Digital Marketing Agency in Kazakhstan

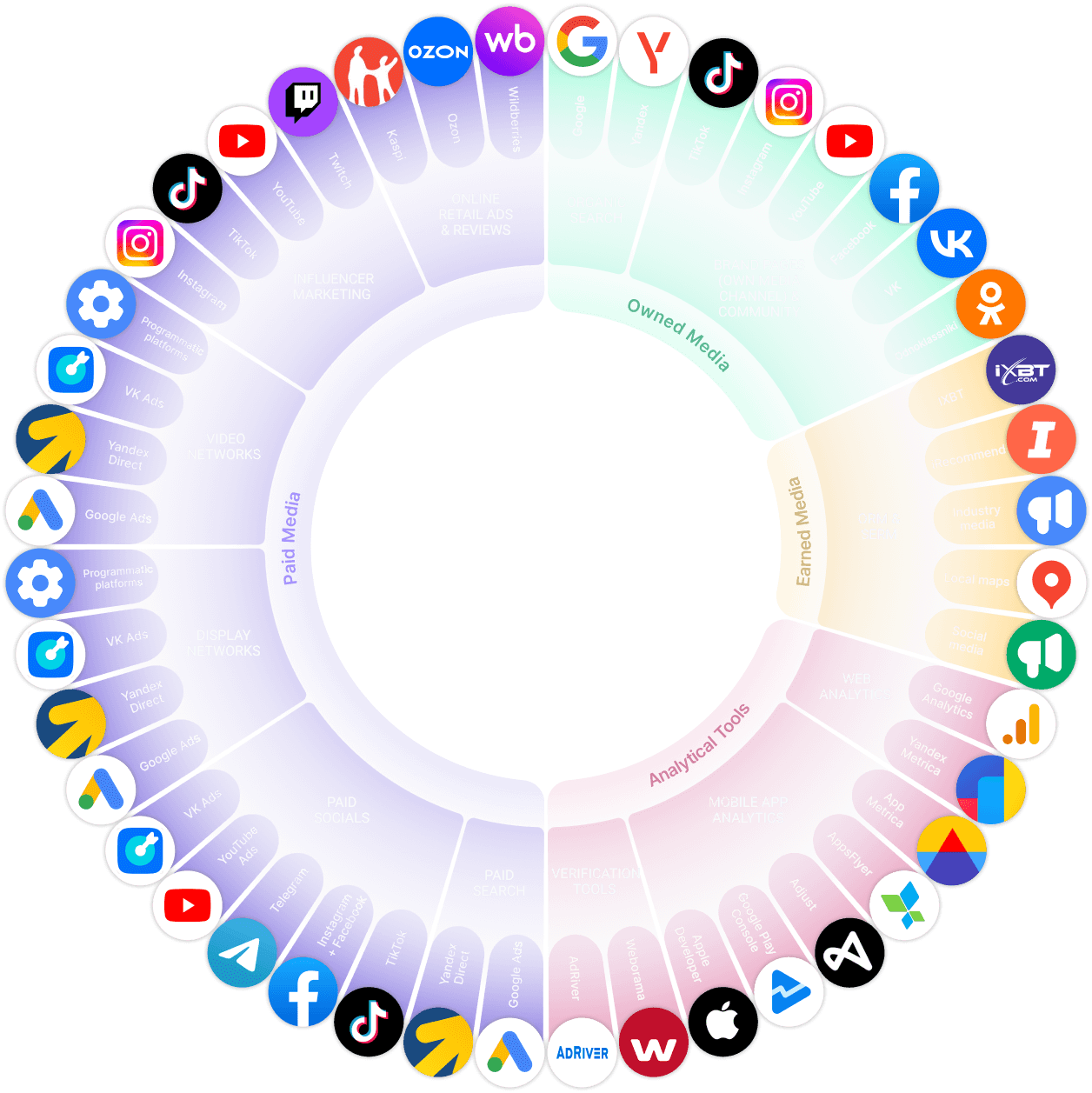

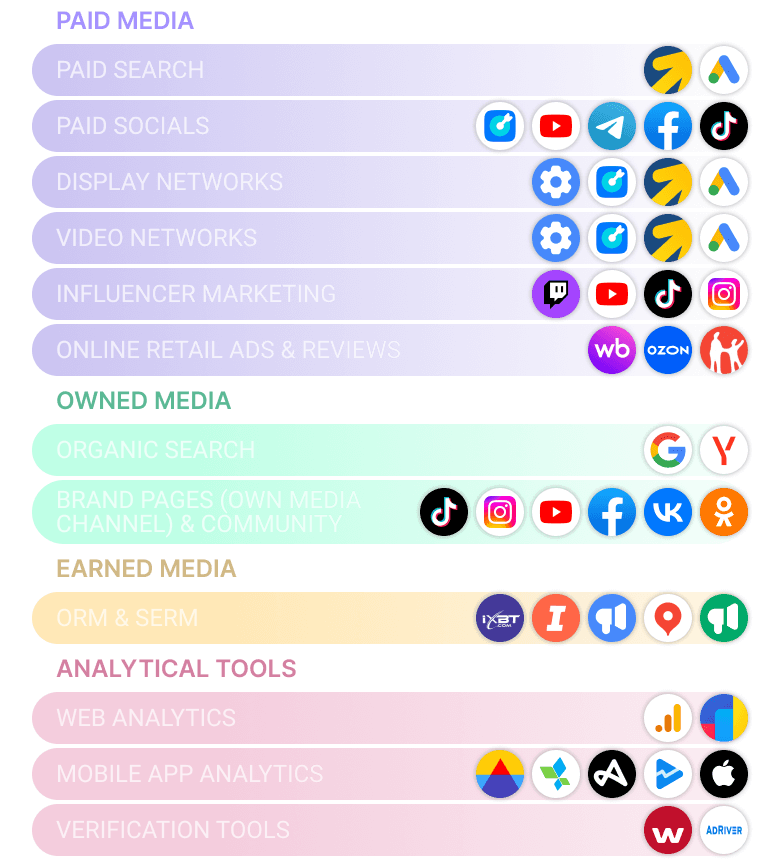

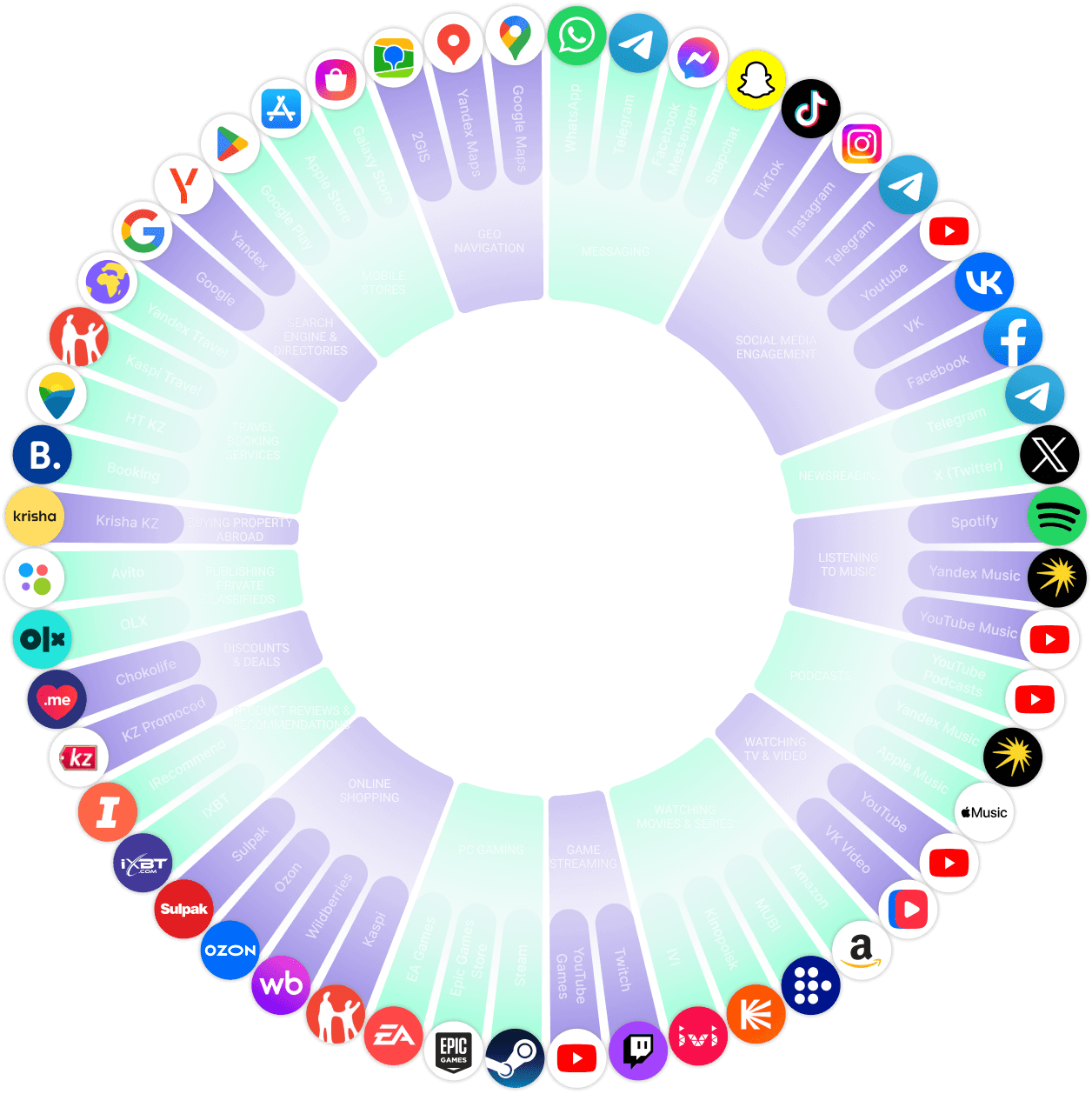

