Blog about successful marketing strategies in russia

Search Engines in Uzbekistan: Key Insights for Brands

DIGITAL MARKETING

Share this Post

Uzbekistan's digital landscape is still taking shape. Many niches remain untouched by major players, leaving the market relatively open to new brands that are ready to speak the local language and connect with people in familiar ways.

Nearly 90 % of the population — over 32 million people — use the internet. The connection is stable and widely accessible, especially on Android devices. People go online daily, most often from their phones.

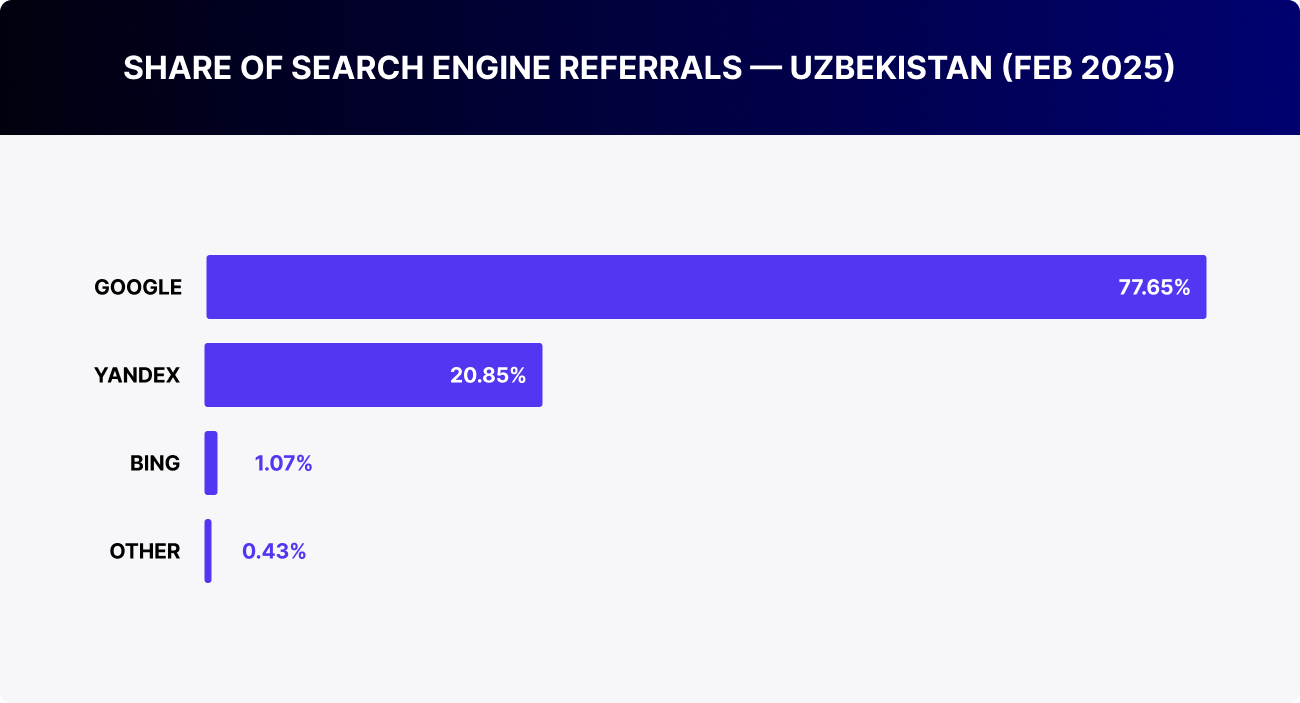

Search is part of everyday behaviour here. Some check the weather, others watch videos on YouTube, or use Telegram to find a translator or the right website. Google remains the leading search engine, but it doesn’t dominate entirely. Approximately 20 % of queries are processed through Yandex, particularly when searches are conducted in Uzbek or are related to .uz domains. This gives brands flexibility: they can build communication in various ways and meet audiences where they’re already looking.

