Blog about successful marketing strategies in russia

Kyrgyzstan Advertising Market: Media Landscape, Costs, and Brand Tips

B2B MARKETING

Share this Post

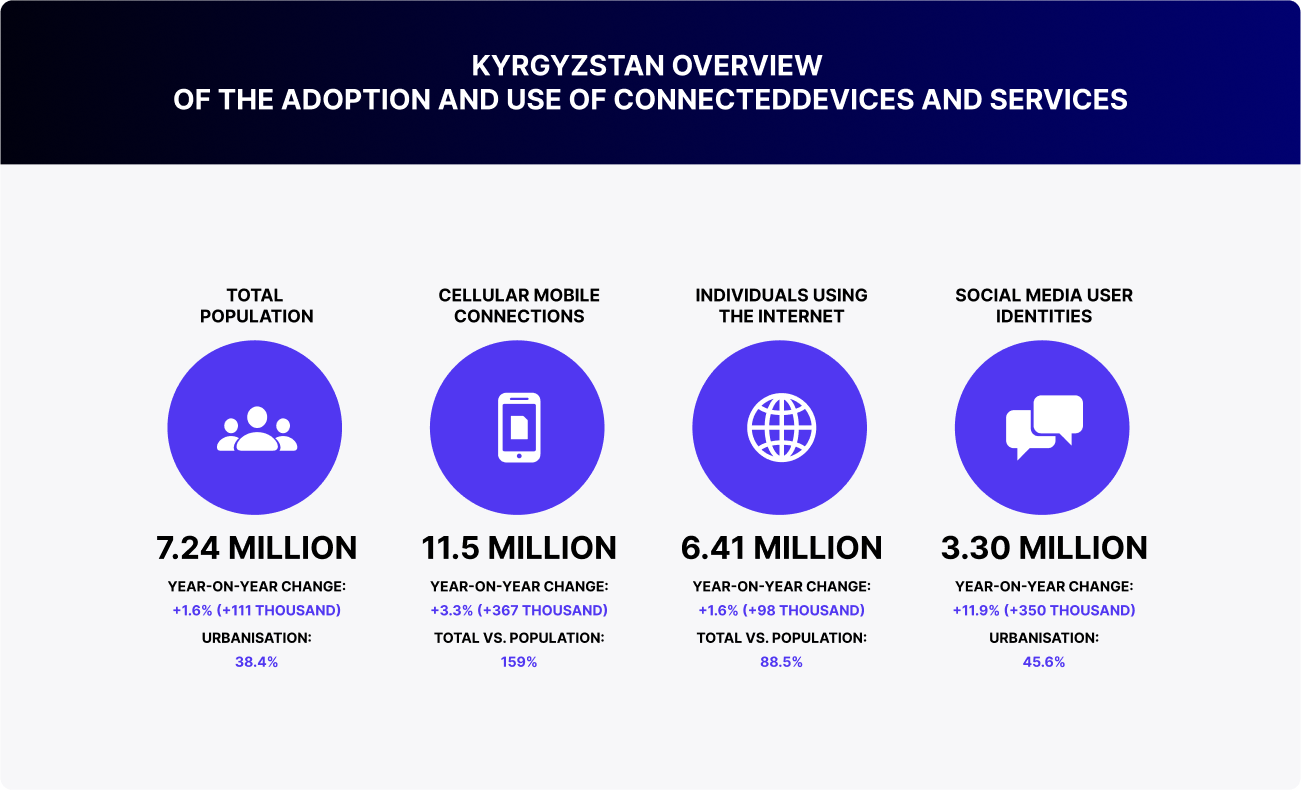

Kyrgyzstan is a compact but fast-moving market. Nearly 89% of the population is online, and 95% are regular TV viewers. It’s a country where digital adoption is outpacing economic growth, and where audience attention still comes at a lower cost compared to neighboring markets.

