Blog about successful marketing strategies in russia

The Potential of Cryptocurrency on the Russian Market

B2B MARKETING

Share this Post

Cryptocurrency, which first appeared on the market in 2007, gradually acquired the status of valuable digital assets not only among entrepreneurs, but also among various audience representatives throughout the world. Many factors contributed to this: wide coverage in the media, among opinion leaders and with the support of third-party online resources. Thanks to this, cryptocurrency is now not just a digital asset, but one of the most discussed topics in world communities.

Furthermore, the more attention the cryptocurrency market and blockchain technologies attract, the more perfect they become. Thus, in 2011 altcoin technologies allowed developers to create not only bitcoins, but also other types of crypto-money. The price for which was significantly lower, what caught interest of a new audience in buying crypto products. As a result, the crypto segment is being constantly enriched with new projects with more reliable, convenient and flexible functionality.

This trend leads cryptocurrency to wide popularization and its active use all over the world as a valuable digital asset, payment instrument or a way to make money (for example, gaming or NFT), as well as, inter alia, on the Russian market, bearing in mind its specific features, interest of the audience in crypto products and the activities of the state in relation to the digital market as a whole. Most experts are sure that the potential for development of the crypto segment in Russia is just beginning to gain strength. And it contributes to introduction of new crypto products and services in Russia.

In order to go into this matter and find out to what extent cryptocurrency is in demand on the Russian market and what prospects for development of this industry in the future are, RMAA specialists carried out their own analysis of the segment.

The Level of Confidence of Russians in Cryptocurrency

The Institute of Public Opinion “Anketolog” conducted a research in which 1,600 Russian people of various socio-demographic groups were asked about crypto currency.

As a result, the following findings were obtained.