The user base is largely young: a third are teenagers, and another 30 % are under 45. Younger audiences tend to be more open to new formats and less likely to ignore ads, especially when the content solves a real problem. Still, people are starting to develop banner blindness, particularly in urban areas.

E-commerce is only beginning to take off. Most sellers are local. The mid- to high-end segments remain uncrowded, offering a chance for newcomers to stand out quickly. What matters is a clear product, honest messaging, and an understanding of how to engage users who are just learning how to choose.

If you're seriously considering Uzbekistan as a launch market, start with search. It remains the most straightforward and transparent channel. It’s more cost-effective than paid social and allows you to test demand quickly and see how people actually respond to your offer.

In this article, you'll learn how search works in Uzbekistan and why Google isn’t the only player. We’ll share real data, help you choose between Google Ads and Yandex.Direct, explain why connecting to TAS-IX matters, and when it makes sense to boost your campaign with DV360 or Telegram Ads.

Google Leads, But It’s Not the Only Player

Google dominates the market. In Uzbekistan, it holds around 78 % of search traffic, and that’s no surprise. Android is the primary operating system in the country, and Google is integrated into the browser, maps, translator, and YouTube. The moment someone picks up their smartphone, they’re already inside the Google ecosystem.

Google runs its own ad network — Google Ads — which makes it easy to reach a broad audience quickly. Integrated into Android, it covers the entire user journey, from search and YouTube to Google Maps. It’s a convenient tool for scaling campaigns, especially if your product is already known or gaining popularity in the region. The platform offers flexible targeting, retargeting, and automated strategies that give you control and the ability to respond precisely to user behavior.

The cost per click here is still lower than in neighboring markets. In popular categories, rates range from $0.09 to $0.57. For instance, electronics repair averages around $0.12, while Korean skincare products are about $0.29. Google Shopping is active in the e-commerce space, with an average CPC of roughly €0.06 and a CTR reaching 2.3 %. However, as demand grows, bids are slowly rising, and it’s not just about price anymore. The quality of traffic matters. Without funnel optimisation, even the cheapest clicks might not convert.

Language settings are another key factor. While the Google Ads interface hasn’t been translated into Uzbek yet, that doesn’t prevent you from running ads in both Uzbek and Russian. This type of segmentation allows you to reach both core audiences at once and broaden your overall reach.

Next, it makes sense to consider geography. The most active and solvent demand is concentrated in Tashkent. With over two million residents, the capital is where most major campaigns are launched. Urban-focused campaigns are a logical first step in market entry.

Beyond geography and language, it’s also important to understand user behaviour. In Uzbekistan, people often respond politely out of courtesy, which means survey data may not always reflect true attitudes. It’s more reliable to track actions — clicks, inquiries, and conversions.

Competition is intensifying. In some sectors, like healthcare or automotive, bids are already approaching Kazakhstan’s levels. Poor campaign setups can lead to budget waste. In competitive markets, accuracy and experience are critical, especially when working with limited resources.

Yandex.Direct: A Different Approach

Yandex holds second place in Uzbekistan’s search market, with a share of around 20–22 %. This isn’t just about user habits. It’s a result of the platform being tailored to the local landscape. Yandex supports the Uzbek language, offers an interface that resonates with local users, and includes built-in scenarios for interacting within the Telegram environment via manual placements. Many rely on Yandex as their go-to tool for searching in Uzbek.

The platform reaches over nine million users. Ads appear both in search results and across partner websites. Geo-targeting in Direct can be configured by region, city, or even district, allowing for highly precise audience targeting, especially in smaller towns and rural areas. This kind of reach is crucial for promoting offline businesses, region-specific logistics, education programs, and B2B services.

You can create ads in Uzbek, Russian, and English, which expands your reach and ensures clarity across different audience segments. Campaigns on Yandex.Direct start with a minimum budget of 100 000 UZS, but to properly assess performance, it’s better to begin with at least 1 300 000 UZS. With that budget, you may also receive a promo code worth 630 000 UZS and free ad setup if you complete a submission form. Click prices are determined by an auction. The minimum bid is 100 UZS, and from there, the cost depends on competition, ad quality, and click-through rates. The format gives advertisers tight control over spending and clear visibility into how pricing changes with content adjustments.