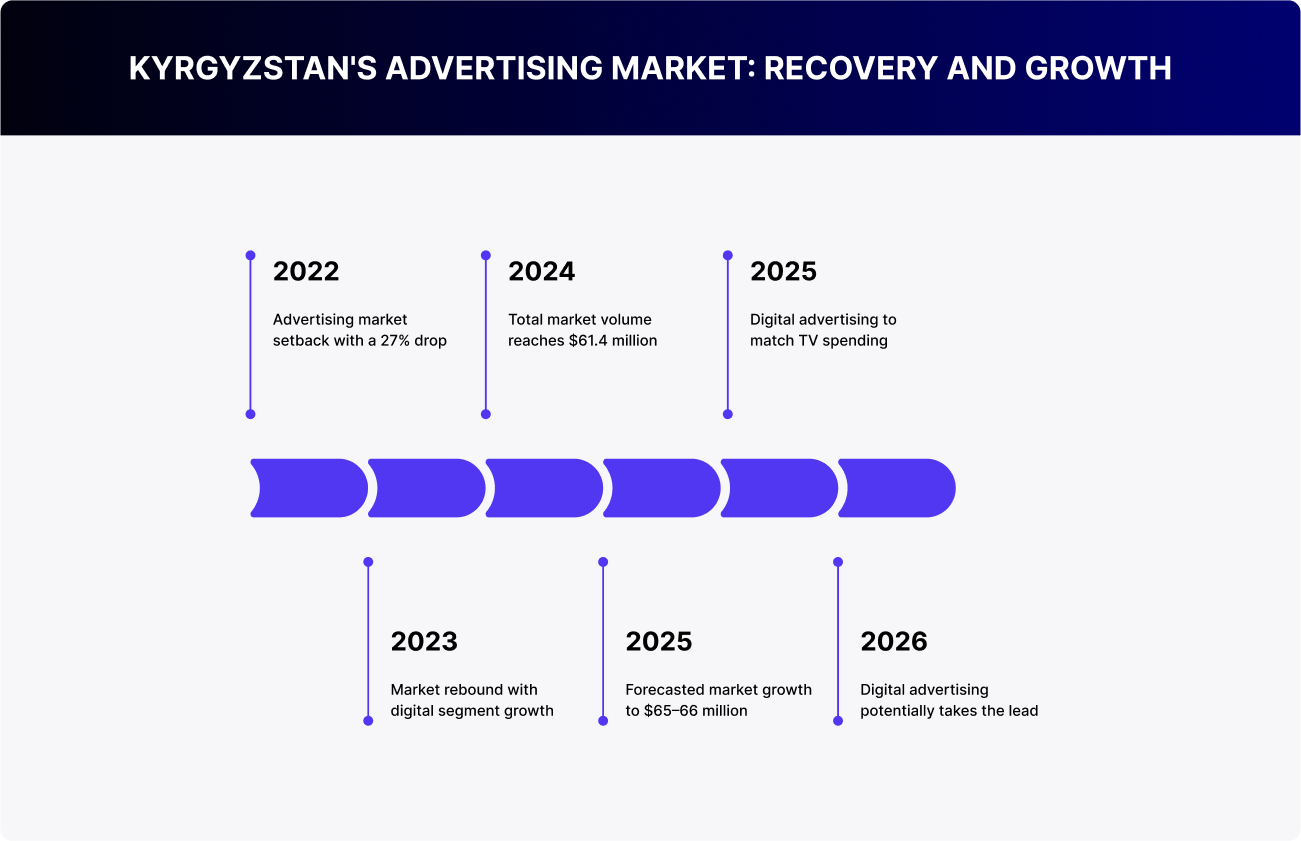

In 2024, Kyrgyzstan’s advertising market reached $61.4 million and continues growing. Forecasts suggest it could surpass $70 million by 2026. At the same time, competition remains low, and many segments are still underdeveloped.

For context, neighboring Uzbekistan recorded around $481.5 million, and Kazakhstan approximately $777.7 million.

For brands willing to adapt and explore bold formats, Kyrgyzstan isn’t just a back-office market—it’s a true entry point into Central Asia.

Market Dynamics: How Advertising in Kyrgyzstan Evolved from 2022 to 2025

2022 was a downturn year. Advertising investments dropped by nearly 27% due to the exit of international brands and overall market uncertainty. Several local agencies and media outlets temporarily suspended operations.

If macroeconomic conditions remain stable, Kyrgyzstan’s ad market is expected to continue growing, with projections from Statista placing it at $65–66 million in 2025. By that time, digital is likely to catch up with TV in terms of ad spend share, and by 2026, it may even take the lead. Annual growth in advertising investments is projected at 7–10%, assuming economic stability holds. Kyrgyzstan’s GDP is expected to grow by around 5% annually through 2025–2026.