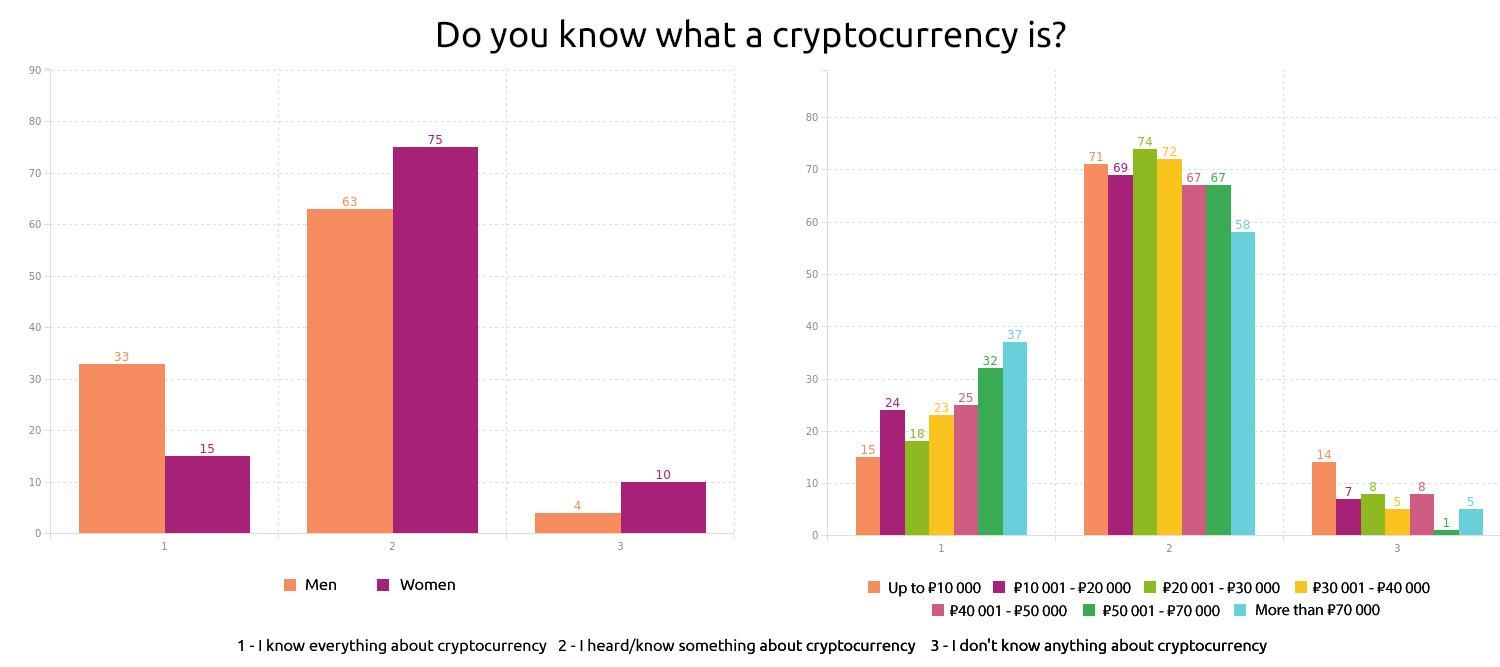

Firstly, the majority of Internet users in Russia (70%) at least have heard about cryptocurrency, 23% are well aware of the product. Whilst, only 7% heard about it for the first time during the survey. Notably, respondents whose income level is above 70 thousand rubles (37% of the total number of survey respondents) know and understand crypto products. This category mainly consists of men (33%). There are much fewer women in this group - 15%.