While Yandex doesn’t deliver as much traffic as Google, its structure is more closely aligned with everyday user behaviour. It performs especially well in areas where local context is key: services, healthcare, telecom, education projects, and government-related promotions. In these segments, Yandex often provides more accurate targeting and lower acquisition costs. That’s why it remains a powerful tool for brands that prioritise depth over scale.

This is the core distinction between the two platforms. Google offers reach; Yandex offers precision. If you’re targeting a broad audience, Google will drive more traffic. But if you need to connect with a specific region, the Uzbek-speaking segment, or get placements in local Telegram channels, Yandex delivers these results faster. This is especially relevant for offline businesses, e-commerce with regional delivery, and brands in sectors like education, healthcare, or fintech.

In practice, they’re not competitors — they’re complementary tools. Both search engines are effective, but they solve different problems. When used together, they can cover the entire funnel, from initial awareness to targeted conversion.

To make this less abstract, we’ve prepared a side-by-side comparison of formats, budgets, and launch conditions to help you choose the right tool for your goals.

Additional Channels: DV360 and Telegram — Enhancements, Not Replacements

Search remains a crucial channel, but in Uzbekistan, it’s increasingly being supplemented by other tools. One of the key platforms is DV360, widely used for broad-reaching digital campaigns, especially in video and mobile advertising. It’s favoured by major brands and digital agencies when scale is the goal. DV360 requires a separate setup through an agency or partner account, and the entry budgets are significantly higher than those in Google Ads.

Google is actively expanding its ad presence in Uzbekistan through this platform, offering access to its premium inventory, including YouTube, mobile apps, and sites within the GDN network. Campaigns are managed through Google’s official partner in the country, Admixer Advertising. Direct access to the platform is not available; campaign setup goes through agency dashboards or DSP providers.

With DV360, advertisers gain both reach and access to premium placements, along with advanced segmentation options. The platform allows you to build cross-channel campaigns — video, display, mobile — in one place. This makes it easier to precisely target audiences and scale results after initial testing in Google Ads.

Telegram Ads serves a different purpose. Its strengths lie in speed, initial reach, and flexibility. The platform offers access to over 10 million users, targeting by language and phone number, and has a low entry barrier. It doesn’t require a website or legal entity, making it a fast way to gauge audience interest.

Telegram is often the first point of contact: a user sees an offer, clicks into a bot, reads a description, and then searches for the brand on Google. This creates additional momentum for paid ads. Still, Telegram remains a relatively new platform in Uzbekistan, and campaign performance depends heavily on the niche and the quality of the creative. CPM rates here tend to be higher than on Google Ads or Yandex.

There are two ad formats in the ecosystem. Telegram Ads appear in channel feeds. TMA Ads run inside mini-apps — storefronts, services, and bots. Both are designed for reach and initial traffic, making them especially valuable for e-commerce and brands with limited budgets.

When combined with search, DV360 and Telegram amplify the overall impact. DV360 builds awareness at scale, while Telegram speeds up user engagement. Together, they don’t just help you enter the market — they help you stay there.

How Users Think: Search Behavior in Uzbekistan

Users in Uzbekistan don’t turn to search for inspiration. They come with a clear task in mind. Whether it’s checking the news, opening the school platform Kundalik, accessing YouTube, or translating a phrase, the intent is direct and practical. Top search queries tend to be highly utilitarian and straightforward, with no complex funnels involved: ‘weather tashkent’, ‘translate uz en’, ‘download telegram’.

| Rank | Search Query | Index (vs. “Pogoda” = 100) |

|---|---|---|

| 1 | Pogoda (Weather) | 100 |

| 2 | Kundalik | 78 |

| 3 | Kundalik.com | 56 |

| 4 | YouTube | 51 |

| 5 | YouTube | 50 |

| 6 | Translate | 49 |

| 7 | Qi Havo (Air quality) | 48 |

| 8 | 38 | |

| 9 | Gidromet (Hydromet) | 34 |

| 10 | 30 |

This means that ads appearing in search need to solve a problem, not tell a brand story. It’s not about saying ‘we’re the best solution provider’, but rather, ‘here’s exactly what you need—right now.’ Practical value, delivered at the right moment and in the right context, is what works.