How Advertising Budgets Are Allocated in Kyrgyzstan

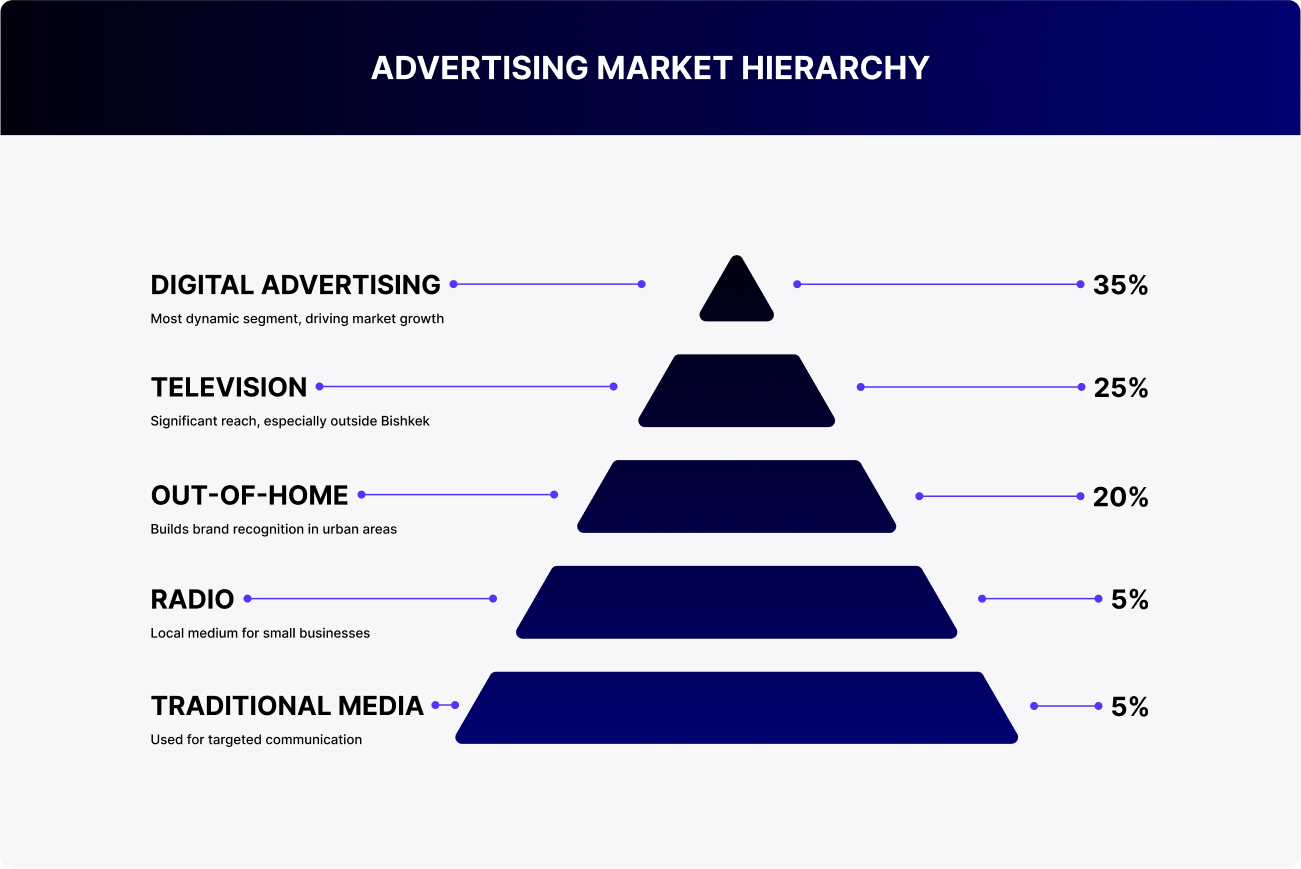

Kyrgyzstan’s advertising market isn’t all about digital. Despite rapid growth in online channels, traditional media still hold their ground. This media split reflects the diversity of the audience.

Urban youth in the capital are fully immersed in TikTok and Telegram, but in the regions, TV and outdoor advertising remain primary sources of information.

Digital advertising accounted for roughly 35–40 % of total ad spend last year, making it the most dynamic segment. Budgets for Instagram, TikTok, and YouTube continue to grow, with increasing demand for paid social and local content creators. Digital was the main driver of market growth in 2023–2024, and even government entities have started experimenting with Telegram campaigns.

Television remains the second-largest channel, holding about 25–27 % of budgets. Its reach is still significant, particularly outside Bishkek. Most nationwide campaigns still include TV—especially in pharma, FMCG, and telecom—but growth has plateaued as younger audiences shift online and rising prime-time rates push down ROI.

