Blog about successful marketing strategies in russia

Pandemic E-commerce: Top 30 Popular Online Retailers in Russia in 2020

DIGITAL MARKETING

Share this Post

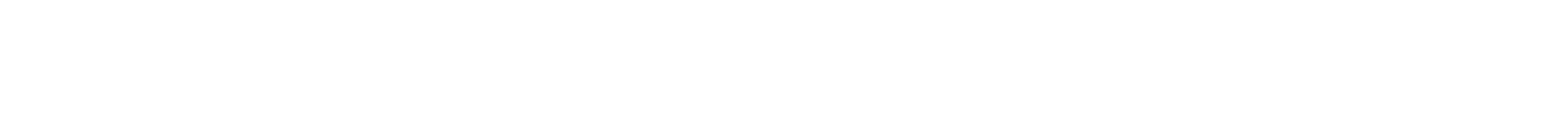

Brand Analytics presented a ranking of e-commerce companies that were most actively discussed by users of Russian-language social media in 2020.

The lockdown became one of the most powerful stimuli for e-commerce development, having enforced positions of e-commerce players in the Russian economy, as well as having changed consumer behavior scenarios. A heavy increase in demand for online shopping caused a bump in talking about online retailers. As a result, there were 26 million messages mentioning ranking participants in 2020.

Rating Leaders

AliExpress became the company most talked about. The giant of the Web is substantially leading: over the past year, users mentioned AliExpress more than 12.42 million times. In the eyes of customers, this platform made its way from "I'll just order a couple of phone cases" to a formidable marketplace. The commitments for development in Russia were proven by creation of AliExpress Russia, a joint venture of Alibaba Group, Mail.ru Group, MegaFon, and the Russian Direct Investment Fund, in 2019.

The second place is taken by an online store Ozon, "the Amazon of Russia". The year turned out a success for the company: over the first nine months of 2020, the retailer demonstrated a 130% increase in the order quantity as compared to a similar period in 2019, and the account growth was 84% just from April to May 2020. In late November, Ozon built on the progress, having completed an IPO in the NASDAQ exchange, which results surpassed experts' expectations. The leading position in the market is also proven with public attention (2.25 million mentions during the year and the 2nd spot in our ranking).

The 3rd ranking spot is taken by a marketplace Wildberries, with 1.96 million mentions. According to the very company, there are more than 1.4 million orders daily in the marketplace: one can order food, home appliances, and even... air tickets on the website or app. Interestingly, VKontakte users discussed purchases on Wildberries more than others, with 52% of the total number of messages.

While leading rating positions of marketplaces are quite anticipated, the presence of some other companies on top came as a surprise. The consumers' interest in reading and the vigorous foothold of the brand in social media let Labirint.ru, an online bookstore, find itself in the 5th ranking spot. Indeed, everyone would look for their cup of tea during the lockdown, but the number of the company's mentions gave the dust even to delivery agents such as Eda.Yandex (7th place) and Delivery Club (12th place). What is more, we can see a jewelry brand Sokolov at the 15th place—an active marketing policy let the company outrank such e-commerce celebrities as Lamoda (16th), M.Video (18th), and Gold Apple (23rd).

Dynamics of Interest in Online Purchases: How Attention to Online Shopping Was Changing Throughout the Year