Source: Anketolog

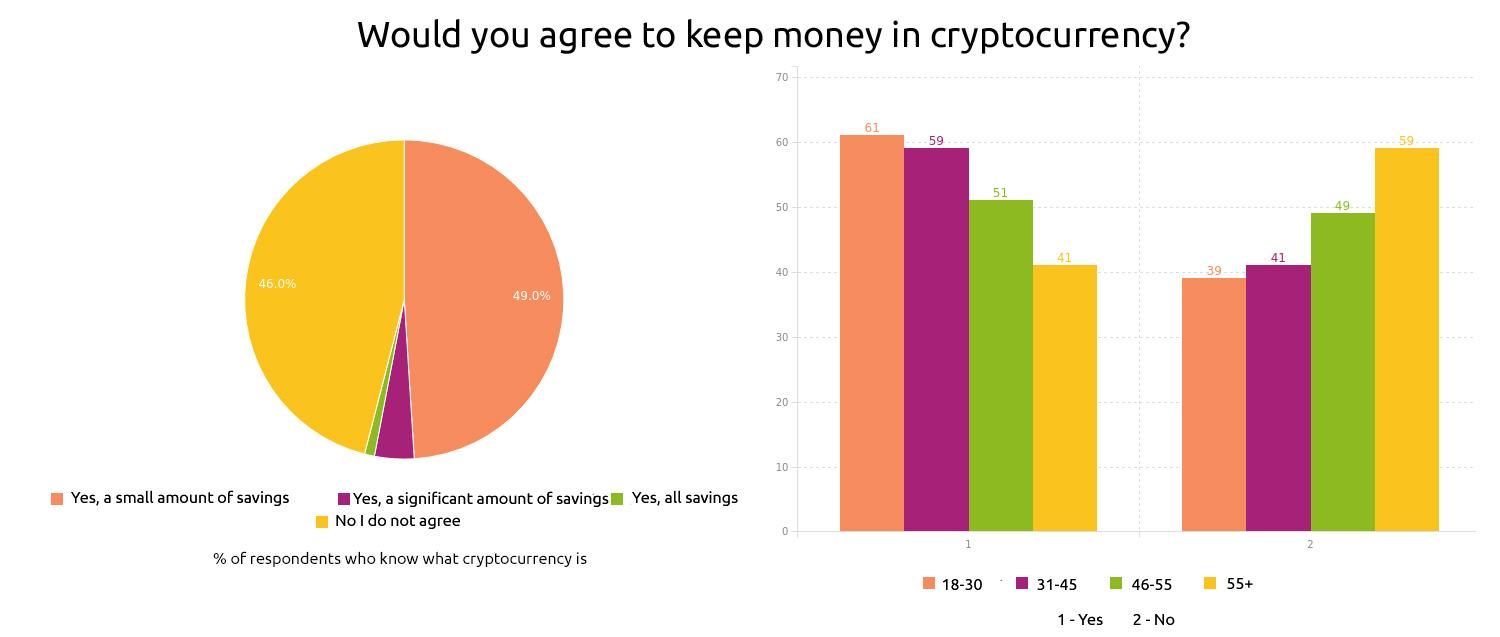

However, let's get back to the 70% who know something about cryptocurrency. And here is the most interesting part. 54% of them are ready to keep their savings in crypto assets. Moreover, 14% already have experience to sell/buy crypto products. 49% are thinking of “digitizing” an insignificant amount of their savings. And 5% are planning to convert most of their monetary assets to cryptocurrency.

Source: Anketolog

That is, it would be wrong to say that cryptocurrency is not in demand among Russians. Either way, Russian citizens take an interest in this monetary asset or are already using it. What is more, the higher their income level, the more they interact with crypto products.