At the same time, there is real potential for purchase behavior. Currently, only 12% of users shop online, but that number is steadily growing, especially in cities where habits like ordering tickets or food have already taken root. That doesn’t mean a banner saying ‘1-day delivery’ will convert immediately. But if a user is actively searching for a product and sees an ad that doesn’t interrupt but helps with the decision, they’re likely to click.

What to Keep in Mind About Devices and Interfaces

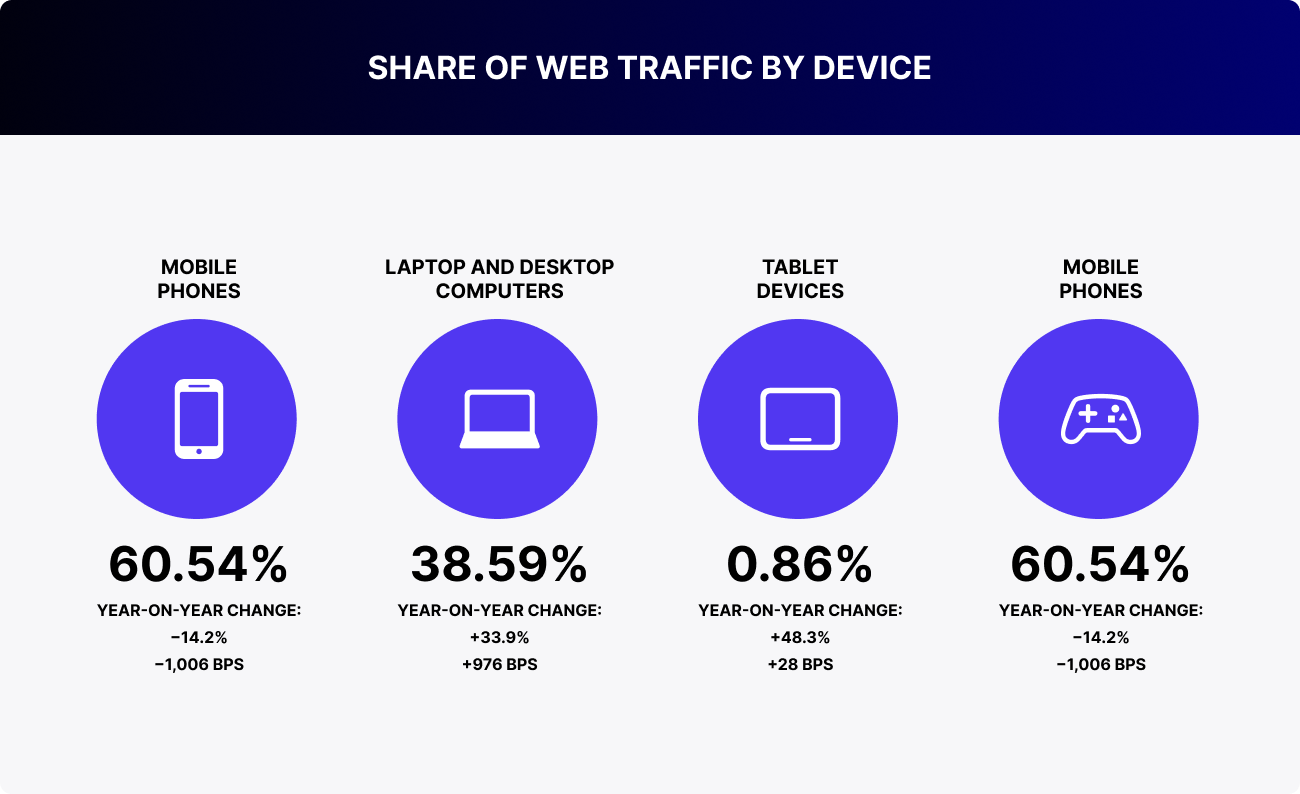

Mobile devices are the primary source of traffic in Uzbekistan. Currently, around 60% of users access the internet via smartphones. However, over the past year, desktop usage has grown by nearly 34%. That’s a clear signal: more search activity is happening in a calm setting, at home, on a laptop screen, with the intent to explore and make a purchase.