Outdoor advertising takes up around 20 % of the market. In Bishkek and Osh, 3 × 6-meter billboards, branded bus stops, and screens are part of the urban fabric. Outdoor remains the cornerstone for brand recognition, especially for companies entering the market and seeking a physical presence.

Radio claims 5–6 % of spend. It is a localised medium popular with small businesses, driving schools, and event promoters, particularly via minibus and regional broadcasts. Limited measurement and a fragmented market, however, constrain large-scale use.

Print media is below 5 %. Newspapers are still used for legal notices, government communication, and healthcare, while magazines have almost disappeared; print today is mostly confined to B2G or rural contexts.

Bottom line: digital and outdoor are the main growth drivers; TV remains a reliable classic. Radio and print are niche but not dead. Brands need a media mix tailored to region, language, and audience behaviour rather than relying on a single channel.

Television: Reliable but Inflexible

Television is still the largest paid-media channel in Kyrgyzstan. Despite its gradually shrinking share, it attracted a significant slice of investment in 2024. Combined spending on TV and video advertising (including online video) could reach $16.5 million by 2025 .

There are about 60 broadcast channels in the country, but commercial advertising is concentrated on 25 main stations, which collectively reach up to 95% of TV viewers. The market is highly centralized. A single sales house, TV Media Kyrgyzstan, manages nearly all TV ad inventory. This setup reduces flexibility and slows down campaign planning.

Top advertisers include pharmaceutical companies, food and beverage brands, and government agencies. While CPM on TV remains lower than in digital, the channel still delivers reliable mass reach, particularly outside major cities. GRP and frequency metrics are used to evaluate campaign effectiveness. However, daily viewership is declining: in Bishkek, only about 41% of residents still watch TV regularly, and that number continues to fall each year.

TV is perceived as a trustworthy and ‘official’ medium. Being on air boosts brand recognition and credibility, especially in the regions. But among younger audiences, its influence is weakening, making it increasingly risky to rely on television as a standalone channel.

Radio: Local Reach Without Precise Metrics

Kyrgyzstan is home to around 20 radio stations, from national networks to regional broadcasters. Radio still functions as a day-to-day reach channel, especially in transit. It’s commonly heard on public transport, in taxis, private cars, and office spaces. For audiences over 30, particularly outside Bishkek, radio remains a familiar and trusted medium.

Key advertisers tend to be local businesses: driving schools, shopping centers, courses, salons, and events. They use radio for direct response, clear messaging, and quick reaction. For these goals, the channel still delivers.

For larger brands, however, radio is less practical. It lacks audience measurement tools, transparent regional statistics, and consistent reach data. This limits media planning and doesn’t align with the performance standards international teams are used to.

That said, radio can be a valuable add-on for regionally focused campaigns, especially for offline activations, local promotions, or efforts in areas where digital engagement is still limited. It’s not a primary channel, but in the right mix, it plays its part effectively.

Outdoor Advertising: A Familiar Format with Local Impact

In 2024, Kyrgyzstan’s outdoor advertising market continues its recovery. There are over a thousand ad structures across the country, with around 700 located in Bishkek. The dominant format remains the standard 3×6 meter billboard, which is placed along roads, on building facades, and at key urban intersections.

Digital surfaces are still limited. The shift to digital is slow, but the first DOOH formats have started to appear in Bishkek and Osh: LED screens at bus stops and illuminated panels along retail streets. Still, the majority of inventory remains static.

For brands, outdoor remains a strong way to make a visual statement—especially in new markets where visibility matters not just online but in physical city spaces. It works well for broad-audience categories such as retail, banking, pharmacies, and telecom.

The main drawback is the lack of verified metrics. There are no GRPs or neighbourhood-level reach data, making it hard to link results directly to performance. Consequently, outdoor is best used as a complementary channel rather than the foundation of a media strategy.

Print Media: A Niche Channel for Targeted Needs

Print advertising accounts for less than 5 % of Kyrgyzstan’s ad market. Most newspapers have reduced circulation and shifted toward digital formats, while magazines have nearly disappeared—only a handful of industry titles still release regular issues.

Today, placements are mainly found on the digital versions of newspapers and news portals: banner ads, sponsored content, and native integrations. Print editions continue to exist but with limited circulation and narrowly defined audiences.

The channel is used selectively—primarily for government communication, real-estate listings, legal notices, and tender announcements. It is not a mass-reach tool but a formal medium often deployed for B2G or PR-related tasks.

For commercial brands, print is rarely a priority. However, in projects involving government participation—where visibility in traditional sources is expected—print can be a valuable complement to a broader digital campaign.