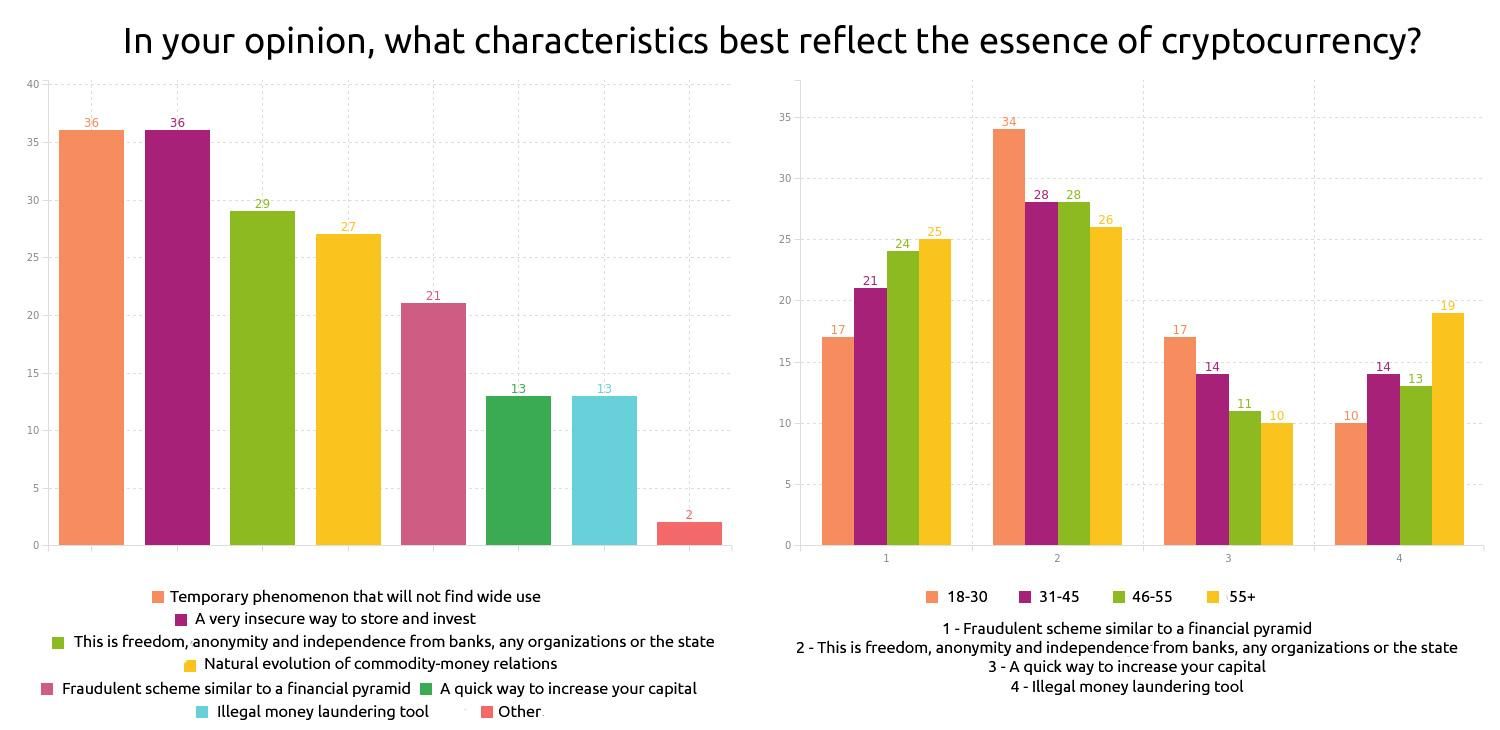

But opinions about the future of such assets are drastically divided. The first category of respondents considers cryptocurrency to be a temporary phenomenon or an unprotected way of storing and investing (36% respectively). Whilst, the other group is sure that cryptocurrency provides freedom, anonymity and independence from banks, any organizations or states (29%), and also that this is a natural evolution of commodity-money relations (27%). Only 13% of respondents think of crypto investments as an illegal means of money laundering.

Despite this, 65% of those who know something about cryptocurrency believe that it will not be able to enter people's daily lives and be used to pay for purchases and bills. Although 4% are absolutely sure of the opposite, and 31% answered positive rather than negative.

Source: Anketolog

Cryptocurrency Transactions of Russians in 2022

More and more companies and services have started offering their customers to pay for services with cryptocurrency. And if a few years ago it partly came to the premium segment and luxury goods (Rolex, Gucci, etc.), as well as NFT auctions and the game industry, now payment with cryptocurrency has become one of the ways to purchase VPN services. Which, in turn, became the most popular for Russian users at the beginning of 2022. Currently, most of the leaders of the Russian VPN market allow paying with crypto money: ExpressVPN, ProtonVPN, Surfshark VPN, etc.

Besides, crypto investments have been infiltrated into the real estate sector a long time ago inside and outside the country. Since 2017, M9 Development has been selling houses in the Moscow region for bitcoins. Later, during the pandemic, Russians began using cryptocurrency to buy real estate in other regions, which ensures the reliability of remote transactions. Now, during the sanctions restrictions in the country, such transactions are the only way to acquire real estate assets abroad, since a number of Russian banks have been disconnected from global payment systems (which limited Russian customers' access to foreign currency accounts). In addition, crypto transactions related to real estate are legalized in many countries.

For example, the UAE approved payments in crypto currency as early as in 2017. After that, many developers added this type of payment for their customers. In 2022, a large development company Damac Properties (Dubai) joined them, allowing the purchase of real estate using Bitcoin and Ethereum cryptocurrencies. The developers justified their decision by the fact that transactions with cryptocurrency will become more comfortable for customers from all over the world (a significant percentage of which are Russian investors).

Also, cryptocurrency transactions are legalized in Germany, Turkey, Georgia and the USA. But there are two important aspects. When it comes to Turkey, it will not be possible to issue a standard cryptocurrency transaction confirming the fact of payment for a product/service. At the same time, some agencies are ready to act as “intermediaries”: accept digital funds, convert into regular currency and transfer to the seller's account. In other words, payment in bank money will be indicated in official real estate purchase documents. But Georgian legislation considers cryptocurrency as an asset, but not a payment instrument. Therefore, the transaction is based on the principle of barter: a buyer changes digital currency for real estate. Purchase price can be written in ordinary currency in a contract: such scheme is officially approved by the government.

Besides real estate purchase and online services acquisition, the matter of cryptocurrency has become relevant for other economic transactions of Russians. First of all, it is the purchase of air tickets. In 2022, Emirates, the largest airline carrier, joined the list of the companies that accept payments in cryptocurrencies. Like Damac Properties, the company is confident that such a solution will provide faster and more flexible interaction with customers. Plus, Emirates plans to use blockchain technology to track aircraft data and share information more quickly in the future.

