this Post

At the end of 2021, BCG consulting company conducted a large-scale study on the global gaming industry for the current period. It turned out that Russia entered the TOP 5 countries in the world in terms of consumption of gaming content (along with the USA, China, Japan and South Korea).

Indeed, the Russian video game market grew by 9% in 2021 (177.4 billion rubles). What is confirmed by the analytics prepared by My.Games specialists. In addition, in 2019 market volume was considerably smaller and amounted to 121.3 billion rubles. Against the background of such indicators, the Russian video game segment was “predicted” to grow steadily, at least by 5% per year until 2025. However, the situation changed dramatically at the end of February 2022. When the Russian market became limited by a number of sanctions to foreign companies. After that, many leading game brands suspended sales of their products to Russian users.

Therefore, the question of the future of the gaming industry in Russia has become extremely debated among experts. But no one can say for sure - if the Russian gaming expects a serious decline in the near future, or it can still be changed if new players come to the market (and if they come)?

RMAA experts, who have been successfully working in the gaming segment for quite a long time, decided to look into the current situation.

They Left the Market - Who, When, and Why?

At the beginning of March 2022, the largest game marketplaces began to refuse Russians from buying games explaining this decision by the sanction restrictions of their work in Russia. One of the first was Valve's digital store, which disabled payment systems for Russian users on March 2, 2022. At the same time, free Dota 2 and Brawlhalla games are still available for download. Then, on March 10, Sony Interactive Entertainment announced termination of deliveries to Russia and temporary closure of PlayStation Store. The same decision was made in Xbox and Nintendo, which transferred its Russian online store to maintenance due to a failure with transactions in rubles. Besides them, Kyoto has postponed the release of "Advance Wars 1+2: Re-Boot Camp" for the Switch console (please note that the game was scheduled to be released on April 8, 2022). As well as - EGS, Blizzard and EA that allow Russian users to play already purchased or free products but have disabled access to the store. Plus, the App Store and Google Play have restricted purchases of mobile games and apps.

Since then, the income of Russian companies in the gaming segment has dropped on average by 15-17% compared to the last year. This was stated by Dmitry Fokin, CEO of CarX Technologies, in his interview to Kommersant.

“CarX Technologies' revenue is formed in equal proportions by sales of games on mobile platforms and on PCs and consoles. Since March 2022, publishers of Valve, Sony, Microsoft have stopped paying remuneration to Russia, therefore we now do not physically receive about half of the revenue".

Besides Fokin, other experts have also noticed negative changes on the market. Gadji Makhtiev, founder of the rawg.io, considers that the video game segment in Russia will decrease by 50% compared to 2021 or even more - by 75-85%. According to Alexander Kuzmenko, an independent expert on video games, the Russian market expects a decline to 50-60 billion rubles by the end of 2022, as well as spread of pirated products. Loudplay is concerned about the decline in the consumer purchasing power. At the same time, representatives of My.Games hope for the appearance of the Asian Games as one of the possible prospects for the development of the industry in the Russian Federation. However, not everything is so simple.

Made by China

China has rightfully deserved its status as one of the most rapidly growing gaming markets in the world. According to the analytical service Statista, the volume of the gaming segment in the country had amounted to 89.2 billion yuan in 2013, and was estimated to surpass 420 billion yuan by 2022. Despite the huge number of gamers in the region (estimated at approximately 666 million Internet users at the end of 2020), experts are sure that the potential of Chinese online games has not yet been fully unleashed. It is largely related to the fact that developing companies do not enter the other markets so quickly, focusing on their native region. However, they have quite significant prospects to go “outside" China. Including - to Russia.