Digital Platforms: Online Advertising, Social Media, and Search

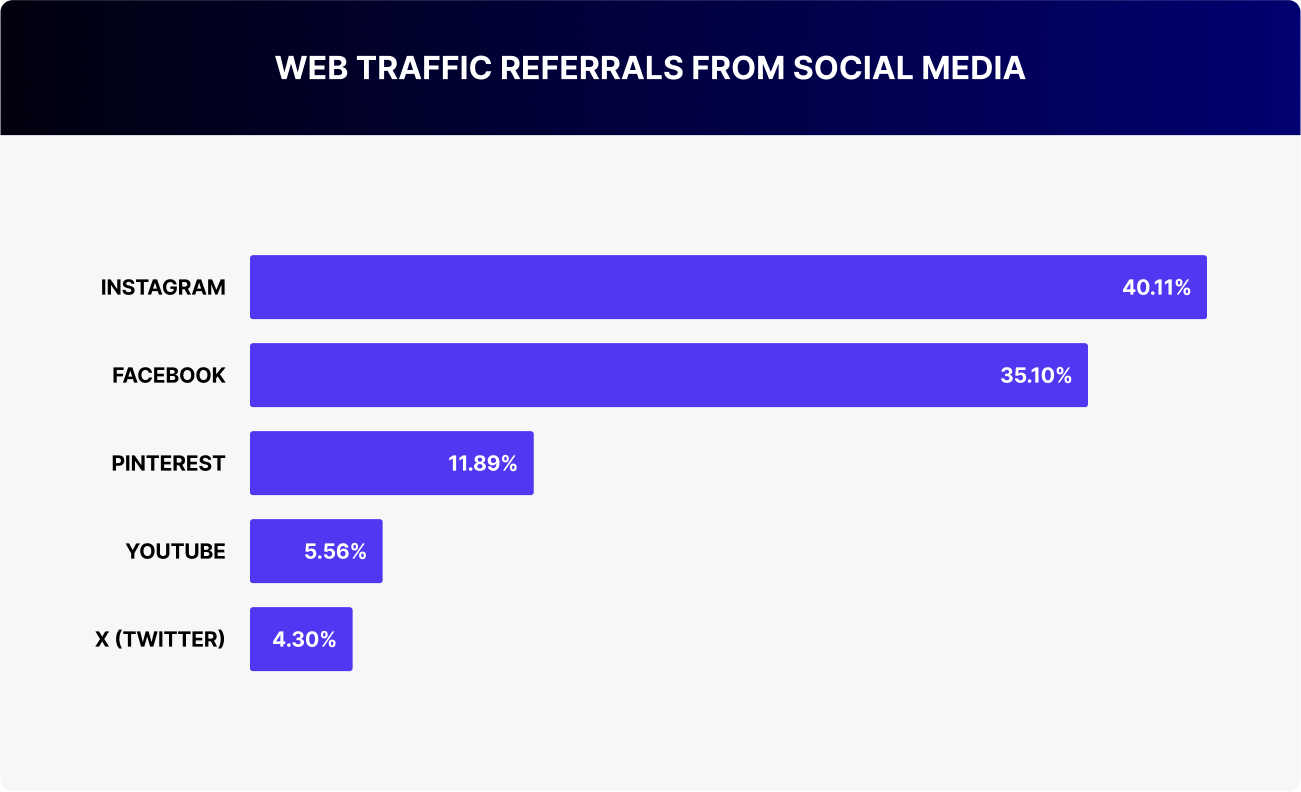

Digital advertising is the fastest-growing segment in Kyrgyzstan. Just 5–6 years ago, it held only about 16% of the market, but by 2024, it accounts for at least one-third and continues to expand. With over 90% of the population online and 83% using the Internet daily, the country has developed a massive digital audience. In 2024, ad spend on social media surpassed 3 billion KGS, a sevenfold increase from the previous year. The most active players include small businesses, banks, and retail brands. Some focus on Instagram promotion, while others run paid social campaigns targeting either the entire country or specific cities.

Instagram and TikTok are the most popular platforms, especially among younger users. Facebook and VKontakte are still relevant, particularly among the 25+ demographic. Social platforms offer highly accurate targeting, and many small businesses are now placing ads directly, bypassing agencies. This reduces costs and gives them clear performance tracking, from clicks and leads to actual sales.

Search advertising on Google and Yandex has become the largest segment within Kyrgyzstan’s digital budgets. It’s especially critical for e-commerce, where businesses invest in queries like ‘buy smartphone Bishkek’ to capture high-intent traffic. Banner ads on local websites are still in use, but tend to be less effective; some traffic is driven by sites hosting pirated content. Major portals earn revenue through display ads and native content, but their share of ad budgets lags behind that of social media.