The issue of crypto savings also touched on labor relations. In April 2022, Zavod IT Russian company provided its employees with the opportunity to receive wages in cryptocurrencies (Bitcoin, Ethereum, XRP and USDT), Alexander Protsyuk, the founder of the company, said the following: “We have made an offer to our employees to pay the salaries in cryptocurrency, which they can use or not... We do not transfer the whole salary to cryptocurrency, leaving most of it in fiat currency (ordinary money), however, the situation may change when the relevant legislative drafts are developed.”

And as of the current date the most popular transaction related to cryptocurrency for Russians turned out to be currency operations. This is stated by several sources, referring to the consequences of the sanctions policy towards Russia.

Kaiko, the analytical platform, stated that USDT trading volume for rubles reached a ten-month high at the end of February 2022 . Later, Bloomberg, based on this fact, counted up that USDT trading volume to the ruble was 2.6 billion rubles on March 5, it was 1.4 billion rubles on March 6, and the volume of transactions with bitcoin reached 2 billion rubles.

Representatives of Russian financial companies confirmed the growth trend of cryptocurrency transactions in an interview with Kommersant. The co-founder of the ENCRY Foundation Roman Nekrasov noted that the influx of customers has increased to offline cryptocurrency sales offices. Marketing Director of the Cryptorg Exchange Andrey Podolyan also stated that the volume of cryptocurrency transactions are growing, especially on p2p platforms (that is, transfers between individuals). At the same time, the demand for hardware cryptocurrency wallets has risen in Russia. Moreover, Roman Nekrasov is sure that the prices for these services have changed. According to him, before the crypto wallet cost up to 10 thousand rubles, now it costs up to 50 thousand rubles. In addition, one of the most popular manufacturers in the Trezor segment has stopped deliveries to Russia. It even more indicates the demand for such crypto products on the market.

All of this tells us that the attitude of Russians to crypto products has changed significantly in a few years. If earlier many people considered cryptocurrency to be something like a “tool to make money quickly with a dubious reputation”, now it is one of the convenient monetary assets for various online transactions.

How to Use It for Promotion

Based on all the research of the Institute of Public Opinion “Anketolog”, it is clear that the majority of Russians are thinking about cryptocurrency in one way or another. The only difference is that some of them already use it in everyday life (as evidenced by the facts of 2022 from various sources). Others have heard something about cryptocurrency and are ready to invest a certain percentage of their savings in it. In fact, the latter turned out to be the majority.

In a global terms, these two groups can be considered a potential audience for promotion of crypto products on the Russian market. But for better results, it should be understood that their demands are different. In the first case, it will be a category of people who want to use more convenient and promising crypto services. Consequently, they need detailed information about the benefits of the products. In the second case, the audience first needs to be told the general trends and ideas about the crypto market, since the majority do not have them (therefore they do not use them).

At the same time, promotion in both groups requires a high percentage of expert content from an advertiser. Because of this, crypto advertising campaigns are mainly successfully implemented with the participation of opinion leaders on this matter on the popular Russian social resources such as Telegram (cryptocurrency ranked third in terms of turnover of thematic content in 2021), Yandex Zen and VKontakte. Probably, other Russian services, the audience of which is currently beginning to increase, will soon be promising.

All this needs to be taken into account to develop a campaign aimed at promotion of crypto products in Russia. And also, it should be mentioned about the state regulation of this issue (according to the Law “On Digital Financial Assets”). RMAA experts are ready to assist you at all stages by providing a wide range of efficient promotion strategies and a more detailed analysis of the Russian crypto segment.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"How to sell to Russian large companies?"

for FREE!

How to Sell to Russian Large Companies?

More about Russian b2b marketing

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

A content lead. Natalia runs marketing projects promotion with different digital tools in the Russian-speaking market.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "How to sell to Russian large companies?" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it