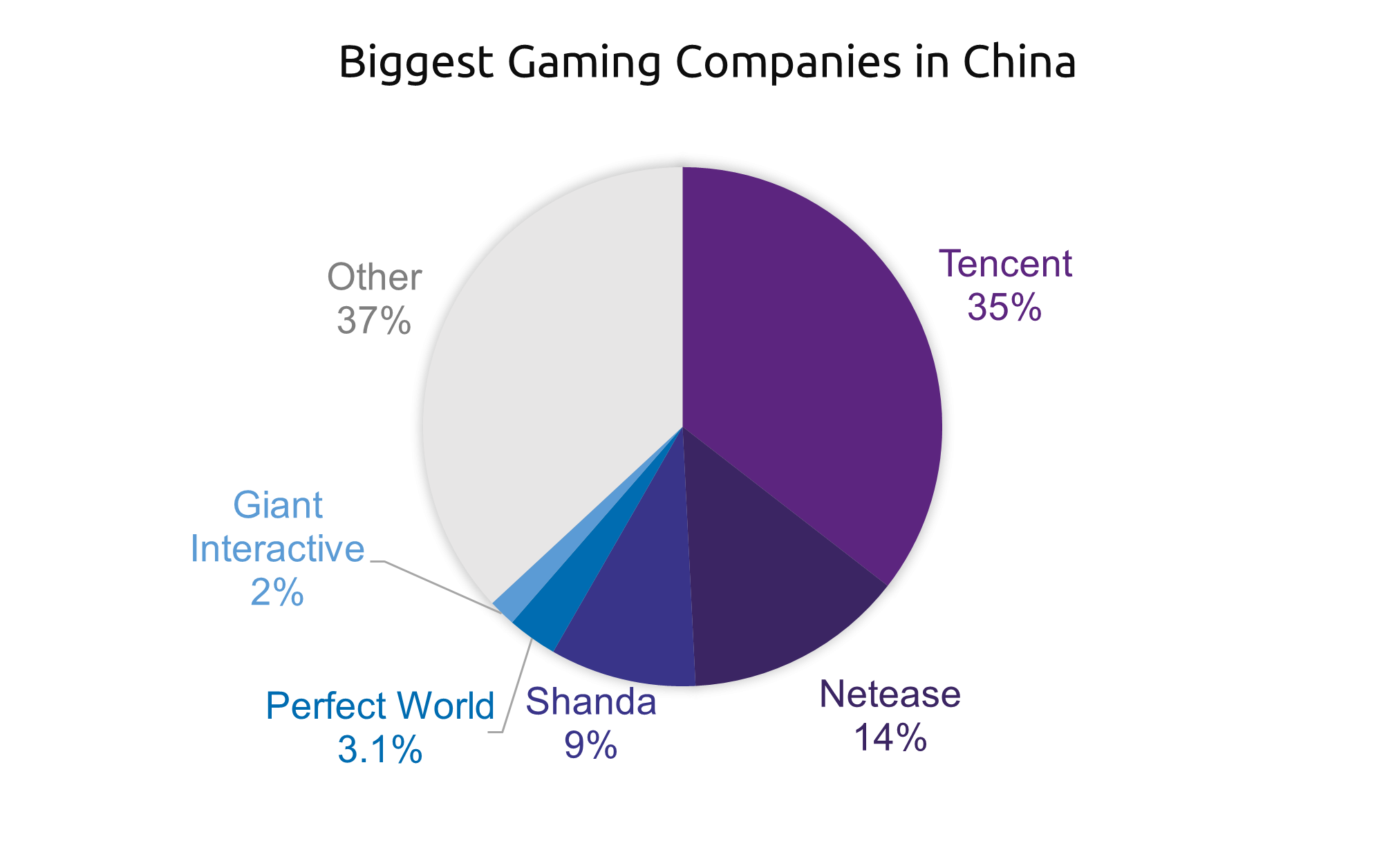

Tencent already did so (having 7% of the Russian Mail.Ru Group) in 2020, releasing a mobile version of the popular MOBA Arena of Valore through the AppStore and Google Play. By the way, the company is a leader in its native region together with NetEase holding. The rest of the market is represented by other local developers (Shanda, Perfect World, Giant Interactive, etc.). With a huge selection of online games and their own cloud ecosystems in their assortment, Chinese companies are gradually expanding their sphere of influence not only “at home”, but also around the world. With this, the expansion to other regions does not occur rapidly and sometimes "drags on" for several years. Basically, this strategy is associated with the use of services from other tech companies, as well as services on provision of cloud infrastructure and support for localization of games abroad.

Source: IBIS World

Again, a good example of this is the localization of Tencent data on the Russian market in 2019. With the help of regional IXcellerate, the company has created the largest infrastructure in Russia aimed at developing cloud and gaming services. At the same time, Tencent has strengthened its position in the region for further integration into the market. And it took the next step in 2021, having acquired the most of the shares of the Russian 1C Entertainment and Inflexion Games - in full.

In turn, NetEase adheres to a different policy and continues to release new game products (including to the Russian market). The company announced this at the last presentation of NetEase Connect 2022. And Perfect World is updating its free version, including the Russian one.

All this suggests that Chinese games gradually began to appear on the Russian market long before the current events limiting the activities of companies from other regions. And the opinions of experts about the development of the Asian direction in Russia can be considered one of the promising options for the market.

If Chinese companies offer a product that is comparable in terms of entertainment and quality of gameplay to the proposals of the Americans, then they can squeeze them out on the market. Users give preference to certain products not because of the country where they were made, but because of the content or popularity in their surroundings. Asian producers are traditionally strong in the MMORPG segment, but we need to understand its niche nature." –Kirill Tanaev, Director of the Institute of Modern Media, shared his opinion (in his interview for Vedomosti).

However, through the example of the same Tencent, we see that Chinese companies (up to 2022) are far from the most active promotion strategy outside their country. This is mainly related to the gradual implementation of technologies into a new region and the subsequent localization of games. Perhaps, the absence of serious competitors in the Russian market will accelerate all of the above listed processes in the near future.