Since 2023, programmatic advertising has gained strong momentum in the market, driven by automated buying through DSP/SSP platforms. This improves targeting accuracy and simplifies campaign analytics. The share of programmatic spend is growing rapidly. At the same time, advertising in mobile apps, on YouTube, and influencer marketing is expanding as well. The influencer market in Kyrgyzstan is projected to reach $2 million by 2025, especially strong in fashion and beauty niches.

Digital is valued for its measurability: metrics like CTR, CPA, CPL, and ROI are closely tracked. The average return is higher than in traditional media. However, competition is increasing as CPM rates are rising in high-demand segments, particularly on Instagram.

Despite this, digital platforms have become the primary communication channel for both businesses and public institutions, from online retailers to banks and government agencies.

Audience Behavior and Regional Differences

Kyrgyzstan’s audience is far from uniform, and this directly impacts media planning. User behaviour, language preferences, and content-consumption channels vary significantly by region.

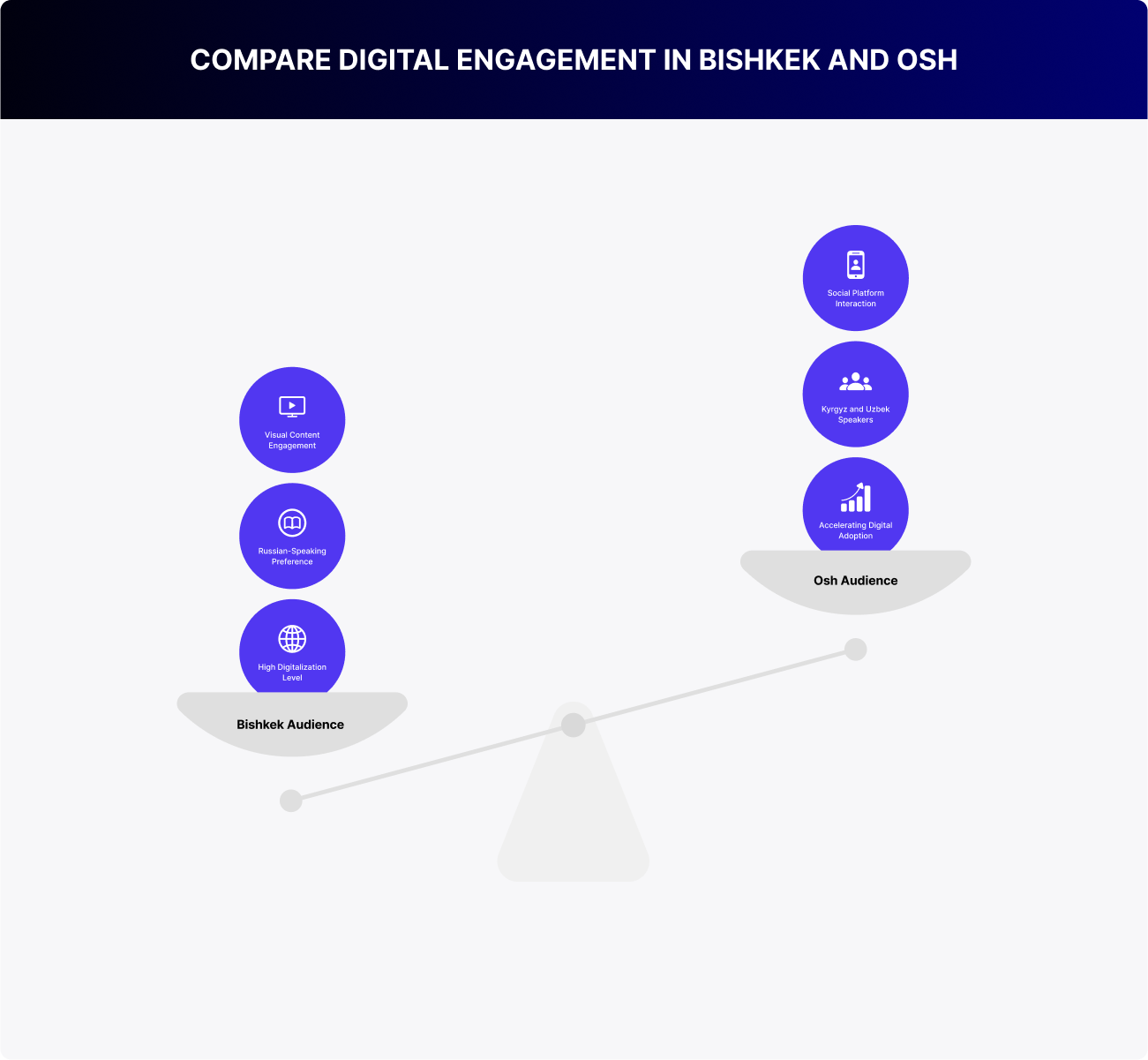

Bishkek is the country’s most digital-forward market. It has a high concentration of 18–35-year-olds, predominantly Russian-speaking, accustomed to online payments and shopping via Instagram and marketplaces. Users are highly engaged with social media and respond quickly to visual content—stories, reels, and paid social campaigns perform especially well.

Osh is the second most important hub. The audience here is more conservative, with a strong preference for Kyrgyz and Uzbek languages. However, digital adoption is accelerating: more users are switching to smartphones and beginning to engage with brands through social platforms and messaging apps. The growth of digital advertising in Osh is especially noticeable in fintech, education, and service sectors.

In rural areas, traditional media—particularly television and radio—continue to dominate. Smartphones, however, are rapidly making inroads, and expanding mobile-internet coverage now lets brands promote products and services well beyond major urban centres. While audiences outside cities are less active on social media, they respond strongly to visual brand presence (outdoor ads and TV) and to messaging delivered in their native language.

Language adaptation is crucial. In Bishkek, a mix of Kyrgyz and Russian works best. In Osh, campaigns should consider both Kyrgyz and Uzbek. In many cases, a brand that communicates in the local language earns more trust than one delivering a generic, one-size-fits-all message.

Top Advertisers and Media Mix: Who’s Promoting and How

The bulk of advertising investment in Kyrgyzstan is concentrated in four key sectors: telecom, pharmaceuticals, FMCG, and banking. These categories shape the media landscape and set the market’s tone. Although their strategies differ, most brands rely on an omnichannel approach, prioritise brand visibility, and adapt to regional specifics.

