Beauty & Skincare Marketing Solutions in Russia & CIS

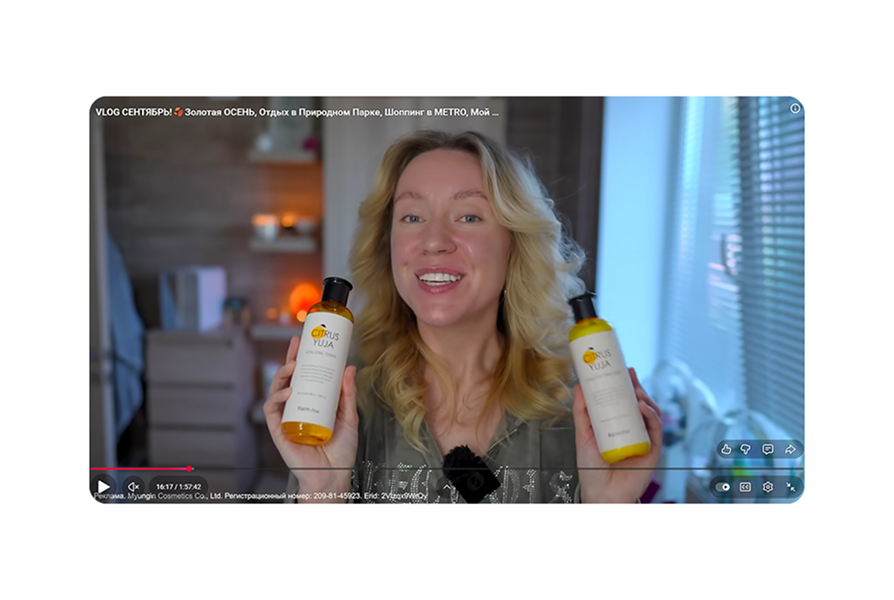

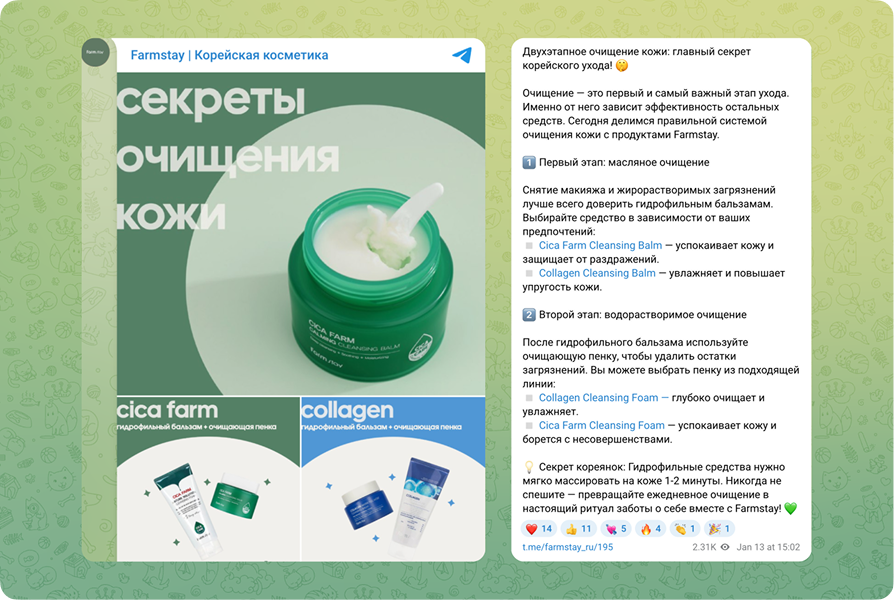

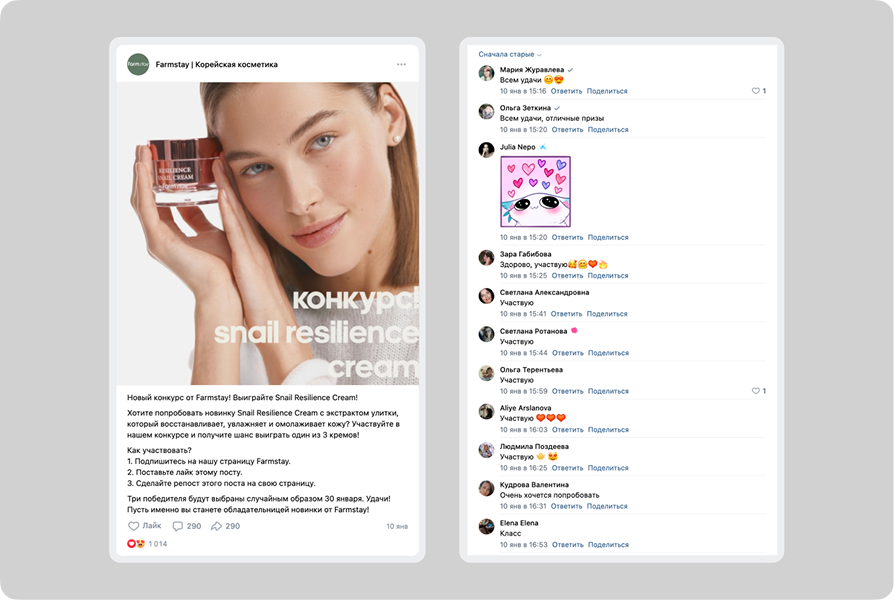

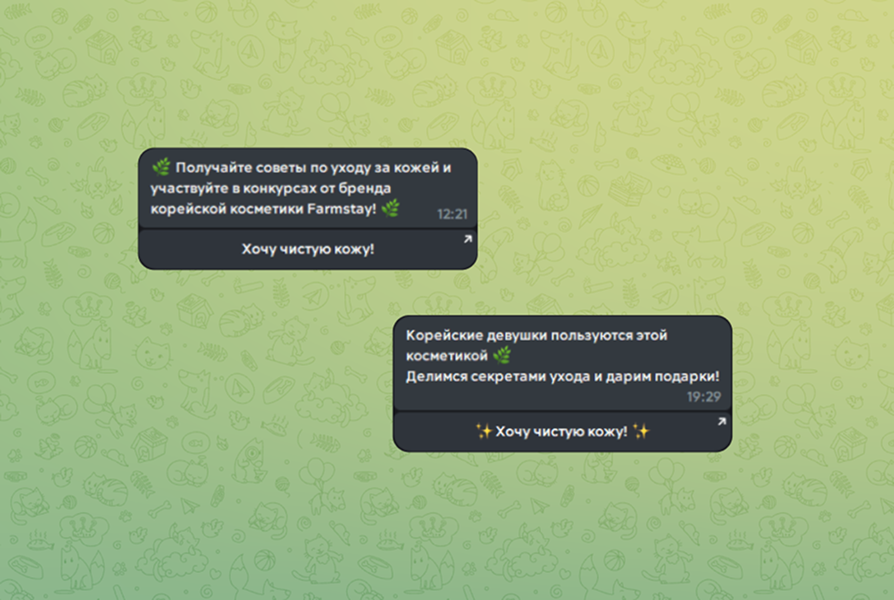

RMAA provides beauty marketing solutions to help skincare and cosmetic brands grow through influencer/KOL programs, paid social on VK, Telegram and YouTube, and Yandex paid search, backed by localized creative and UGC/video that converts. With over 10 years of experience, we've helped numerous beauty brands gain recognition across these markets