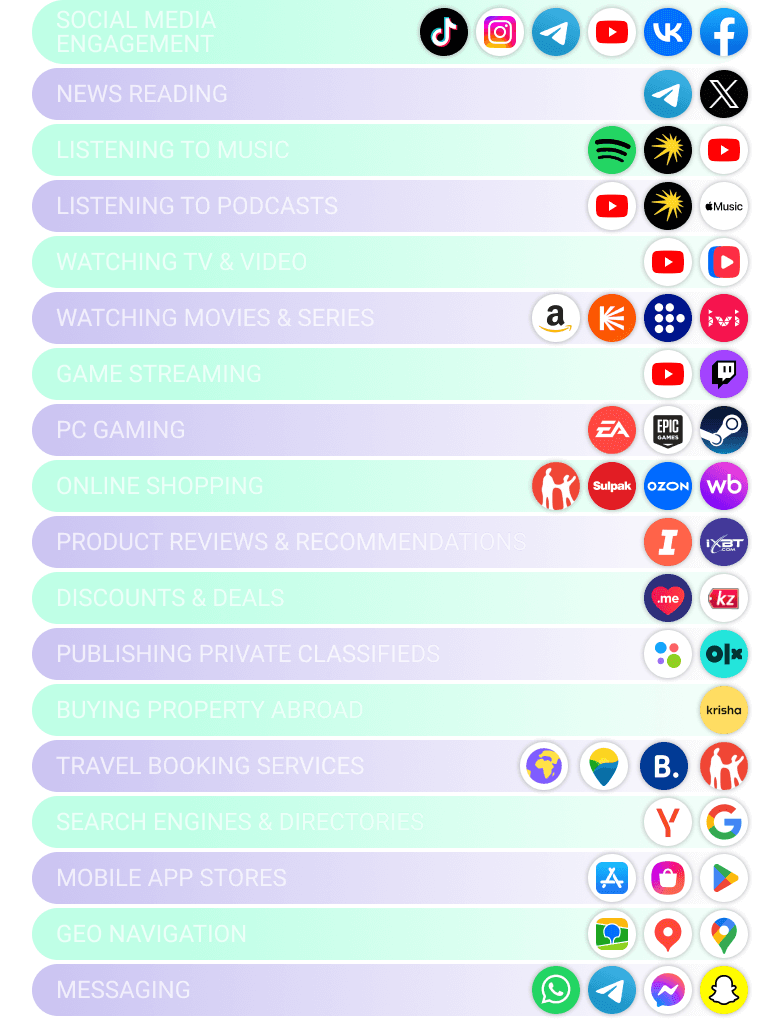

RMAA delivers full-service digital marketing solutions tailored for the online space in Kazakhstan, reaching audiences in the country’s major cities such as Almaty, Astana, Shymkent, and beyond, as well as in other CIS countries