Telecom: Reach and Frequency

Leading operators—Beeline, MegaCom, and O!—maintain a presence across all major channels. TV supports image-building campaigns, outdoor advertising provides nationwide coverage, and digital targets younger audiences with mobile-focused offers. At the same time, telcos actively participate in offline events, run giveaways, and sustain high-frequency exposure across media.

Pharmaceuticals: Awareness and Trust

Pharma remains one of the most active categories, especially during cold-and-flu season. Core channels include TV, outdoor, and radio. Campaigns are timed to audience habits and seasonal demand, while digital is used selectively for over-the-counter products—mainly via medical articles, specialist platforms, and influencer content.

FMCG: Consistent Presence and Emotional Engagement

Brands in beverages, snacks, cosmetics, and household goods aim for maximum reach. They combine TV, outdoor, digital, and BTL activations. Digital campaigns often feature challenges, influencer collaborations, and visual-first content tailored to TikTok and Instagram. In-store advertising and POS tools remain essential, particularly for impulse-driven categories.

For instance, the Indian shampoo brand Trichup, in partnership with RMAA , launched a TV campaign integrated into popular Indian series and films aired on local Kyrgyz channels. This approach effectively reached its core audience—viewers with a strong preference for Indian content.

The campaign significantly boosted brand recognition and expanded the customer base in both Kyrgyzstan and Kazakhstan.

Banks & Fintech: Brand Image Meets Targeted Messaging

Financial institutions promote mobile apps, loans, cards, and service tools. They use outdoor media to reinforce brand presence in city spaces and tailor digital messaging to specific segments—one for youth, another for entrepreneurs. Activity is growing on Telegram and YouTube, with microfinance companies in particular targeting consumers directly.

Some banks are also forming partnerships with digital services. For example, Optima Bank offered clients 60 days of free access to Yandex Plus (movies, music, books, and discounts on Yandex Go). Activation occurs through the bank’s mobile app, with communication via push notifications and short, social-friendly guides.

In summary, Telecom builds reach and frequency, pharma focuses on trust and seasonal recall, FMCG drives engagement and visual impact, and banks focus on spot messaging and personalized advertising.

Competition, Agencies, and Infrastructure

The structure of Kyrgyzstan’s advertising market remains fragmented, with stark differences across channels.

Television is centralised, dominated by a single sales house. This simplifies buying but limits flexibility and options. The TV market is heavily influenced by government contracts and large-scale brand campaigns, making it relatively closed and slow-moving.