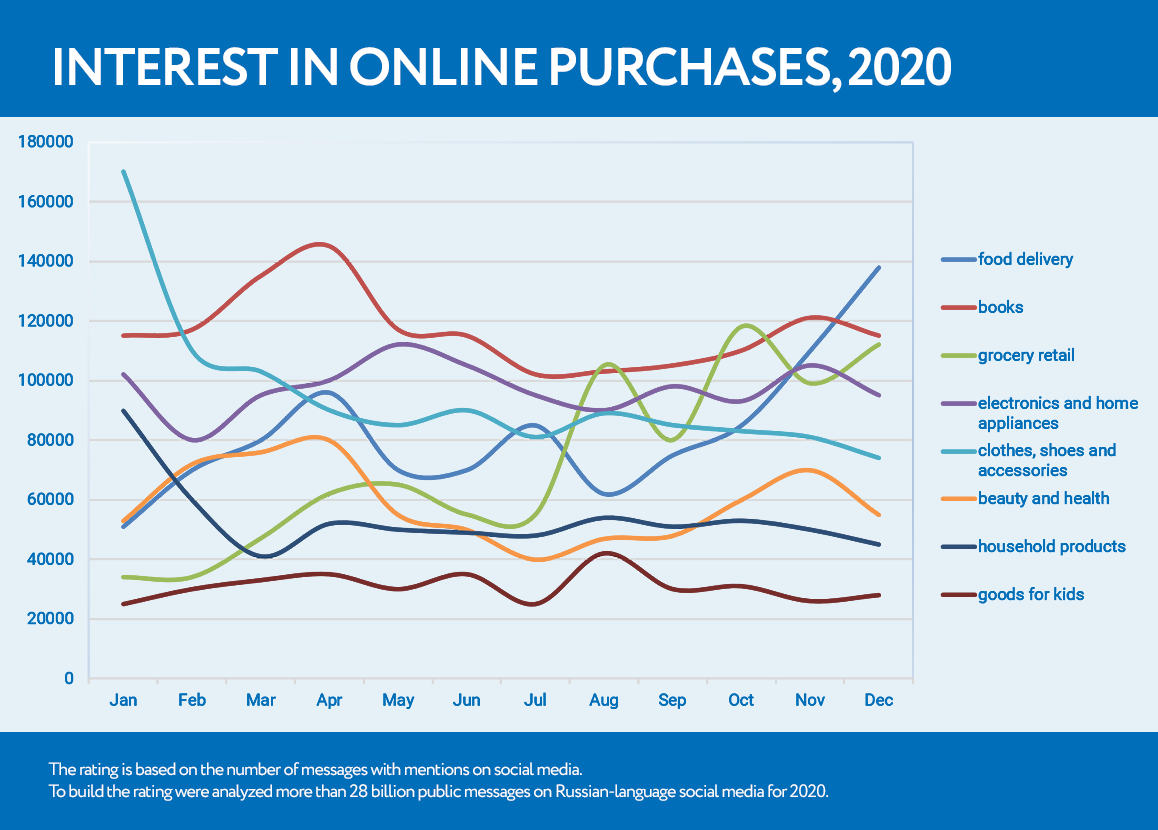

When building a dynamic ranking of e-commerce goods categories, we omitted data about marketplaces in order to look over dynamics in certain categories. It may just be noted that the dynamics of marketplace mentions in 2020 was minimal. So, what directions went up, and which ones lost their relish in the eyes of consumers?

A vivid growth was demonstrated by food retailing. Interestingly, an explosion of the respective concern coincided with the very second half of 2020 and not with the spring lockdown. Having started the year with 26,000 messages monthly, the interest in food online purchasing reached 114,000 mentions in October at zenith.

At the end of the year, a final push let food delivery gain the upper hand of the month—the category got almost 133,000 mentions in December. With this in mind, the interest in Delivery Club and Eda.Yandex was fluctuating over the course of the year, having initiated a tendency for sustainable growth only in September 2020.

Electronics, having fallen in the beginning of the year, restored the demand by late spring and early summer. In the second half of the year, the situation in social media remained stable for the category. For children's goods, the whole year turned out to be stable, while books had an obvious uptick during the first wave of quarantine restrictions.

However, there are categories that had losses, and the users' interest in them would go down now and then. Fashion shopping had the biggest drop: having started the year with 170,000 mentions per month, the fashion segment had retained only 68,000 messages by December. Wellness and household goods noted a drop, too. The situation was not even saved by seasonal sales and a traditional growth of attention on the eve of the New Year holidays.