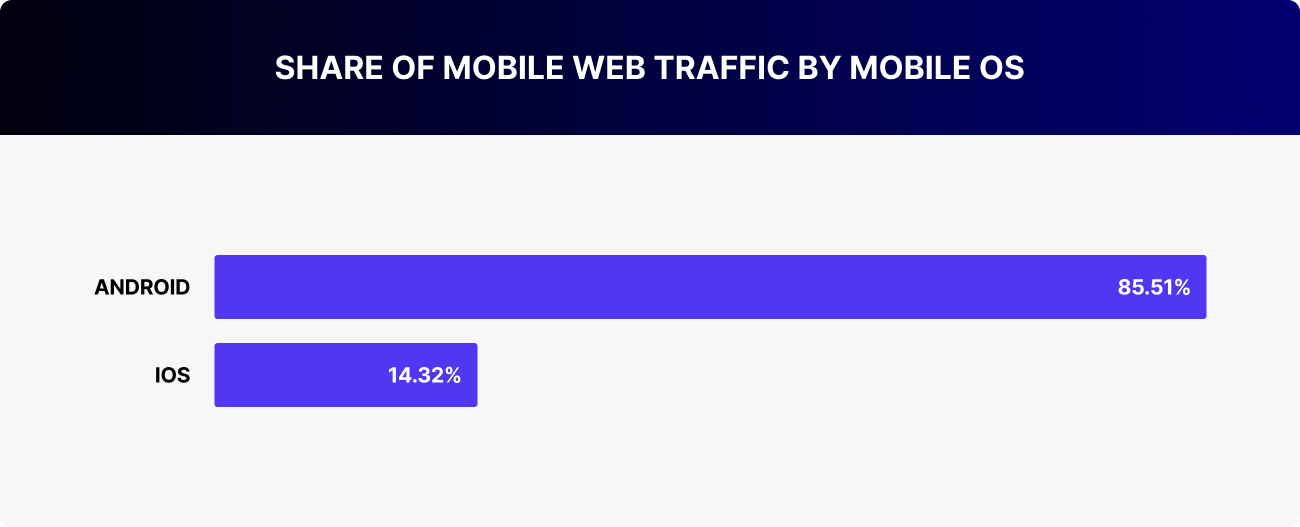

The technical landscape is predictable. Android runs on 85% of devices, and Chrome is the main browser for 74% of users. In this environment, failing to adapt to Android directly translates into losing a significant share of the audience. It’s essential that your site loads quickly and displays properly on smartphones, especially on lower-end Android models. If a site is slow or looks sloppy, users simply leave.

iOS accounts for around 14% of traffic in Uzbekistan. These users matter for niche products and high-end segments, but they don’t shape the overall landscape. At the same time, interfaces designed primarily for iPhones often break down on mainstream devices.

Users won’t stop to figure out why; they’ll just leave. That’s why your site needs to be optimized for the dominant access conditions: smartphones, Android, and average connection speeds. This isn’t about aesthetics — it’s about survival in a search-driven environment, where competitors load in 2 seconds and require no effort to use.

Why Being on TAS-IX Matters

Uzbekistan is one of the few markets where the internal TAS-IX network, the national traffic exchange point, is still in active use. Any site connected to TAS-IX loads faster, doesn’t consume international data, and is perceived by users as “local”. Even entertainment platforms like allplay.uz (430 K monthly visits) and tas-ix.tv (178 K) thrive within this ecosystem, and that’s exactly why they remain popular.

For advertisers and SEO specialists, this is a critical factor. If a site loads slowly, especially on Android with low-cost Internet, users won’t wait. It’s not a matter of patience; it’s a numbers game: bounce rates rise, page depth drops, and behavioral signals weaken. As a result, your search rankings take a hit, even if your SEO is technically sound.