Radio and outdoor, by contrast, are highly fragmented. In the outdoor sector, dozens of contractors operate with varying inventory quality. Some placements exist in a legal grey area—used without long-term contracts—complicating planning and increasing risk. Radio comprises many small stations that cater to local businesses, but the lack of standardised metrics (e.g., GRP, CPT) makes systematic planning difficult.

Digital is evolving faster than any other segment. In Bishkek and Osh, new-generation agencies and freelance teams handle targeting, Instagram content, Telegram distribution, and local community channels. These vendors are flexible and affordable, but often focus on short-term results for domestic clients.

For international brands, this model may fall short. Most digital placements go through external platforms (Meta, Google, TikTok). Without proper integration, analytics, and legally structured workflows, working with local teams can feel fragmented and opaque.

Hence the need for a partner who understands both local context and global-marketing demands—someone who can bridge the gap between on-the-ground execution and strategic consistency at scale.

Risks and Considerations: What to Know Before Launching a Campaign

Despite strong growth and accelerated digitalisation, Kyrgyzstan’s advertising market still presents several limitations worth considering at the outset.

1. Measurement gaps in offline channels. Radio and outdoor still lack industry-standard metrics such as GRP, CPT, or audited reach. They can be effective, but require extra diligence: visual inspections, photo reports, and timely performance updates from vendors are essential.

2. Informal digital ecosystem. A share of digital budgets flows through untracked channels—direct influencer posts, Telegram placements, or story ads without proper tags. This complicates verification and transparent reporting, especially for brands with strict compliance standards.

3. Geographic disparities. Bishkek and Osh have active digital users and a functioning media mix, but reach drops sharply beyond these cities. In rural areas, internet access is less stable, and media habits remain focused on traditional channels.

Direct digital outreach in these zones tends to underperform unless paired with offline reinforcement.

Currency risk: placements on platforms like Meta, Google, and TikTok are billed in USD. Fluctuations in the Kyrgyz som can significantly affect the real cost of campaigns—especially long-term ones—so currency exposure must be factored into media planning and budget allocation.

The good news: these challenges are manageable with a clear strategy, a trusted local partner, and a willingness to adapt tools to real-market conditions. When approached thoughtfully, Kyrgyzstan offers brands a highly promising environment with room for growth and standout visibility.

Takeaways and Recommendations: How to Approach the Kyrgyz Market

Kyrgyzstan’s advertising market is small but steadily evolving. It provides a blend of digital growth, offline visibility, local nuance, and plenty of space for new entrants. What it doesn’t require is oversized budgets; what it does require is precise calibration—an understanding of the audience, regional distinctions, and the limits of available performance tracking.

For brands entering the country for the first time, a channel mix is key. In Bishkek, digital performs well—especially on Instagram, YouTube, and Telegram. In Osh and the regions, outdoor and TV remain crucial for awareness, while radio and print make sense for B2G initiatives and region-focused projects. In all cases, language, visuals, and messaging need to be adapted to each city and audience segment.

Some channels still don’t provide complete reporting, and without local oversight, a campaign can become fragmented. Success therefore depends not just on placing ads, but on managing them—tracking, documenting, and optimising along the way.

RMAA supports international brands across CIS markets, including Kyrgyzstan. We understand how to launch campaigns, build strategies, coordinate local vendors, adapt content, and deliver measurable results.

Considering Kyrgyzstan for your regional playbook? Submit a request through the contact form below and we’ll help you explore launch formats, brand goals, and available opportunities.

And don’t forget to subscribe to our blog—we regularly share CIS market overviews, media trends, case studies, and actionable insights tailored to international teams.

Join 2,000+

of your Peers!

You will be the first to know about Russian marketing insights, news and updates from our agency. Stay tuned!

Get our latest articles delivered to your email inbox and get our exclusive White Paper

"How to sell to Russian large companies?"

for FREE!

How to Sell to Russian Large Companies?

More about Russian b2b marketing

Ready to partner with the specialists in Russian marketing and advertising?

About the Author

A content lead. Natalia runs marketing projects promotion with different digital tools in the Russian-speaking market.

Join 2,000+ of your Peers!

Get our latest articles delivered to your email inbox and get our exclusive White Paper "How to sell to Russian large companies?" for FREE!

You will be the first to know about Russian marketing insights,

news and updates from our agency.

Stay tuned!

We're updating our website's design step by step, so some pages may look different. Thank you for your understanding.

Got it