Perspective from Russian Users

Meanwhile, Mediascope estimated that 69% of Russians at least sometimes play games. 42% of them play games on smartphones, 33% use PCs and 9% prefer game consoles. In addition, one part of the audience (55%) plays regularly, others (68%) - at least once a month. And 40% of users enter at least one mobile game daily. Thereby, gaming applications have become one of the leading categories in terms of using time (15%), giving the pas to social media.

Despite the popularity of mobile games, the PC segment takes the first place in sales in Russia. In 2021, it accounted for 85.4 billion rubles (48.1% of the market). And in March 2022, retail sales of video games tripled (according to DTF data). Experts explained this trend with a number of restrictions that appeared due to sanctions (which were mentioned above). In the light of this, Russian users hurried to purchase their favorite games, since no platform blocked access to already purchased or free games. Moreover, the most popular versions were for PlayStation 5 (Horizon Forbidden West, Elder Ring, Mortal Kombat 11: Ultimate) and PlayStation 4 (Horizon Forbidden West, FIFA 22, Cyberpunk 2077). Then, products for Xbox (FIFA 22, Cyberpunk 2077, Assassin's Creed Valhalla) and Nintendo Switch (The Legend of Zelda: Breath of the Wild, Animal Crossing: New Horizons, Pokemon Legends: Arceus).

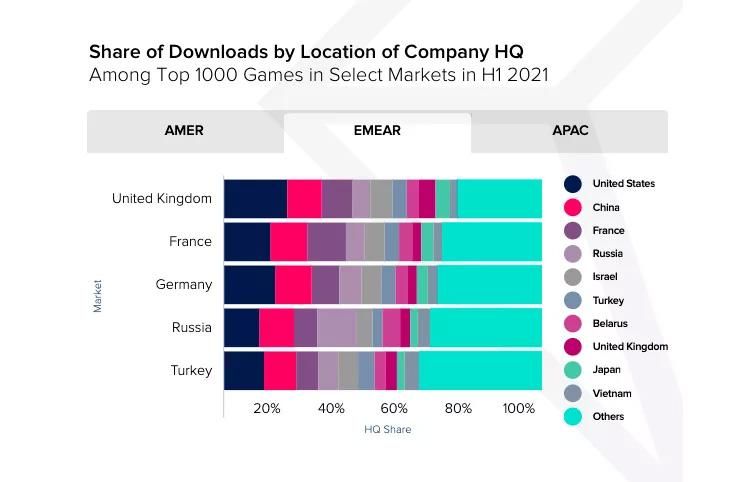

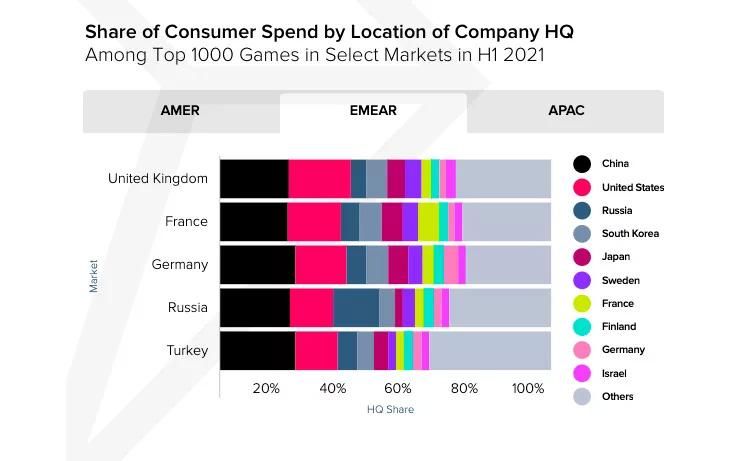

The budget of gaming applications amounted to 76.5 billion rubles (43.1% of the market). Which is quite predictable, because there are many free games on mobile marketplaces. In 2021, the most downloaded of them were applications created by Russian companies (12.2%). American releases turned out to be in the second place (11.2%). But the third place was taken by games from China (10.7%). However, they appeared to be the leaders in sales (21% of user costs), outrunning Russian, American, and other Korean developers (14.1%; 13.1%; 4.6%, accordingly).

Source: Data.ai, The State of Mobile 2021

In other words, the involvement of Russian users in online games is also growing, despite any bans and restrictions from some foreign companies. But at the same time, leading American, Japanese and European manufacturers are leaving the market. Accordingly, in the near future this niche will be promising for new gaming products. First of all, it will be promising for Chinese gaming companies according to many experts. Since they already have a successful experience of promotion in Russia. However, this factor does not prevent developers from other countries from entering the market in the absence of serious Western competitors.

At the Same Time, It Should Not

be forgotten that the assistance of specialists is necessary for successful promotion. Entering a new market is a serious step that requires creating an effective strategy taking into account different features and the specific nature of the audience. RMAA experts are ready to carry out a personal expertise for your gaming products in order to present them to the audience of Russian-speaking gamers as quickly as possible.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Video Games Promotion in the Russian Market

How to market games to Russian-speaking gaming community

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

A content lead. Natalia runs marketing projects promotion with different digital tools in the Russian-speaking market.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it