Google struggles in this environment because it evaluates websites independently of local network conditions. Yandex, on the other hand, operates with more nuance: it indexes .uz domains, recognizes TAS-IX-connected sites, and tracks clicks from Telegram channels. It doesn’t have a physical presence in the country, but its algorithms are more attuned to local specifics.

That’s why running ads alone isn’t enough. Hosting your site on a TAS-IX-connected server is a basic technical necessity. Without it, your site loads slowly, loses users, and slips in search results. Fast loading times, a consistent user experience, and stable visibility all depend on the infrastructure your project is built on.

Legal Reality: How to Avoid Getting Banned After the Click

Starting July 2025, new regulations for e-commerce will take effect in Uzbekistan. Any company that accepts online payments, processes orders, or arranges delivery within the country must now operate under local laws. Quick setups and test launches without formal registration will no longer be allowed.

To operate in the e-commerce space, a business must have a legal entity registered in Uzbekistan. This includes opening a local bank account, registering in the national e-commerce operator registry, and integrating with the tax and customs systems, all of which are now mandatory. Any business receiving payments from Uzbek residents is subject to these regulations, regardless of where it’s based.

Advertising that doesn’t involve a direct transaction is, for now, outside the scope of these rules. Landing pages without checkout, Telegram Ads with promo content, or brand integrations that don’t include order processing are still unregulated. However, authorities are discussing expanding these requirements, especially for platforms that collect user data, generate demand, or drive purchase intent.

This shift calls for a reevaluation of marketing strategies. Selling through distributors is one option, but it limits both brand control and profit margins. Telegram storefronts without direct checkout can help test demand, but it’s important to remember that this kind of traffic doesn’t always convert to actual sales. For brands planning long-term operations, legal registration provides a far more stable foundation. A flexible traffic distribution strategy is key: some traffic goes to awareness-building, some through local partners, and some to testing before launching full-scale sales.

Quick adaptation to the new rules is becoming a competitive edge. Delays carry the risk of being blocked and losing access to the market.

In A Nutshell

Search marketing in Uzbekistan delivers results, not because it’s simple or cheap, but because the market isn’t oversaturated yet. The audience is young, habits are still forming, and most competitors are local companies without structured strategies. This creates an advantage for brands that know how to enter precisely and at the right time.

Google offers scale and reach. It’s a powerful tool, but it demands expertise — bids are rising, and mistakes can get expensive. Yandex is highly effective in niche segments, especially where Uzbek-language targeting, Telegram behavior, and local search rankings matter. DV360 is a fit for brands with ready video content and large-scale awareness goals. Telegram Ads are used for quick launches, without complex infrastructure or legal registration. The channel brings in clean traffic and fast feedback.

At the initial stage, defining your goal is critical. If the aim is simply to gauge audience interest, a combination of Telegram Ads and branded search traffic on Google works well. For long-term efforts, you’ll need a different setup: a local team, Yandex integration, legal registration, and compliance with the new e-commerce regulations.

The market is evolving quickly. The winner is the one who speaks the audience’s language — clearly, accurately, and at the right moment.

The RMAA team is here to guide you through that journey, step by step. We support launches, build strategies, connect you with local partners, set up analytics, and handle market communication. We have hands-on experience in Uzbekistan. We know how to enter, expand reach, and drive campaigns to results.

If you’re preparing for a launch or want to discuss your go-to-market strategy, fill out the form below. Our managers will be in touch. And if you don’t want to miss regional breakdowns, case studies, and updates on the ad landscape across the CIS, subscribe to our blog.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"Digital Marketing in Russia. Finding your customers on the internet"

for FREE!

Russian Digital Market Overview

Strategic Insights into Russian Digital Marketing Landscape

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

Digital Strategist. Head of one of the project groups at RMAA. Maria started her journey in digital marketing in 2009.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "Digital Marketing in Russia. Finding your customers on the internet" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it