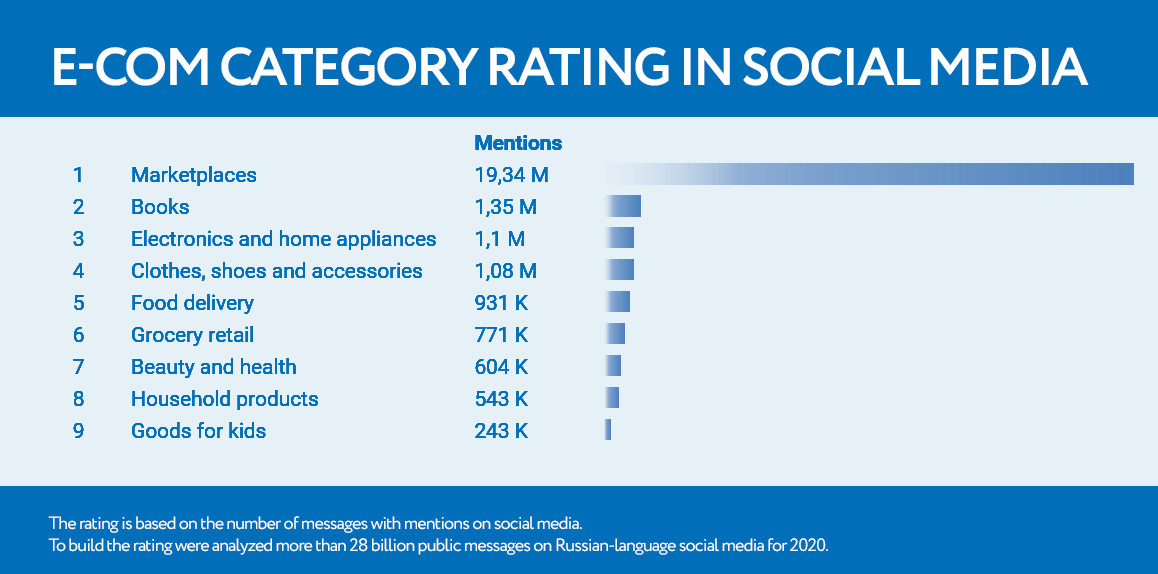

E-commerce Category Rating in 2020

Marketplaces (7 positions) is a category with the biggest number of mentions: 19.34 million during the year. E-commerce platforms are rating leaders: 6 category representatives at once are in the Top 10 of popular online retailers. Users choose AliExpress (1), Ozon (2), Wildberries (3), Sima Land (4), Yandex.Market (6), Ebay (11), and goods.ru (30) for an opportunity to buy all necessary goods, attractively priced, in one place. Regular offers and discounts, competitive pricing, and a variety of products appeal to users.

Books (2 positions). The lockdown became a great opportunity for self-development: the interest in books was going through the second Renaissance. In 2020, Russian-speaking online users left 1.35 million messages mentioning Labirint.ru (5) and LitRes (8), the largest online bookstores. People actively shared links to their favorite books and published literature selections for all cases.

Electronics and household appliances (5 positions). The category represents the largest players from the offline segment, which started their activities as land-based businesses with shopping spaces, checkout lines, and stock phrases said by sales assistants in corporate polo shirts. M.Video (18), Citilink (19), Eldorado (20), DNS (21), and Svyaznoy (22) have 1.1 million mentions in total.

Curiously, this is a neck-and-neck race. The absence of a clear leader means high competition where the choice of one or another shop is made because of more favorable conditions and offers.

(No) Man is an Island: e-commerce development trends

Marketplaces kept the pandemic front and center—they have been offering buyers comfortable shopping, great variety, adequate pricing, and convenient delivery for a long time. A spiked affinity became a point of increase both for marketplaces and for brands—distribution and effective sales via such channels became a key element of the survival strategy for brands, but not the only one.

The second trend is investment of extensive resources in direct online sales, dark stores, and delivery services.

The third one is mergers/acquisitions and floatation of a top player.

Data Calculation Specifics of Brand Analytics

For the rating analysis, more than 28 billion Russian-language messages in social media were analyzed within the period from January 1 until December 31, 2020. The data includes messages from such social media as VKontakte, Odnoklassniki, Instagram, TikTok, YouTube, Facebook, Twitter, as well as blogs, forums, review sites, public channels of messengers, comments to news articles, and other sources.

Rating participants were online retailers that make it possible to purchase and order goods delivery in the territory of Russia, as well as have an interface in Russian. The study analyzed the popularity of all companies out of the Top 100 largest Russian online stores, a rating published by Data Insight, as well as the popularity of a number of new industry players. The companies that offer digital multimedia content (music, movies) were not included.

As for companies represented both online and offline, only messages related to online sales were taken into account when analyzing popularity. Rating results are affected by the company's popularity among users, as well as its marketing activity.

Source: Brand Analytics, Top 30 Online Retailers in Social Media in 2020

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Russian Digital Market Overview

Strategic Insights into Russian Digital Marketing Landscape

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Head of Digital, editor-in-chief of the RMAA Agency Blog

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it